CHAPTER 7: Pricing Calculations

1/60

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

61 Terms

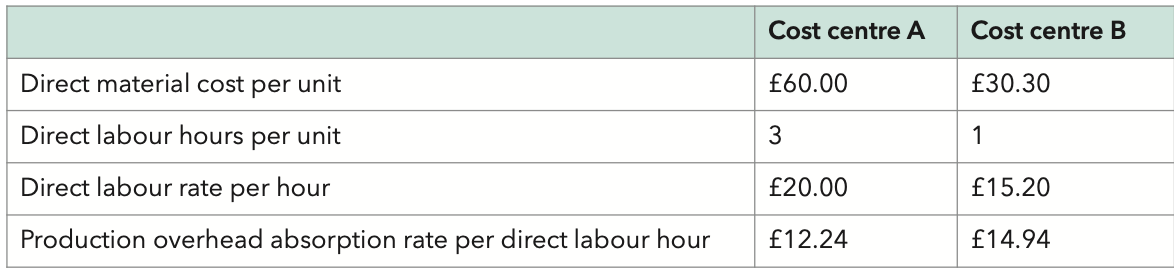

Product X is produced in two production cost centres. Budgeted data for product X are as follows:

General overheads are absorbed into product costs at a rate of 10% of total production cost.

If a 20% return on sales is required from product X, its selling price per unit should be:

A £271.45

B £282.31

C £286.66

D £298.60

D £298.60

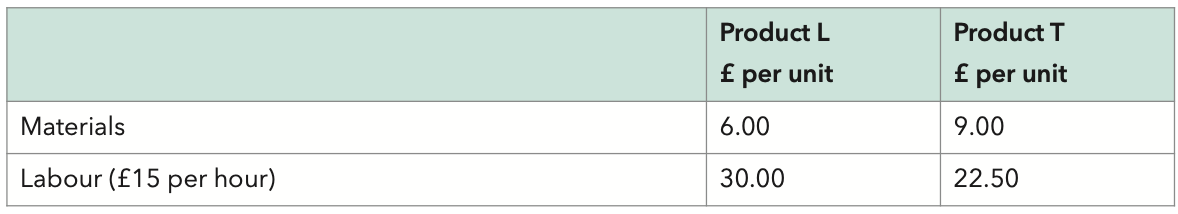

A company manufactures two products for which budgeted details for the forthcoming period are as follows:

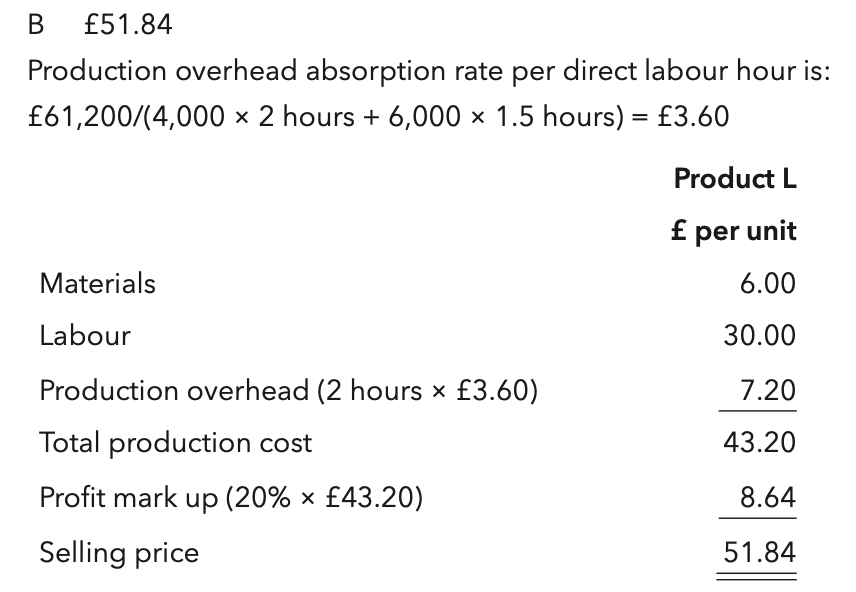

Production overhead of £61,200 is absorbed on a labour hour basis. Budgeted output is 4,000 units of product L and 6,000 units of product T.

The company adds a mark-up of 20% to total production cost in order to determine its unit selling prices.

The selling price per unit of product L is:

£51.84

Calculating Price from Cost - Mark Up

Price = cost x (1+mark-up)

Calculating Price from Cost - Margin

Price = cost x (1-margin)

Calculate margin from profit

Margin = (Price - Cost) / price = profit /price

Calculate Mark-Up from Profit

Margin = (price - cost) / cost = profit / cost

Price Elasticity of Demand

% Change in Quantity Demanded / % Change in Price

Cross Elasticity of Demand

% Change in Quantity of good A / % Change in price of Good B

Price Elasticity of Supply

% Change in Quantity / % Change in Price

A company manufactures two products for which budgeted details for the forthcoming period are as follows:

Production overhead of £61,200 is absorbed on a labour hour basis. Budgeted output is 4,000 units of product L and 6,000 units of product T.

The company adds a mark-up of 20% to total production cost in order to determine its unit selling prices.

