(4) RMIN 4000

5.0(2)

Card Sorting

1/107

Earn XP

Description and Tags

Last updated 8:32 PM on 11/26/22

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

108 Terms

1

New cards

Basis of Legal Liability

A legal wrong is a violation of a person’s legal rights, or a failure to perform a legal duty owed to a certain person, to a business organization, or to a society as a whole.

2

New cards

1. Crime (state vs. individual)

2. Breach of Contract

3. Tort (suing for damages)

2. Breach of Contract

3. Tort (suing for damages)

Types of legal wrongs

3

New cards

Tort

A legal wrong for which the court allows a remedy in the form of monetary damages.

4

New cards

Plaintiff

the person who is injured

5

New cards

Tortfeasor

the alleged wrongdoer

6

New cards

1. Intentional torts

2. Strict liability

3. Negligence

2. Strict liability

3. Negligence

Three categories of torts

7

New cards

1. Intentional Tort

+ Intentional act or omission resulting in harm or injury to another person or damage to their property.

+ Examples:

- Libel

- Slander

- Invasion of privacy

- Assault

- Battery

+ Examples:

- Libel

- Slander

- Invasion of privacy

- Assault

- Battery

8

New cards

2. Strict Liability

+ Liability imposed regardless of negligence or fault.

+ Examples:

- Defective products

- Damages caused by animals

- Hazardous activities

- Workers’ Compensation (exclusive remedy in most employee injury situations)

+ Examples:

- Defective products

- Damages caused by animals

- Hazardous activities

- Workers’ Compensation (exclusive remedy in most employee injury situations)

9

New cards

3. Negligence

+ Failure to exercise the standard of care required by law to protect others from an unreasonable risk of harm.

+ Standard of care

- Based on the care required by a reasonably prudent person.

- Not the same for each wrongful act.

+ Standard of care

- Based on the care required by a reasonably prudent person.

- Not the same for each wrongful act.

10

New cards

1. Existence of a legal duty owed

2. Breach of legal duty

3. Damage or injury

4. Proximate cause between the negligence act and the damage

2. Breach of legal duty

3. Damage or injury

4. Proximate cause between the negligence act and the damage

***Elements of Negligence

11

New cards

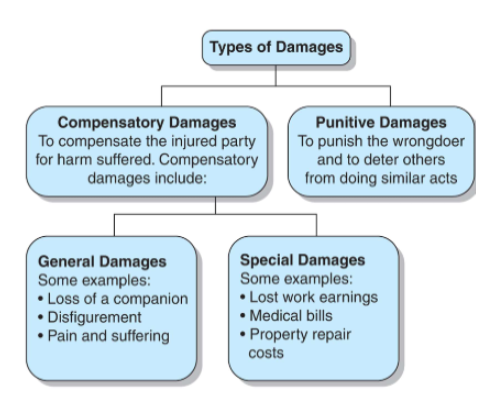

Types of Damages

Types of Damages

12

New cards

Compensatory Damages

Compensate the victim for losses actually incurred.

13

New cards

Special Damages

Provide compensation for medical expenses, lost earnings, or property damages.

14

New cards

General Damages

Cannot be specifically measured (pain and suffering).

15

New cards

Punitive Damages

Designed to punish people and organizations so that others are deterred from committing the same wrongful act

16

New cards

+ These vary by state

+ The ability to collect damages for negligence depends on state law.

+ Legal Defenses

1. Contributory Negligence

2. Comparative Negligence

3. Last Clear Chance Rule

4. Assumption of Risk

+ The ability to collect damages for negligence depends on state law.

+ Legal Defenses

1. Contributory Negligence

2. Comparative Negligence

3. Last Clear Chance Rule

4. Assumption of Risk

Legal Defenses for Negligence

17

New cards

1. Contributory Negligence

+ The injured person cannot collect damages if his or her care falls below the standard of care required for his or her protection.

+ Under strict application of common law, the injured cannot collect damages if his or her conduct contributed in any way to the injury.

+ Under strict application of common law, the injured cannot collect damages if his or her conduct contributed in any way to the injury.

18

New cards

2. Comparative Negligence

+ The financial burden of the injury is shared by both parties according to their respective degrees of fault.

+ Pure rule – You can collect damages even if you are negligent, but your reward is reduced in proportion to your fault.

+ 50 percent rule – You cannot recover if you are 50 percent or more at fault.

+ 51 percent rule – You cannot recover if you are 51 percent or more at fault.

+ Pure rule – You can collect damages even if you are negligent, but your reward is reduced in proportion to your fault.

+ 50 percent rule – You cannot recover if you are 50 percent or more at fault.

+ 51 percent rule – You cannot recover if you are 51 percent or more at fault.

19

New cards

3. Last Clear Chance

A plaintiff who is endangered by his or her own negligence can still recover damages from the defendant if the defendant has a last clear chance to avoid the accident but fails to do so

20

New cards

4. Assumption of Risk

A person who understands and recognizes the danger inherent in a particular activity cannot recover damages in the event of an injury

21

New cards

Imputed Negligence

+ Under certain conditions, the negligence of one person can be attributed to another person or organization.

+ Examples:

- Employer – Employee Relationship

- Vicarious Liability law

- Family purpose doctrine

- Joint business venture

- Dram Shop / Liquor Liability law

+ Examples:

- Employer – Employee Relationship

- Vicarious Liability law

- Family purpose doctrine

- Joint business venture

- Dram Shop / Liquor Liability law

22

New cards

Res Ipsa Loquitur

+ “The thing speaks for itself.”

+ The very fact that the injury or damage occurs establishes a presumption of negligence.

