Business 3.5

1/35

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

36 Terms

What is a budget?

A financial plan that forecasts revenue from sales and expected costs over a time period

What is a cash flow forecast?

It shows the movement of cash in and out of a business over a time period

Definition of cash flow?

The movement of cash into and out of a business over a period of time

Why is cash flow important?

If there is not enough cash flowing into and out if a business then it may be forced into liquidation even if it is profitable

What is the formula for contribution per unit (CPU)?

Revenue per unit - variable costs per unit

What is the formula for total contribution?

Contribution per unit x number of units sold

How do you calculate profit using total contribution?

Contribution - fixed costs

What is contribution?

The difference between sales revenue and variable costs of production

What is the formula for breakeven output?

Fixed costs / contribution per unit

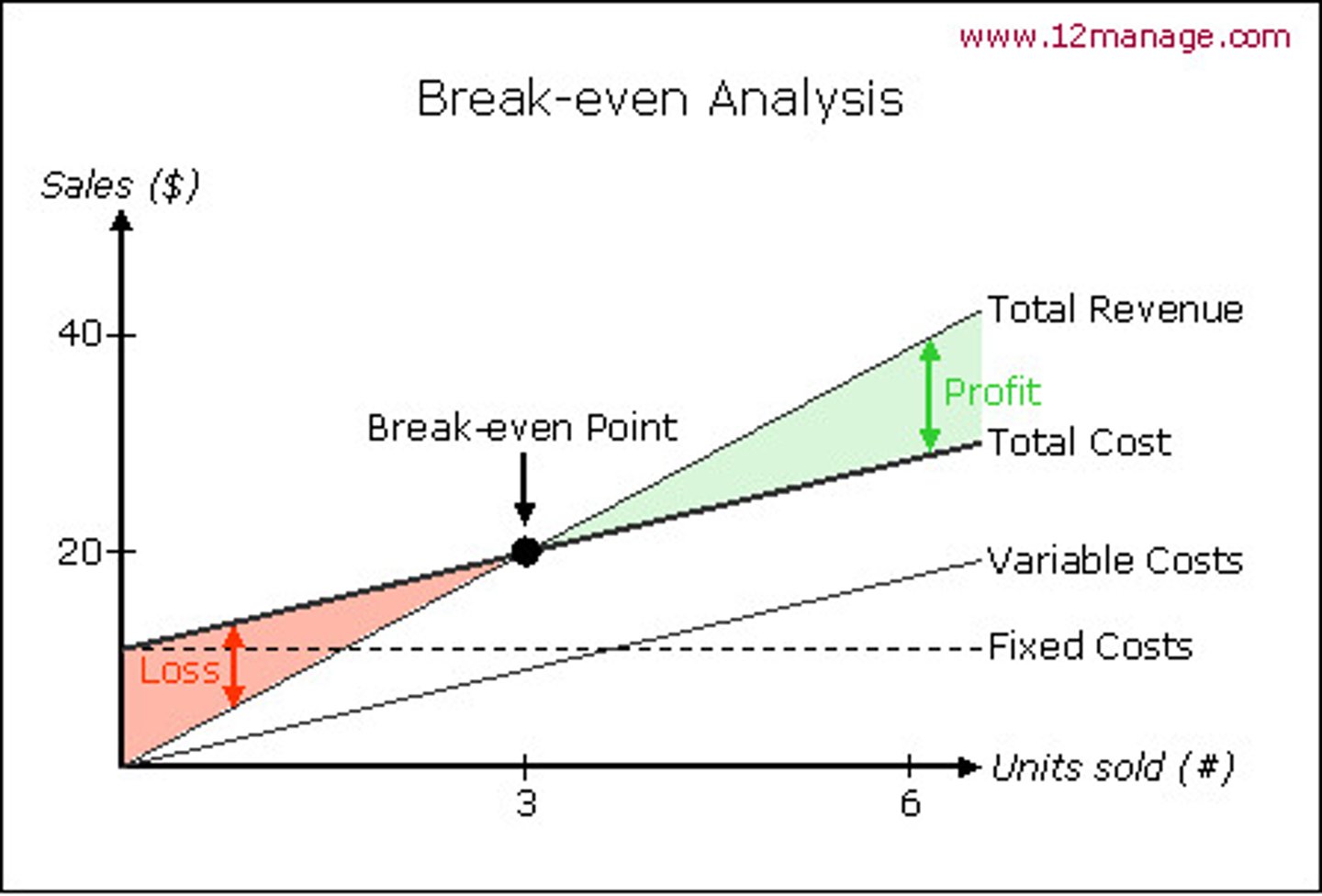

Break even chart and labels

What is margin of safety?

The amount by which the existing level of output is greater than the break even point

What is variable costs?

Costs that change as output changes (e.g. raw materials, wages)

What are fixed costs?

Costs that do not vary with the quantity of output produced

What are total costs?

Fixed costs + variable costs

What is revenue for a business?

The total amount of money brought in by company's operations

How do you calculate revenue?

Price x Quantity

What is the selling price per unit?

The amount a customer pays for each unit bought

How do you calculate selling price per unit?

Total costs / number of units bought

What is variance analysis?

It shows the comparison between the budgeted figure and the actual figure achieved. This analysis helps identify any discrepancies and assesses their impact on financial performance.

What is the expenditure budget?

A sum of money to be spent at a given time period by a department of business

What is a budget holder?

A person who is accountable for seeing that a budget is kept to

What is income budget?

The sales revenue target for a department or whole new business during a specific time period. It outlines the expected income and plays a key role in financial planning.

What is the delegated budget?

Giving some control in the setting and spending of budgets to departments or individuals

What is profit budget?

The target profit for the business over a given period of time - this is created by combining expenditure and income budgets

What is it when you are monitoring budgets?

Keeping a check on progress towards achieving targets during the budget period

Why is budgeting important when financial planning?

To reduce costs

To make sure you are spending as much as you are earning

So the business doesn’t experience loses

Benefits of budgets?

It is required for lenders and investors

Increases staff performance so they can achieve objectives

Controls finances

Prevents risk of overspending

Drawbacks of budgeting?

Possible unexpected costs

Short term budget costs may lead to long term problems

Demotivated staff

Departments may compete for funding

What is favourable variance?

When the actual figure is better than the budgeted figure, resulting in an increase in profit or a reduction in costs.

What is adverse variance?

When the actual figure is worse than the budgeted figure

What could cause favourable variance?

Increase in demand

Revenue increase

Lower costs

What is zero budgeting?

A budgeting approach where all expenses must be justified for each new period, starting from a base of zero.

What is the benefit of analysing budgets?

Shareholder trust

Target levels will be met

Money is being spent on the correct items

Why is budgeting important for a business

Helps to allocate recourses efficiently

Improves financial control

Helps planning strategy

Makes sure financial goals are being met

What are financial objectives?

Capital structure objectives

Revenue objectives

Cost objectives (minimise them)

Profit objectives

Possible cash flow

Return on investment