How the macroeconomy works

1/90

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

91 Terms

What is national income?

The total value of goods and services a country produces. It is the output in one year; economic growth

What is a withdrawal from the circular flow of income?

A withdrawal from the circular flow of income is money which leaves the economy

What are the pros and cons of GNI per capita?

GNI includes the income generated by domestic workers abroad, which would make living standards more accurate. HOWEVER,

- GNI doesn't account for any environmental costs

What is the difference between nominal and real income?

Nominal income is not adjusted for inflation whilst real income is adjusted for inflation, which means the inflationary effect is removed.

What are the measures of economic growth

- GDP

- GDP per capita

- GNI (per capita)

- Green GDP

Why are national income statistics useful?

- Tracking the rate of economic growth (real GDP)

- Tracking changes to living standards (real GDP per capita)

- Tracking changes to the distribution of income between groups within the economy.

What is the circular flow of income?

The circular flow of income model is a simplified representation of the flow of money, goods, and services between households and firms in an economy.

What does the circular flow of income assume?

- Households spend all their income on goods and services (in reality they do not; i.e saving)

- Firms spend all their income on factors on production

- There is no government

- There is no foreign trade

How does the circular flow of income work?

1. Households provide firms with the factors of production

2. Firms provide households with factor incomes (income method)

3. Households provide firms with consumer expenditure (expenditure method)

4. Firms provide households with goods and services (output method)

What is an injection into the circular flow of income?

An injection is money which enters the economy

What are the injections into the circular flow of income?

- Investment; when businesses invest in capital

- Government expenditure

- Exports

What are the withdrawals from the circular flow of income?

- Savings

- Imports

- Taxes

When does the economy reach a state of equilibrium?

When the rate of withdrawals = the rate of injections

What is the relationship between income, expenditure and output in the circular flow of income?

There are no injections into or withdrawals from the circular flow of income so: Income = expenditure = output

What happens if there are net injections into the economy?

An increase in GDP

What happens if there are net withdrawals from the economy?

A decrease in GDP

What are the ways of calculating GDP?

- Expenditure method

- Output method

- Income method

What is the expenditure method?

The total money spent in the economy

- Consumption

- Government spending

- Investment spending

- Change in value of stocks and exports - imports

What is the output method?

The value added from each of the main economic sectors

What is the income method?

- Income for workers and self-employed

- Profits of private and public sector businesses

- Rental income from land ownership

What are the pros and cons of GDP?

GDP gives us a measure of growth. HOWEVER:

- There is a risk of double counting, which is including the value of output in the primary sector and then including it again when the primary commodity has been manufactured; inflates the value of GDP

- Informal activity is not included in our GDP value so GDP can be lower than it should be

GDP gives us a measure of living standards. HOWEVER:

- GDP only looks at the quantity of output, not the quality of output which excludes the negative externalities of production such as the cost of resource depletion. This makes living standards seem higher than they are

- GDP doesn't regard the distribution of income and income inequality

What are the cons of GDP per capita?

GDP per capita has similar issues to GDP but also it doesnt take into account:

- Factor incomes abroad and remittances which increases living standards, especially in developing countries.

What is GNI?

The total incomee generated by a country's factors of production regardless of where they are located.

What is aggregate demand?

The total level of planned real expenditure on the goods and services produced within an economy.

What is the formula for aggregate demand and what are the components?

C + I + G + (X - M)

Consumption

Investment

Government expenditure

Exports - Imports

What is the average share of each component of aggregate demand?

Consumption - 60%

Investment - 14%

Government spending - 25%

Net exports - 1%

What is consumption?

The total spending by households on goods and services.

What determines the level of consumption in a household?

Disposable income

The higher the level of disposable income, the greater the level of consumption

Depends on tax and wage rates

Interest rates

Lower interest rates mean higher consumption as saving is less attractive

Levels of personal debt

Households will consume more if they have low levels of personal debt as less disposable income is converted to repayments

Confidence

If households are confident in their economic prospects, they consume more.

Marginal propensity to consume or save

How likely an individual is to consume or save an extra £1 of income they receive.

What is an example of incomes falling?

Closure of welsh mines leading to job losses

2008/9 financial crash

COVID-19 pandemic

What are the determinants of saving?

