ACCT 201 EXAM 2 (CH 4 - 6)

1/29

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

30 Terms

An account that will have a zero balance after closing entries have been journalized and posted

Service Revenue (or any revenue or expense account)

Closing entries are necessary for

Temporary accounts

Patents and copyrights are

Intangible assets

The purpose of the post-closing trial balance is to

prove the equality of the balance sheet account balances that are carried forward into the next accounting period

A post-closing trial balance will contain only

Permanent accounts

Assets that a company expects to convert to cash or use up within one year or the operating cycle, whichever is longer are called

Current assets

All of the following are property, plant, and equipment except

Supplies

Current liabilities…

are obligations that a company is to pay within the coming year or its operating cycle, whichever is longer

Maxim Company had the following partial listing of accounts and balances at year-end: Cash, $7,000; Accounts Receivable, $6,000; Accounts Payable, $15,000; Equipment, $23,000; Inventories, $1,000; Land, $75,000; Unearned Service Revenue, $13,000; and Prepaid Rent, $4,000. The total current assets for Maxim Company is:

$23,000

A company has purchased a tract of land. It expects to build a production plant on the land in approximately 5 years. During the 5 years before construction, the land will be ideal. The land should be reported as

a long-term investment

Gross profit is

Sales revenue less cost of goods sold

Under a perpetual inventory system,

Purchases on account are debited to Inventory

FOB shipping point means that the

Buyer pays the freight costs

A credit sale of $750 is made on June 13, terms 2/10, net/30. A return of $50 is granted on June 16. The amount received as payment in full on June 23 is

$686

A company determines the cost of goods sold each time a sale occurs in

a perpetual inventory system only

FOB shipping point means that the

buyer pays the shipping freight

In a perpetual inventory system, which account is debited when goods are purchased with the intent of being sold?

Inventory

In a perpetual inventory system, a return of defective merchandise by a purchaser is recorded by crediting

Inventory

To record the sale of goods for cash in a perpetual inventory system,

two journal entries are necessary: one to record the receipt of cash and sales revenue, and one to record the cost of goods sold and reduction of inventory

The contra revenue account that normally has a debit balance is

Sales returns and allowances

Inventory items on the assembly line in various stages of production are classified as

work in progress

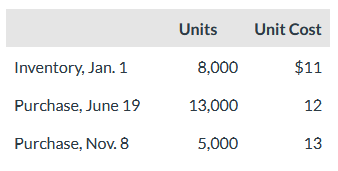

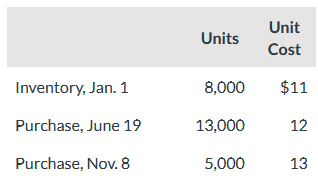

Tinker Bell Company has the following:

If Tinker Bell has 9,000 units on hand at December 31, the cost of the ending inventory under FIFO is:

100,000

Goods in transit should be included in the inventory of the buyer when the

terms of sale are FOB shipping point

Cecil gives goods on consignment to Jerry who agrees to try and sell them for a 20% commission. At the end of the accounting period, which of the following parties includes the consigned goods in its inventory?

Cecil

Cost of goods available for sale consists of two elements: the cost of beginning inventory and the cost of

goods purchased

The cost flow method that often parallels the actual physical flow of merchandise is the

FIFO method

Hudson Company started its year with 600 units of the beginning inventory at a cost of $4 per unit. During the year, the company made the following purchases: May, 900 units at $5 per unit and July, 500 units at $6 per unit. A physical count of inventory at year end indicates that there are 700 units in ending inventory. What is the cost of the ending inventory if Hudson Company uses the FIFO method for valuing inventory?

(500 units x $6) + (200 units x $5) = $4,000

Tinker Bell Company has the following information for the current year:

If Tinker Bell has 9,000 units on hand at December 31st, the cost of inventory under the FIFO cost flow method is

(5,000 x $13) + (4,000 x $12) = $113,000

Davidson Electronics has the following:

If Davidson has 7,000 units on hand at December 31st, the cost of ending inventory under the average cost method is

$430,000 = (5,000 x $8) + (15,000 x $10) + (20,000 x $12)

Average cost per unit = (430,000/total units available for sale or 40,000) = $10.75

($10.75 × 7,000) = $75,250

In a period of inflation, which cost flow method produces the highest net income?

FIFO method