Lecture 11: Great Recession 2007-2009

1/14

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

15 Terms

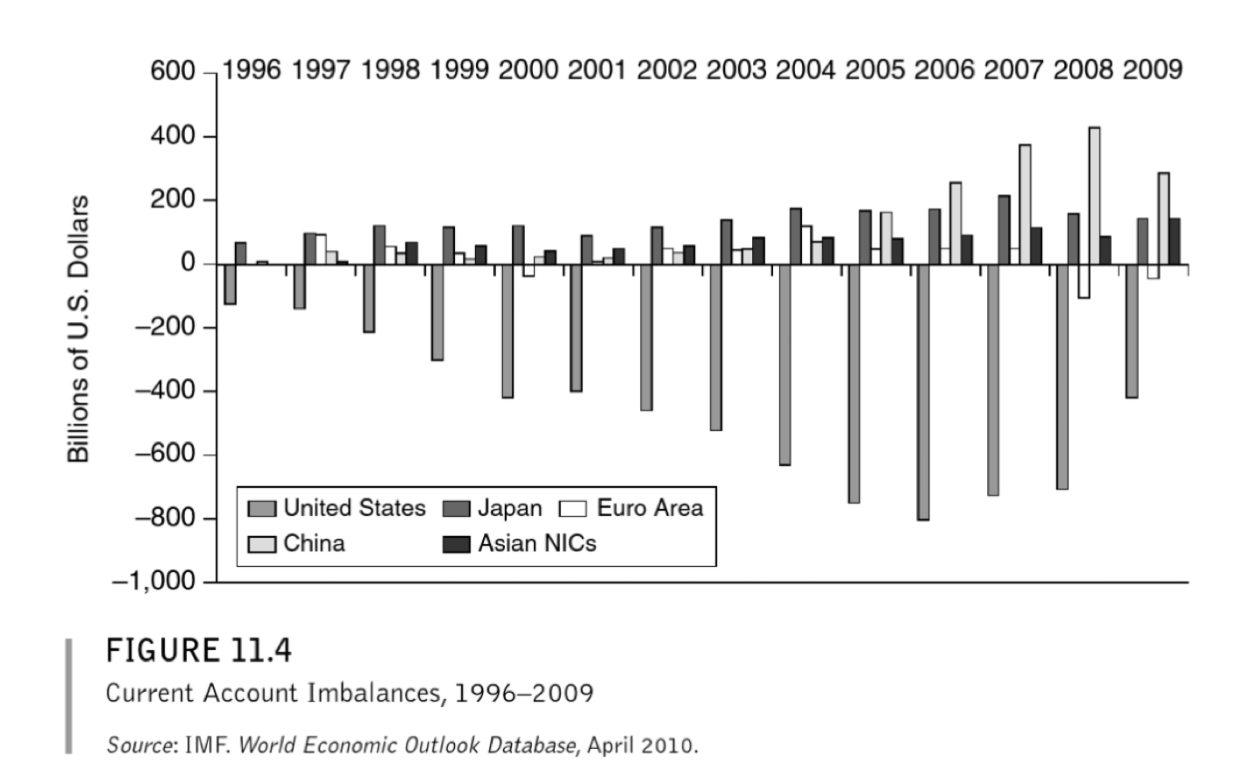

Global Imbalances

The lessons that Asia learned from their crisis leads to this huge imbalance

Buying up US currency to put into their reserves

Exports more to US than US exports to them

Global imbalances: international bargaining failure → US blames…

Savings Glut (saving too much)

Bush administration tries to push China to expand consumption and allow RMB to appreciate against dollar

Tries to shift IMF's attention to China Unsuccessful

presses European governments (Germany) to reduce their Current Account surpluses

Global imbalances: international bargaining failure → Govs in surplus counties blames …

US, demand American policy changes instead

EU says that its not saving too much, US is spending too much

Europeans blame US federal gt's budget deficit following 2001 tax cut for US CA deficit

