wills trusts & estates

1/275

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

276 Terms

law of succession

wills, intestacy, trusts, other non-probate, charitable foundations, death taxes

Freedom of Disposition

wealth holders have dead-hand control

Freedom Of Disposition: R. 3d

...nearly unrestricted right to dispose of property... not grant courts the power... the authority to question wisdom... of donor... law in this field is to facilitate rather than regulate... by establishing rules.

Freedom of Disposition and Mairage

-a restraint unreasonably limits the transferee's opportunity to marry if marriage permitted by the restraint is not likely to occur

- restraints on marriage allowed for surviving spouse

Alternatives to Freedom of Disposition

- Forced succession in most countries

- confiscation by the state in failed soviet experiment

Death Tax

If wealth is below $5.4 mil, no death tax

UPC Section 2-602. Will Pay Pass All Property and After-Acquired Property

A will may provide for the passage of all property the testator owns at death and all property acquired by the estate after the testator's death

Posthumously acquired Property: heir v. beneficiary

if a dead man inherits property and has an hair and a residuary beneficiary, property goes to beneficiary

Probate Property Examples

wills and intestacy

Non-Probate Property Examples

-Inter Vivos Trust

-Life Insurance

-POD and TOD Contracts

-Joint Tenancy

-Retirement Benefits

Probate Property Definition

property or interests in property that would not pass except by the judicial process, i.e. probate, (or its substitute) established by the law of the state. The property passes as directed by the decedent's will or the law of intestacy

Non Probate Property Definition

property or interests in property that pass at the time of death, but by a non-judicial mechanism - usually by contract or its equivalent

functions of probate

-Provide evidence of transfer of title to the new owners;

-Protect creditors and debtors by providing a procedure for payment of debts; and

-Distribute the decedent's property to those intended after the decedent's creditors are paid.

5 Common Phases of Probate

1) Opening of the estate - Personal Rep. Identified

2) Inventory and appraisal of assets

3) Property Management and Sale (if necessary)

4) Creditors Paid

5) Distribution of Assets and Closing (with Court's approval)

UPC 3-801 Notice to Creditors

(a) Unless notice has already been given under this section, a personal representative upon appointment [may] [shall] publish a notice to creditors once a week for three successive weeks in a newspaper of general circulation in the [county] announcing the appointment and the personal representative's address and notifying creditors of the estate to present their claims within four months after the date of the first publication of the notice or be forever barred.

Solemn (formal) Probate UPC 3-401

Notices to Interested Parties Probate

- Representative petitions for formal testacy

-Litigated judicial determination after notice to interested parties

-Formal proceedings become final judgments if not appealed

Common (informal) Probate

No Notice to Interested Parties Probate

-Representative petitions for appointment

- Validity of the will or determination of intestacy need not be litigated unless interested party objects

-If for will, original must accompany petition

-If an interested party objects by caveat (challenges), the solemn form process begins

Supervised Administration

The court supervises the actions of the personal

representative (executor or administrator) in administering the estate through a potentially costly and time consuming process.

Unsupervised Administration

The personal representative may administer the

estate without court supervision unless an interested party asks for court review.

Intestacy

Decedent leaves no will. The probate estate passes by intestacy.

Partial Intestacy

Decedent leaves a will that disposes of only part of the probate estate; the part of the estate not disposed of by the will passes by intestacy.

Default Choice of Law

-real property: where the property is located

-personl property: where the decedent is domiciled at death

testacy

Decedent leaves a will that prvides for the disposition of her property at death

Heirs

those who would take in Intestacy (while living - "heirs apparent")

Ancestors

those from whom the Intestate Descended

Issue

the progeny of the Intestate (usually synonymous with "Descendants")

collaterals

those outside the line of ascent (ancestors) and descent (issue/ descendants)