Interest rates

High interest rates increase the incentives to save as the reward is greater

Confidence

If workers are nervous about their future, they will be inclined to save more of their income in the event of wage cuts or redundancy.

Inflation

If prices are rising quickly, then the real value of savings is eroded, so the incentive to save reduces.

What is an example of a lack of consumer confidence?

Following the Brexit referendum in 2016, many consumers lost confidence and worried about the UK’s future prospects.

What is investment?

Spending by firms on capital goods.

What are the influences on invesmtnet?

The rate of economic growth

Business expectations and confidence

Keynes and ‘animal spirits’

Demand for exports

Interest rates

Access to credit

The influence of government and regulation

How does the rate of economic growth affect investment?

The faster the pace of economic growth, the quicker capital equipment will wear out or require replacement, so investment increases.

How does business expectations and confidence affect investment?

If firms are confident in future prospects and the likelhood of consumption increasing, they are more likely to increase investment

How does Keynes and ‘amimal spirits’ affect investment?

When animal spirits (collective mood of investors and consumers) is high, investment increases.

What is an example of animal spirits?

In the late 1990s, new technology companies such as eBay and Microsoft began to earn considerable revenue, boosting investor confidence and encouraging them to invest in start-ups in the ‘dotcom bubble’. For example, Webvan earned £375 million.

Adversely, when the dot-com bubble burst in 2001, many investors lost confidence and stopped investing.

How does the demand for exports affect investment?

It ecnourages firms to invest in capital goods to increase capacity to meet demand.

How does access to credit affect investment?

The easier it is for businesses to get loans, the more likely they are to invest.

How does the influence of government and regulations affect investment?

Businesses can take advantages of government grants; especially start-ups or business in deprived areas

Reducing rules and regulations makes it easier for firms to invest in capital goods.

What is government expenditure?

The tax revenue and borrowing spent by the government for the benefit of the country’s citizens.

What are influences on government expenditure?

The trade cycle

If the country is in a recession

Fiscal policy

What the governments taxation policy is, for example, austerity between 2010 and 2019.

What are net exports?

The value of a country’s total exports minus the value of its total imports.

What determines the level of exports and imports?

Real income

Exchange rates

Changes in the state of the world economy

Degree of protectionism

How does real income affect the level of exports and imports?

An increase in real income leads to increased demand for exports dependent on the marginal propensity to import.

How do exchange rates affect the level of exports and imports?

A strengthening currency will make UK exports less competetiive as they are more expensive so demand may fall, causing net exports to decrease.

A strengthening currency will make imports more attractive to UK consumers and demand may increase, causing net exports to decrease.

How do changes in the state of the world economy affect the level of exports and imports?

If countries are becoming richer, they will demand more of UK exports

If countries are becoming pooorer, they will demand less of UK exports

What is the basic accelerator process?

When an increase in real GDP/national income leads to a proportionately larger rise in capital investment spending.

Why does the accelerator process happen?

If firms see a rise in demand and expect it to be maintained, they will soon begin to reach full capacity.

Firms respond by investing in capital goods to meet this future demand.

What does an increase in price do to AD/AS?

A contraction in aggregate demand

An expansion in aggregate supply

What does an increase in price do to AS/AD?

An expansion in aggregate demand

A contraction in aggregate supply

What factors shift the AD curve?

Consumer confidence

Interest rates

Taxes

Government spending

Exchange rate

Wealth effect

Do price changes affect aggregate demand?

No, aggregate demand only changes when the components of aggregate demand change independent of price change.

What is the wealth effect?

Changes in consumer wealth affect consumer confidence and spending.

For example, increasing house prices has a positive wealth effect as it increases the confidence of consumers and causes them to spend more.

However, falling house prices, as seen with the 2008/9 financial crash, have a negative wealth effect and cause consumers to lose confidence and spend less.

What is the balance of trade effect?

As the price level decreases, exports become more competitive. As exports become more competitive there will be a greater demand for exports so the revenue of exports increases and less is imported. As a result, there is an expansion in aggregate demand

What is the interest effect?

If price inflation is low, there might be a reduction in interest rates to meet inflation targets.

Lower inflation rates mean there is less incentive to save and more to spend, causing an expansion in aggregate demand

What is the multiplier effect?

When an increase or decrease in an injections leads to a more than proportionate change in national income.

