INTRNTL MKT exam 2

1/115

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

116 Terms

Elements of geography managers consider

Location, Topography, Climate

What can managers not controll (geography)

The physical elements of a location

Location

Builds Political and trade relationships

Topography

Creates differences in economies, culture, politics, and social structures

Bodies of water

Attract people and facilitate transportation

Meteorological conditions

Temperature, precipitation, and wind

Climatic conditions

Explain differences in human and economic development

Natural resources

anything supplied by nature on which people depend on

Nonrenewable energy

Petroleum, nuclear power, coal, natural gas

renewable energy

Hydroelectic, solar, wind, geothermal, waves, tides, biomass

Petroleum reserves

Estimates of petroleum reserves change for a number of

reasons:

• New discoveries in proven fields with improved prospecting

equipment

• Governments open their countries to exploration and production

• Improved techniques in steam and hot water injection enable

producers to obtain greater output from operating wells and open

new areas

• Automated equipment lowers offshore drilling costs. Company

can profitably work smaller-sized discoveries

Petroleum (crude oil)

cheap source of energy and raw material for plastics and fertilizers

Petroleum (Heavy oil)

Does not flow easily and cannot be drawn from wells

Petroleum (shale)

Sedimentary fossil rock yielding 25+ liters of liquid hydrocarbon per ton @500 degrees Celsius

Nuclear power benefits

-low pollution

-low carbon emission

-growth in devel nations

Nuclear power problems

-radiation

-spent fuel storage

Coal

-49% increase in 2030

-problems include pollution and global warming

Kyoto Protocol

UN Framework convention on climate change calling on nations to reduce global warming by reducing emissions

Environmental sustainability

A systems concept if maintaining something.

Environement

society

the economy

people

within the economy of the organization

both local and global

Characteristics of environmentally stable business

• Limits

– Environmental resources are exhaustible

• Interdependence

– Actions in one ecological, social, and

economic system affects the others

• Equity in Distribution

– For interdependence to work, there cannot

be vast differences in gains

Stakeholder theory

decision making takes into account all identifiable interest holders

Addresses Underlying Values and Principles like

Type of relations with stakeholders

Tension among stakeholders can be balanced

Profits are a result not a driver of value creation

Companies with Societal Context Consistent with Stakeholder Theory

Johnson & Johnsom,ebay,google,lincoln etc

Global Gauntlet

How immeadiate is the fossil fuel crisis

How do we know when oil reserves reach midpoint and start to decline

Are these risks really above ground political issues

Why firms are nationalized

1. Extract money: government suspects hidden profits

2. Profitability: government seeks to increase firm’s

efficiency and profits

3. Ideology

4. Job preservation: government saves jobs by saving

dying industries

5. Control follows money: subsidized firms often

targets of nationalization

6. Happenstance: nationalization of German firms

after World War 2

Unfair competition from Gov. owned companies

They can

Cut prices unfairly (don’t have to make profits

Access government contracts

Access cheaper financing

Receive export assistance

Hold down wages with government assistance

Receive government subsidies

Privatization

Transfer of public sector assets to the private sector

Transfer of management of state activities through contact and leases

Contracting of activities previously conducted by the state

Privatization anywhere

Need not involve ownership transfer from government to private sector

Activities can be contracted out

Government Protection

Historical function is to protect economic activities within its geographic areas of control

Attacks, destruction, or robbery by bandits, foreign invaders, or terrorists

Aftermath of war shows influence of politics on business

solidify political and military alliances

grattitude for support and appeasement

Government STability vs. instability

Stability:

– Characteristic of a government’s ability to

maintain itself in power and keep fiscal,

monetary, and political policies predictable

• Instability:

– Characteristic of a government’s inability to

maintain power, becomes unpredictable

International Companies

50% of the worlds largest economic units are firms not nations.

IC’s make decisions about where to invest, conduct reasearch and development and where to manufacture

financial large size gives strong negotiating position

terrorism

Unlawful acts of

violence for a variety of

reasons:

– Ransom

– Overthrow government

– Release of imprisoned

colleagues

– Revenge

– Punish religious

nonbelievers

Country risk assessment

Evaluation carried out by bank or

business that assesses a country’s

economic situation and policies to

determine how much risk exists of losing

an investment.