+ Three requirements:

1. The event is one that normally does not occur in the absence of negligence.

2. The defendant has exclusive control over the instrumentality causing the accident.

3. The injured party has not contributed to the accident in any way.

+ The very fact that the injury or damage occurs establishes a presumption of negligence.

+ Three requirements:

1. The event is one that normally does not occur in the absence of negligence.

2. The defendant has exclusive control over the instrumentality causing the accident.

3. The injured party has not contributed to the accident in any way.

23

New cards

Trespasser

- Person who enters or remains on property without the owner’s consent.

- No obligation to this group, but cannot deliberately (or set trap to) injure.

- No obligation to this group, but cannot deliberately (or set trap to) injure.

24

New cards

Licensee

- Person who enters or remains on property with occupant’s permission.

- Required to warn them of any unsafe conditions.

- Required to warn them of any unsafe conditions.

25

New cards

Invitee

- Person who is invited onto the premises for the benefit of the occupant.

- Obligation to inspect the premises and to eliminate any dangerous conditions.

- Obligation to inspect the premises and to eliminate any dangerous conditions.

26

New cards

***Attractive Nuisance

- A condition that can attract or injure children.

- Occupants of the land are liable for the injuries of children who may be attracted by some dangerous condition.

- Example: Playground in a community

- Occupants of the land are liable for the injuries of children who may be attracted by some dangerous condition.

- Example: Playground in a community

27

New cards

Respondeat Superior

An employer can be held liable for the negligent acts of employees while they are acting on the employer’s behalf

28

New cards

Parents and Children

- Parents can be held liable for the actions of a child if:

- The child uses a dangerous weapon to injure someone.

- The child is acting as an agent for the parents.

- A minor child is operating a family car

- The child uses a dangerous weapon to injure someone.

- The child is acting as an agent for the parents.

- A minor child is operating a family car

29

New cards

1. Defective tort liability system

2. Medical sector claims

3. Class action lawsuits

2. Medical sector claims

3. Class action lawsuits

Tort Liability Problems

30

New cards

Insurance Services Office (“ISO”)

Organization that provides statistical, actuarial, underwriting, and claims information and analytics; compliance… Policy language

31

New cards

1. State Farm

2. GEICO / Berkshire

3. Progressive

4. Allstate

5. USAA

6. Liberty Mutual

7. Farmers

8. Nationwide Mutual

9. American Family

10. Travelers

+ Top 5 have over half of the market

2. GEICO / Berkshire

3. Progressive

4. Allstate

5. USAA

6. Liberty Mutual

7. Farmers

8. Nationwide Mutual

9. American Family

10. Travelers

+ Top 5 have over half of the market

10 Largest US Auto Insurers 2021

32

New cards

Types of Vehicles Are Covered Under a Personal Auto Policy (“PAP”)

1. Private Passenger Auto

2. Station Wagon

3. Sport Utility Vehicle (SUV)

4. Pickup Truck or Van

+ Gross vehicle weight must be 10,000 pounds or less

+ Must not be used in business (with exceptions)

2. Station Wagon

3. Sport Utility Vehicle (SUV)

4. Pickup Truck or Van

+ Gross vehicle weight must be 10,000 pounds or less

+ Must not be used in business (with exceptions)

33

New cards

ISO Personal Auto Policy (“PAP”)

Part A: Liability Coverage

Part B: Medical Payments Coverage

Part C: Uninsured Motorists Coverage

Part D: Coverage for Damage to Your Auto

Part E: Duties after an Accident or Loss

Part F: General Provisions

Part B: Medical Payments Coverage

Part C: Uninsured Motorists Coverage

Part D: Coverage for Damage to Your Auto

Part E: Duties after an Accident or Loss

Part F: General Provisions

34

New cards

Definition of “Your Covered Auto”

1. Any auto shown in the declarations

2. A “newly acquired auto”

3. A “trailer” owned by the Named Insured

4. A temporary substitute vehicle

2. A “newly acquired auto”

3. A “trailer” owned by the Named Insured

4. A temporary substitute vehicle

35

New cards

Part A: Liability Coverage

+ Most important part of the policy.

+ Protects a covered person against suit or claim arising out of ownership or operation of a covered vehicle.

+ Covers damages and defense costs.

+ Split Limits ($100,000 / $300,000 / $100,000) vs. Combined Single Limit ($500,000)

+ Protects a covered person against suit or claim arising out of ownership or operation of a covered vehicle.

+ Covers damages and defense costs.

+ Split Limits ($100,000 / $300,000 / $100,000) vs. Combined Single Limit ($500,000)

36

New cards

Split Limits Under A PAP Policy

+ More common than combined limits

+ The amount of insurance for Bodily Injury (“BI”) and Property Damage (“PD”) are typically stated separately.

+ Example:

$100,000 / $300,000 / $100,000 means:

- $100,000 Bodily Injury per person / $300,000 Bodily Injury per accident / $100,000 Property Damage per accident

+ The amount of insurance for Bodily Injury (“BI”) and Property Damage (“PD”) are typically stated separately.

+ Example:

$100,000 / $300,000 / $100,000 means:

- $100,000 Bodily Injury per person / $300,000 Bodily Injury per accident / $100,000 Property Damage per accident

37

New cards

ANSWER: $75,000 ($25,000 x 2 injured people, additional $25,000 of property)

Example Split Limits: Bubba has a Personal Auto Policy on his Ford F-150 with the minimum statutory liability limits in Georgia of $25,000 / $50,000 / $25,000. While speeding recklessly on I-95 south of Savannah on the way to St,. Simons he hits a car with New York license plates, injuring the 2 passengers in the car.