What is an example of the multiplier effect?

The UK government spent £8.8 billion on the 2012 London Olympics

As a result, UK real GDP increased by £16.5 billion

How do you calculate the multiplier ratio?

Total change in real GDP / initial injection

What is the marginal propensity to consume (MPC)?

The proportion of an increase in income consumers will spend (e.g how much consumers will spend if given an additional £1)

How do you calculate the MPC?

MPC = Change in consumption / Change in income

How do you calculate the multiplier using MPC?

1 / 1 - MPC

What is the marginal propensity to save?

The proportion of an increase in income consumers will save (e.g how much consumers will save if given an additional £1)

What is the relationship between MPC and MPS?

A consumer’s marginal propensity to consume added to the marginal propensity to save is equal to 1.

What is aggregate supply?

The quantity of goods and services that producers in an economy are willing and able to supply at a given level of prices.

What is meant by the short-run in economics?

The short-run is where at least one factor of production is fixed

For example, capital is fixed but labour is variable

What is meant by the long-run in economics?

The long-run is where all factors of production are variable

For example, a firm is able to build a bigger factory

What is short-run aggregate supply (SRAS)?

SRAS shows the total planned output when prices in the economy can change when

Productivity is fixed

The cost of production is fixed

The state of technology is constant

What does SRAS show?

How much output the economy can generate in the short term, at each given price level.

What is the main factor causing a shift in SRAS?

The cost of producing goods and services

What are the external factors affecting AS?

World oil and gas prices

Energy prices/costs

Other mineral/metal prices

Foodstuff prices

Import tariffs

What is long-run aggregate supply (LRAS)?

The LRAS shows the potential supply of an economy in the long run. This means

Prices can change

Costs can change

Productivity of factor inputs can change

What does classical LRAS view?

Y represents the maximum capacity of the economy to produce goods, for example, there is full employment and all resources are being used efficiently.

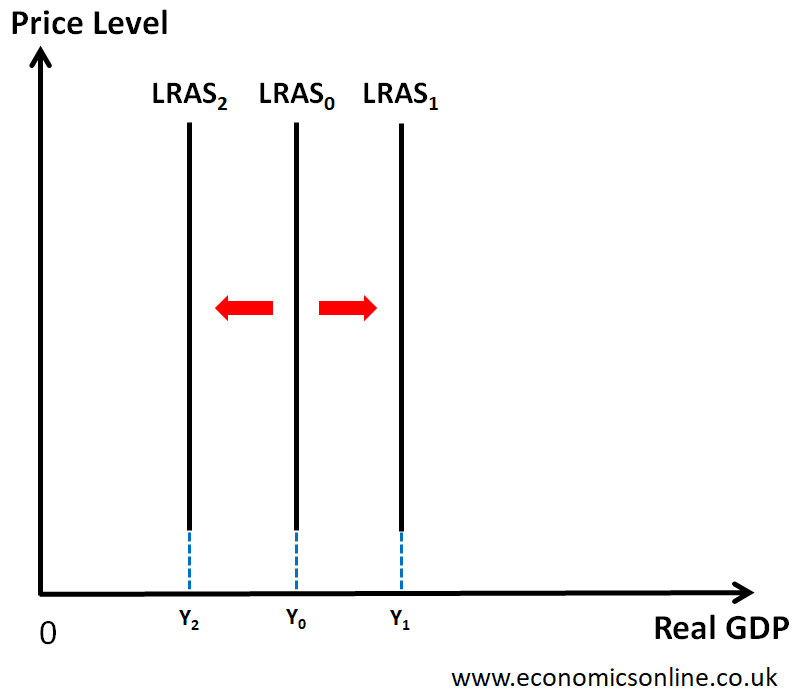

What does an increase in quantity or quality of the factors of production do to LRAS?

Shift LRAS rightwards

What does a decrease in quantity or quality of the factors of production do to LRAS?

Shift LRAS leftwards

What are the determinants of LRAS?

Technological advances

Changes in eduation and skills

Changes in relative productivity

Changes in government regulations

Demographic changes and migration

Why do technological advances shift LRAS?

Help increase productivity

Why do changes in education and skills shift LRAS?

Training and education of the workforce leading to a changes in efficiency and skills

Why do changes in government regulations affect LRAS?

