COMM-201 Final Review

1/73

Earn XP

Description and Tags

Review of entire course for the final, contra accounts are highlighted

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

74 Terms

the basic accounting equation

Assets

=

Liabilities

+

Shareholder's Equity

Resources controlled by the company that have measurable value and are expected to provide benefits to the company

Amounts owed by the business to creditors

Owners' claims on the business resources

Contributed capital

Retained earnings

Balance Sheet

company title

statement title

at date

includes assets, liabilities, shareholder’s equity

double underline grand totals

underline totals

covenant

something the bank puts into the loan to make them more comfortable with handing the loan out

Income Statement

company title

statement title

for the period ended

revenues, expenses, net income

use parentheses to indicate negative values

net income is the only double underlined

Cash Flow Statement

company title

statement title

for the period ended

cash flows from OIF activities

direct method

gross receipts and payments

indirect method

adjusts net income to compute cash flows from operating activities

Statement of Retained Earnings

Shows the amt of this year's earnings (net income) that have either been paid out to stockholders (dividends) or retained in the business

Current Assets/Liabilities

will be used up in the next 12 months/will be paid back within the next 12 months

Tangible Assets

physical assets owned for producing goods/services

ex. equipment, building, land

Intangible Assets

long-lived assets with special rights, but no physical existence

ex. trademarks, patenets, copyrights

Goodwill

the premium a company will pay to purchase another company

Allowance for Doubtful Accounts (+xA, -A)

the estimated amount of uncollectible accounts receivable balances

Accumulated Depreciation (+xA, -A)

accumulation of depreciation to reflect the use of long-lived assets over their useful lives

Wages Payable (+L)

an amount owing to employees for work they’ve already performed

Deferred Revenue (+L)

cash has been received though revenue (goods sold/services provided) has not yet been provided

Current Portion of Long-Term Debt

the amount of principal payments from the long-term debt balance that will be paid in the next twelve months

Revenue: Sales Revenue (+R, +SE)

the gross amount of revenue the company has earned once the risks and rewards pass to the customer

Revenue: Sales Returns (+xR, -SE)

amount of returns that customers have made

Revenue: Sales Allowances (+xR, -SE)

amount of discounts the company gives customers on invoice payments and allowances (refunds without returning products)

Bad Debt Expense (+E, -SE)

the expense of selling on account to customers who do not pay in full; the amount of potentially uncollectible customer accounts the company expects they will not collect

General Operating Expenses (+E, -SE)

expenses incurred as part of the operations of the company

ex. rent, utilities, supplies, general administrative

Dividends (+L)

distribution of a company’s earnings to its shareholders as a return on their investment

NOT AN EXPENSE

Retained Earnings (+SE)

amount the company has earned through profitable business operations

Contributed Capital (+SE)

amount owners directly invest in the company in exchange for shares

What are the three categories of cash flow?

Operating: day-to-day business (buying goods, paying wages, etc.), Current assets/liabilities

Investing: acquire/sell long-term assets (equipment, buildings, etc.), non-current assets

Financing: obtain/repay lenders and shareholders, non-current liabilities/shareholder’s equity

Temporary Accounts

track financial results for a limited period of time, these balances are zeroed out at the end of each accounting year.

includes: revenues, expenses, dividends declared

Permanent Accounts

track financial results from year to year, their ending balances carry forward to the next year

balance sheet accounts are permanent accounts

Revenue Earned Table

Cash is received before the revenue is earned | Cash is received in the same period as the revenue is earned | Cash is received after the revenue is earned |

Dr cash Cr deferred revenue Dr deferred revenue Cr revenue | Dr cash Cr revenue | Dr accounts receivable Cr revenue Dr Cash Cr accounts receivable |

Expenses Incurred Table

Cash is paid before the expense is incurred | Cash is paid in the same period as the expense is incurred | Cash is paid after the expense is incurred |

Dr prepaid expenses Cr cash Dr expense Cr prepaid expense | Dr expense Cr cash | Dr expense Cr accounts payable Dr accounts payable Cr cash |

FOB Shipping Point

(Free on Board) goods are owned by the customer the moment they leave the seller’s premises

FOB Destination Point

(Free on Board) goods are owned by the seller until they are delivered to the customer

Cost of Goods Sold Equation

*(Beginning Inventory + Cost of New Purchases) - Ending Inventory

*otherwise known as cost of goods available for sale

LC&NRV

lower of cost and net realizable value

requires inventory to be written down when the nrv or replacement cost falls below original cost

NRV: value likely to be realized when sold

FIFO

First in, first out

costs are assigned assuming the first item purchased is the first item sold

WAC

Weighted average cost

total inventory costs are averaged over total inventory units

(price 1 + price 2 + price 3)/3 = price

Specific Identification

the cost of each inventory item is individually identified and (when sold) recorded as COGS