The selling price per unit of product L is:

£51.84

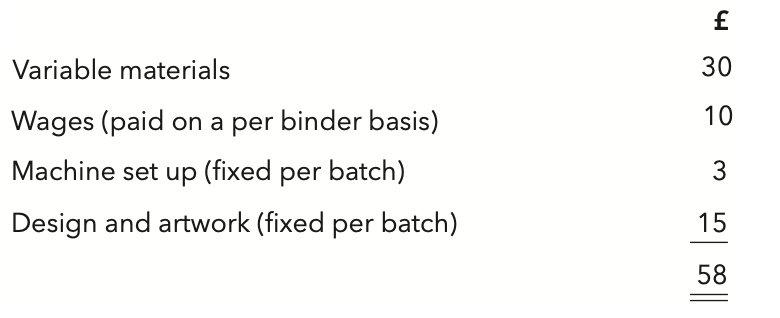

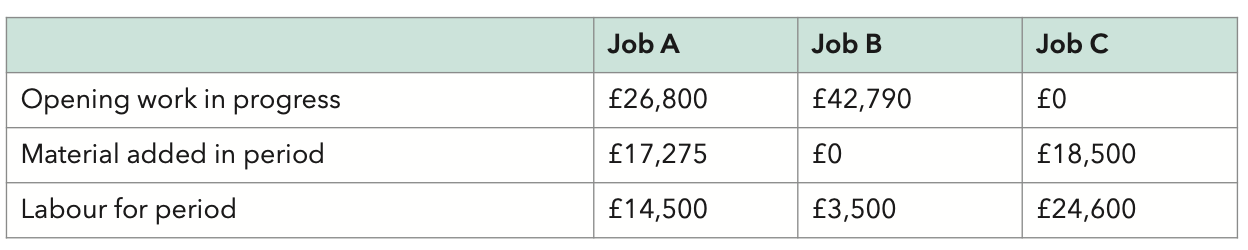

Print Ltd manufactures ring binders which are embossed with the customer's own logo. A customer Has ordered a batch of 300 binders. The following data illustrate the cost for a typical batch of 100

binders:

Print Ltd absorbs production overhead at a rate of 20% of variable wages cost. A further 5% is added to the total production cost of each batch to allow for selling, distribution and administration overhead.

Print Ltd requires a profit margin of 25% of sales value.

£201.60

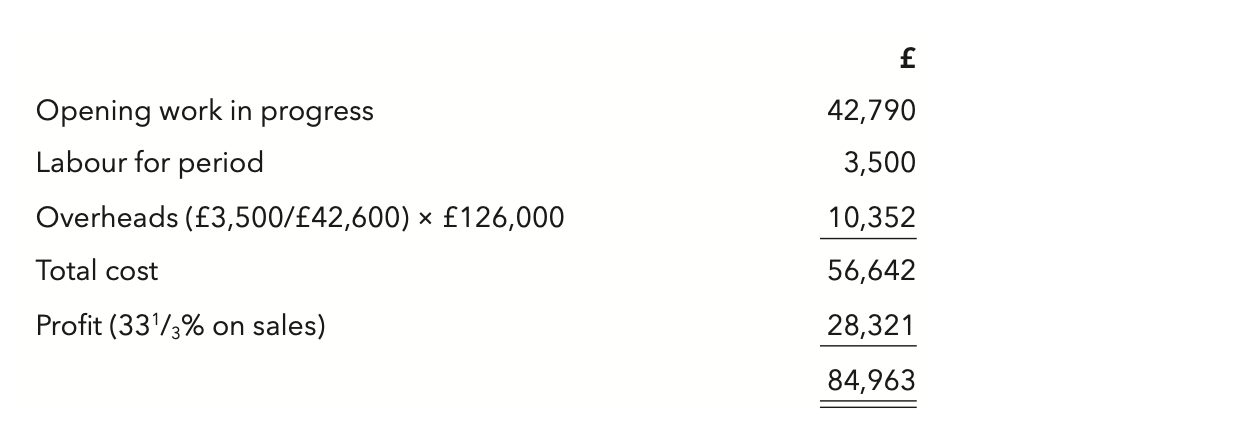

A firm makes special assemblies to customers' orders and uses job costing.

The data for a period are:

The budgeted overheads for the period were £126,000 and these are absorbed on the basis of labour cost.

Job B was completed and delivered during the period and the firm wishes to earn a 33 1 / 3 % profit margin on sales.

What should be the selling price of job B?

£84,963

An item priced at £90.68, including local sales tax at 19%, is reduced in a sale by 20%.

The new price before sales tax is added is:

£60.96

Three years ago a retailer sold electronic calculators for £27.50 each. At the end of the first year he increased the price by 5% and at the end of the second year by a further 6%. At the end of the third year the selling price was £29.69 each.

The percentage price change in Year 3 was a:

3.0% decrease

At a sales tax rate of 12%, an article sells for £84, including sales tax.

If the sales tax rate increases to 17.5%, the new selling price will be:

A £75.00

B £86.86

C £88.13

D £88.62

C £88.13

A greengrocer sells apples either for 45p per kg, or in bulk at £9 per 25 kg bag.

The percentage saving per kg from buying a 25 kg bag is:

A 9%

B 11.25%

C 20%

D 25%

C 20%

A skirt which cost a clothes retailer £50 is sold at a profit of 25% on the selling price.

The profit is therefore:

A £12.50

B £16.67

C £62.50

D £66.67

B £16.67

Sunita sells an item for £240 on which there is a mark-up of 20%.

What profit was made on this transaction?