One person’s medical expenses are $25,000 and the other person’s medical expenses are $40,000. The cost to repair the damaged car is $30,000.

How much will Bubba’s policy pay on the liability claim?

One person’s medical expenses are $25,000 and the other person’s medical expenses are $40,000. The cost to repair the damaged car is $30,000.

How much will Bubba’s policy pay on the liability claim?

38

New cards

ANSWER: $95,000 ($25,000 + $40,000 + $30,000)

Example Combined Single Limits: Bubba has a Personal Auto Policy on his Ford F-150 with liability limits in Georgia of $100,000 combined single limit While speeding on I-95 south of Savannah on the way to St. Simons he hits a car with New York license plates, injuring the 2 passengers in the car.

One person’s medical expenses are $25,000 and the other person medical expenses are $40,000. The cost to repair the damaged car is $30,000.

How much will Bubba’s policy pay on the liability claim?

One person’s medical expenses are $25,000 and the other person medical expenses are $40,000. The cost to repair the damaged car is $30,000.

How much will Bubba’s policy pay on the liability claim?

39

New cards

Compulsory Insurance Laws

Require motorists to carry at least a minimum amount of liability insurance before the vehicle can be licensed or registered.

* Limits on following pages from III

* Limits on following pages from III

40

New cards

GA: Bodily Injury and Property Damage Liability, $25,000/$50,000/$25,000

Statutory Minimum Liability Limits in GA

41

New cards

1) ***The named insured and any resident family member

2) ***Any Person using the named insured’s covered auto with permission

3) Any person or organization legally responsible for any insured’s use of a covered auto on behalf of that person or organization.

4) Any person or organization legally responsible for the named insured’s or family members’ use any auto or trailer (other than a covered auto or one owned by the person or organization)

2) ***Any Person using the named insured’s covered auto with permission

3) Any person or organization legally responsible for any insured’s use of a covered auto on behalf of that person or organization.

4) Any person or organization legally responsible for the named insured’s or family members’ use any auto or trailer (other than a covered auto or one owned by the person or organization)

Who Are Insured Persons Under the Liability Coverage Section in PAP?

42

New cards

- Intentional injury or damage

- Property owned or transported

- Property rented, used or in the insured’s care

- Used as a public or livery conveyance

- Vehicles used in a business

- Vehicles with fewer than four wheels

- *** Using a vehicle without reasonable belief the person is entitled to do so

- Property owned or transported

- Property rented, used or in the insured’s care

- Used as a public or livery conveyance

- Vehicles used in a business

- Vehicles with fewer than four wheels

- *** Using a vehicle without reasonable belief the person is entitled to do so

Important Exclusions to Liability Coverage (Not a Comprehensive List)

43

New cards

Other Liability Coverage Provisions

+ Out-of-State Coverage

- If you drive into a state with higher minimum liability limits, your policy will automatically match those limits.

+ If more than one policy covers a loss (other insurance):

- The insurer pays its pro rata share of the loss for an owned vehicle

- For a non-owned vehicle the insured’s coverage is excess over any other insurance maintained by the vehicle’s owner.

+ General Rule: Primary liability coverage follows the vehicle

- If you drive into a state with higher minimum liability limits, your policy will automatically match those limits.

+ If more than one policy covers a loss (other insurance):

- The insurer pays its pro rata share of the loss for an owned vehicle

- For a non-owned vehicle the insured’s coverage is excess over any other insurance maintained by the vehicle’s owner.

+ General Rule: Primary liability coverage follows the vehicle

44

New cards

Part B: Medical Payments Coverage

- Covers reasonable medical expenses (medical, surgical, X- ray, dental, & funeral) incurred by an insured in an accident.

- Coverage is not based on fault.

- Covers medical services rendered within 3 years from the date of the accident

- Limits typically range from $1,000 to $10,000 per person.

- Coverage is not based on fault.

- Covers medical services rendered within 3 years from the date of the accident

- Limits typically range from $1,000 to $10,000 per person.

45

New cards

Who Has Medical Payments Coverage Under the PAP?

+ The Named Insured and family members:

1. While occupying any motor vehicle.

2. As pedestrians when struck by a motor vehicle.

+ Other persons occupying a covered auto are covered, but only in an owned vehicle.

1. While occupying any motor vehicle.

2. As pedestrians when struck by a motor vehicle.

+ Other persons occupying a covered auto are covered, but only in an owned vehicle.

46

New cards

Important Exclusions to Medical Payments Coverage

+ Occupying any vehicle with fewer than four wheels.

+ Public or livery conveyance.

+ Using the vehicle as a residence.

+ Vehicle used during course of employment. (Would likely be covered under Workers’ Compensation)

+ Public or livery conveyance.

+ Using the vehicle as a residence.

+ Vehicle used during course of employment. (Would likely be covered under Workers’ Compensation)

47

New cards

Other Insurance Provisions in Medical Payments Coverage

+ If more than one policy covers a loss (other insurance):

- The insurer pays its pro rata share of the loss for an owned vehicle.

- The insurance coverage is excess over any other insurance for a non-owned vehicle.

- The insurer pays its pro rata share of the loss for an owned vehicle.

- The insurance coverage is excess over any other insurance for a non-owned vehicle.

48

New cards

Todd’s Coverage pays $10,000

Susan’s Coverage pays $2,000

Susan’s Coverage pays $2,000

Medical Payments Other Insurance Examples:

+ Todd is driving his SUV and Susan is a passenger. They are heading downtown for dinner. Todd’s PAP policy has a Medical Payment limit of $10,000 per person. Susan’s PAP has a Medical Payment limit of $5,000 person.