EU argued not their issue, since overall Euro area in CA deficit

As a whole the EU is in balance

China adopts more flexible peg in 2005, but otherwise also demands US balance its budget instead

Global imbalances: international bargaining failure Result

no action, flow of cheap and plentiful credit from the surplus countries to the US

Cheap Credit in the US fuels real estate bubble

Real estate prices rose 60% btw 2000 and 2006

Mortgage-backed securities: bundles of different risk in a single security

Easier and easier to get loan for a house

Low interest rate

No credit check

Little check on you in general

Prices rose bc more buyers in system

Financial institutions discounted risk of nationwide collapse of real estate prices, worst case scenario planned for: regional collapse

2007: real estate prices fall by almost 25 percent nationwide, mortgage default rates rise sharply

Banks taking a lot of risks and underestimating the risks in the real estate market

Planned for regional default

Did not plan for national default

Fewer and fewer people are able to afford their homes bc the mortgages can’t be paid

Securities suffered large losses, many bought with debt - debt-service problems entire financial system

Crisis becomes international

Great Britain, Ireland and Spain, had their own real estate bubbles that collapsed

Copied the US business model

European financial institutions had purchased mortgage-backed securities in large quantities - suffer same losses

Freezing of global credit markets after bankruptcy of Lehman Brothers in fall of 2008 made it difficult for all financial institutions to secure credit for their activities

Banks lend a lot to each other to keep each other/system going

Usually with low interests rats

Credit dries up -> interest rates on inter-bank lending grow sharply

Policy reactions

Bank bailouts

Monetary policy

International cooperation

Policy reactions: bank bailouts

Initially US government regulators close some failing banks, arrange sales

E.g. Bear Stearns sold to JP Morgan

failed to find buyer for Lehman Brothers

Banks deemed too big to fail got bailouts in both the US and the EU

Ireland with the largest bailouts in the EU => creates debt problems in the Eurozone debt crisis

Policy reaction: monetary policy

Central Banks inject liquidity → As much money as possible

August 2007: ECB, Bank of England, and Fed inject $200 billion into markets, again in December 2007

Lower interest rates to 0

Eventually: Unconventional monetary policy - asset purchasing to stimulate the economy = "Quantitative Easing"

Quantitative easing

Creation of money to try and fix economy

Creation of new/more money —> not printing but digital

Increase money supply

CB decreasing money supply

Abandoned safe investment and go more for riskier ones (goal)

Long run will lead to inflation (hindsight- not the case)

Short run - stopped a deep recession

At the time untested policy, no other choice —> no action will lead to catastrophe

Put more money into the system but commercial banks were keeping more in

Policy reaction: International cooperation

Shift from importance of G-7 to G-20 (with emerging markets) to coordinate response

Governments agreed to coordinate fiscal stimulus measures to boost economic activity

Try to grow out of the crisis

Expanded IMF lending capacity

Financial Stability Board charged with coordinating and monitoring efforts on reform of financial regulation

Current account balances today

Global imbalances stubbornly large

US continues to have CA deficits

Trump (largely unsuccessfully) pressured China and Germany to change their policies (sound familiar?)

How to prevent banking/financial crisis for banks

Regulation!

Increase Reserve requirements - share of deposits/liabilities a bank has to hold as reserves

Need to have more in reserve

Less that they can lend out

Deposit insurance - the government insures bank deposits

Learned from Great Depression

Need people to believe that their money is safe otherwise bank run = bankruptcy

Division between risky investment & retail banking

Regulatory Oversight

Limit risk

How to prevent banking/financial crisis for governments

Governments can try (but often fail) to prevent the global imbalances that drive financial crisis

Coordinate monetary and fiscal policy —> happens rarely (too self interested)

How to prevent banking/financial crisis for both

Lenders of Last Resort

Institutions that lend money in a crisis to provide emergency liquidity (although beware of moral hazard!)

Central Banks, IMF

Good idea to have a lender of last resort —> prevent moral hazards

Saves you from things like bank-runs —> good for banks

Trust in system

Pair lender of last resort with good/strong regulatory oversight