A £40

B £48

C £192

D £200

A £40

A company calculates the prices of jobs by adding overheads to the prime cost and then adding 30% to total costs as a profit mark up. Job number Y256 was sold for £1,690 and incurred overheads of £694.

What was the prime cost of the job?

£606

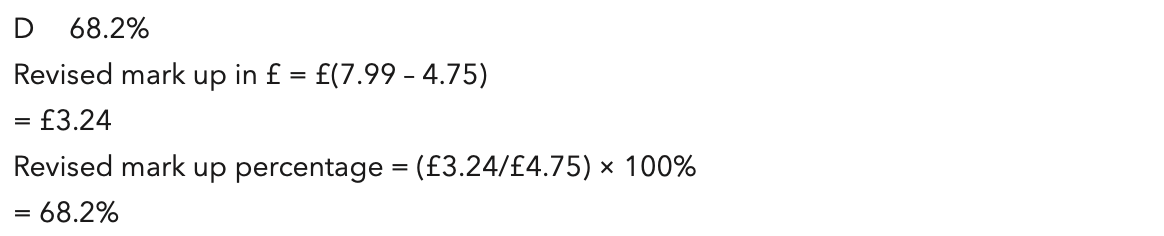

A company prices its product at the full cost of £4.75 per unit plus 70%. A competitor has just launched a similar product selling for £7.99 per unit. The company wishes to change the price of its product to match that of its competitor.

The product mark up percentage should be changed to:

68.2%

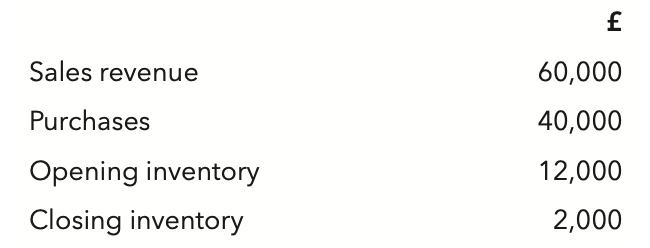

Details from a retailer's records concerning product D for the latest period are as follows.

The profit margin for product D is:

A 16.7%

B 20.0%

C 33.3%

D 50.0%

A 16.7%

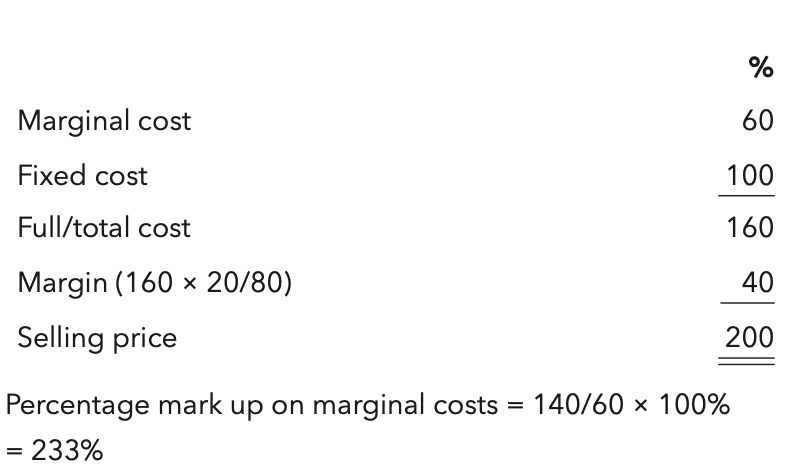

A product's marginal costs are 60% of its fixed costs. Selling prices are set on a full cost basis to achieve a margin of 20% of selling price.

To the nearest whole number, which percentage mark up on marginal costs would produce the same selling price as the current pricing method?

A 67%

B 108%

C 220%

D 233%

D 233%

A company determines its selling prices by adding a mark up of 100% to the variable cost per unit.

If the selling price is increased by 50%, the quantity sold each period is expected to reduce by 40% but the variable cost per unit will remain unchanged.

Which of the following statements is correct?

A The total revenue will increase and the total contribution will increase.

B The total revenue will increase and the total contribution will decrease.

C The total revenue will decrease and the total contribution will increase.

D The total will decrease and the total contribution will decrease.

C The total revenue will decrease and the total contribution will increase.