+ Todd is involved in an at-fault accident that results in Susan being injured and incurring $12,000 of medical expenses

+ Todd is driving his SUV and Susan is a passenger. They are heading downtown for dinner. Todd’s PAP policy has a Medical Payment limit of $10,000 per person. Susan’s PAP has a Medical Payment limit of $5,000 person.

+ Todd is involved in an at-fault accident that results in Susan being injured and incurring $12,000 of medical expenses

49

New cards

Part C: Uninsured Motorists (“UM”) Coverage

+ Covers Bodily Injury caused by:

1) an uninsured motorist,

2) a hit-and-run driver or

3) a negligent driver whose insurance company is insolvent.

+ Property damage may also be covered (depending on the state).

+ The uninsured motorist must be legally liable.

1) an uninsured motorist,

2) a hit-and-run driver or

3) a negligent driver whose insurance company is insolvent.

+ Property damage may also be covered (depending on the state).

+ The uninsured motorist must be legally liable.

50

New cards

Florida – 26.7%

Georgia – 12%

Georgia – 12%

Estimated % of Uninsured Motorists

51

New cards

Who Has Uninsured Motorists Coverage Under the PAP?

+ The Named Insured and family members.

+ Another person while occupying a covered auto.

+ Any person legally entitled to recover damages (example: A surviving spouse).

+ Another person while occupying a covered auto.

+ Any person legally entitled to recover damages (example: A surviving spouse).

52

New cards

What Vehicles Are Considered To Be Uninsured Vehicles?

+ A motor vehicle or trailer for which no bodily injury liability insurance policy applies at the time of the accident.

+ An insured vehicle with less coverage than the amount required by the state’s financial responsibility law.

+ A hit-and-run vehicle.

+ A vehicle covered by an insurer that denies coverage or becomes insolvent.

+ An insured vehicle with less coverage than the amount required by the state’s financial responsibility law.

+ A hit-and-run vehicle.

+ A vehicle covered by an insurer that denies coverage or becomes insolvent.

53

New cards

Important Exclusions To Uninsured Motorists Coverage

1. Uninsured motor vehicles owned by the insured or family member.

2. The insured settles a claim without the insurer’s consent.

3. The vehicle is used as a public or livery conveyance.

4. When Workers’ Compensation benefits are applicable.

5. There is no reasonable belief the person is entitled to use the vehicle.

6. No coverage for Punitive Damages.

2. The insured settles a claim without the insurer’s consent.

3. The vehicle is used as a public or livery conveyance.

4. When Workers’ Compensation benefits are applicable.

5. There is no reasonable belief the person is entitled to use the vehicle.

6. No coverage for Punitive Damages.

54

New cards

Underinsured Motorists Coverage

- May be abbreviated as “UN” or “UIM”

- Optional coverage that can be added to PAP.

- In general, the maximum amount paid is the underinsured motorist’s coverage limit stated in the policy less the amount paid by the negligent driver’s insurer.

- Coverage differs depending on the state.

- Optional coverage that can be added to PAP.

- In general, the maximum amount paid is the underinsured motorist’s coverage limit stated in the policy less the amount paid by the negligent driver’s insurer.

- Coverage differs depending on the state.

55

New cards

Part D: Coverage for Damage to Your Auto

+ Covers direct and accidental loss to a covered auto or non-owned auto.

+ Includes:

1) “Collision”

2) “Other-Than-Collision”.

+ Includes:

1) “Collision”

2) “Other-Than-Collision”.

56

New cards

1. Collision Coverage

+ Definition: The upset of your covered auto or non-owned auto or its impact with another vehicle or object.

+ Paid regardless of fault.

+ Examples:

- Car overturns on icy roads.

- Car hits another car, telephone pole, tree or building.

- You bang your car door against another car damaging your door.

+ Paid regardless of fault.

+ Examples:

- Car overturns on icy roads.

- Car hits another car, telephone pole, tree or building.

- You bang your car door against another car damaging your door.

57

New cards

2. Other-Than Collision Coverage (Referred to as “Comprehensive”)

+ ***Hitting a deer falls under this coverage

+ Definition: Other than collision

+ Example of losses include the following:

- Glass breakage

- Contact with a bird or animal (For example: hitting a deer is comprehensive, not collision)

- Theft or larceny

- Falling objects

- Hail, water, flood, fire, windstorm

- Explosion or earthquake

- Malicious mischief or vandalism

- Riot or civil commotion

+ Definition: Other than collision

+ Example of losses include the following:

- Glass breakage

- Contact with a bird or animal (For example: hitting a deer is comprehensive, not collision)

- Theft or larceny

- Falling objects

- Hail, water, flood, fire, windstorm

- Explosion or earthquake

- Malicious mischief or vandalism

- Riot or civil commotion

58

New cards

Non-Owned Autos

+ Part D coverages also apply to Non-owned Autos

+ Definition: Vehicle not owned by or made available for the regular use of the named insured or family member, while it is in the custody of or being operated by the Named Insured or family member.

+ Coverage also applies to temporary substitute vehicle.

+ Definition: Vehicle not owned by or made available for the regular use of the named insured or family member, while it is in the custody of or being operated by the Named Insured or family member.

+ Coverage also applies to temporary substitute vehicle.

59

New cards

Rental Car – Collision Damage Waiver

+ Read the small print in rental car agreements.

+ Optional “Collision Damage Waiver” or “Loss Damage Waiver” is a very expensive option that is hugely profitable for rental car companies.

+ A Collision Damage Waiver (CDW) may be unnecessary on a rental car if you carry collision and comprehensive coverage on your own car(s) under your Personal Auto Policy.