Journalizing Bad Debt

Dr Accounts receivable

Cr sales revenue

Dr bad debt expense (+E, -SE)

Cr allowance for doubtful accounts (+xA, -A)

Dr allowance for doubtful accounts (-xA)

Cr accounts receivable (-A)

Straight-Line Depreciation

Assumes equal use over life

Equation: (cost - residual value) / useful life (in years)

Units of Production

based on actual production

equation: (cost - residual value) / useful life (in units)

Double Declining Balance (Accelerated)

greater benefit in earlier years

equation: (cost - accumulated depreciation) * rate

rate = 2 / useful life

Depreciation v Amortization

Depreciation: cost of a tangible asset’s use in a period

Amortization: cost of an intangible asset’s use in a period

Disposal of Tangible Assets

Gain if > book value, loss if < book value

Journal Entry

Dr Cash

Dr Accumulated Depreciation

- Cr Equipment

- Cr Gain on Disposal (+R, +SE)

Payroll Liabilities

Gross Pay - Payroll Deductions = Net Pay

Gross Pay: salaries and wages expense

Payroll Deductions: liabilities owed to government and other organizations

Net Pay: liabilities owed to employees

CPP and EI contributions

CPP: match the employee’s contribution

EI: 1.4x employee’s contribution

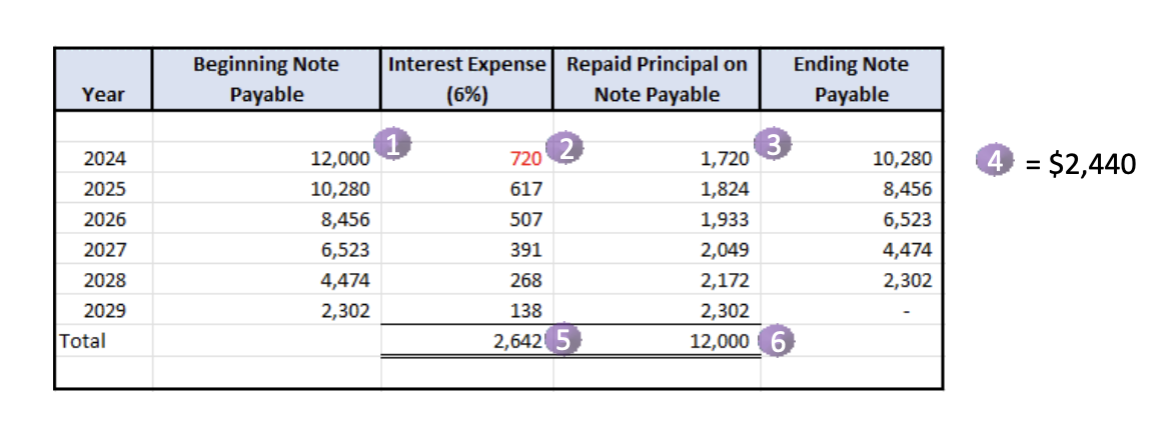

Instalment Notes

Beginning note payable balance

interest paid in the period

actual amount deducted from the note payable balance

value of 2 + 3 in any given period is cash paid

total amount of interest paid over life of the note payable

total amount of principal paid over life of the note payable should = the beginning balance

Inventory Purchase Entries

Purchase of inventory | Transportation costs | Purchase return | Purchase allowance | Purchase discount |

Dr inventory Cr accounts payable | Dr inventory Cr accounts payable | Dr accounts payable Cr inventory | Dr accounts payable Cr inventory | Dr accounts payable Cr Cash Cr inventory |

Always affects accounts payable and inventory in some way

Prepaid Expense (+E, -SE)

Purpose: cash paid for the future benefit of an expense

Prepaid rent expense, prepaid insurance expense, etc

Common entry:

Dr prepaid expense

Cr cash

Dr expense

Cr prepaid expense

IFRS

international financial reporting standards

ASPE

accounting standards for private enterprises

Financial Statements Effects on Creditors

creditors: people/business to whom money is owed

does the company own enough assets to pay liabilities? — B/S

will the company generate enough cash in future periods to repay loans? — SCF

Financial Statements Effects on Investors

investors: people/businesses who own some of the company

has the company earned profits? — I/S

does the company have history of paying dividends? — R/E

Prepaid Insurance

paid cash in exchange for service in the future

asset, therefore debit it

What is paying with visa considered to be?

