3.2 Inflation

1/11

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

12 Terms

Inflation

Sustained increase in general price level

Deflation

Sustained decrease in general price level

Disinflation

When inflation occurs at a lower rate. Prices are still increasing, but at a slower rate

CPI

Measures cost of living for typical households, comparing value of a ‘basket of goods+services‘ from 1 year to the base year.

Inflation Rate

Change in CPI divided by initial CPI

Limitations of Inflation Rate

CPI may not entirely reflect consumption patterns of households

Cannot account for discounts sales

Cannot account for new products/substitutes

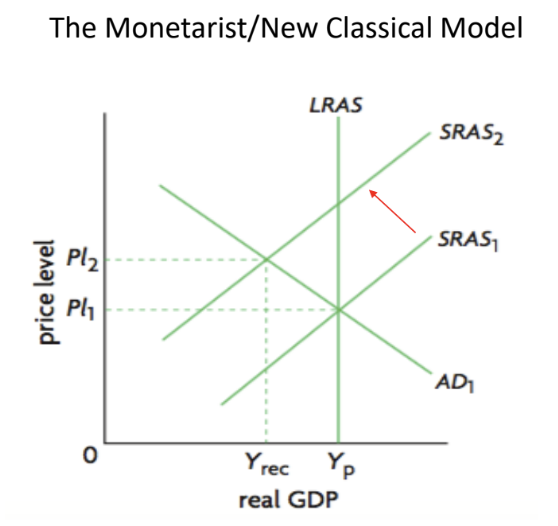

Cost Push Inflation

Caused by increase in COP, cuasing a fall in AS (aka Stagflation)

Only occurs in Monetarist Model

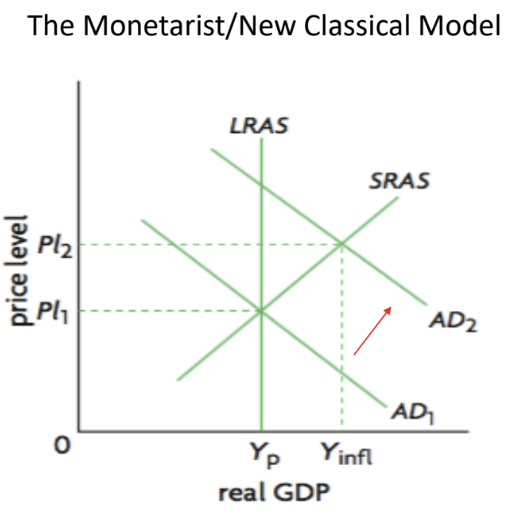

Demand Pull Inflation

Caused by excess AD in the economy (inflationary gap)

Purchasing Power

Quantity of products which can be bought with money

Consequences of Inflation (FIREW)

Firms

Firms spend more money on menu costs

Firms may be cautious about making future investments due to fluctuating price levels

International Competitiveness

If domestic IR > foreign IR, our exports are relatively more expensive

Redistribution Effects

Pensioners, people on fixed wages lose out (typically low income households)

Hence government has to spend more $ on welfare for them

Effects on Economic Growth

(X-M) component

I component

Wage Price Spiral

Trade unions argue for higher wages for workers due to the higher cost of living

Firms comply, but their COP is higher, so they pass it on to consumers

Hence cost of living increases, spirals

Hyperinflation

When the price level increases by more than 50% per month

Deflationary Spiral

AD Falls

So price level falls

Firms lay off workers due to falling profits (from lower prices) + lower AD

Unemployment rises, consumers have less disp. income, so AD. falls