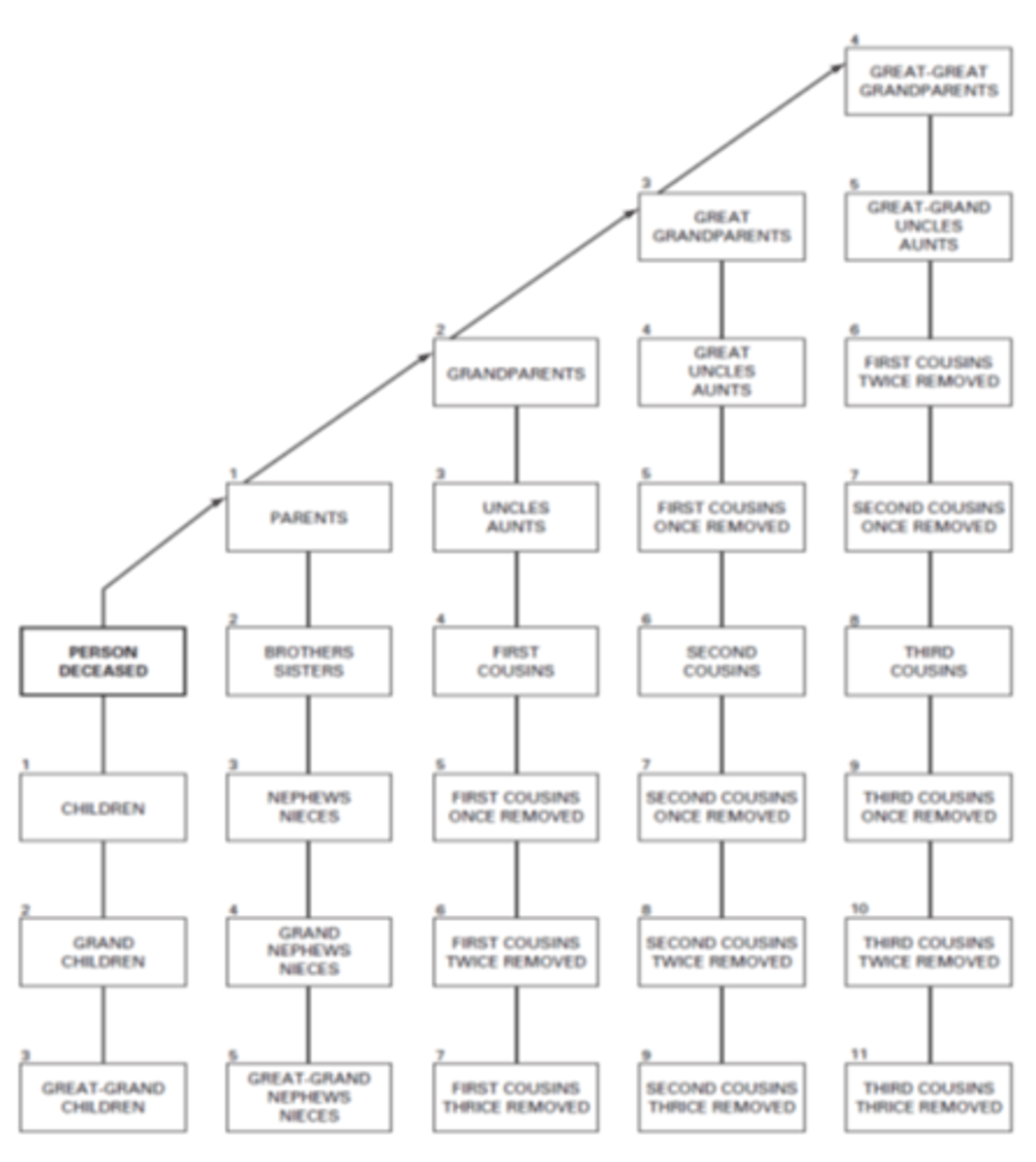

Table of Consanguinity (provided on exam)

-Table that represents the degrees of relationship/kinship.

- draw a line b/t 3rd and 4th column bc it separates who can inherit from those who cannot

