Chapter 4: Cost-volume relationship, contribution margin, CMR, break-even point

1/15

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

16 Terms

What are the 5 elements of the cost-volume profit relationship?

Prices of products

Volume/activity level

Per unit variable costs

Total fixed costs

Mix of products sold

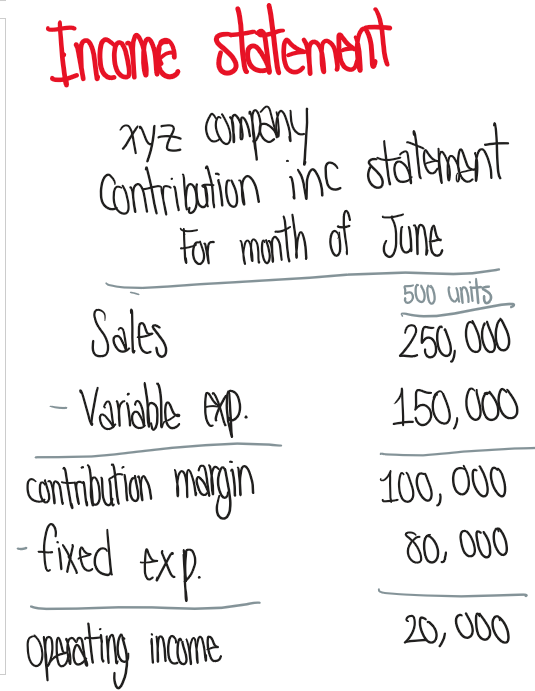

What are the basic components of an income statement?

Sales

- variable expenses

= contribution margin

- fixed expenses

= operating income

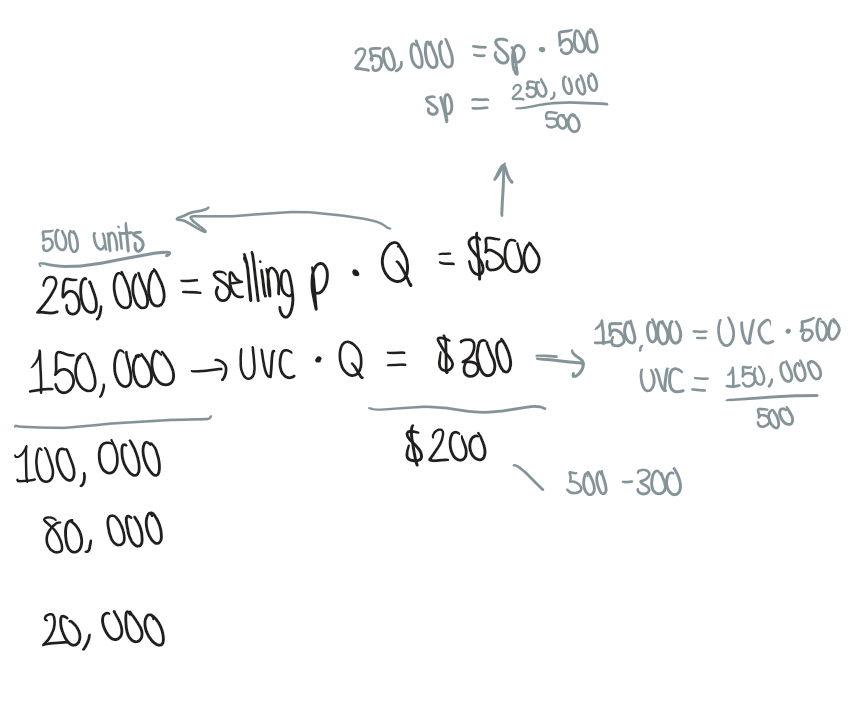

How do you find the per-unit prices of sales, variable expenses, and contribution margin?

