Chapter 11: IFRS 16 Leases

1/15

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

16 Terms

IFRS 16 Lease

A lease is a contract, or part of a contract, that conveys the right to use an asset (the underlying asset) for a period of time in exchange for consideration.

Lessor

Entity that provides the right of use an underlying asset for a period of time in exchange for consideration.

Lessee

Entity that obtains the right to use an underlying asset for a period of time in exchange for consideration.

Right-of-use Asset

An asset that represents a lessee’s right to use an underlying asset for the lease term.

Initial Lease Recognition

Credit: Lease liability

Debit: Right-of-use asset

The debit/credit don’t have to match as may be debits too cash or provisions as well.

Lease Liability: Initial Recognition

Present value (discounting) of lease payments not yet made (future payments) which include:

Fixed payments (in advance & arrears) - always included

Variable payments (valued as at inception) - on day 1 like interest

Amounts expected to be payable under residual value guarantees

Options to purchase that are expected to be exercised

Termination penalties if expected to be paid

Right-of-use Asset: Initial Recognition

Cost which includes:

Initial value of lease liability (same figure as credit to lease liability)

PLUS

Payments made at or before commencement (deposit). Debit ROU Asset, Cr Cash.

Initial direct costs (legal/prof. Fees). Debit ROU Asset, Cr Cash.

Estimated costs of asset removal or dismantling as per lease conditions @ PV. Debit ROU Asset, Cr Provisions.