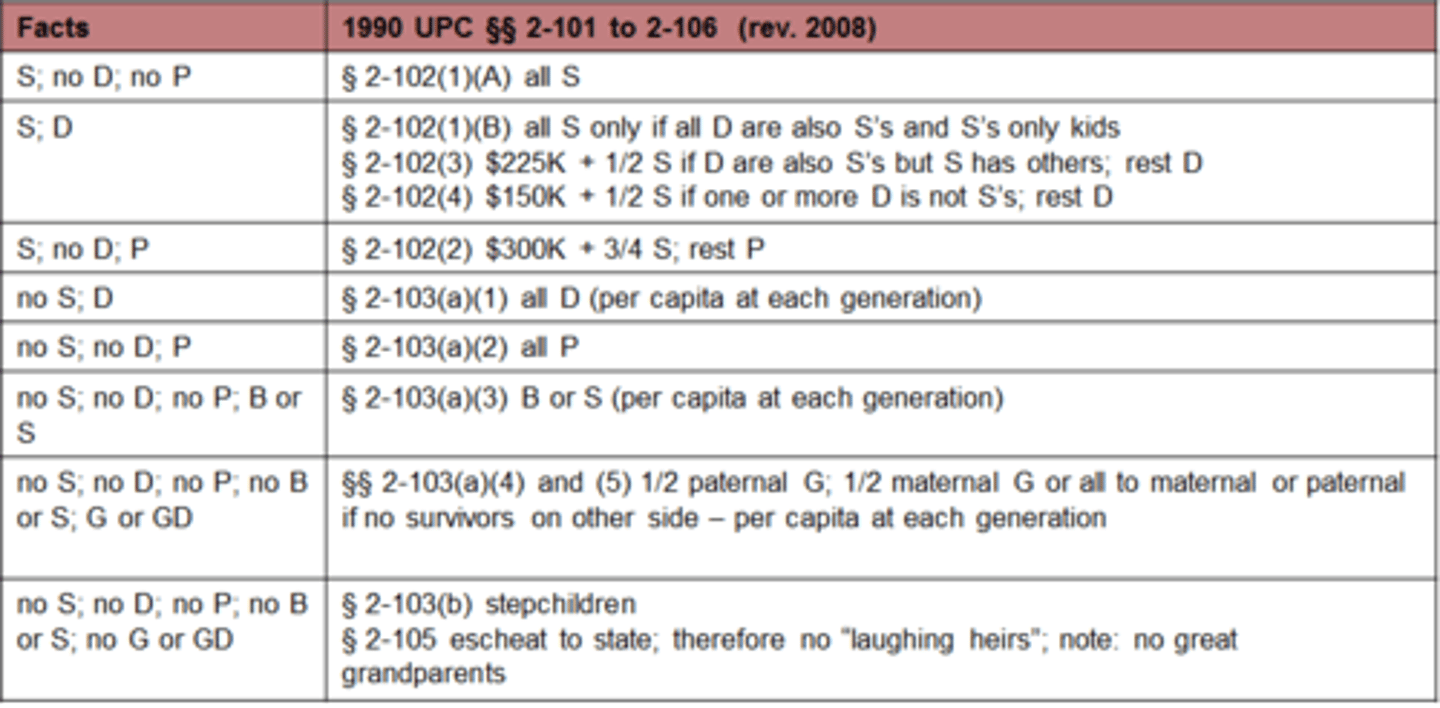

Summary of UPC Intestacy Provison

Common Intestacy Scheme

-Protective Provisions (homestead, exempt property go to spouse, children)

-Creditors

-Spouse's Share is First, then

-Look Down (descendants), Look Up (parents), Look Down (siblings, then nieces/ nephews), Look Up (grandparents), Look Down (other collaterals)

Intestacy: Spouse; no Descendants; no Parents

All S

Intestacy: Spouse ; Descendants

- All Spouse only if all Descendants are also Spouse's and Spouse's only kids

- 225k + 1/2= Spouse if Descendants are also Spouse's, but Spouse has other kids; rest=Descendants

- 150K +1/2= Spouse if one or more Descendants is not Spouse's; rest= Descendants.

Intestacy: Spouse, No Descendants, Parents

300k + 3/4=spouse; rest= parents

Intestacy: No Spouse; Descendants

All Descendants (per capita at each generation

Intestacy: No Spouse; No Descendants; Parents

All Parents

Intestacy: No Spouse; No Descendants; No Parents; Parent's Descendants

Parent's Descendants (per capita at each generation)

Intestacy: No Spouse; No Descendants; No Parents; No Parent's Descendants; Grandparents; Grand parent's descendants

1/2 to paternal side and 1/2 to maternal side or all if no survivors on the other side. (per capita at each generation)

Intestacy: No Spouse, No Descendants; No Parents; No Parent's Descendants; No Grandparents; No Grandparent's Descendants

step-children or escheat

Elective Share

You cannot disinherit your spouse, except in GA. There is a minimum share graduated by the length of the marriage

Uniform Simultaneous Death Act 1945

If there is no sufficient evidence of survivorship, the beneficiary is deemed to have predeceased the donor

Simultaneous Death as of 1991

claimant must establish survivorshp by 120 hours (5 days) by clear and convincing evidence.