Divide the sales & variable expenses by the units produced

subtract the variable expenses from sales to find the contribution margin per unit

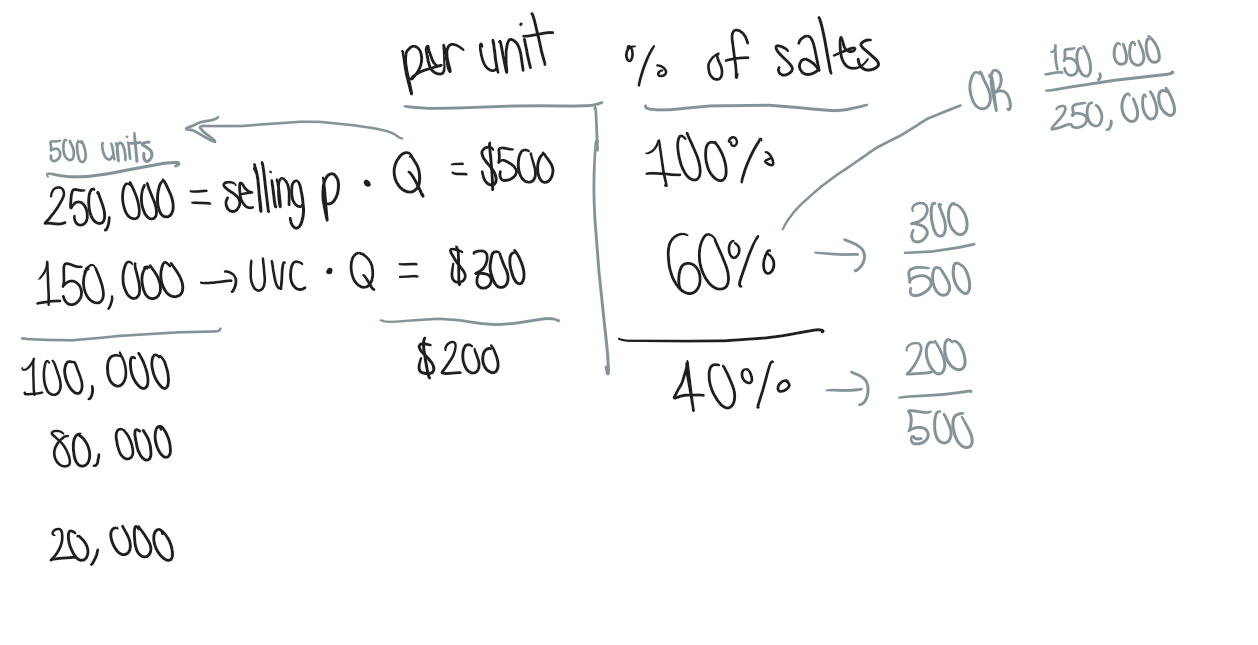

How do you find the percentage contributions of sales, variable expenses, and contribution margin?

Sales = 100%

Variable expenses = unit variable cost / unit sales

Contribution margin = unit CM / unit sales

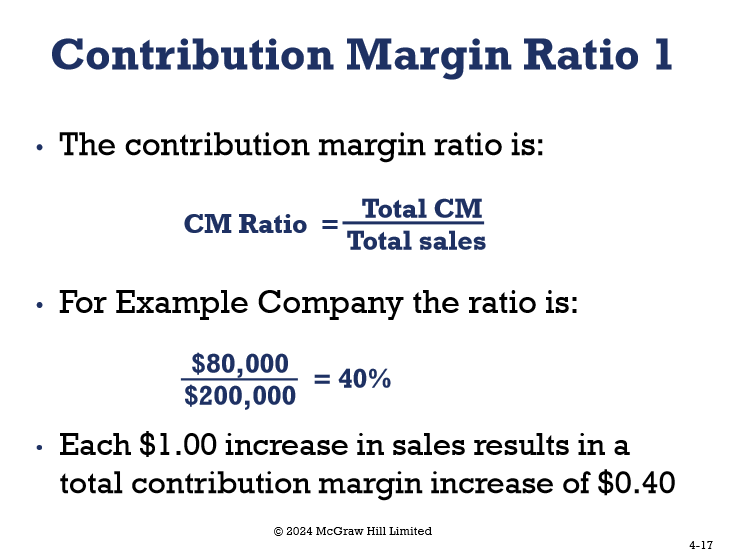

this means, 40% contributes to covering fixed costs

If the activity level changes, these ratios are still the same!