Types of country risks political

– Wars

– Revolutions

– Coups

– New

governments

hostile to

private or

foreign-owned

business

Types of country risks economic/financial

BOP Deficits

– High

Inflation

– Low Labor

Productivity

– Militant

Labor

Unions

Types of country risks Legal related

Taxes

– Currency

Conversion

– Tariffs

– Quotas

– Labor

Permits

– Fair Trial

Country risk assesment who does it

Conference board, euromoney,business environement risk intelligence, economist intelligence unit, stratfor, moodys investor services

info needs to vary because of nature of business and time to yield satisfactory roi

Arguments for trade restrictions

– National defense

– Sanctions to punish offending nations

– Protection for infant (or dying) industry

– Protection for domestic jobs from cheap foreign

labor

– Scientific tariff or fair competition

– Retaliation

– Dumping

– Subsidies

National defense AFTR

– Industries vital to

national security

must be kept

operating even

though not

competitive with

foreign suppliers

Sanctions to punish offending nations AFTR

Inflict economic

damage to punish or

encourage desired

change

AFTR Protect infant or dying industry

Protect new industries till

they gain comparative

advantage

– Protect new industries

against lower cost imports

– Protect smooth transition

of dying industry’s

resources to other sectors

AFTR Protect Domestic Jobs from Cheap Foreign

Labor

Low labor costs bring in

lower priced goods and

eliminate home-country

jobs

AFTR Fallacies

Wages not total labor or

production cost

– Productivity rates greater

in developed countries

AFTR Scientific Tariff/ Fair competition

Import duty to bring cost

of imports up to cost of

domestic goods

AFTR retaliation

– Industries facing

restrictions ask their

governments to

retaliate with similar

restrictions

Dumping (WTO definition)

Selling a product

abroad for less than:

• the average cost of

production in the

exporting nation, or

• the market price in the

exporting nation, or

• the price to third

countries

Predatory dumping

– Lowering export price

to force import

country’s producer

out of business, then

expecting to raise

price

New types of dumping

Social Dumping

– Unfair competition from lower labor costs and poor working

conditions

• Environmental Dumping

– Unfair competition caused by lax environmental standards

• Financial Services Dumping

– Unfair competition caused by low requirements for bank capital-

asset ratios

• Cultural Dumping

– Unfair competition caused by cultural barriers aiding local firms

• Tax Dumping

– Unfair competition cause by different corporate tax rates or special

breaks

AFTR subsidies

– Financial contributions to encourage

exports or protect against imports:

• Cash payments

• Ownership Participation

• Low cost loans

• Preferential taxes

Tariff Barriers

Taxes on imports to raise their price to reduce competition for local producers or to stimulate local production.

Official Prices:

– guarantees that a minimum import duty is paid

• Variable Levy:

– import duty set at the difference world-market prices and

government-supported local prices

• Lower Duty for More Local Input

– Lower duty on goods requiring local assembly, repackaging, etc.

Nontariff Barriers

All forms of

discrimination

against imports

other than import

duties

• Quotas:

– Absolute quota

– Global quota

– Allocated quota

• Voluntary Export

Restraints (VERs)

• Orderly Marketing

Arrangements

• Nonquantitative

Nontariff Barriers

Quantitative NTBs

Absolute Quota

– When specific quantity of

imports reached, imports

are prohibited for rest of

period (usually 1 year)

• Global Quota

– Total import quantity is

fixed regardless of source

• Allocated Quota

– Importing government

assigns quantities to

specific countries

Voluntary Export

Restraints (VERs)

– Export quotas imposed by

the exporting nation

• Orderly Marketing

Arrangements

– Formal agreements

between importing &

exporting countries

stipulating quotas for

each country

Nonquantitative Nontariff Barriers

Direct government participation in trade:

– Government subsidy – to protect and support targeted

industries (agriculture)

– Government procurement policies – restrict purchases of

imported goods by government agencies

– Local content – domestic manufacturing using local materials

& labor (Buy America Act)

• Customs and other administrative procedures:

– Government policies/procedures that favor exports or

discriminate against imports

• Standards:

– Protect a nation’s citizens’ health and safety, but can be

complex and discriminatory

costs of barriers to trade

cost to consumers is tens of billions annualy

benefit few companies in proteted economic sectors

result companies pay 7x annual comp of workers to save their jobs

Rule of law

The basis of a countries legal system, protects investment

Sources of law

– Treaties

– agreements between countries – also called

conventions, covenants, compacts, protocols

– Customary International Law

– International rules derived from customs and

use over centuries

Extraterritoriality application of laws

A country’s attempt to apply its laws to

foreigners or nonresidents and to acts and

activities that take place outside of its

borders

EU and U.S. attempt to enforce laws outside border

International dispute settlement

Litigation

• Performance of Contracts

• United Nations Solutions

• Private Solutions – Arbitration

Litigation

Major Problems:

– Which jurisdiction’s

laws should apply?

– Where will litigation

occur?