3 Systems of Representation

1) English Per Stirpes

2) Modern Per Stirpes

3) UPC

English Per Stirpes

-Divide at the first level, regardless of survivors. If the descendant has predeceased the decedent, the descendants take by representation

- Vertical Equity: Each line of descent treated equally

Modern Per Stirpes

Divide decedent's property at the closest generation to the decedent in which there is at least one descendant living

If all takers are in the same degree of relationship to the decedent, they take equally

If takers are in different generations, they take per stirpes

UPC 1990 system of representation

Horizontal equality — each taker at each generation treated equally ("equally near, equally dear").

UPC 2-101 Negative Wills

You can expressly disinherit a will, contrary to C/L

UPC 2-114(b) Adoptions

An adopted child is the child of his [her] adopting parent or parents and not of his [her] natural parents, but adoption of a child by a the spouse of either natural parent has no effect on (i) the relationship between the child and that natural parent or (ii) the right of the child or a descendant of the child to inherit from or through the other natural parent.

UPC 2-119 (b) Stepchild Adopted by Stepparent

A parent-child relationship exists between an individual who is adopted by the spouse of either genetic parent and:

(1) the genetic parent whose spouse adopted the individual; and

(2) the other genetic parent, but only for the purpose of the right of the adoptee or a descendant of the adoptee to inherit from or through the other genetic parent.

UPC 2-119(c) Individual Adopted by Relative of Genetic Parent

A parent-child relationship exists between both genetic parents and an individual who is adopted by a relative of a genetic parent, or by the spouse or surviving spouse of a relative of a genetic parent, but only for the purpose of the right of the adoptee or a descendant of the adoptee to inherit from or through either genetic parent.

UPC 2-119(d) Individual Adopted After Death of Both Genetic Parents

A parent-child relationship exists between both genetic parents and an individual who is adopted after the death of both genetic parents, but only for the purpose of the right of the adoptee or a descendant of the adoptee to inherit through either genetic parent.

UPC 2-113 Double Inheritance

An individual who is related to the decedent through two lines of relationship is entitled to only a single share based upon the relationship that would entitle the individual to the larger share

UPC 2-705 Transferor Not Adoptive Parent

In construing a dispositive provision of a transferor who is not the adoptive parent, an adoptee is not considered the child of the adoptive parent unless:

(1) the adoption took place before the adoptee reached [18] years of age;

(2) the adoptive parent was the adoptee's stepparent or foster parent; or

(3) the adoptive parent functioned as a parent of the adoptee before the adoptee reached [18] years of age.

UPC 2-109 Advancements

a) If an individual dies intestate as to all or a portion of his [or her] estate, property the decedent gave during the decedent's lifetime to an individual who, at the decedent's death, is an heir is treated as an advancement against the heir's intestate share only if (i) the decedent declared in a contemporaneous writing or the heir acknowledged in writing that the gift is an advancement, or (ii) the decedent's contemporaneous writing or the heir's written acknowledgment otherwise indicates that the gift is to be taken into account in computing the division and distribution of the decedent's intestate estate.

b) For purposes of subsection (a), property advanced is valued as of the time the heir came into possession or enjoyment of the property or as of the time of the decedent's death, whichever first occurs.

(c) If the recipient of the property fails to survive the decedent, the property is not taken into account in computing the division and distribution of the decedent's intestate estate, unless the decedent's contemporaneous writing provides otherwise.

Guardianship and Conservatorship for Minors: 4 Types

1) Guardianship of Property

2) Conservatorship

3) Custodianship

4) Trusteeship

Guardianship and Conservatorship for Minors: Guardianship of Property

Origin in feudal practice in which a guardian took possession of the ward's lands; still subject to extensive judicial supervision.

Guardianship and Conservatorship for Minors: Conservatorship

A guardian of property with investment powers similar to those of trustees, more flexible than guardianship.

Guardianship and Conservatorship for Minors: Custodianship

A person who is given property to hold for the benefit of a minor under the UTMA. This is an easy facility of payment device.

Guardianship and Conservatorship for Minors: Trusteeship

Flexible and highly customizable property management arrangement.