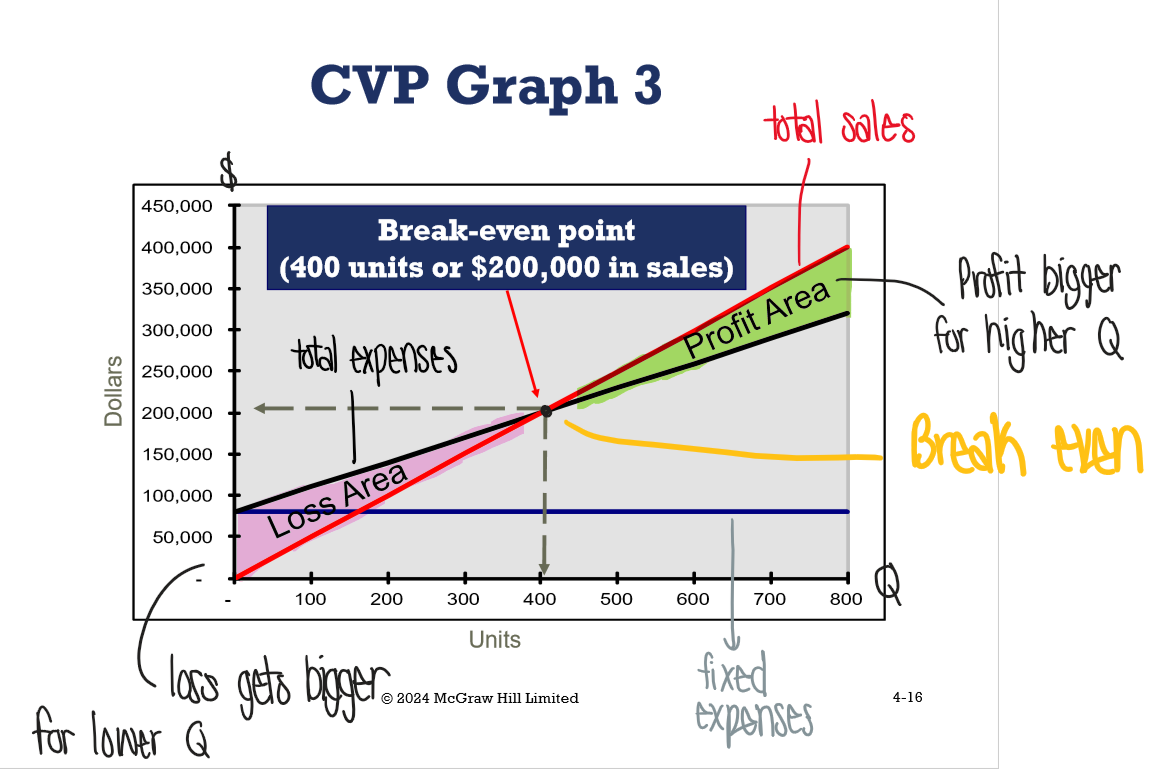

What is the cost-volume profit graph?

If you sell above the break even quantity (intersection), you make a profit

If you sell below, you make a loss

What is the contribution margin ratio formula?

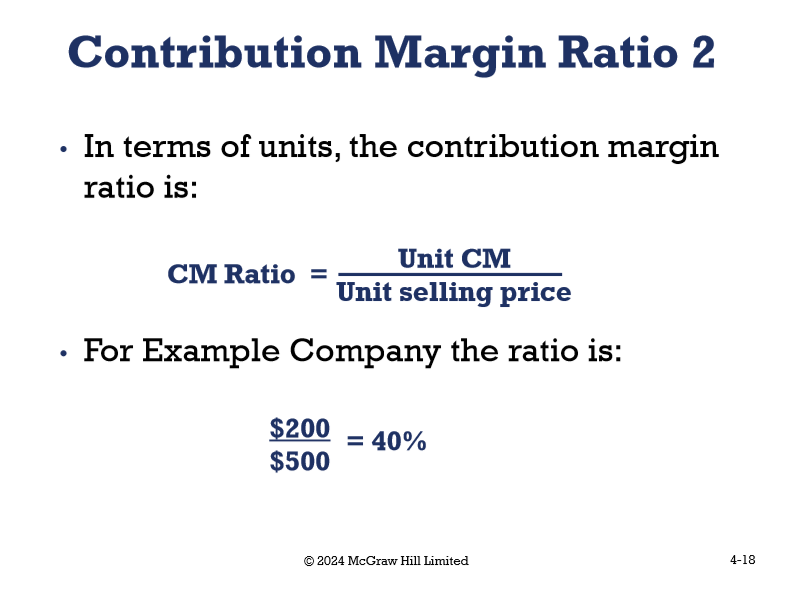

How do you find the contribution margin ratio using units?