Greater regulations boost competition, making firms more efficient.

Why do demographic changes and migration affect LRAS?

Changes in population, for example population aging or increase in labour force through immigration

What are money wage rates?

The amount of money a person earns each day.

What does an AD/AS diagram look like in the short-run?

- y-axis labelled price level

x-axis labelled real GDP

downward sloping curve labelled AD

upward sloving curve labelled SRAS

equilibrium is where AD = SRAS, price level = PLe and real GDP = Ye

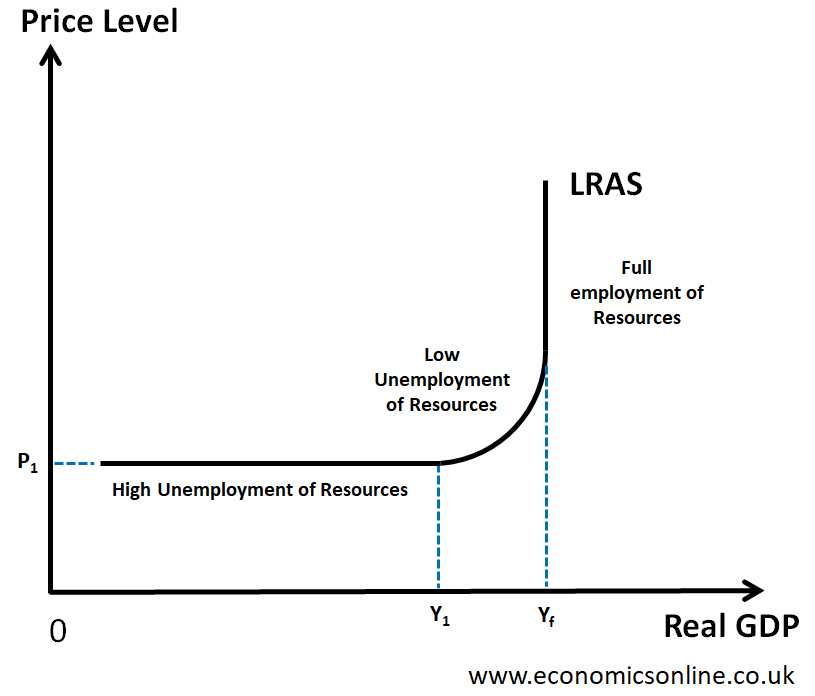

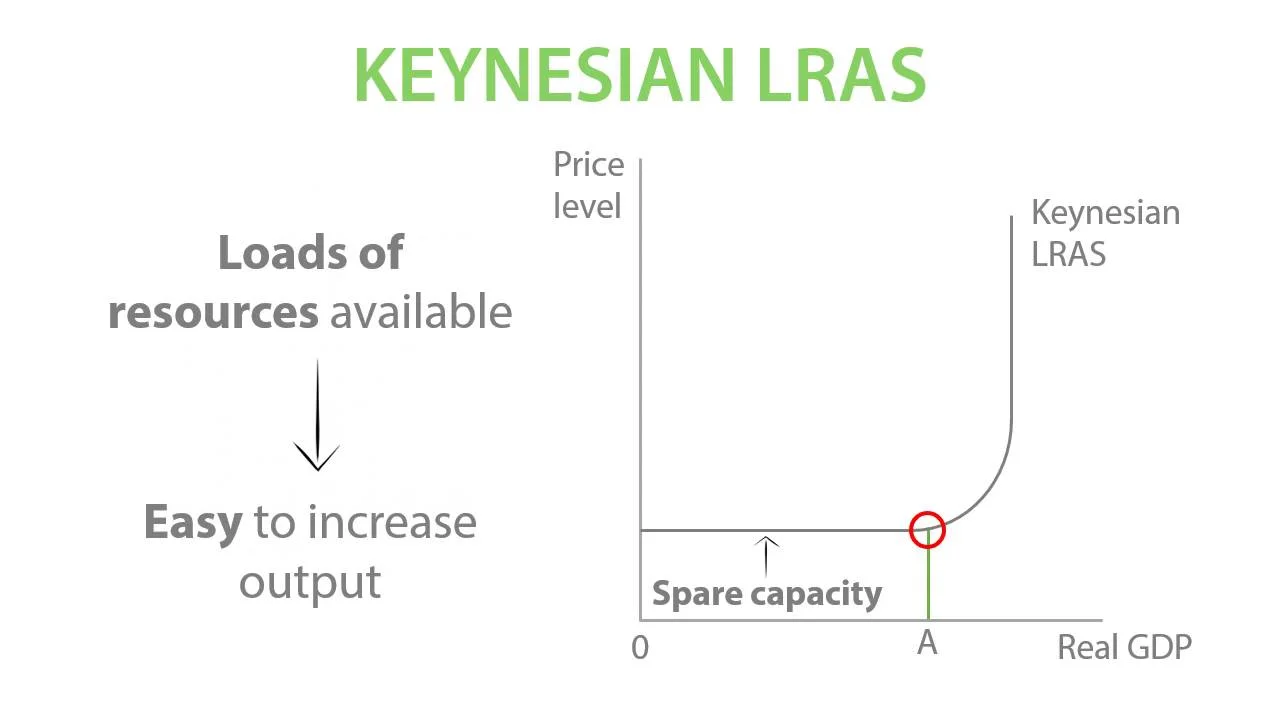

What are the three parts of the Keynesian LRAS?

Horizontal section - spare capacity (high unemployment of resources)

Bending section - bottleneck (low unemployment of resources)

Vertical section - full employment of resources

What is the difference between the Keynesian LRAS and the classical LRAS?

Classical LRAS assumes that the economy will always be producing at full employment in the long-run i.e all resources will be used.

The Keynesian LRAS is more complex and shows that an economy can be at equilibrium in the long-run at spare capacity or full employment

There is a loss of mining jobs in Wales, what will the impact be?