4 Bars to Succession

1) Spouse

2) Parents

3) Slayer Statutes

4) Disclaimer/ Renunciation

Bars to Succession: Spouses

(a)The following persons shall lose the rights specified in subsection (b) of this section:

(1) A spouse from whom or by whom an absolute divorce or marriage annulment has been obtained or from whom a divorce from bed and board has been obtained; or

(2) A spouse who voluntarily separates from the other spouse and lives in adultery and such has not been condoned; or

(3) A spouse who wilfully and without just cause abandons and refuses to live with the other spouse and is not living with the other spouse at the time of such spouse's death; or

(4) A spouse who obtains a divorce the validity of which is not recognized under the laws of this State; or

(5) A spouse who knowingly contracts a bigamous marriage.

(b)The rights lost as specified in subsection (a) of this section shall be as follows:

(1) All rights of intestate succession in the estate of the other spouse;

Bars to Succession: Parents

Any parent who has wilfully abandoned the care and maintenance of his or her child shall lose all right to intestate succession in any part of the child's estate and all right to administer the estate of the child, except -

(1) Where the abandoning parent resumed its care and maintenance at least one year prior to the death of the child and continued the same until its death; or

(2) Where a parent has been deprived of the custody of his or her child under an order of a court of competent jurisdiction and the parent has substantially complied with all orders of the court requiring contribution to the support of the child.

Bars to Succession: Slayer

Slayer barred from testate or intestate succession and other rights.

The slayer shall be deemed to have died immediately prior to the death of the decedent and the following rules shall apply:

(1) The slayer shall not acquire any property or receive any benefit from the estate of the decedent by testate or intestate succession or by common law or statutory right as surviving spouse of the decedent.

(2) Where the decedent dies intestate as to property which would have passed to the slayer by intestate succession and the slayer has living issue who would have been entitled to an interest in the property if the slayer had predeceased the decedent, the property shall be distributed to such issue, per stirpes. If the slayer does not have such issue, then the property shall be distributed as though the slayer had predeceased the decedent.

(3) Where the decedent dies testate as to property which would have passed to the slayer pursuant to the will, the devolution of such property shall be governed by G.S. 31‑42(a) notwithstanding the fact the slayer has not actually died before the decedent.

UPC Definition of Slayer

(b) [Forfeiture of Statutory Benefits.] An individual who feloniously and intentionally kills the decedent forfeits all benefits under this [article] with respect to the decedent's estate, including an intestate share, an elective share, an omitted spouse's or child's share, a homestead allowance, exempt property, and a family allowance. If the decedent died intestate, the decedent's intestate estate passes as if the killer disclaimed his [or her] intestate share.

General Requirements for a Valid Will

-The Presence of Mental Capacity - the testator must have the requisite mental capacity to make a "valid" will.

-The Intent to make a will, i.e., intent for the document in question to serve the purpose of carrying out how the assets should be distributed.

-The Absence of

1) Insane Delusion

2) Undue Influence

3) Fraud

4) Duress

-The Statutorily Required Formalities (e.g. writing, signature, witness, presence)

Statutory Formalities/ Will Execution

1) in writing

2) signed by the testator or in the testator's name by some other individual in the testator's conscious presence and by the testator's direction; and

3) either:

(A) signed by at least two individuals, each of whom signed within a reasonable time after the individual witnessed either the signing of the will as described in paragraph (2) or the testator's acknowledgment of that signature or acknowledgment of the will; or

(B) acknowledged by the testator before a notary public or other individual authorized by law to take acknowledgments.

Presence in will execution

- Line of Sight: the testator does not actually have to see the witnesses sign, but must be able to see them were the testator to look

-Conscious Presence: The testator, through sight, hearing, or general consciousness of events, comprehends what the witness is signing

Signature in will execution issue

What forms of signature evidence finality, distinguishing a will from a draft or mere notes?

Self-Proving Affidavits

A notarized statement by the testator and the witnesses affirming under oath that all the requirements of a valid will have been satisfied. Practically all states permit this affidavit to substitute for the in-court testimony of the witnesses when the testator's will is probated. This is not required in order to probate. Raises a rebuttable presumption that the matters stated therein are true. (quizlet)

UPC § 2-504(a):

One-step self-proving affidavit that combines the attestation clause and self-proving affidavit; the testator and the witnesses sign only once.

UPC § 2-504(b):

Two-step self-proving affidavit to a will that is already signed and attested; the testator and witnesses sign the separate affidavit after they have signed the will.