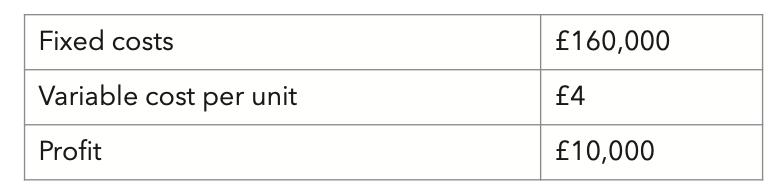

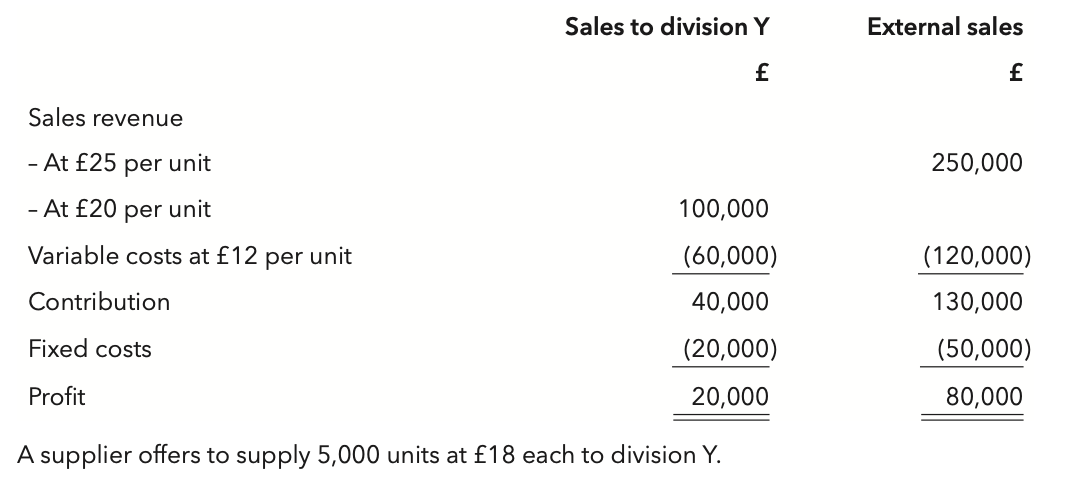

The following information is available for the latest period.

A 2% increase in selling price would not alter the number of units sold each period but the profit would increase by £5,000.

The current selling price per unit is:

A £0.08

B £10.00

C £12.50

D £12.75

C £12.50

profit =

contribution - fixed costs

A contract is agreed between a supplier and a buyer. The contract will take four weeks to complete and the price to be charged will be agreed upon at the point of sale as the actual costs incurred plus an agreed percentage mark up on actual costs. The buyer is to be granted four weeks credit from the point of sale.

Which of the following best describes how the risk caused by inflation will be allocated between the supplier and the buyer?

A The supplier and the buyer will each bear some of the inflation risk but not necessarily equally.

B The supplier and the buyer will each bear equal amounts of the inflation risk.

C Only the supplier will bear the inflation risk.

D Only the buyer will bear the inflation risk.

A The supplier and the buyer will each bear some of the inflation risk but not necessarily equally.

Which of the following statements is correct?

A A cost-plus pricing method will enable a company to maximise its profits.

B A selling price in excess of full cost will always ensure that an organisation will cover all its costs.

C The percentage mark up with full cost plus pricing will always be smaller than the percentage mark up with marginal cost-plus pricing.

D Since it is necessary to forecast output volume to determine the overhead absorption rate, full cost-plus pricing takes account of the effect of price on quantity demanded.

C The percentage mark up with full cost plus pricing will always be smaller than the percentage mark up with marginal cost-plus pricing.

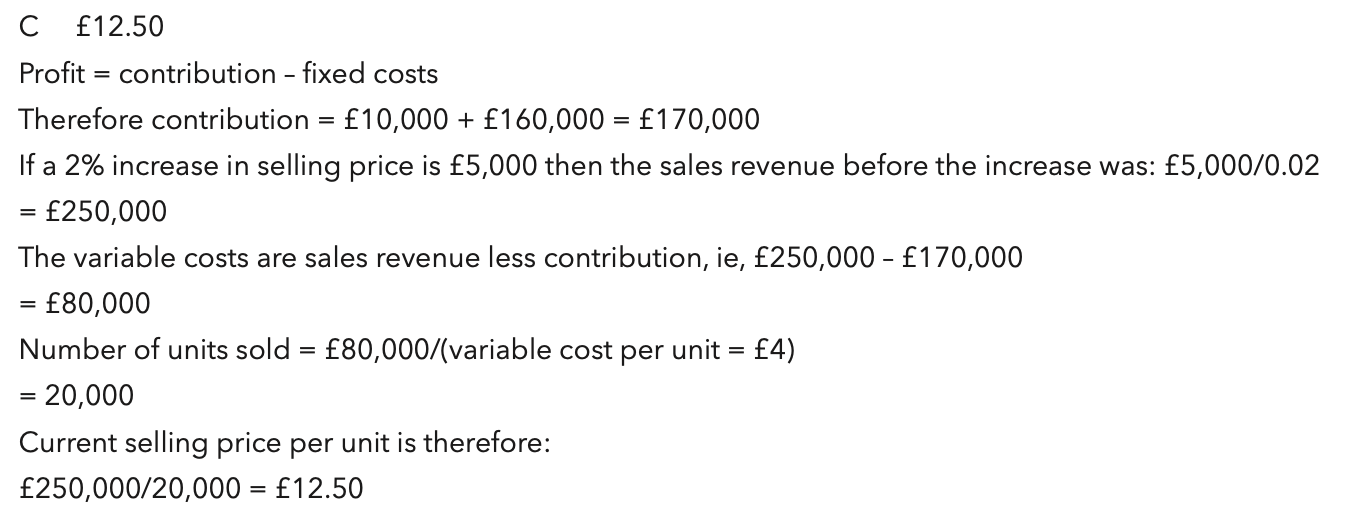

The following data relate to Bailey plc, a manufacturing company with several divisions. Division X produces a single product which it sells to division Y and also to external customers.

If division Y buys from the external supplier and division X cannot increase its external sales, the change in total profit of Bailey plc will be a:

A £10,000 decrease

B £30,000 decrease

C £10,000 increase

D £30,000 increase

B £30,000 decrease

Which two of the following criteria should be fulfilled by a transfer pricing system?

A Should encourage dysfunctional decision-making.

B Should encourage output at an organisation-wide profit-maximising level.

C Should encourage divisions to act in their own self interest.

D Should encourage divisions to make entirely autonomous decisions.