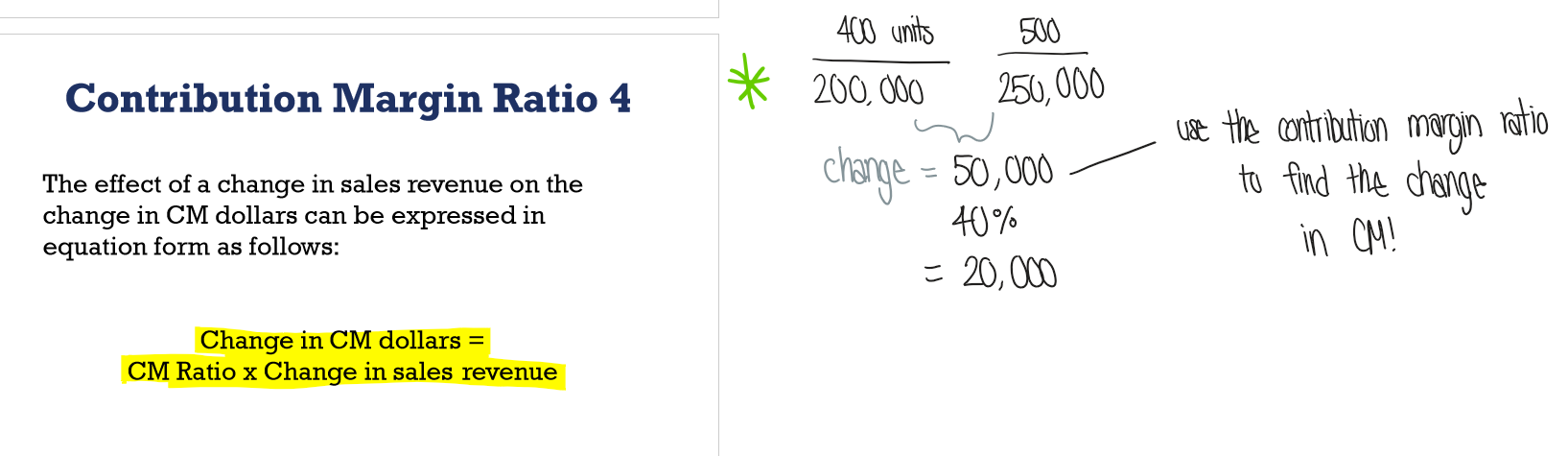

How can you use the contribution margin ratio to find the change in contribution margin dollars?

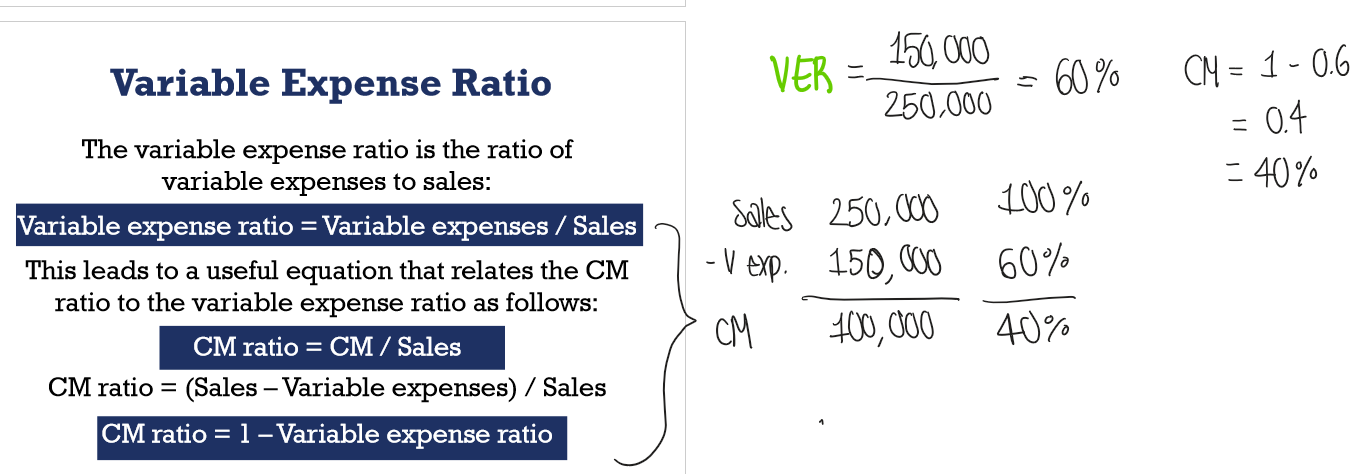

What is the variable expense ratio?