Safeguarding a Will

UPC §2-515 and NCGS §31-11 provide for deposit of the will with the clerk of the probate court. In NC, the clerk of Superior Court is the probate judge ex officio. Therefore, in NC the will is deposited by delivering it to the clerk.

Types of Curative Doctrines

1) Substantial Compliance

2) Harmless Error Rule

Substantial Compliance

the court may deem a defectively executed will as being in accord with statutory formalities if there is clear and convincing evidence that the purposes of those formalities were served

Harmless Error Rule

The court may excuse noncompliance if there is clear and convincing evidence that the decedent intended this document to be his will

Notarized Wills

Except as otherwise provided..., a will must be:

(1) in writing;

(2) signed by the testator or in the testator's name by some other individual in the testator's conscious presence and by the testator's direction; and

(3) either:

(A) signed by at least two individuals, each of whom signed within a reasonable time after the individual witnessed either the signing of the will as described in paragraph (2) or the testator's acknowledgment of that signature or acknowledgment of the will; or

(B) acknowledged by the testator before a notary public or other individual authorized by law to take acknowledgments.

Holographic Will

Only "material portions" must be in the handwritig of the testator and allows extrinsic evidence to supply that which would be lacking

Holographic Wills (Testamentary Intent) issue

Does the document indicate finality of intention to transfer, or is it merely an indication of some future disposition?"

Testamentary Intent

-Testamentary Intent means the intent that the document or transaction control events (normally the disposition of property) at the maker's death, but create no rights or powers until that time."

-Do not confuse "testamentary intent" with the desire/intent to transfer assets at death or the intent to later make a will that shall transfer assets at death. "Testamentary intent" is the intent that this document will control the distribution of assets at death.

-It is usually signified by title ("Will" or "Last Will and Testament"), by standard dispositive language ( "I give, bequeath, devise") and by common formalities of execution.

-But if a jurisdiction allows for non-attested wills, problems of testamentary intent can arise.

Signature

In almost all states permitting holographs, the location of the signature is not specified. The will may be "signed" at the end, at the beginning, or anywhere else on the face of document.

Generally it is will be deemed to meet the statutory requirement of "signed" if it has the testator's name on it in the testator's hand.

BUT, if not actually signed at the end, there may be doubt about whether the decedent intended his name to be a signature.

Holographic Will definition

A will that does not comply with [notarized will] is valid as a holographic will, whether or not witnessed, if the signature and material portions of the document are in the testator's handwriting.

Holographic Will Intent

Intent that a document constitute the testator's will can be established by extrinsic evidence, including, for holographic wills, portions of the document that are not in the testator's handwriting.

Revocation of a Will

a) A will or any part thereof is revoked:

(1) by executing a subsequent will that revokes the previous will or part expressly or by inconsistency; or

(2) by performing a revocatory act on the will, if the testator performed the act with the intent and for the purpose of revoking the will or part or if another individual performed the act in the testator's conscious presence and by the testator's direction.

Revocation of a Written Will

A written will, or any part thereof, may be revoked only

(1) By a subsequent written will or codicil or other revocatory writing executed in the manner provided herein for the execution of written wills,

or

(2) By being burnt, torn, canceled, obliterated, or destroyed, with the intent and for the purpose of revoking it, by the testator himself or by another person in the testator's presence and by the testator's direction.

Wills, Codicils, and Inconsistency

-a physical act revocation of a codicil does not revoke the underlying will

-the revocation of a will revokes all its codicils, unless the testator intends the codicil to operate independently of the will. Result is intestacy.

Presumption of Revocation

If the evidence establishes that the will was last seen in the possession of the Testator and is not found at the Testator's death, it is presumed that the testator destroyed the will with the intent to revoke it.

Probate of Lost Will

A will that is lost, or destroyed without the intent to revoke, can be admitted into probate if its contents are proved. Proof is often made by a copy of the will or by other clear and convincing evidence.

Dependent Relative Revocation (rule of second-best)

If a testator undertakes to revoke her will upon a mistaken assumption of law or fact, under the doctrine of dependent relative revocation (DRR) the revocation is ineffective p. 232if the testator would not have revoked the will but for the mistaken belief.

Revival of Revoked Wills - UPC

Under UPC § 2-509(a), if will 2 (the revoking instrument) wholly revokes will 1, the revocation of will 2 by a revocatory act does not revive will 1 unless the proponent of will 1 shows that the decedent intended the revocation of will 2 to revive will 1. Note: this could have been done in the Alburn case.