E Should enable the realistic measurement of divisional profit.

B Should encourage output at an organisation-wide profit-maximising level.

E Should enable the realistic measurement of divisional profit.

Which of the following best describes a dual pricing system of transfer pricing?

A The receiving division is charged with the market value of transfers made and the supplying division is credited with the standard variable cost.

B The receiving division is credited with the market value of transfers made and the supplying division is charged with the standard variable cost.

C The receiving division is charged with the standard variable cost of transfers made and the supplying division is credited with the market value.

D The receiving division is credited with the standard variable cost of transfers made and the supplying division is charged with the market value.

C The receiving division is charged with the standard variable cost of transfers made and the supplying division is credited with the market value.

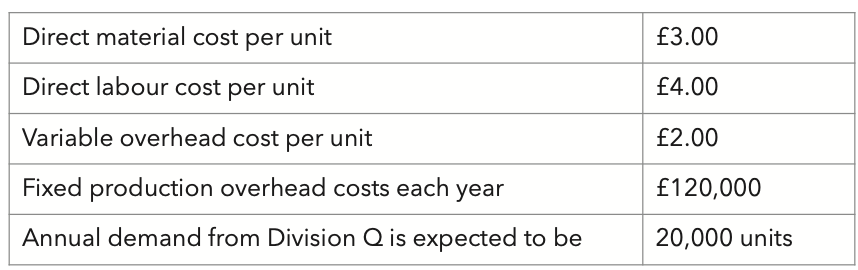

Division P produces plastic mouldings, all of which are used as components by Division Q. The cost schedule for one type of moulding, item 103, is shown below.

Two methods of transfer pricing are being considered:

(1) Full production cost plus 40%

(2) A two-part tariff with a fixed fee of £200,000 each year

The transfer price per unit of item 103 transferred to Division Q using both of the transfer pricing methods listed above is:

A (1): £12.60; (2): £9

B (1): £12.60; (2): £19

C (1): £21.00; (2): £9

D (1): £21.00; (2): £19

C (1): £21.00; (2): £9

A and B are two divisions of company C. A manufactures two products, the X and the Y. The X is sold outside the company. The Y is sold only to division B at a unit transfer price of £410. The unit cost of the Y is £370 (variable cost £300 and absorbed fixed overhead £70). Division B has received an offer from another company to supply a substitute for product Y at a price of £330 per unit.

Assume Division A and B have spare operating capacity.

Which of the following statements is correct with regard to the offer from the other company?

A The offer is not acceptable from the point of view of company C and the manager of Division B will make a sub-optimal decision.

B The offer is not acceptable from the point of view of company C and the manager of Division B will not make a sub-optimal decision.

C The offer is acceptable from the point of view of company C and the manager of Division B will make a sub-optimal decision.

D The offer is acceptable from the point of view of company C and the manager of Division B will not make a sub-optimal decision.

A The offer is not acceptable from the point of view of company C and the manager of Division B will make a sub-optimal decision.

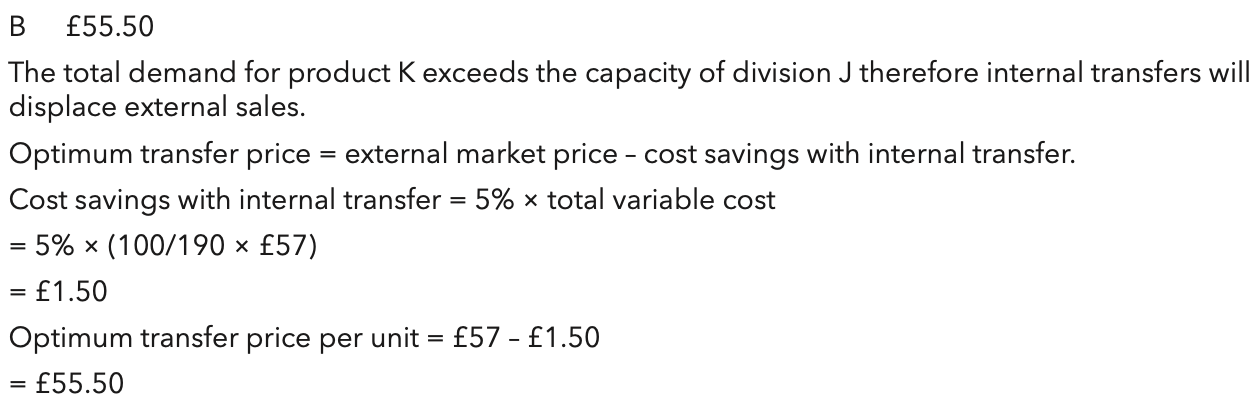

Division J manufactures product K incurring a total cost of £50 per unit. Product K is sold to external customers in a perfectly competitive market at a price of £57, which represents a mark up of 90% on marginal cost.

Division J also transfers product K to division R. If transfers are made internally then division J does not incur variable selling costs which amount to 5% of the total variable cost.

Assuming that the total demand for product K exceeds the capacity of division J, the optimum transfer price per unit between division J and division R is:

A £54.50

B £55.50

C £56.72

D £57.00

B £55.50

Optimum Transfer Price =

external market price - cost savings with internal transfer

Cost savings with Internal Transfer =

% x total variable cost

In a contract to sell a commodity the selling price is agreed between the supplier and the buyer to be the actual costs incurred by the supplier plus a profit mark-up using a fixed percentage on actual costs. No credit period is offered by the supplier.

