Untitled

0.0(0)

Card Sorting

1/70

Earn XP

Description and Tags

Last updated 2:52 PM on 9/16/22

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

71 Terms

1

New cards

economics

study of how society manages its scare resources

2

New cards

society

individuals, firms, government

3

New cards

scarcity

limited nature of society's resources, individuals face time and income scarcity

4

New cards

behavior of the economy

reflects the behavior of the individuals who make up the economy

5

New cards

opportunity cost

what you give up

- value of certain resources could have produced had they been used in the best alternative way, not always cost related, could be time

- implicit+explicit cost

- living expenses are not opp cost, since you're going to spend that anyway

- value of certain resources could have produced had they been used in the best alternative way, not always cost related, could be time

- implicit+explicit cost

- living expenses are not opp cost, since you're going to spend that anyway

6

New cards

marginal change

small incremental adjustments around the edges of what you're doing

- ex: marginal benefits, marginal costs

- ex: $40 a month for a movie streaming service and you watch 8 movies a month, the marginal cost: the extra you would have incurred by streaming another film (would be 0) because you pay the same $40 for the service

- ex: marginal benefits, marginal costs

- ex: $40 a month for a movie streaming service and you watch 8 movies a month, the marginal cost: the extra you would have incurred by streaming another film (would be 0) because you pay the same $40 for the service

7

New cards

marginal benefit

depends on how much the person already has

- water vs diamonds, water is essential but the marginal benefit of having it is small because water is plentiful

- water vs diamonds, water is essential but the marginal benefit of having it is small because water is plentiful

8

New cards

a rational decision maker

takes an action if the action benefits exceed its cost

9

New cards

incentive

something that induces a person to act

- ex: when the price of apples rises, people decide to eat fewer apples, and tax on gas encourages different transportation

- ex: when the price of apples rises, people decide to eat fewer apples, and tax on gas encourages different transportation

10

New cards

trade

allows each person to specialize in the activities she does best

11

New cards

market economies

the decisions of the central planner are replaced by the decisions of millions of firms and households

- firms decide who to hire, households decide which firms to work for

- these all interact in the marketplace where prices and self interest guide decisions

- firms decide who to hire, households decide which firms to work for

- these all interact in the marketplace where prices and self interest guide decisions

12

New cards

free markets

contain many buyers and sellers, and goods and servies

-

free market, an unregulated system of economic exchange, in which taxes, quality controls, quotas, tariffs, and other forms of centralized economic interventions by government either do not exist or are minimal.

-

free market, an unregulated system of economic exchange, in which taxes, quality controls, quotas, tariffs, and other forms of centralized economic interventions by government either do not exist or are minimal.

13

New cards

market failure

to refer to a situation in which the market on its own fails to produce an efficient allocation of resources, caused by externalities and market power

- the individual incentives for rational behavior do not lead to rational outcomes for the group, known as negative externalities: traffic, litter, obesity, pollution

- the individual incentives for rational behavior do not lead to rational outcomes for the group, known as negative externalities: traffic, litter, obesity, pollution

14

New cards

externality

can be harmful or beneficial, the impact of one person's actions on the well-being of a bystander

- in a negative externality such as pollution the market may fail to take this cost into account

- positive externality=getting an education

- in a negative externality such as pollution the market may fail to take this cost into account

- positive externality=getting an education

15

New cards

market power

ability of a firm to unduly influence the market prices-> having only one well for water, the person who owns it has lots of power and takes advantage

- causes externalities

- causes externalities

16

New cards

a country standard of living depends on...

its ability to produce, more productive, then high standard of living

17

New cards

prices rise when

too much money is printed

18

New cards

inflation

increases in overall prices in the economy, value of money decrease so prices rise

19

New cards

a short run trade-off between inflation and unemployment

increasing the amount of money in the economy stimulates overall level of spending thus higher demand for goods and services, more demand may overtime cause firms to raise their prices but also encourages them to higher more workers

- over a period of a year or two, many economic policies push inflation and unemployment in opposite directions

- over a period of a year or two, many economic policies push inflation and unemployment in opposite directions

20

New cards

explicit cost

monetary cost $$$

21

New cards

implicit cost

time, things you could've done instead, a student who gives up income of a job when he stays in college for 4 years