The ratio of variable expenses to sales

What is the break even point in units?

Fixed expenses / unit CM

What is the break even point in sales dollars?

Fixed expenses / CM ratio

CM ratio = CM / Sales

can also get it by multiplying the unit break even point by the selling price

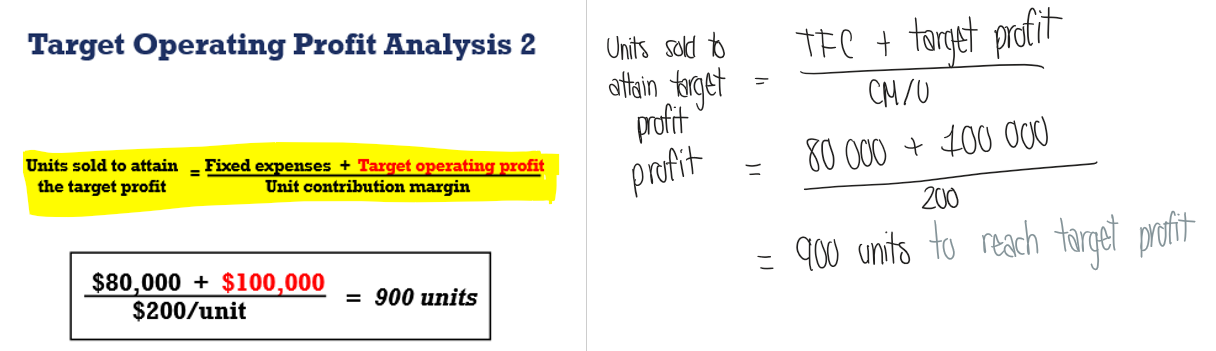

How do you find the units needed to attain the target profit?

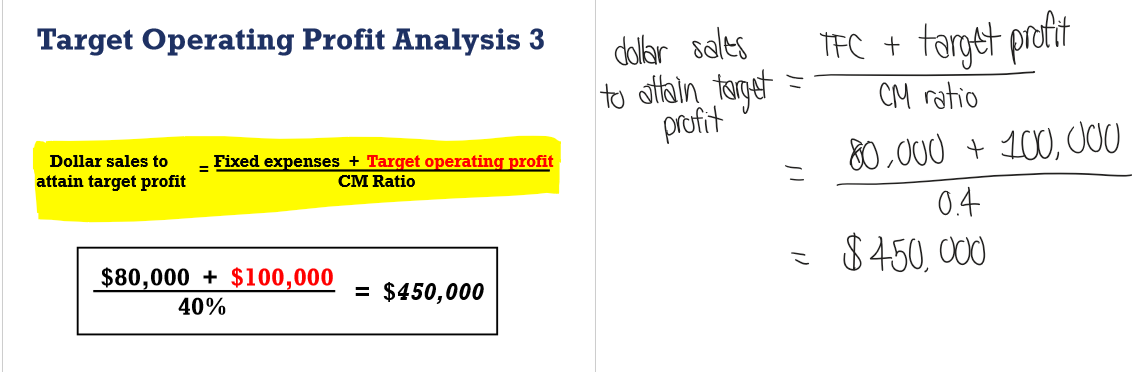

How do you find the sales needed to attain target profit?