Under UPC § 2-509(b), if will 2 only revoked will 1 in part, then the revocation of will 2 by a revocatory act does revive the rest of will 1, unless the party arguing against revival shows that the decedent did not intend the revocation of will 2 to revive those parts of 1 revoked by 2.

Under UPC § 2-509 (c), if will 2 is revoked by a later will, will 3 does not revive will 1 unless the text of will 3 indicates such a result is what the testator intended.

Integration of a Will: issue

What papers were present (actually or by inference) a the time of the execution and intended to be part of the will?

Codicil

A document that is executed by a person who had previously made his or her will, to modify, delete, qualify, or revoke provisions contained in it.

- West Encyclopedia of American Law

The same formalities that are necessary for the valid execution of a will must be observed when a codicil is executed. Failure to do so renders the codicil void.

A valid will and any/all valid codicils are submitted to the probate court and form the basis of the distribution of the property.

Republication by Codicil

A will is treated as if it were executed when its most recent codicil was executed, whether or not the codicil expressly republishes the prior will, unless the effect of so treating it would be inconsistent with the testator's intent." - R. (3d) of Property: Wills and Other Donative Transfers §3.4

Republication by Codicil applies only to a validly executed previous will. A Codicil does not republish a document that is not a valid will. However, it might incorporate that document by reference.

Incorporation by Reference

Any writing in existence when a will is executed may be incorporated by reference if the language of the will manifests this intent and describes the writing sufficiently to permit its identification.

Separate Writing Identifying Devise of Certain Types of Tangible Personal Property

Whether or not the provisions relating to holographic wills apply, a will may refer to a written statement or list to dispose of items of tangible personal property not otherwise disposed of by the will, other than money. To be admissible under this section as evidence of the intended disposition, the writing must be signed by the testator and must describe the items and the devisees with reasonable certainty. The writing may be referred to as one to be in existence at the time of the testator's death; it may be prepared before or after the execution of the will; it may be altered by the testator after its preparation; and it may be a writing that has no significance apart from its effect on the dispositions made by the will.

Acts of Independent Significance

A will may dispose of property by reference to acts and events that have significance apart from their effect upon the dispositions made by the will, whether they occur before or after the execution of the will or before or after the testator's death.

-this doctrine permits changes in your estate plan that are incidental to ordinary lifetime activities.

Contracts concerning succession

A contract(with consideration) to make a will or devise, or not to revoke a will

or devise, or to die intestate . . . may be established only by

(i) provisions of a will stating material provisions of the contract,

(ii) an express reference in a will to a contract and extrinsic evidence proving the terms of the contract, or

(iii) a writing signed by the decedent evidencing the contract. The execution of a joint will or mutual wills does not create a presumption of a contract not to revoke the will or wills.

General Requirements for a Valid Will

1. The Presence of Mental Capacity - the testator must have the requisite mental capacity to make a "valid" will.

2. The Intent to make a will.

3.The Absence of

a)Insane Delusion

b)Undue Influence

c)Fraud

d)Duress

4. The Statutorily Required Formalities (e.g. writing, signature, witness, presence)

mental capacity

Testator "must be capable of knowing and understanding in a general way[:]

[1] the nature and extent of his or her property,

[2] the natural objects of his or her bounty, and

[3] the disposition that he or she is making of that property,

And must also be capable of

[4] relating these elements to one another and forming an orderly desire regarding the disposition of the property."

Destroying Testamentary Capaicity

-Testamentary Capacity cannot be destroyed by showing a few isolated facts

- Burden is on the contestants to rebut the presumption of capacity once the proponent shows due execution

Lucid Intervals

A person who is mentally incapacitated part of the time but who has lucid intervals during which he or she meets the standard for mental capacity can, in the absence of an adjudication or statute that has contrary effect, make a valid will or a valid inter vivos donative transfer, provided such will or transfer is made during a lucid interval.

Mental Capacity: Issue

whether the testator was able to form a rational desire for the disposition of her property.

Insane Delusion

a false belief not susceptible to correction by presenting the testator with evidence indicating that the belief is false. For insane delusion, a remedy - nullifying the will provision - is provided.

Mistake

a false belief that is susceptible to correction if the testator is presented with the true facts. Under traditional rules NO remedy is provided for mistake - the mistaken will provision stands