AC105 - Week 5: depreciation

1/45

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

46 Terms

What are non-current assets?

assets that provide future benefit but not trading

2 types of NCA

Finite or Infinite

meaning of finite life of a NCA

will be used up over their useful life through wear and tear

meaning of infinite life of a NCA

Benefits from assets with indefinite lives may or may not be used up over time

What is depreciation?

Accounting method that allocates cost of a tangible asset cross its useful life, reflecting gradual loss of value due to wear and tear or obsolescence

What is the NBV

cost (acq) - accumulated depreciation

What are fair values

NCA may be recorded using fair values (measured with a reasonable degree of certainty)

represent the selling price that can be obtained in an orderly transaction under current market conditions

Benefit of measuring using fair value instead of cost

more up to date information which may be more relevant to their needs

better financial figures for entity as NCA like property have increased significantly over time

What is amortisation

depreciation of intangible assets

What 4 factors have to be considered to calculate the depreciation expense

Acquisition cost of the asset

Useful life of the asset

Residual value (RV) of the asset

Approved depreciation method

What principle guides inventory write downs when market value falls below cost

Prudence principle - Inventory is valued at the lower of cost or net realisable value (NRV).

Double entry for inventory writedown

UP: Cost of Goods Sold

DOWN: Inventory

What is carrying amount

initial cost of an asset

What is the NRV of an asset

The estimated selling price minus any costs involved in selling and distributing the goods

What is PPE

PPE are tangible assets that are held for use in the production or supply of goods or services for rental to others or administrative purposes

They are expected to be used during more than one period

What does the cost of an item of PPE include

The purchase price

All costs incurred in order to bring the asset into a location and condition ready for use

What is capital expenditure

Cash spent to purchase assets, the asset is expected to provide future benefits, items last for more than a year

What is revenue expenditure

Any cash spent on day to day operations and is consumed within an accounting year

The entire amount is charged to the income statement

When and only when can subsequent expenditure on PPE be capitalised ( Added to the cost of the asset on the SOFP)

If it enhances the economic benefit of the asset

e.g. repairs will not but adding an extension will

What are the 2 ways of subsequent measurement of PPE

The cost model

OR

The revaluation model

What is the cost model

The cost model is where the asset is included in the SOFP at cost less accumulated depreciation and impairment losses

This net amount is referred to as a carrying amount or Net Book Value

What is the revaluation model

Where the asset is included on the SOFP at revalued amount (fair value) less subsequent depreciation and impairment losses

Arising revaluation gains are credited to an account 'revaluation reserve' this is part of a companys equity

Revaluation double entry

UP non-current assets

UP Revaluation Reserve

What are the 2 methods of depreciation

Straight line

Reducing balance

SL method of depreciation

Constant change over the life of the asset

Reducing balance method of depreciation

Decreasing changes over the life of the asset

Useful life of a NCA

Refers to the period over which an asset generates benefits

What is the physical life of an asset not necessarily equal to

Its economic life

What are assets depreciated based on

Their useful economic life

What does residual value refer to

The selling value of an asset at the end of its useful life

What is the formula for the depreciable amount of an asset

Initial cost - residual value

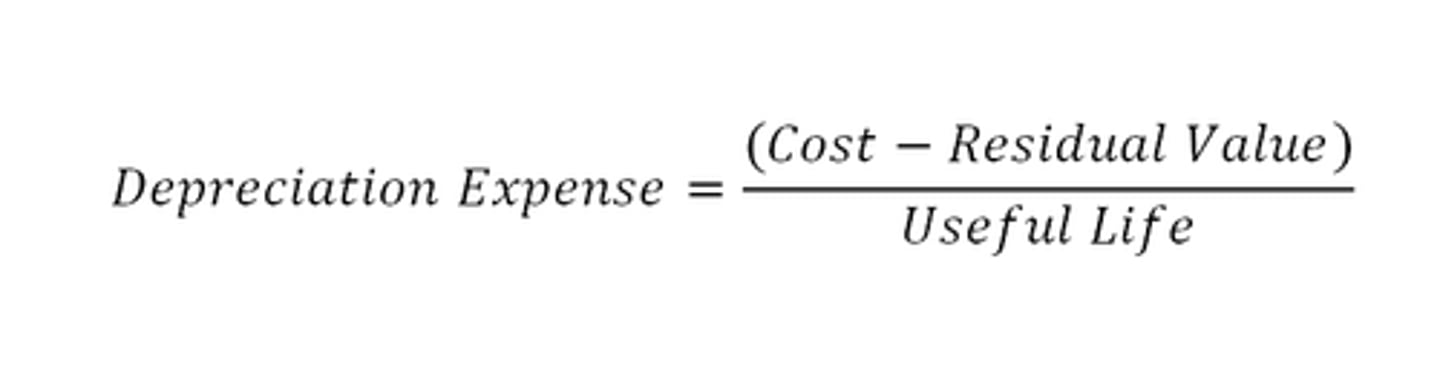

What formula does the straight line method use to calculate depreciation expense

How does the rate of depreciation differ between reducing balance method and straight line method

The reducing balance method results in more depreciation in the earlier years of an assets life and less depreciation in the later years

What is the equation for depreciation expense through reducing balance method

Depreciation expense = Depreciation rate x NBV at the start of the year

What is the double entry for depreciation

Dr depreciation expense (IS)

Cr accumulated depreciation (SOFP)

What type of entry is accumulated depreciaiton

Contra account

What are the 2 accounts we use for non-current assets

Cost and Accumulated depreciation

What is the net balance of cost and accumulated depreciation

The net book value of ppe

What should the depreciation method used reflect

The pattern in which the assets economic benefits are consumed by the entity

Why do entities in the same industry usually use the same method of depreciation

improve comparability

What is an impairment of an asset

When an asset suffers a significant fall in value

What is the general rule when recording impairment

The asset on the balance sheet should be reduced to its recoverable amount and recognise an impairment loss

Double entry for impairment loss

UP Impairment loss

DOWN Equipment

Gain/loss on disposal formula

proceeds - NBV

PPE disposal steps

1) Remove disposed asset cost

2) Remove disposed accumulated depreciation

3) Record proceeds

4) Gain or loss transfer to P&L account

5) Depreciation on remaining NCA

PPE disposal steps (double entry method)

1) Remove cost of asset from PPE cost account

Dr Disposal

Cr PPE

2) Remove the accumulated depreciation

Dr Depreciation

Cr Disposal

3) Record the Cash proceed

Dr Cash

Cr Disposal

4) The benefits figure in the disposal account is the gain/loss on disposal