Which of the following best describes how the risk caused by inflation will be allocated between the supplier and the buyer?

A The supplier and the buyer will each bear some of the inflation risk but not necessarily equally.

B Only the supplier will bear the inflation risk.

C Only the buyer will bear the inflation risk.

D The supplier and the buyer will each bear equal amounts of the inflation risk

C Only the buyer will bear the inflation risk.

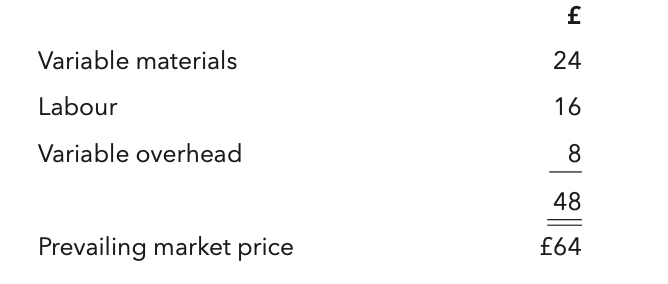

F and G are two divisions of a company. Division F manufactures one product, Rex. Unit production cost and the market price are as follows:

Product Rex is sold outside the company in a perfectly competitive market and also to division G. If sold outside the company, Rex incurs variable selling costs of £8 per unit.

Assuming that the total demand for Rex is more than sufficient for division F to manufacture to capacity, what is the price per unit (in round £s) at which the company would prefer division F to transfer Rex to division G?

A £64

B £56

C £40

D £48

B £56

£64 - 8 (variable overhead)

A company estimates indirect costs to be 40% of direct costs and it sets its selling prices to recover the full cost plus 50%.

What percentage represents the mark-up on direct costs that would give rise to the same selling price as using the method described above?

A 90%

B 110%

C 190%

D 210%

B 110%

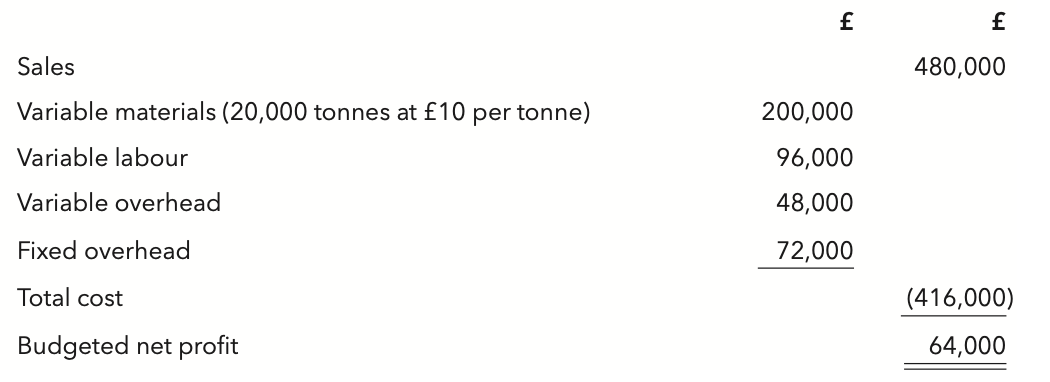

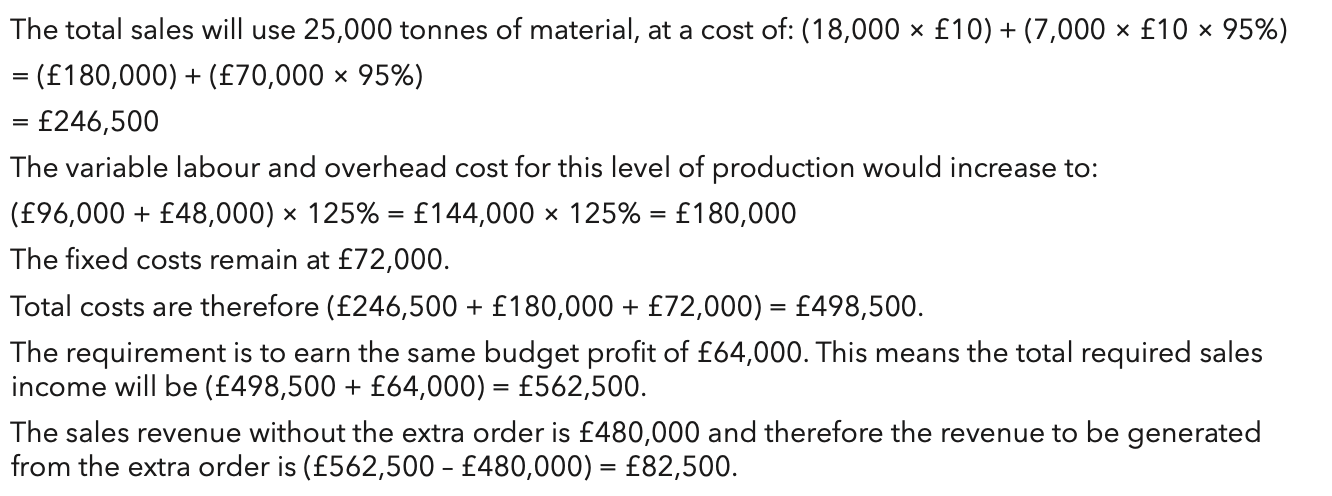

The master budget for Serse Ltd, a single-product firm, for the current year is as follows:

Serse Ltd has substantial excess production capacity. A sales enquiry has been received, late in the year, which will increase sales and production for the year by 25% over budget.