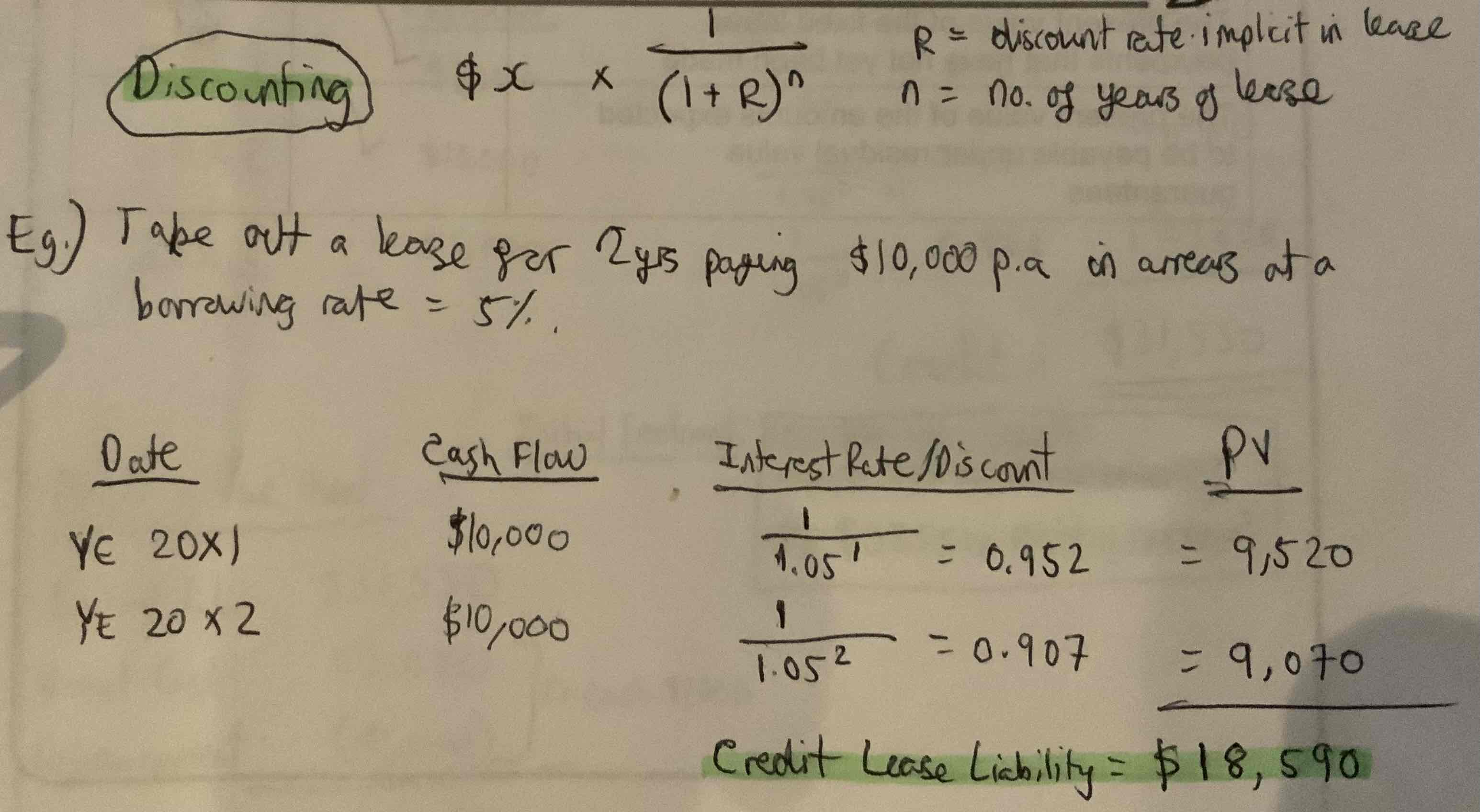

Discounting

The discount rate used to discount the liability will be the rate implicit in the lease (interest, borrowing, discount, rate implicit, rate of incremental borrowing.

Lease Term

Non-cancellable periods

Periods covered by an option to extend the lease if reasonably certain to be exercised.

Periods covered by an option to terminate the lease if reasonably certain NOT to be exercised.

