AP Macro Unit Four: Financial Sectors

4.0(1)

Card Sorting

1/26

Last updated 5:55 PM on 3/11/23

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

27 Terms

1

New cards

Financial Assets

* stocks (ownership of a company)

* bonds (loan to a company)

* money (most LIQUID asset)

* bonds (loan to a company)

* money (most LIQUID asset)

2

New cards

Liquid Assets

Assets that are easily spent

3

New cards

Functions of Money

* medium of exchange (can be used to buy goods/services)

* Unit of Account (standard of value)

* Store of Value (value of work is stored in dollars)

* Unit of Account (standard of value)

* Store of Value (value of work is stored in dollars)

4

New cards

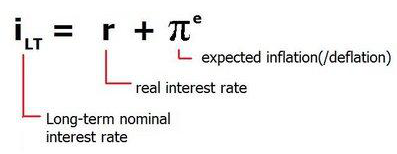

Real vs. Nominal

The Fisher Formula →i = r + π

* i → Nominal Interest Rate

* r → Real Interest Rate

* ***π → Inflation Rate***

* i → Nominal Interest Rate

* r → Real Interest Rate

* ***π → Inflation Rate***

5

New cards

Unexpected Inflation

Borrowers that were HELPED pay a lower real rate of interest

Lenders that helped are HURT b/c they’re paid a lower real rate of interest

\

GDP/Wages → %Change in Nominal = %Change in Real - π

\

\*\* Difference between real and nominal is inflation

\*\* Nominal has inflation, real DOES NOT

Lenders that helped are HURT b/c they’re paid a lower real rate of interest

\

GDP/Wages → %Change in Nominal = %Change in Real - π

\

\*\* Difference between real and nominal is inflation

\*\* Nominal has inflation, real DOES NOT

6

New cards

Measures of Money

M0 (Monetary Base) → bank reserve (not money) and currency (money)

M1 (Money) → Currency and checkable deposits, etc.

M2 (Money and Near Money) → M1 + Savings Deposits, etc.

M1 (Money) → Currency and checkable deposits, etc.

M2 (Money and Near Money) → M1 + Savings Deposits, etc.

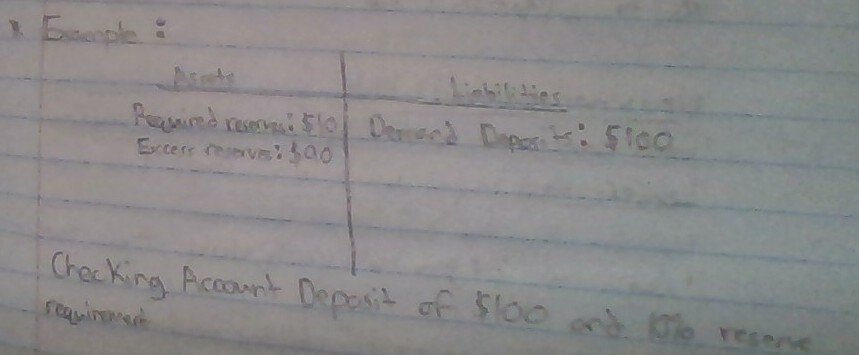

7

New cards

Bank Balance Sheets

* Assets ALWAYS equal liabilities in a Bank Balance Sheet

\

Assets include

* Total Reserve (required reserves and excess reserves)

* Loans Given

* The Bank Itself

\

Liabilities include

* Demand Deposits (checkings accounts from people)

* Savings Deposits

* Owner Equity (owed to owners)

* Loans owed to banks

\

Assets include

* Total Reserve (required reserves and excess reserves)

* Loans Given

* The Bank Itself

\

Liabilities include

* Demand Deposits (checkings accounts from people)

* Savings Deposits

* Owner Equity (owed to owners)

* Loans owed to banks

8

New cards

Required Reserves

Percentage of demand deposits **set by the Federal Reserve**

(I think it has to do with the FDIC during FDR’s presidency)

(I think it has to do with the FDIC during FDR’s presidency)

9

New cards

Excess Reserves

Money the bank can loan out

* Total Reserves minus Required equals Excess

* Total Reserves minus Required equals Excess

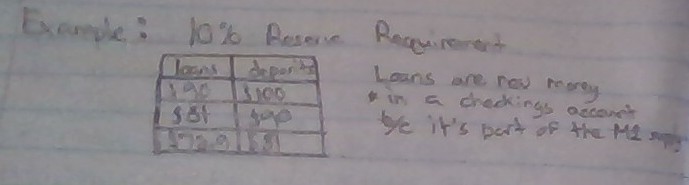

10

New cards

Money Multiplier

How many dollars worth of new loans, deposits, and money can be created from excess reserves

\

1/Required Reserves

Example: 1/10% = 10

\

\*\* For deposits, include the original deposit (if a deposit or another money)

* Money multiplier tells us the MAXIMUM number of deposits, loans, and new money, BUT numbers are usually much lower due to Leakages

\

1/Required Reserves

Example: 1/10% = 10

\

\*\* For deposits, include the original deposit (if a deposit or another money)

* Money multiplier tells us the MAXIMUM number of deposits, loans, and new money, BUT numbers are usually much lower due to Leakages