The extra requirement for 5,000 tonnes of material will enable the firm to purchase 7,000 tonnes at a discount of 5% on its normal buying price. The additional 2,000 tonnes will be used to complete the year's budgeted production.

What price should Serse Ltd charge for the special order in order to earn the same budgeted net profit for the year of £64,000?

A £83,500

B £100,500

C £82,500

D £101,500

C £82,500

Gabba sets up in business to clean carpets. She will charge £30 per carpet cleaned and estimates the direct variable and fixed costs per carpet cleaned to be £9 and £6 respectively. She also estimates her variable and fixed advertising costs per carpet cleaned to be £2 and £3 respectively.

What is the contribution per carpet cleaned and the mark up on total costs?

A Contribution: £21; Mark-up: 50%

B Contribution: £19; Mark-up: 100%

C Contribution: £10; Mark-up: 100%

D Contribution: £19; Mark-up: 50%

D Contribution: £19; Mark-up: 50%

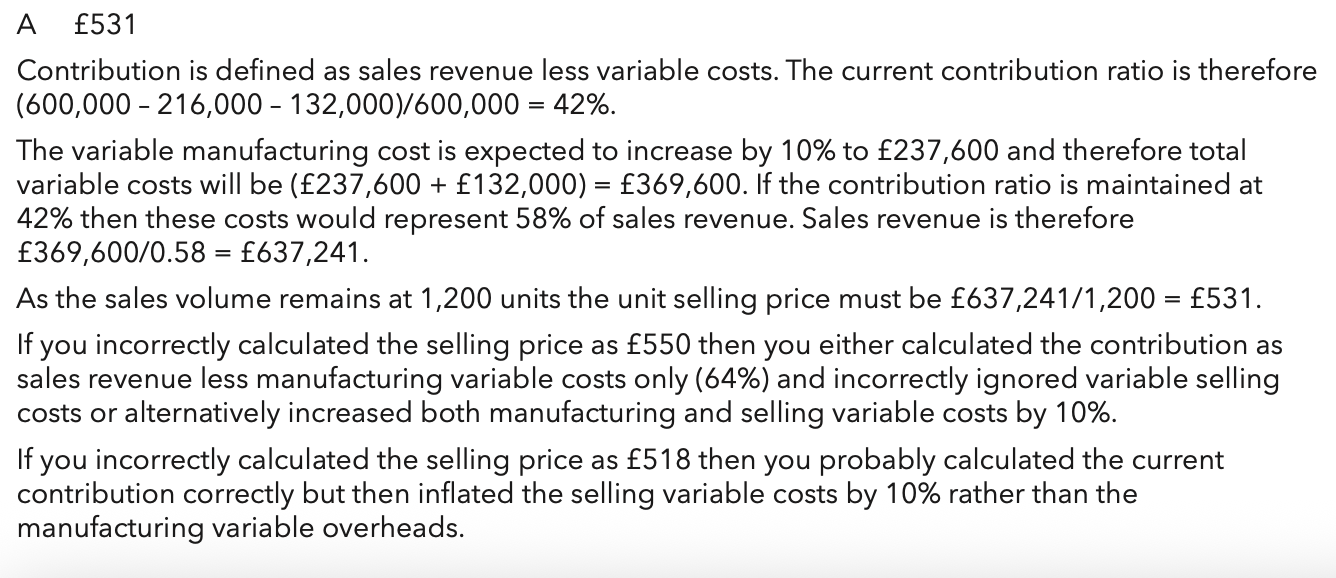

Next month's budget for a single product company is shown below:

The company's variable manufacturing cost per unit is now expected to increase by 10%, but all other costs remain unchanged.

Assuming an unchanged volume of sales, calculate the selling price per unit that would maintain the contribution ratio.

A £531

B £733

C £550

D £518

A £531

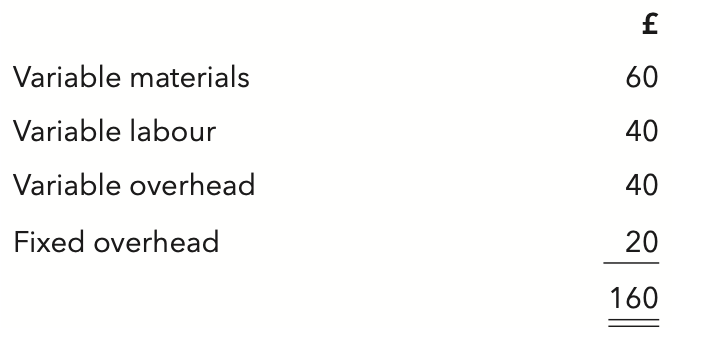

Delta and Gamma are two divisions of a company. Delta manufactures two products X and Y. X is sold outside the company. Y is sold only to division Gamma at a unit transfer price of £176. Unit costs for product Y are:

Division Gamma has received an offer from another company to supply a substitute for Y for £152 per unit.