Solutions:

– Choice-of-law clause

• Which law governs

– Choice-of-form clause

• Where disputes will be

settled

Performance contracts

Major Problems:

– Getting other side to

perform obligations

– No worldwide court has

power to enforce decrees

– UN International Court of

Justice relies on voluntary

compliance

– International contracts

are complicated to enforce

Possible Solutions:

– UN Convention on

International Sale of

Goods (CSID)

– Private Solutions –

Arbitration, an

alternative to litigation

– Incoterms, the

International Chamber of

Commerce’s universal

trade terminology

FAS (free alongside ship-port of call) Incoterms

Seller pays all transportation and delivery expense up to the ships side and clears the goods for export

CIF (cost,insurance,freight-foreign port) Incoterms

The price includes the cost of goods, insurace, and all transportation and other charges to the named portof final destination

CFR (cost and freight-foreign port)incoterms

Same as CIF except buyer purchases the insurance. due to lower price or government insists on local company

DAF (delivered at frontier) incoterms

Often with exporters to canada or mexico

Price covers all costs up to the border where the shipment is delivered to the buyers representative.

Specific National Legal Forces

• Competition Laws – EU equivalent of

U.S. Antitrust laws

• U.S laws & attitudes different, but

narrowing

– U.S law vigorously enforced, focuses on:

• Price fixing

• Market sharing

• Business monopolies

Competition laws

- U.S. applies antitrust laws extraterritorially

• U.S. antitrust law has civil and criminal penalties

• EU applies competition policy extraterritorially

• U.S. proposal for global antitrust regulations

• WTO may be best institution to standardize antitrust

law

Trade obstacles

Trade obstacles are:

– Legal, political & financial

• Trade obstacle examples:

– Health or packaging requirements

– Language requirements

– Weak patent and trademark protection

– Tariffs & quotas

– VARs – voluntary restraint agreements

– VERs –voluntary export restraints

Torts

Injuries inflicted on

other people, either

intentionally or

unintentionally

• U.S. tort cases result

in large monetary

awards

• Product Liability

– Company, officers and

directors liable and

subject to fines and

imprisonment when

products cause damage,

injury or death

– Strict Liability holds

firms responsible without

plaintiff proving

negligence

Differences on Product Liability

U.S.:

– High liability insurance

premiums

– High standards of strict

liability

– No caps on damages

– Lawyers paid contingency

fees

– Juries hear cases, award

actual + punitive damages to

“teach defendant a lesson”

– Juries tend to be

sympathetic to plaintiffs

Outside U.S.:

– Lower liability under “state-

of-the-art” & “developmental

risks” defenses

– Caps on damages

– Lawyer is paid on settlement

or if case is lost

– Plaintiff when unsuccessful,

may be directed to pay

defendant’s legal fees

– Judges hear liability cases

– Judges sympathetic to

defendant may not award

punitive damages

Miscellaneous Foreign Laws

• Laws in foreign countries are different.

• Laws demand compliance, esp. from

outsider.

• Ignorance of foreign law is no excuse.

• In the case of arrest and imprisonment,

punishment or fines, your country may

not be able to help you.

Foreign corrupt practices act (US law affecting US international firms)

• Foreign Corrupt

Practices Act (FCPA)

– U.S. law banning

payments to foreign

government officials for

special treatment

– Bribes (questionable or

dubious payments) paid to

government officials by

companies seeing to

purchase contracts from

those governments

Foreign corrupt practices act uncertainties

– “Grease” is not outlawed

– No clear distinction between

legal grease and illegal bribes

– Justice Department may

prosecute grease payments to

attack corruption in U.S.

– Accounting standards

compliance and management’s

responsibility under “had reason

to know”

– “Facilitating payments” seen as

bribes

– Do FCPA standards put U.S.

firms at competitive

disadvantage abroad?

Global financial scandals

– lead investor to question

integrity of financial

reporting and corporate

governance

• Result: global

economic damage

US accounting practice guided by

– Securities & Exchange

Commission (SEC)

– Financial Accounting Standards

Board (FASB)

– General Accepted Accounting

Principles (GAAP)

EU and other countries follow

– International Accounting

Standards Board (IASB)

– International Financial

Reporting Standards (IFRS)

Gold standard

The use of gold at an established number of units per currency

Bretton Woods System

Monetary system from 1945 to 1971

Used a par value based on gold and U.S. dollar

Fixed exchange rates

• Specific currency exchange equivalence upheld by government

Par value

stated value

History of gold standard

-Price of gold has risen from 1200 A.D. through today.

• Traders carried bullion, gold + silver coins till late 19th C.

• 1717, Sir Isaac Newton put England on the gold standard based

on British currency, pound sterling.

• Britain converted gold → currency until 1914 and WWI, except

during Napoleonic Wars.

• British sold gold to finance WWI, then stopped gold exchange.

Germany, France and Russia followed.

The simplicity of the gold standard is its appeal

Money only created if backed by gold

Bretton woods system history

Allied representatives met in Bretton Woods, NH, to

plan post-WWII monetary arrangements.