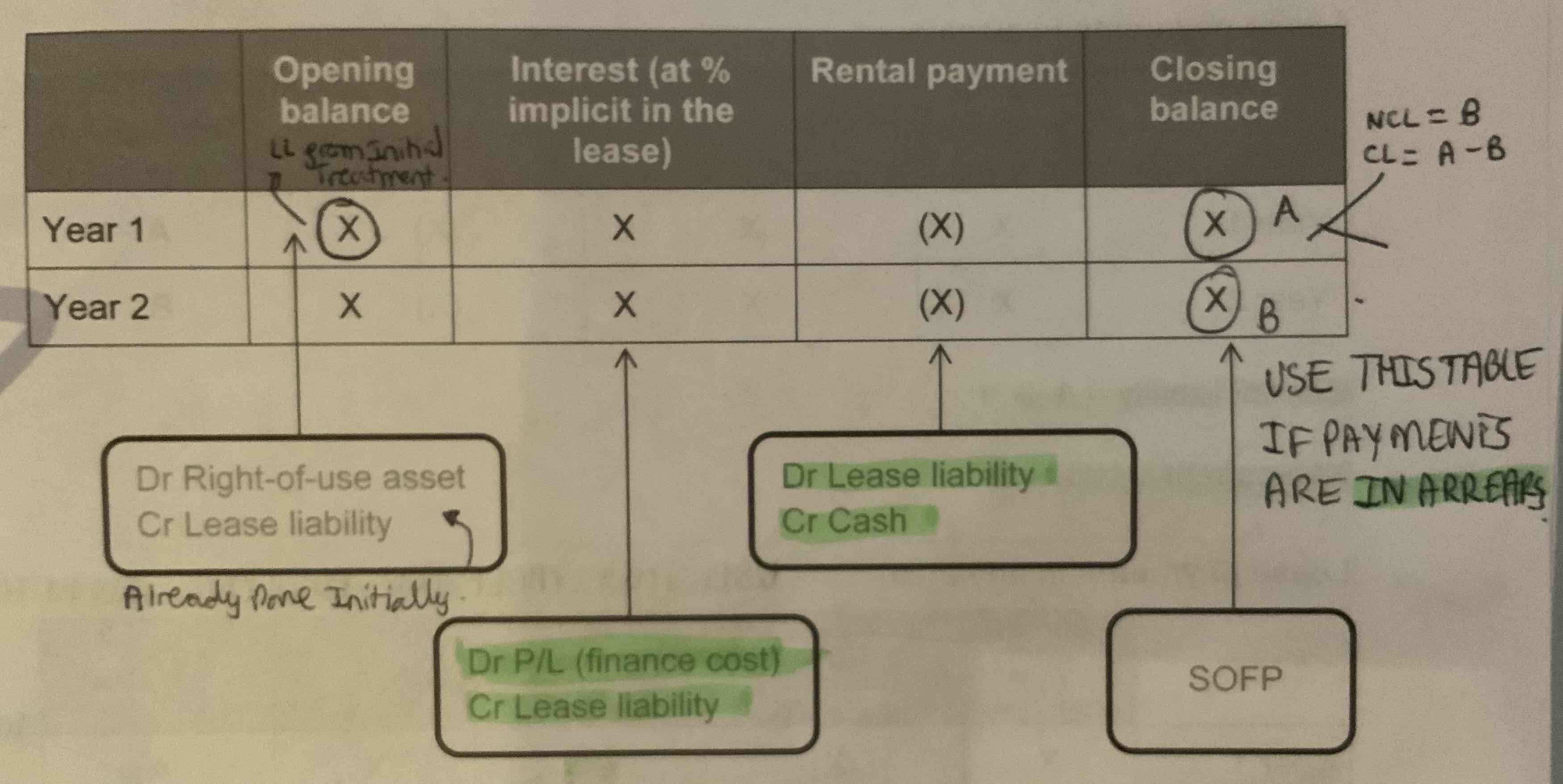

Subsequent Treatment: Lease Liability - Payment in Arrears

Add the interest charge implicit in the lease and reduce by cash payments (a.k.a amortised cost).