+ Optional “Collision Damage Waiver” or “Loss Damage Waiver” is a very expensive option that is hugely profitable for rental car companies.

+ A Collision Damage Waiver (CDW) may be unnecessary on a rental car if you carry collision and comprehensive coverage on your own car(s) under your Personal Auto Policy.

60

New cards

Important Exclusions to Coverage for Damage to Your Auto

- Use as a public or livery conveyance.

- Damage from wear and tear, freezing, and mechanical or electrical breakdown.

- Electronic equipment that is not permanently installed.

- Trailer, camper body, or motor home.

- Custom furnishings and equipment (coverage available through endorsement

- Damage from wear and tear, freezing, and mechanical or electrical breakdown.

- Electronic equipment that is not permanently installed.

- Trailer, camper body, or motor home.

- Custom furnishings and equipment (coverage available through endorsement

61

New cards

Part D Loss Settlement

+ For a total loss, actual cash value (ACV) is paid.

+ For a partial loss, pays the amount required to repair or replace the damaged property with like kind and quality.

+ Deductibles

- May be different for Collision and OTC / Comprehensive.

- Some insureds chose lower Comprehensive deductibles due to glass claims.

+ Diminution in Value (DIV)

- Loss in market or resale value.

- May be owed by insurer depending on the state.

+ For a partial loss, pays the amount required to repair or replace the damaged property with like kind and quality.

+ Deductibles

- May be different for Collision and OTC / Comprehensive.

- Some insureds chose lower Comprehensive deductibles due to glass claims.

+ Diminution in Value (DIV)

- Loss in market or resale value.

- May be owed by insurer depending on the state.

62

New cards

Part D Other Coverage Information

+ Temporary Transportation Expenses

- Provides coverage for rental car usage (up to a daily and total limit) if covered vehicle is damaged due to comprehensive or collision loss.

+ Towing and Labor Expenses coverage may be added by endorsement.

+ Gap Insurance

- Available by endorsement.

- Pays the difference between the amount insurer owes and the amount owed on a loan or lease.

- Provides coverage for rental car usage (up to a daily and total limit) if covered vehicle is damaged due to comprehensive or collision loss.

+ Towing and Labor Expenses coverage may be added by endorsement.

+ Gap Insurance

- Available by endorsement.

- Pays the difference between the amount insurer owes and the amount owed on a loan or lease.

63

New cards

Other Insurance Provisions In Coverage For Damage To Your Auto

+ If more than one policy covers a loss (other insurance):

- The insurer pays its pro rata share of the loss for an owned vehicle.

- The insurance coverage is excess over any other insurance for a non-owned vehicle.

- The insurer pays its pro rata share of the loss for an owned vehicle.

- The insurance coverage is excess over any other insurance for a non-owned vehicle.

64

New cards

Part E: Duties After an Accident or Loss

+ After an accident, the insured must:

- Promptly notify the insurance company or agent.

- Cooperate with the insurer in the investigation.

- Send the insurer copies of any legal notices received in connection with an accident.

+ Notify the police:

- If a hit-and-run driver is involved.

- Vehicle is stolen.

+ The insurer is allowed to inspect your vehicle prior to repair/disposal if you are seeking coverage under Part D.

- Promptly notify the insurance company or agent.

- Cooperate with the insurer in the investigation.

- Send the insurer copies of any legal notices received in connection with an accident.

+ Notify the police:

- If a hit-and-run driver is involved.

- Vehicle is stolen.

+ The insurer is allowed to inspect your vehicle prior to repair/disposal if you are seeking coverage under Part D.

65

New cards

Part F: General Provisions

+ Includes provisions related to:

- Policy changes

- Fraud

- Suit against the insurer

- Policy period

- Policy Termination

+ ***Territory

- Coverage in United States, Puerto Rico, and Canada

- No coverage in Mexico, etc.

- Policy changes

- Fraud

- Suit against the insurer

- Policy period

- Policy Termination

+ ***Territory

- Coverage in United States, Puerto Rico, and Canada

- No coverage in Mexico, etc.

66

New cards

Termination Provisions

+ Varies by State

+ Cancellation

- Named Insured can cancel at any time.

- After 60 days, the insurer can cancel only if:

1) The premium has not been paid (10 days’ notice)

2) The driver’s license of any insured has been suspended.

3) The policy was obtained through material misrepresentation.

+ Nonrenewal

- If an insurer decides to discontinue coverage, the insured must be given notice at least 20 days before the end of the policy period.

+ Automatic Termination

- A policy is automatically terminated if the insured declines the insurer’s offer to renew.

+ Cancellation

- Named Insured can cancel at any time.

- After 60 days, the insurer can cancel only if:

1) The premium has not been paid (10 days’ notice)

2) The driver’s license of any insured has been suspended.

3) The policy was obtained through material misrepresentation.

+ Nonrenewal

- If an insurer decides to discontinue coverage, the insured must be given notice at least 20 days before the end of the policy period.

+ Automatic Termination

- A policy is automatically terminated if the insured declines the insurer’s offer to renew.

67

New cards

No-Fault Auto Insurance

+ Applicable in some states; not in Georgia.

+ After an accident involving bodily injury, each party collects from their own insurer regardless of fault.

+ Pure No-Fault

- Accident victims cannot sue for bodily injury at all, no payments for pain and suffering.

+ Modified No-Fault

- Accident victims can sue if bodily injury exceeds a certain dollar amount or verbal threshold (death, dismemberment, etc.)

+ Personal Injury Protection (PIP) endorsement added to policy.

+ Motorists can still sue the negligent driver for property damage.

+ After an accident involving bodily injury, each party collects from their own insurer regardless of fault.