11

New cards

Leakages

* banks usually hold excess reserves

* consumers might hold cash, rather than depositing

* consumers might hold cash, rather than depositing

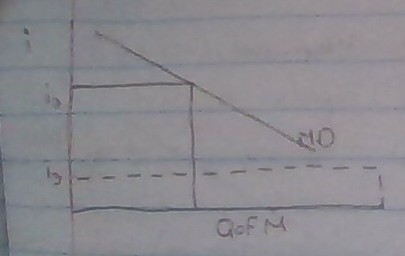

12

New cards

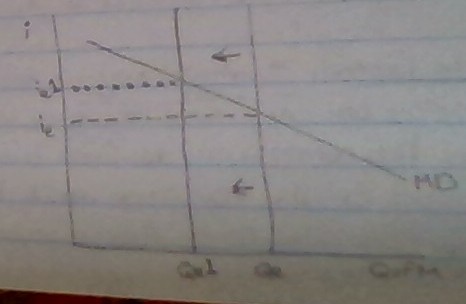

Money Demand

Nominal interest rate is the opportunity cost for holding money

* When the nominal interest rates are high, people demand fewer dollars b/c the opportunity cost of holding your money increases

\

* when Nominal interest rates fall, the demand for money will increase

* When the nominal interest rates are high, people demand fewer dollars b/c the opportunity cost of holding your money increases

\

* when Nominal interest rates fall, the demand for money will increase

13

New cards

Asset Demand for Money

The desire to hold wealth as money, instead of other assets such as stocks or bonds

14

New cards

Transaction Demand for Money (Determinates of Money Demand)

Money is needed in order to buy goods/services

GDP = C + Ig + G + Xn

Price Levels

\

\* if either of the two facets change, the money demand will increase or decrease

GDP = C + Ig + G + Xn

Price Levels

\

\* if either of the two facets change, the money demand will increase or decrease

15

New cards

Money Supply

Determined by the actions of the Federal Reserve

* looks like the long-run aggregate supply in that its vertical

* looks like the long-run aggregate supply in that its vertical

16

New cards

Open Market Operations

The buying/selling of government bonds or stocks

17

New cards

Discount Rate

Interest rate the Federal Reserve charges banks

18

New cards

Reserve Requirements (expounded)

The percentage of checkable deposits (money that cannot be loaned out)

\

\*\* The FED targets the __Federal Funds Rate__

* Federal Funds Rate is the rate at which banks charge each other

\

\*\* The FED targets the __Federal Funds Rate__

* Federal Funds Rate is the rate at which banks charge each other

19

New cards

Monetary Policy is impacted by

Multiplier

20

New cards

Expansionary MONETARY Policy

Buy bonds, lower the discount rate, or lower the reserve requirement

* lower Nominal Interest, more Gross Investment

\*\* Increases in Gross Investment shift AD curves to the right, back to full employment

\

\*\* When in a recessionary gap

* lower Nominal Interest, more Gross Investment

\*\* Increases in Gross Investment shift AD curves to the right, back to full employment

\

\*\* When in a recessionary gap

21

New cards

Contractionary MONETARY Policy

Sell bonds, raise the discount rate, raise the reserve requirements

* Higher Nominal Interest, less Gross Investment

\

\*\* Decreases in Gross Investment shift AD curves to the left, back to full employment

\

\*\* When in an inflationary gap

* Higher Nominal Interest, less Gross Investment

\

\*\* Decreases in Gross Investment shift AD curves to the left, back to full employment

\

\*\* When in an inflationary gap

22

New cards

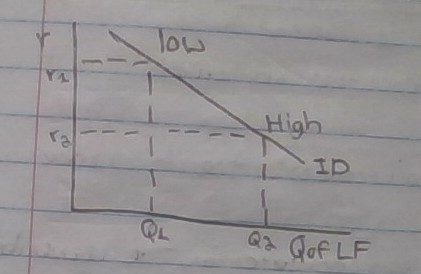

Demand for Loanable Funds

At high interest rates, low quantities of investment will be demanded

\

\*\* Real interest quantity of Loanable Funds Investment Demands - demand by business for Gross Investment

\

\*\* Real interest quantity of Loanable Funds Investment Demands - demand by business for Gross Investment

23

New cards

Shifts in Investment Demand (Loanable Funds Demand Determinates)

Anything that impacts the profit potential of new investments

* changes in economic outlook

* investment tax credits

* changes in economic outlook

* investment tax credits

24

New cards

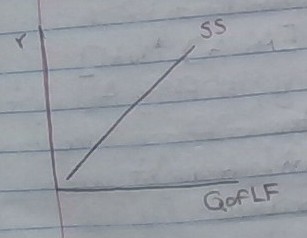

Savings Supply

Money saved that’s available for loans

* at high interest rates, the quantity of loanable funds will also rise

* at high interest rates, the quantity of loanable funds will also rise

25

New cards

Shifts in Savings Supply

* Disposable income

* Economic outlook

* Foreign investment

* Economic outlook

* Foreign investment

26

New cards

Crowding Out

An increase in the government deficit will increase interest rates and reduce Ig (Investment)

\

\[increase in demand or decrease in supply makes interest rates higher\] → less Gross Investment

\

\*\* Less long-term development

\

\[increase in demand or decrease in supply makes interest rates higher\] → less Gross Investment

\

\*\* Less long-term development

27

New cards

Budget Surplus

Government won’t have to borrow as much money, which decreases interest rates and increases Ig

\

\[decreased demand/increased supply\]

\

\*\* More long-term development

\

\[decreased demand/increased supply\]

\

\*\* More long-term development