Assuming division Delta is only operating at 80% of capacity, if Gamma accepts the offer the effect on profits will be:

A Division Delta profit: Increase; Overall company profit: Increase

B Division Delta profit: Increase; Overall company profit: Decrease

C Division Delta profit: Decrease; Overall company profit: Increase

D Division Delta profit: Decrease; Overall company profit: Decrease

D Division Delta profit: Decrease; Overall company profit: Decrease

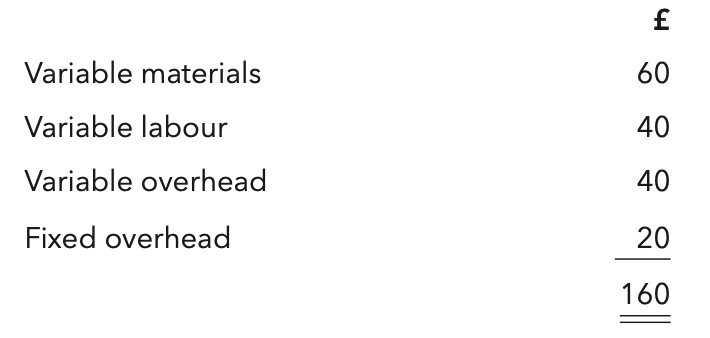

Delta and Gamma are two divisions of a company. Delta manufactures two products X and Y. X is sold outside the company. Y is sold only to division Gamma at a unit transfer price of £176. Unit costs for product Y are:

Division Gamma has received an offer from another company to supply a substitute for Y for £152 per unit.

Assuming division Delta can sell as much of Product X as it can produce and the unit profitability of X and Y are equal, what will be the effect on profits if Gamma accepts the offer?

A Division Delta profit: No change; Overall company profit: Decrease

B Division Delta profit: Decrease; Overall company profit: No change

C Division Delta profit: No change; Overall company profit: Increase

D Division Delta profit: Increase; Overall company profit: No chance

C Division Delta profit: No change; Overall company profit: Increase

A company currently sets its selling price at £10, which achieves a 25% mark-up on variable cost.

Annual production and sales volume is 100,000 units and annual fixed costs are £80,000.

By how much would the selling price need to be increased in order to double profit if costs, production and sales volume remain unchanged?

A 12%

B 17%

C 20%

D 25%

A 12%

Anu manufactures pieces of classic furniture. Anu predicts that 'if people's incomes rise next year, then the demand for my furniture will increase'.

The accuracy of Anu's prediction depends on whether the pieces of furniture he produces:

A Are normal goods

B Have few substitutes

C Have many complements

D Have few complements

Are normal goods

Potatoes are a Giffen good. An increase in the price of potatoes will cause:

A An increase in demand for potatoes

B A decrease in demand for substitutes for potatoes

C A decrease in demand for potatoes

D An increase in demand for substitutes for potatoes

A An increase in demand for potatoes

Giffen goods are

rare and essential items, such as potatoes

demand rises as the price rises

A brand of cheese is an inferior good. A consultant has made two statements about the cheese.

Statement (1): Demand for the cheese will rise as incomes rise.

Statement (2): Demand for the cheese only exists because of the effects of advertising.

Both are False

Demand for Inferior Goods

fall with rises in income, as individuals move to better quality goods.

The cross elasticity of demand between the Terra product and the Nova product is zero. The two products are:

A Complements

B Substitutes

C Veblen goods

D Unrelated

D Unrelated

Zero Cross-Elasticity means the goods

are unrelated

The UK government has recently imposed a maximum price on Pratex which is set at a lower level than its equilibrium price. In future, therefore, it can be expected that there will be:

A Excess supply of the product

B Excess demand for the product

C No effect on supply but an increase in demand

D No effect on demand but a decrease in supply

B Excess demand for the product

A price below market equilibrium price will

attract demand but deter suppliers

An analyst with Lanes plc has drawn a supply curve for one of the company's major products, the Ledo. The curve is a vertical straight line. This indicates that supply of the Ledo is:

A Perfectly inelastic

B Of unitary elasticity

C Perfectly elastic

D One

A Perfectly inelastic

There has been a significant rise in factor costs for the Tempo product during recent months. It can be expected that there will be:

A A contraction in demand and supply

B An expansion in demand and supply

C A contraction in demand and an expansion in supply

D An expansion in demand and a contraction in supply

A A contraction in demand and supply

If the price of a particular product is £9.00 per unit, on average 150 units of the product are sold per month. At a price of £10.00 per unit, on average 110 units per month are sold. The price elasticity of demand for the product is:

A –0.42

B –2.40

C –0.27

D –0.11

B –2.40

The minimum price for a good is set by the government above the current free market equilibrium price.

What will be the effect (if any) on demand for and supply of the good in the short term?

A Demand for the good will fall; supply of the good will rise

B Demand for the good will rise; supply of the good will fall

C Both demand for and supply of the good will rise

D There will be no effect on either demand for or supply of the good

A Demand for the good will fall; supply of the good will rise

Bench Ltd produces chairs. An economist predicts that, if average incomes rise next year, demand for the chairs will increase in direct proportion to the rise in incomes (assuming all other factors remain unchanged).

The accuracy of the economist's prediction depends on whether the chairs:

A Are normal goods

B Have many complementary goods

C Have few complementary goods

D Have few substitutes

A Are normal goods

Changes in the supply of a product which arise due to reduced costs of its manufacture will be represented on the product's supply curve by:

A A shift to the right in the supply curve

B A shift to the left in the supply curve

C Movements along the supply curve

D None of these

A A shift to the right in the supply curve

Pinewood Ltd produces two complementary products, the Buggle and the Chine.

Which of the following describes the cross elasticity of demand between the two products?

Negative