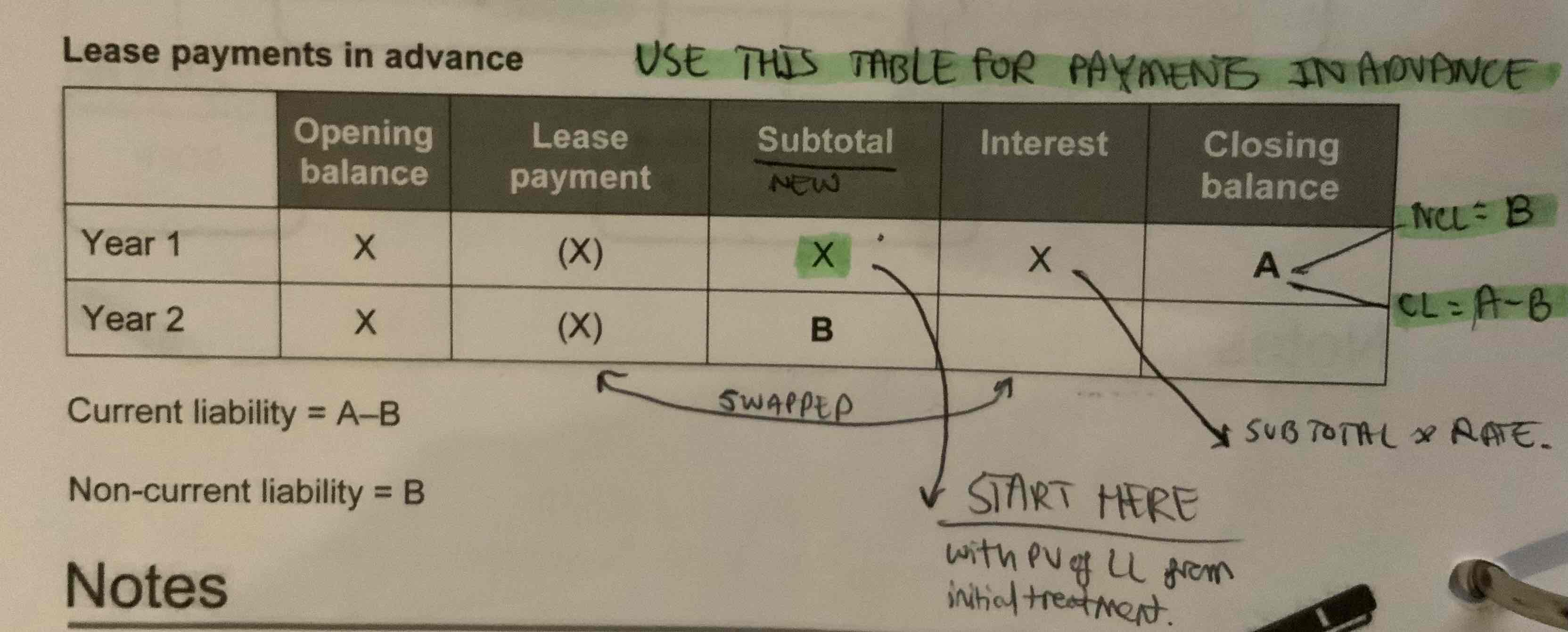

Subsequent Treatment: Lease Liability - Payments in Advance

Subsequent Treatment: Right-of-use Asset

Right-of-use asset is measured by the cost model measured at:

PV of ROU = Cost - Accumulated Depreciation & Impairment Losses

The asset is depreciated over the SHORTER of the lease term and the useful life of the asset if ownership does not transfer to the lessee (default).

Over the asset’s useful life if ownership transfers to the lessee (have to state in question).

Debit/Credit: ROU Asset

Debit - Depreciation Expense (SPL)

Credit - Accumulated Depreciation (ROU Asset - SFP)

Subsequent Treatment: Short-life and Low-value Assets

If the lease us short term (less than 12 months) or low value:

The lessee can ignore the right-of-use asset and lease liability.

INSTEAD

Lease rentals are charged it P/L systematically over lease term (typically straight line

Difference between the amount in P/L and the cash payment is recognised as a prepayment or accrual.

Debit/Credit: Short-life and Low-value Assets

Debit - Rental Expense (SPL) = straight line basis

Credit - Cash = actual cash paid in year

Cr/Dr Accrual/Prepayment

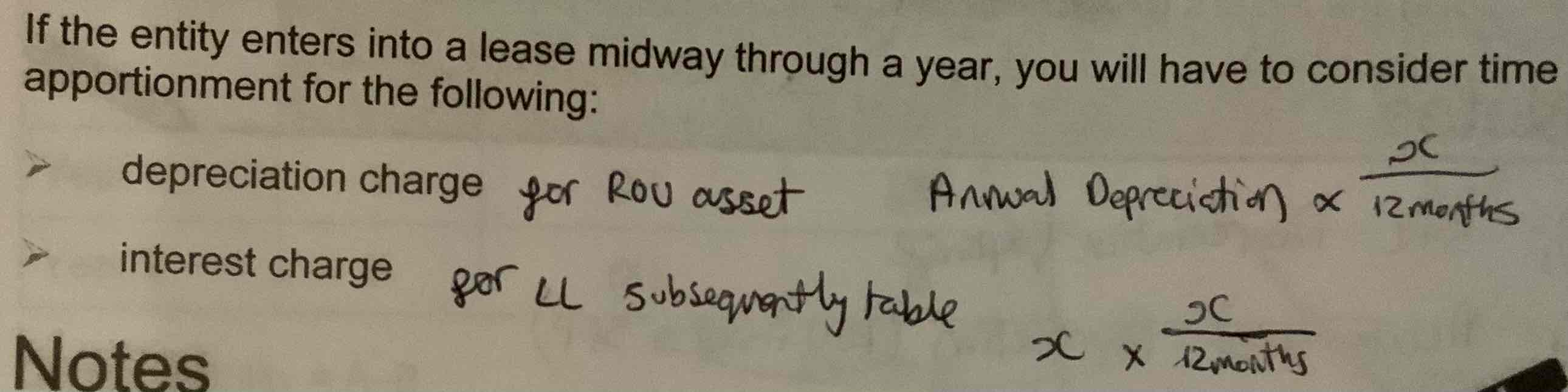

Mid-Year Entry to a Lease