22

New cards

marginal analysis

every decision you make you have to determine that the marginal benefit is at least as great as the marginal cost

23

New cards

total benefit

revenue generated by all customers for all advertising hours

24

New cards

total cost

total amount of time spend for all hours of advertising

-change in total cost, margins of total cost

-change in total cost, margins of total cost

25

New cards

net benefit

total benefit-total cost

26

New cards

marginal benefit

revenue generated by additional customers gained from the last hour of advertising- the margins of total benefit

27

New cards

you are going to keep advertising

as long as marginal benefits exceeds or equals marginal cost, advertising is MB is at least as great as MC

28

New cards

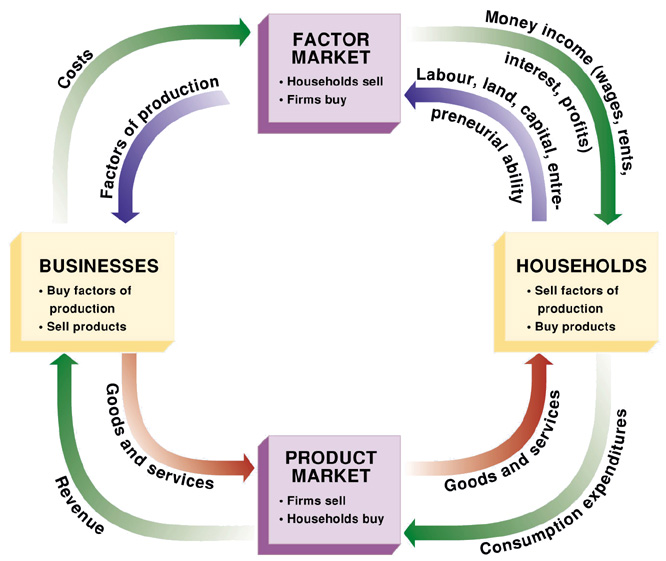

circular flow diagram

model how the economy is organized and how participants interact

- outer arrow is the flow of dollars, inner arrows, flow of inputs and outputs

- two markets: goods and services and factors of production

- two groups of people: households and firms

- outer arrow is the flow of dollars, inner arrows, flow of inputs and outputs

- two markets: goods and services and factors of production

- two groups of people: households and firms

29

New cards

two types of decision makers

firms and households (in a circular flow diagram)

30

New cards

firms

produce goods and services using inputs, labor, land, capital,

- inputs are called factors of production

- inputs are called factors of production

31

New cards

factors of production

labor, land, capital

32

New cards

households

own the factors of production and consume the goods/services the firms produce

- sell factors

- buy products

- sell factors

- buy products

33

New cards

households and firms in the market

households are buyers, firms are sellers, and in the market for factors of production, firms are buyers and households are sellers

34

New cards

factor market

households sell, firms buy (top of diagram)

35

New cards

businesses

(left side of diagram)

- buy factors of production

- sell products

- buy factors of production

- sell products

36

New cards

product market

firms sell, households buy (bottom of diagram)

37

New cards

inner loop

flows of inputs and outputs

- households sell labor, land, and capital, to firms for factors of production

- firms use these factors to produce goods and services, which in turn are sold to households

- households sell labor, land, and capital, to firms for factors of production

- firms use these factors to produce goods and services, which in turn are sold to households

38

New cards

outer loop

the corresponding flow of money

- households spend money to buy goods and services from firms

- the firms use the revenue from sales for payments to the factors of production such as wages

- whats left is the re-profit for the firm owners who are themselves, members of households,

- households spend money to buy goods and services from firms

- the firms use the revenue from sales for payments to the factors of production such as wages

- whats left is the re-profit for the firm owners who are themselves, members of households,

39

New cards

economists

develop models to explain behavior and/or events

- model is a relationship between variables

- model is a relationship between variables

40

New cards

law of demand

all else the same, an increase in the price of a good will reduce the quantity demanded of the good

41

New cards

ppf

an economy that only produces two goods--> cars and computers

- the ppf shows the various combinations of output that the economy can possibly produce given the available resources

- slope measures the opp cost of a car in terms of computers

- the ppf shows the various combinations of output that the economy can possibly produce given the available resources

