ME#3 money creation

1/16

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

17 Terms

Assets side of CB balance sheet

Gold and currency reserves

Loans to banks

Loans to the government

Securities

Government bonds

Corporate bonds

Other securities

Liability side of CB balance sheet

▪ Cash in circulation (‘C’)

▪ Reserve accounts of banks (‘R’)

▪ Debt securities

▪ Government account

▪ Other liabilities

How is base money created

Central banks extend loans to commercial banks

CB buy securities from commercial banks/other institutions via a bank

Central bank buy foreign currencies from commercial banks

What’s money multiplier

relation btw monetary base and money in circulation

Some notes about the formula

either c or k increase → m decrease4

cashless society → m = 1/k

people wants all cash → k =1 → no money creation

Draw backs of money multiplier

strongly dependent on assumptions

much too mechanical in character

ignores demand side

ignores other sources of money creation:

banks buying assets from non-banks

cross-border transactions → changes in money supply

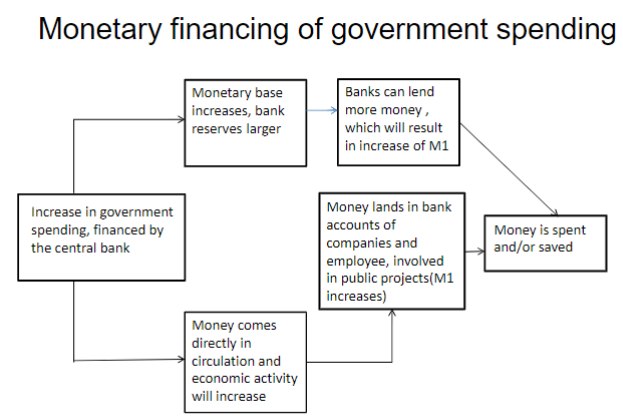

What's the difference btw monetary financing and QE

Monetary financing: CB creates new money (M0) to finance new gov spending (buy new gov bonds)

QE: only existing bonds are bought by CB

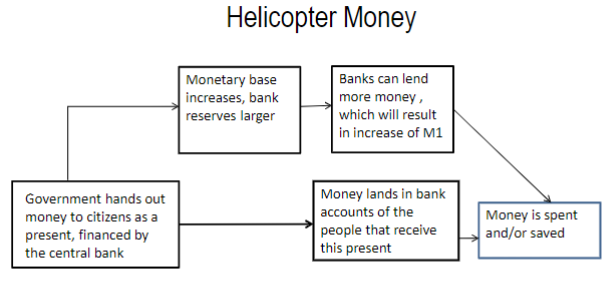

Differences btw monetary financing and helicopter money

helicopter money is given directly to people → less certain about if effectiveness

helicopter money takes effect immediately while monetary financing takes longer → helicopter money more effective in acute crisis

Pros of fractional reserve banking

flexible system

the money supply varies with the economy

money is created and destroyed on the initiative of the banks’ clients in the right amounts and in the right place in the economy

Cons of fractional reserve banking

Liquidity reserves < current accounts → all banks vulnerable for bank run (liquidity risk)

In normal times: banks with a liquidity shortage can finance themselves on the money market (borrowing from banks or other professional counterparts with cash surplus

If the money market as a whole has a liquidity shortage and/or a solvent bank has an acute liquidity shortage the central bank has to step in as ”lender of last resort” (LOLR)

Alternative system ?

full (liquidity) reserve banking

banks must cover their current liabilities with 100% liquid reserves

Bank lending has to be financed with savings that already exist

No money creation by commercial banks ==> government is given a monopoly for the creation of money

An independent government committee will announce ex-ante monetary targets

Pros of full reserve banking

Probability of a bank run (almost) fully eliminated

Liquidity risk for banks much smaller

Cons of full reserve banking

Depositors are forced to hold their savings in deposits with a longer maturity. Liquid savings should be held on an non-interest current account

(note that in today’s world this doesn’t make any difference)

Banks lose a source of income

It won’t work in a world with large cross-border financial flows

Government monopoly on money creation may be dangerous

Banks become more stable because the risks are to a large extent shifted to depositors.

It becomes more expensive to hold a bank account