When Welsh coal miners lost their jobs, incomes decreased causing consumption (C), which accounts for over 60% of AD to fall. This effect will be multiplied by the multiplier effect. Because of decreased consumption, firms will make fewer sales and less profit, causing a reduction in investment (I). This also means the government receives less tax revenue and therefore government spending will be reduced.

What is an evaluative point for changes on an economy in related to the Keynesian LRAS?

However, the effects on the Welsh economy depend on where along the LRAS the economy is. If our initial equilibrium is at spare capacity, YePLe, a decrease in AD to AD1 will not affect the price level

What was the dotcom bubble?

A period of rapid growth for internet-based companies such as e-Bay. This was due to increased investor confidence which increased animal spirits and increased investment.

What is the exchange rate?

The exchange rate of a currency is the value of one currency relative to another.

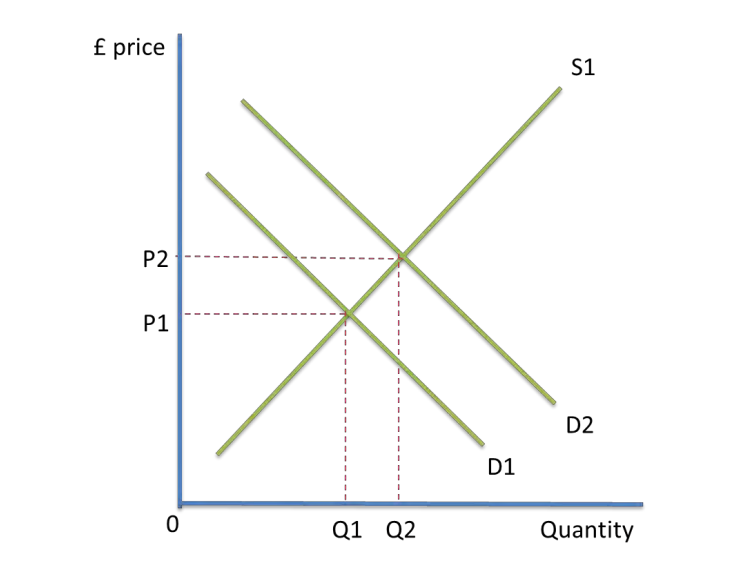

How do you draw an exchange rate diagram?

On the y-axis is the price of £

On the x-axis is the quantity of £

What determines the supply and demand of a currency?

The supply of a currency is determined when we supply pounds in exchange for foreign currencies for:

Tourism abroad

Imports

The demand for a currency is determined when foreign consumers demand pounds for:

Domestic tourism

Exports