+ Pure No-Fault

- Accident victims cannot sue for bodily injury at all, no payments for pain and suffering.

+ Modified No-Fault

- Accident victims can sue if bodily injury exceeds a certain dollar amount or verbal threshold (death, dismemberment, etc.)

+ Personal Injury Protection (PIP) endorsement added to policy.

+ Motorists can still sue the negligent driver for property damage.

68

New cards

Major Rating Variables for Personal Auto Insurance

Territory / Garaging Location

Age, Gender, Marital Status

Vehicle Use

Type of Vehicle

Driving Record (MVR)

Number of Vehicles

Limits / Deductibles

Insurance Score / Credit

Good Student Discount

Driver Education

Multi-Policy Discount

Age, Gender, Marital Status

Vehicle Use

Type of Vehicle

Driving Record (MVR)

Number of Vehicles

Limits / Deductibles

Insurance Score / Credit

Good Student Discount

Driver Education

Multi-Policy Discount

69

New cards

Louisiana

________ is a nightmare for auto

70

New cards

New Insurance Entity of the Class

+ Insurance Institute for Highway Safety (IIHS)

+ Highway Loss Data Institute (HLDI)

- Are wholly supported by auto insurers and insurance associations

+ Highway Loss Data Institute (HLDI)

- Are wholly supported by auto insurers and insurance associations

71

New cards

Ransomware

Phishing schemes

Phishing schemes

Headline Risks in Cyber

72

New cards

Headline Risk D&O

+ Protects from damages against directors and officers

+ Protects against shareholders suing executives

+ Defense are outside of the limits of coverage; there is also retention included in most claims

+ Protects against shareholders suing executives

+ Defense are outside of the limits of coverage; there is also retention included in most claims

73

New cards

Financial Lines – Broad Term

+ Directors & Officers Liability

+ Employment Practices Liability – discrimination, harrasment, wrongful termination (excludes wages & salary because that is government run)

+ Fiduciary Liability – against directors and officers for retirement practices

+ Crime

+ Professional Liability/Errors & Omissions – professional liability that you can be sued as a broker

+ Cyber

+ Transactional Liability – Reps & Warranties

+ Intellectual Property Insurance

+ Employment Practices Liability – discrimination, harrasment, wrongful termination (excludes wages & salary because that is government run)

+ Fiduciary Liability – against directors and officers for retirement practices

+ Crime

+ Professional Liability/Errors & Omissions – professional liability that you can be sued as a broker

+ Cyber

+ Transactional Liability – Reps & Warranties

+ Intellectual Property Insurance

74

New cards

Financial Lines – Differences to P&C

+ Blends Several Skill Sets:

- Bespoke insurance product

- Underwritten to company financials

- Guarding against complex legal/technical risks

+ Deal with the highest level of company management

- Seen as “door opener” to C-Suite

- Broker must be able to “speak the language” of CFO, General Counsel, CISO, etc.

+ Remains highly subjective

- Company financials only give so much information

- Relaying management commitment, risk tolerance, experience remains highly important

- Bespoke insurance product

- Underwritten to company financials

- Guarding against complex legal/technical risks

+ Deal with the highest level of company management

- Seen as “door opener” to C-Suite

- Broker must be able to “speak the language” of CFO, General Counsel, CISO, etc.

+ Remains highly subjective

- Company financials only give so much information

- Relaying management commitment, risk tolerance, experience remains highly important

75

New cards

Broker Experience

+ Similarities and Differences within Brokerages

- Much more SIMILAR than DIFFERENT at top brokerages

- Boss/Team more impactful than company

- Larger brokerages have more resources, but more opportunity to be affected by large-scale strategy shifts

+ Differences to Agency/Underwriting

- Data-driven and results oriented

- You (the broker) are the “product”

- Focus on wholistic risk-transfer solutions, total cost of risk

- Much more SIMILAR than DIFFERENT at top brokerages

- Boss/Team more impactful than company

- Larger brokerages have more resources, but more opportunity to be affected by large-scale strategy shifts

+ Differences to Agency/Underwriting

- Data-driven and results oriented

- You (the broker) are the “product”

- Focus on wholistic risk-transfer solutions, total cost of risk

76

New cards

Homeowners Policy Coverages

+ Section I

Coverage A: Dwelling

Coverage B: Other Structures

Coverage C: Personal Property

Coverage D: Loss of Use

+ Section II

Coverage E: Personal Liability

Coverage F: Medical Payments to Others

Coverage A: Dwelling

Coverage B: Other Structures

Coverage C: Personal Property

Coverage D: Loss of Use

+ Section II

Coverage E: Personal Liability

Coverage F: Medical Payments to Others

77

New cards

Who is an “Insured” under Section I?

- Named Insured and spouse

- Resident relatives

- Other persons under age 21

- Full-time student away from home

- Resident relatives

- Other persons under age 21

- Full-time student away from home

78

New cards

Coverage A - Dwelling

- Covers the dwelling (house) on the residence premises.

- Structures attached to the dwelling.

- Materials intended for construction.

- No coverage for land.

- Structures attached to the dwelling.

- Materials intended for construction.

- No coverage for land.

79

New cards

Coverage B - Other Structures

+ Covers other structures on the residence premises set apart from the dwelling by clear space.

+ Examples:

- Detached garage

- Tool Shed (if on a foundation)

+ Structures that are rented out or used for business are excluded.

+ Examples:

- Detached garage

- Tool Shed (if on a foundation)

+ Structures that are rented out or used for business are excluded.

80

New cards

Coverage C – Personal Property

- Covers personal property owned or used by an insured while it is anywhere in the world.

