ACCT 2001: Final Formulas

1/43

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

44 Terms

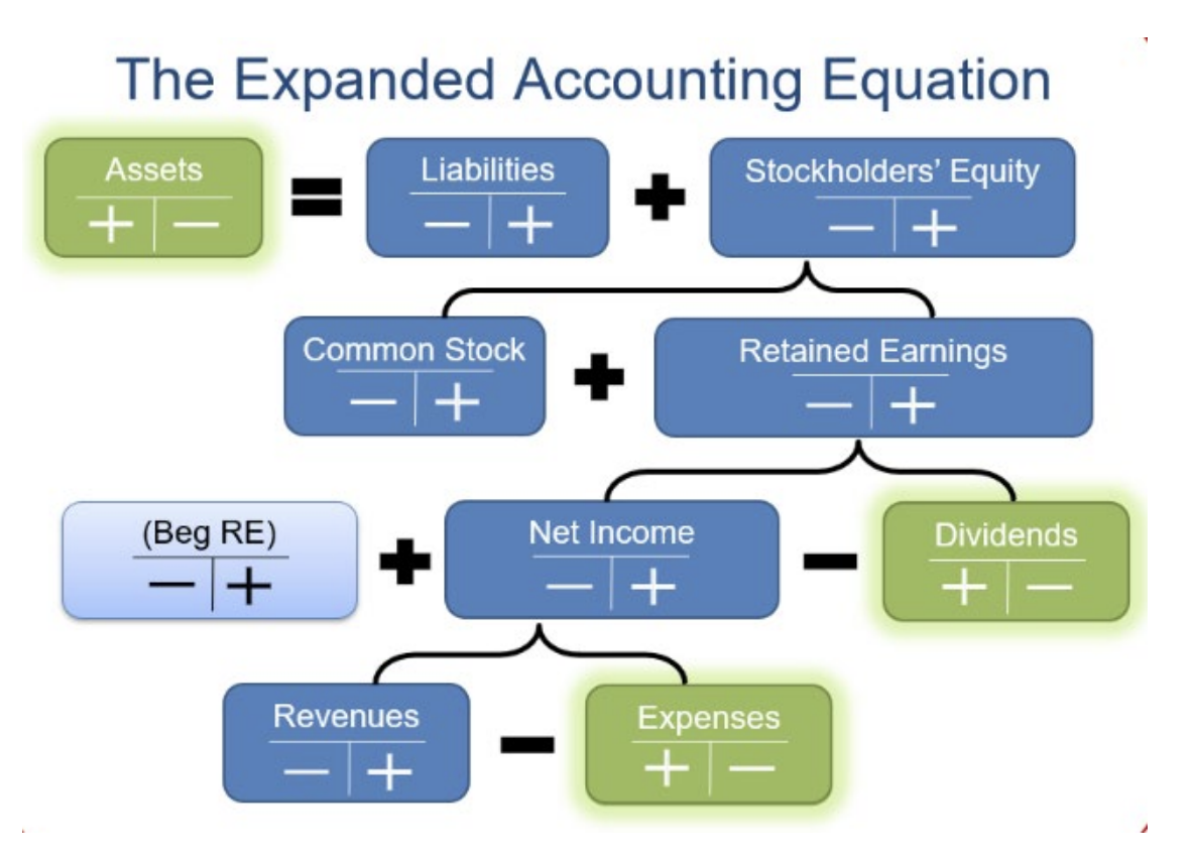

expanded accounting equation

DEALER: (debits) Dividends, Expenses, Assets, (credits) Liabilities, Equity, Revenue

current ratio

current assets/current liabilities

net profit margin

net income/total revenues

net book value

purchase cost-accumulated depreciation

asset usage/expense equation

beginning balance+purchases-supplies expense=supplies on hand at end of period

cash basis to accrual

cash basis revenue=accrual rev- increase in AR+ decrease in AR

CGS

beg inven+purchases- end inven

gross profit

sales rev-CGS

gross profit percentage

gross profit/net sales

gross profit

sales revenue-CGS

net sales

gross sales-discounts & allowances

gross margin

net sales-CGS

weighted average unit cost

cost of goods available for sale/# of units available for sale

inventory turnover ratio

CGS/average inven

days to sell

365/inven turnover ratio

interest

principle*interest rate*time

receivables turnover ratio

net sales/avg net receivables

AR

debit balance+credit sales-collection of AR-writeoffs

allowance for doubtful accounts

credit balance-writeoff+estimated bad debt loss

book value

acquisition cost of asset-accumulated depreciation

straight line method

annual depreciation=(cost-residual value)*(1/useful life)

units of production method

annual depreciation=(cost-residual value)*(prod this period/estimated total prod)

double declining method

(cost-accumulated depreciation)*2/useful life

book value

og cost-accumulated depreciation

loss/gain on disposal

selling price-book value

fixed asset turnover ratio

net revenue/avg net fixed assets

annual interest rate

face value*stated interest rate

cash received

face value*issue price

carrying value

face value+premium OR -discount

debt to asset ratio

total liabilities/total assets

times interest ratio

(net income+interest exp+income tax exp)/interest exp

sales w/ tax

sales revenue*(sales tax rate+1)

sales revenue

sales w/ tax/(sales tax rate+1)

total labor cost

salaries & wages earned+FICA taxes withheld+unemployment taxes

dividends of $x

par value*preferred dividend rate

earnings per share (EPS)

(net income-preferred dividends)/avg # of common shares outstanding

return on equity (ROE)

(net income-preferred dividends)/avg common stock holder’s equity

price/earnings (PE) ratio

current stock price per share/EPS

direct method (cash flows)

cash revenues-cash expenses= net cash provided by operating activities

indirect method

net income + noncash exps (ex: depreciation, amortization)+ losses-gains= net cash provided by operating activities

cash collected from customers

sales revenue-increases in AR AND +decreases in AR

cash paid to inventory suppliers

CGS+INCREASE in iven+DECREASE in AP

CGS-DECREASE in inven-INCREASE in AP

cash paid to employees

selling, general, & administrative expenses+INCREASE in prepaid exps+DECREASE in accrued liabilities

selling, general, & administrative expenses-DECREASE in prepaid exps-INCREASE in accrued liabilities

anything equation

end balance=beginning allowance-writeoffs/expenses+purchases/BDE/increases