- slope measures the opp cost of a car in terms of computers

42

New cards

less steep parts of the curve

less opportunity cost, bowed out because the opp costs isn't consistent

43

New cards

what determines the price that trade takes place

has to lie between their opp costs

44

New cards

comparative advantage

ability to produce a good at a lower opp cost

45

New cards

market

place where buyers and sellers interact and determine the price of a good

- buyers determine the demand for a product and sellers determine supply

- buyers determine the demand for a product and sellers determine supply

46

New cards

supply and demand

supply-> sellers of a good or service

demand-> buyers of a good or service

they refer to the behavior of people as they interact with one another in competitive markets

demand-> buyers of a good or service

they refer to the behavior of people as they interact with one another in competitive markets

47

New cards

competitive markets

lots of buyers and many sellers that each has a negligible impact on the market price

- each seller of ice cream has limited control over the price because other sellers are offering similar products

- no buyer can influence the price because each buyer purchases only a small amount, raising prices too high means people will just buy elsewhere

- each seller of ice cream has limited control over the price because other sellers are offering similar products

- no buyer can influence the price because each buyer purchases only a small amount, raising prices too high means people will just buy elsewhere

48

New cards

perfectly competitive

the goods offered for sale are exactly the same

- the buyers and sellers are so numerous that no single buyer or seller has any influence over the market price

- buyers and sellers are price takers, they must accept the price the market determines, buyers can buy all they want, sellers can sell all they want

- the buyers and sellers are so numerous that no single buyer or seller has any influence over the market price

- buyers and sellers are price takers, they must accept the price the market determines, buyers can buy all they want, sellers can sell all they want

49

New cards

monopoly

a market in which there are many buyers but only one seller, and they set the price

50

New cards

demand curve

relationship between price and quantity demanded

51

New cards

quantity demanded

determined by the goods price

52

New cards

law of demand

as price increase quantity demanded goes down

53

New cards

market demand vs. individual demand

two peoples demand curve = market demand

- found by adding horizontally the individual demand curves

- found by adding horizontally the individual demand curves

54

New cards

variables that shift demand

income: lower income means less spending so less demand

- expectations:

-

- expectations:

-

55

New cards

normal good

if demand for a good falls, while income falls, its a normal good

56

New cards

inferior good

if demand falls while income increases

- if demand for a good rises when income falls

- bus rides: as income falls you are less likely to buy a car or take a cab

- if demand for a good rises when income falls

- bus rides: as income falls you are less likely to buy a car or take a cab

57

New cards

variables that influence buyers

price of good itself (movement along the demand curve)

- income, prices of related goods, tastes, expectations, number of buyers (all shift curve)

- income, prices of related goods, tastes, expectations, number of buyers (all shift curve)

58

New cards

quantity supplied

the amount that sellers are willing and able to sell

59

New cards

law of supply

relationship between price and quantity supplied (slopes upward)

60

New cards

market supply

some of all the supplies of all sellers

61

New cards

things that effect supply

- input prices

- technology

- expectations

- number of sellers

- technology

- expectations

- number of sellers

62

New cards

equilibrium

where supply and demand intersect, called equilibrium price and quantity

- at this point, the quantity that buyers are willing and able to sell balances the quantity that sellers are able to sell

- actions of buyers and sellers naturally moves markets towards equilibrium

- at this point, the quantity that buyers are willing and able to sell balances the quantity that sellers are able to sell

- actions of buyers and sellers naturally moves markets towards equilibrium

63

New cards

increase in demand no change in supply

P up

Q up

Q up

64

New cards

increase in demand, increase in supply

P ambiguous

Q up

Q up

65

New cards

increase in demand, decrease in supply

P up

Q ambiguous

Q ambiguous

66

New cards

no change in demand, increase in supply

P down

Q up

Q up

67

New cards

no change in demand, decrease in supply

P up, Q down

68

New cards

decrease in demand, no change in supply

P down, Q down

69

New cards

decrease in demand, increase in supply

P down, Q ambiguous

70

New cards

decrease in demand, decrease in supply

P ambiguous, Q down

71

New cards

invisible hand

in a free market economy, self-interested individuals operate through a system of mutual interdependence. This interdependence incentivizes producers to make what is socially necessary, even though they may care only about their own well-being.