- Coverage for personal property at another residence or in storage is limited to 10% of the Coverage C limit or $1,000, whichever is greater.

- Coverage for personal property at another residence or in storage is limited to 10% of the Coverage C limit or $1,000, whichever is greater.

81

New cards

Personal Property Not Covered

+ Property insured elsewhere (example: jewelry)

+ Animals, birds and fish

+ Motor vehicles

+ Aircraft, hovercraft

+ Property of roomers, boarders, tenants

+ Property in a regularly rented apartment

+ Business data

+ Credit cards, electronic funds transfer cards or access devices (Sub-limit for unauthorized use)

+ Water or steam

+ Animals, birds and fish

+ Motor vehicles

+ Aircraft, hovercraft

+ Property of roomers, boarders, tenants

+ Property in a regularly rented apartment

+ Business data

+ Credit cards, electronic funds transfer cards or access devices (Sub-limit for unauthorized use)

+ Water or steam

82

New cards

Coverage D – Loss of Use

+ Provides protection when the residence premises cannot be used because of a covered loss

+ Includes

1. Additional Living Expenses

2. Fair Rental Value

3. Prohibited Use – Civil authority

+ Includes

1. Additional Living Expenses

2. Fair Rental Value

3. Prohibited Use – Civil authority

83

New cards

Additional Coverages

+ Debris Removal (of damaged property)

- Up to 5% of Cov. A limit in addition to limit if needed.

- Up to $1,000 for the removal of fallen trees (due to wind/hail/ice/snow) from covered property.

+ Reasonable Repairs

- To protect property from further damage.

- Examples:

- Tarp over hole in roof

- Board up broken window

+ Trees, Shrubs, and Other Plants

- If loss caused by specific perils

- Up to $500 per tree/shrub/plant

+ Fire Department Service Charge (up to $500)

+ Unauthorized Use of Credit Card (up to $500)

+ Loss Assessment (up to $1,000)

+ Collapse

+ Landlord’s Furnishings (up to $2,500)

+ Ordinance or Law (up to 10% of Coverage A limit)

+ Grave Markers (up to $5,000)

- Up to 5% of Cov. A limit in addition to limit if needed.

- Up to $1,000 for the removal of fallen trees (due to wind/hail/ice/snow) from covered property.

+ Reasonable Repairs

- To protect property from further damage.

- Examples:

- Tarp over hole in roof

- Board up broken window

+ Trees, Shrubs, and Other Plants

- If loss caused by specific perils

- Up to $500 per tree/shrub/plant

+ Fire Department Service Charge (up to $500)

+ Unauthorized Use of Credit Card (up to $500)

+ Loss Assessment (up to $1,000)

+ Collapse

+ Landlord’s Furnishings (up to $2,500)

+ Ordinance or Law (up to 10% of Coverage A limit)

+ Grave Markers (up to $5,000)

84

New cards

HO-3 Section I – Perils Insured Against

+ Coverages A (Dwelling) and B (Other Structures) are “Open” (a/k/a “All Risk” unless excluded) perils

- Exclusions to Coverages A and B

+ Collapse (except as covered in Additional Coverages), Freezing of pipes if building is not heated, Theft of materials from building under construction, Vandalism if vacant more than 60 days, Mold, fungus, or rot unless caused by covered loss, Wear and tear, mechanical breakdown, Birds, rodents, insects; nesting or infestation

+ Coverage C (Personal Property) has “named perils”

- Covered perils for Coverage C (Personal Property)

- Fire or lightning, Wind or hail (subject to exclusions), Explosion, Riot or Civil Commotion, Aircraft and vehicles, Smoke, Vandalism, Theft (subject to exclusions), Falling objects, Weight of ice/sleet/snow (subject to exclusions), Accidental discharge of water/steam, Freezing if building is heated, Sudden & accidental damage from artificial electrical current, Volcanic eruption

- Exclusions to Coverages A and B

+ Collapse (except as covered in Additional Coverages), Freezing of pipes if building is not heated, Theft of materials from building under construction, Vandalism if vacant more than 60 days, Mold, fungus, or rot unless caused by covered loss, Wear and tear, mechanical breakdown, Birds, rodents, insects; nesting or infestation

+ Coverage C (Personal Property) has “named perils”

- Covered perils for Coverage C (Personal Property)

- Fire or lightning, Wind or hail (subject to exclusions), Explosion, Riot or Civil Commotion, Aircraft and vehicles, Smoke, Vandalism, Theft (subject to exclusions), Falling objects, Weight of ice/sleet/snow (subject to exclusions), Accidental discharge of water/steam, Freezing if building is heated, Sudden & accidental damage from artificial electrical current, Volcanic eruption

85

New cards

HO-3 Section I - Exclusions

These exclusions apply to A (Dwelling), B (Other + Structures), and C (Personal Property)

- Ordinance or law (other than provided by Additional Coverages), Earth movement, Flood, surface water, storm surge, water back-up, Power failure, Neglect, War, Nuclear hazard, Intentional loss, Governmental action, Weather actions

- Ordinance or law (other than provided by Additional Coverages), Earth movement, Flood, surface water, storm surge, water back-up, Power failure, Neglect, War, Nuclear hazard, Intentional loss, Governmental action, Weather actions

86

New cards

Deductible

- May be a flat dollar amount ($1,000) or a percentage of the Coverage A limit (2%).

- Coastal states frequently require a percentage deductible for wind and hail.

- If more than one deductible is applicable, the highest is applied.

- Coastal states frequently require a percentage deductible for wind and hail.

- If more than one deductible is applicable, the highest is applied.