Cash

Deferral Adjustments

update what’s there

some/all of asset’s future benefits have expired or been used up in current period creating an expense or

the company provides provides goods or services to earn revenue and satisfy existing liability

Accrual Adjustments

include what’s not yet there

assets and revenues are generated in the current period but haven’t been recorded

The Closing Process

take temporary accounts and close them to equity accounts

transfer net income/loss and dividends to retained earnings

The amount credited or debited to retained earnings in the first journal entry must equal net income or net loss on the income statement

Entries:

1 | 2 |

dr revenues……xx Cr expenses…….xx Cr retained earnings…….xx | Dr retained earnings…….xx Cr dividends declared…….xx |

Each revenue account needs to be debited separately and each expense account needs to be credited separately The effect is that retained earnings goes up by an amount equal to net income If a loss, we debit retained earnings for a net loss | Retained earnings goes down by amount equal to dividends |

Post-Closing Trial Balance

An internal report prepared as the last step in the accounting cycle to check that debits equal credits and all temporary accounts have been closed

The Three Types of Employee Fraud

Corruption: using tax payer money for personal power, people in position of power and trust usually

Asset Misappropriation: (embezzlement) stealing actual assets from a company

Financial Statement Fraud: lowest frequency but causes the greatest losses, presenting financial statements that doesn't reflect the company in actuality

The 5 Principles for Reducing Fraud

Principle | Explanation | Example |

Establish responsibility | Assign each task to only one employee | Give a separate cash register drawer to each cashier at the beginning of a shift |

Segregate duties | Do not make one employee responsible for all parts of a process | Inventory buyers do not also approve payments to suppliers |

Restrict access | Do not provide access to assets of information unless it is needed to fulfill assigned responsibilities | Secure valuable assets such as cash and restrict access to computer systems (passwords, firewalls, etc.) |

Document procedures | Prepare documents to show activities that have occurred | Pay suppliers using prenumbered cheques and digitally documented electronic fund transfers |

Independently verify | Check others' work | Compare the cash balance in the company's accounting records to the cash balance reported by the bank and account for any differences |

Perpetual v Periodic Inventory Systems

perpetual: updating as inventory changes occur

periodic: do not update inventory until the end of the period

2*/10*, n/30*

a discount of 2% if paid within 10 days, otherwise the full balance is due within 30 days

*these numbers are subject to variations

Consignment Inventory

inventory held by a company on behalf of someone else

Land Improvements

since land has an indefinite lifespan, this refers to the fences/sidewalks/pavements/etc. that improve the land

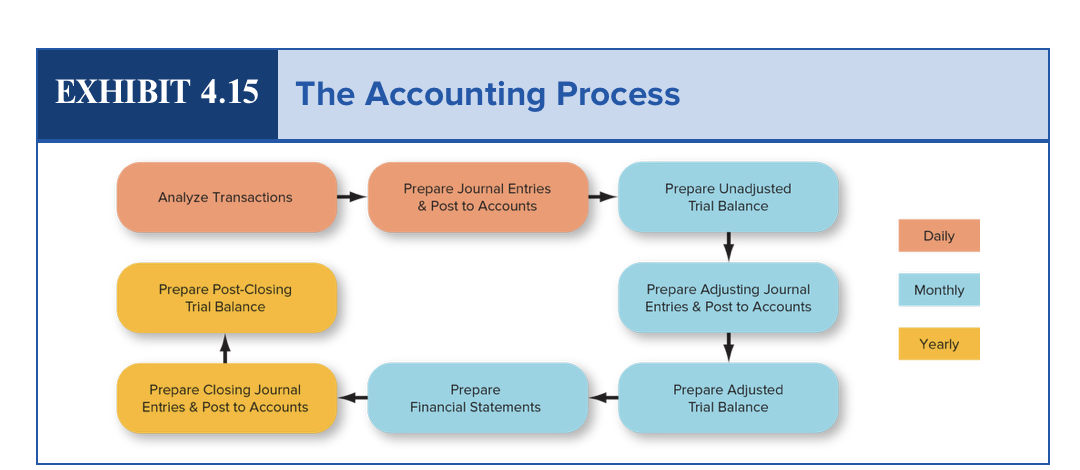

The Accounting Process

Construction in Progress

cost of constructing new buildings and equipment

once finished, they move to their respective accounts

Book/Carrying Value

the amount an asset/liability is reported (or carried) at in the financial statements

property and equipment at cost - accumulated depreciation = net property and equipment = book value

Capitalizing v Expensing

Capitalizing: adding to the asset

needed to obtain the inventory

future benefit is the sale

Expensing

may not sell the inventory

What are accrued liabilities?

liabilities for expenses that have been incurred but not yet billed/paid at the end of the period

also called accrued expenses

Contingent Liabilities

potential liabilities resulting from a past transaction, the ultimate outcome will not be known until a future event occurs or fails to occur

What’s the date of our final?

June 25, 2025 @ 2:00 PM

What enhances the usefulness of financial statements?

Timeliness

Understandability

Comparability

Verifiability

What principle do private companies use?

ASPE or IFRS (their choice)

ESG

Environmental, Social, and Governance

Accounting for Business Activities

Picture → Name → Analyze

paying with a cheque is ?

(accounts payable, cash, notes payable)

cash