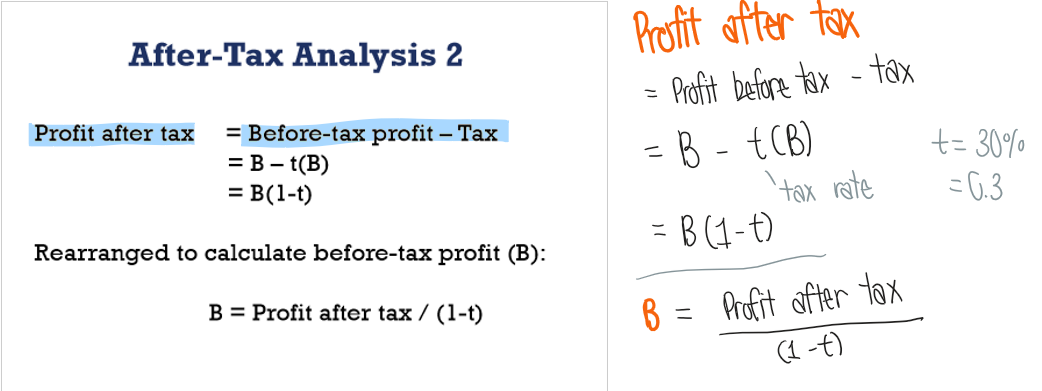

How do you find the profit after tax & the profit before tax?

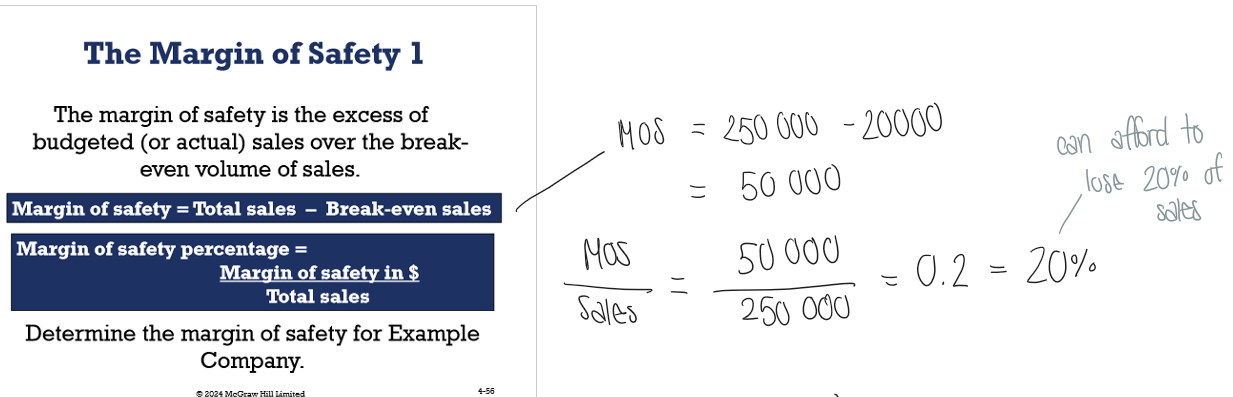

What is the margin of safety?

The excess of sales over the break-even volume of sales

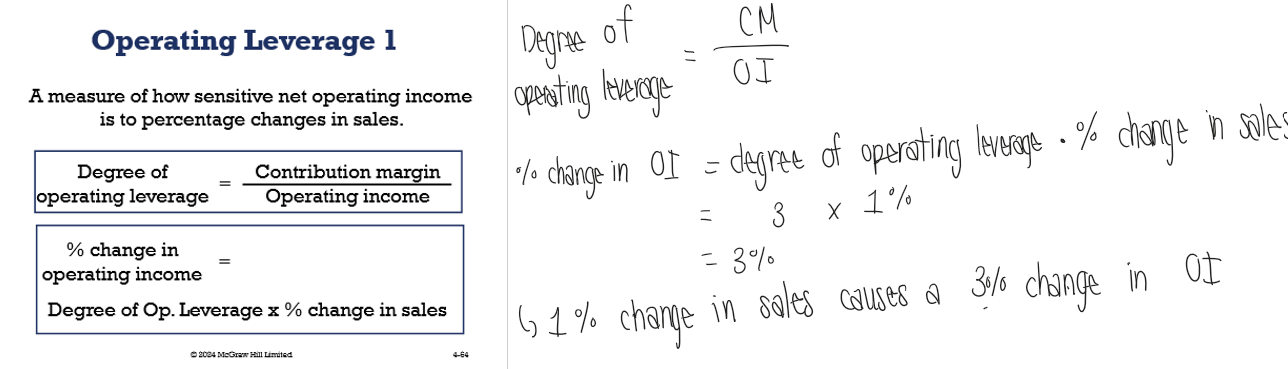

What is operating leverage?

Measures how sensitive net operating income is to percentage change in sales