87

New cards

Duties After Loss

- Give prompt notice to insurer

- Notify police if theft has occurred

- Protect property from further damage

- Cooperate with insurer

- Prepare inventory of damaged items

- Notify police if theft has occurred

- Protect property from further damage

- Cooperate with insurer

- Prepare inventory of damaged items

88

New cards

Loss Settlement

+ Buildings

- Covered at replacement cost (“RC”)

- Must be insured to 80% of RC to avoid coinsurance penalty

- Actual cash value (ACV) is paid initially, depreciation reimbursed when property is actually replaced/repaired.

+ Personal Property

- Covered at ACV

- Endorsement can be purchased for RC coverage.

- Covered at replacement cost (“RC”)

- Must be insured to 80% of RC to avoid coinsurance penalty

- Actual cash value (ACV) is paid initially, depreciation reimbursed when property is actually replaced/repaired.

+ Personal Property

- Covered at ACV

- Endorsement can be purchased for RC coverage.

89

New cards

Appraisal

Used when insured and insurer agree that loss is covered but disagree as to loss amount

90

New cards

Other Insurance

- Pro-rata if another insurance policy applies.

- Excess if service warranty applies.

- Excess if service warranty applies.

91

New cards

Suit Against Insurer

Must be started within two years after loss occurs

92

New cards

Sections I and II - Conditions

+ Cancellation and nonrenewal provisions similar to Personal Auto Policy.

+ Assignment

- You cannot assign policy benefits to another party without insurer’s consent.

+ Assignment

- You cannot assign policy benefits to another party without insurer’s consent.

93

New cards

Coinsurance in HO Property Insurance (Yet Again!)

- Encourages the insured to insure the property to a stated percentage of its insurable value.

- If coinsurance requirement is not met at the time of loss, the insured must share the loss (as a coinsurer)

- If coinsurance requirement is not met at the time of loss, the insured must share the loss (as a coinsurer)

94

New cards

$75,000

Example: HO Property Coinsurance

A dwelling has a replacement cost of $500,000

The homeowner insures the dwelling for $300,000

The HO policy includes an 80% coinsurance clause

A covered fire causes $100,000 in damages to the dwelling

How much does the insurer pay?

A dwelling has a replacement cost of $500,000

The homeowner insures the dwelling for $300,000

The HO policy includes an 80% coinsurance clause

A covered fire causes $100,000 in damages to the dwelling

How much does the insurer pay?

95

New cards

Section II – Liability Coverages

Coverage E – Personal Liability

Coverage F – Medical Payments to Others

Coverage F – Medical Payments to Others

96

New cards

Coverage E - Liability

+ Protects an insured when a claim or suit for damages is brought because of bodily injury or property damage allegedly caused by an insured’s negligence.

+ Pays amount for which the insured is found legally liable, up to policy limits.

+ Insurer also pays defense costs.

+ Pays amount for which the insured is found legally liable, up to policy limits.

+ Insurer also pays defense costs.

97

New cards

Examples: Coverage E – Liability

+ Your dog bites a neighbor.

+ While burning leaves in your backyard, the fire gets away from you and damages your neighbor’s home.

+ A friend visiting your house trips over one of your children’s toys and sues you for their resulting injuries.

+ You are shopping and your child breaks an expensive vase.

+ While burning leaves in your backyard, the fire gets away from you and damages your neighbor’s home.

+ A friend visiting your house trips over one of your children’s toys and sues you for their resulting injuries.

+ You are shopping and your child breaks an expensive vase.

98

New cards

Coverage F – Medical Payments to Others

+ Pays the reasonable expenses of another person who is accidentally injured:

- while on an insured location,

- or by the activities of an insured or residence employee,

- or animal owned by or in the care of an insured.

+ Not based on legal liability

+ Medical expenses must be incurred within 3 years of the date of the accident.

Examples:

+ A guest falls on your front steps and breaks his arm.

+ A neighbor’s child falls off a swing set in your backyard and is injured.

+ Your dog bites a houseguest.

- while on an insured location,

- or by the activities of an insured or residence employee,

- or animal owned by or in the care of an insured.

+ Not based on legal liability

+ Medical expenses must be incurred within 3 years of the date of the accident.

Examples:

+ A guest falls on your front steps and breaks his arm.

+ A neighbor’s child falls off a swing set in your backyard and is injured.

+ Your dog bites a houseguest.

99

New cards

Section II – Exclusions to Coverages E and F

+ Motor Vehicle Liability

+ Exceptions

- Vehicle in dead storage on insured location.

- Vehicle used to service residence.

- Vehicle designed to assist the handicapped.

- Coverage in some situations for golf-carts and recreational motor vehicles (RMVs).

+ Watercraft, Aircraft, Hovercraft Liability.

+ Expected or intended injury

+ Business activities

+ Professional services

+ Transmission of communicable disease

+ Sexual molestation, corporal punishment, physical/mental abuse

+ Controlled substance

+ Exceptions

- Vehicle in dead storage on insured location.

- Vehicle used to service residence.

- Vehicle designed to assist the handicapped.

- Coverage in some situations for golf-carts and recreational motor vehicles (RMVs).

+ Watercraft, Aircraft, Hovercraft Liability.

+ Expected or intended injury

+ Business activities

+ Professional services

+ Transmission of communicable disease

+ Sexual molestation, corporal punishment, physical/mental abuse

+ Controlled substance

100

New cards

Section II – Exclusions to Coverage E - Liability

- Contractual liability

- Property owned by or in the care of an insured

- Workers’ Compensation

- Bodily injury to an insured

- Property owned by or in the care of an insured

- Workers’ Compensation

- Bodily injury to an insured