• IMF established.

• IMF Articles of Agreement:

• Bretton Woods system for fixed exchange rates among

member’s currencies, with par value based on gold @ $35/oz

and the U.S.$.

• Bretton Woods system supported huge international trade

growth in the 1950ies and 1960ies.

Floating currency exchange rate system history

Precipitated by French

redemption of $ holdings for

gold, 1971

• Nixon stops gold exchange for

$

• Since March 1973, major

currencies floated in FX

market

• 1976 – IMF members enact

Jamaica Agreement on

floating exchange rates and

abandon gold as reserve

currency

Floating Currency Exchange rates

– Rates that are all allowed

to float against other

currencies and are

determined by market

forces.

Jamaica Agreement

– 1976 IMF agreement

allowing flexible exchange

rates among members.

Current Currency Arrangements

• Exchange arrangement with no separate legal tender

U.S.$ in El Salvador & Ecuador; €

• Currency board arrangement, exchange at fixed rate

Hong Kong, Bulgaria

• Conventional fixed peg arrangement

fluctuations < 1% allowed. Saudi riyal -U.S.$

• Pegged exchange rate within horizontal band:

peg with fluctuation > 1%. Danish kroner - €

Crawling peg, crawling band versions

Managed floating with no preannounced path

Monetary authority intervention in FX without disclosing goals or targets —- China’s Yuan

Independently Floating Exchange Rates

Market drives exchange rates.

Interventions designed to impact rate of exchange,

not establish currency’s level.

Challenges to the floating exchange rate system

• 2008 Central Bank Liquidity Crisis

• G8 central bank influence on currency

movement

• Explosive growth in volume of currency

trades in FX markets challenge G8 efforts

• Floating currencies can move against each

other quickly and with large swings

Hedging helps protect against fluctuations

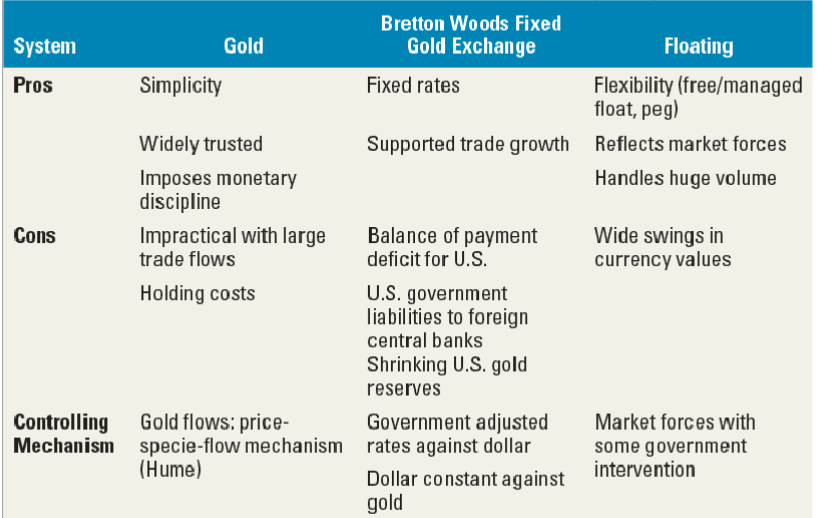

Pros and cons of different IMS

Financial Forces

• Fluctuating Currency Values

– Freely fluctuating currencies fluctuate

against each other

– Central banks can intervene in FX markets

buy/sell currency to affect supply & demand

– Central banks let major currencies ($,€,£,¥)

freely fluctuate

– Fluctuations can be huge

Foreign Exchange

• FX Quotations:

the price of 1 currency

given in terms of

another:

• $1U.S.= £0.642767

or

• £1.00 = $1.55577

The U.S.$ is a:

• Central Reserve Asset:

– Currency asset held by

central banks

• Vehicle Currency:

– Currency used in

international trade &

investment

• Intervention Currency:

– Currency used by gov’ts.

to intervene FX markets

to influence the price of a

given currency

Exchange rate quotations

• Spot Rate:

– Exchange rate

between 2

currencies

deliverable within

2 business days

• Forward

Market:

– Market for

currency

purchases at

specified rates

deliverable in 30,

60, 90, or 180 days

Causes of Exchange rate Movement

Market forces establish floating currency values and ease of convertability

– Supply & demand forecasts for 2 currencies

– Inflation in the 2 countries

– Productivity and unit labor cost changes

– Political developments – election results

– Expected government fiscal, monetary, and currency exchange

market actions

– BOP accounts

– Psychological aspects

Causes of Exchange Rate Movement Monetary+Fiscal policies

• Monetary Policies:

– Government decisions

that control amount of

money in circulation and

its growth rate

• Fiscal Policies:

– Address government’s

collecting and spending

money