Liabilities & Equity

1/25

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

26 Terms

Liabilities

The company’s obligations to others that will be met through the use of cash, goods, or services (must be measurable and probable; transactions from which these obligations arise have taken place).

(Slide 237 / 315)

Current liabilities vs. long-term liabilties

Current: due within 1 year (reported by order of maturity, amount, or liquidation)

Long-term: not due within a year

(Slide 237 / 315)

Accounts Payable (A/P)

A current liability representing amounts owed by the company to suppliers for prior purchases or services.

(Slide 238 / 315)

Accrued Expenses

Expenses that have already been incurred, but not yet paid (e.g. wages, insurance, rents, taxes, dividends, litigation costs).

(Slide 239-240 / 315)

Deferred (Unearned) Revenue

Revenue received for services not yet provided by the company (especially in regards to software companies, as well as companies that sell long-term memberships like magazine subscriptions and gift certificates).

NOTE: Deferred revenue is a current liability if the revenue is expected to be recognized within the year; otherwise, it is long-term.

(Slide 243 / 315)

Short-term debt

A current liability; debt owed within a year (also includes portion of long-term debt due within a year).

(Slide 246 / 315)

Long-term debt

A long-term liability and is often a sizable liability; not due within a year.

(Slide 247 / 315)

Leases

Many companies make lease payments for their equipment, office space, and retail locations that are defined contractually between the lessee (company making payments) and the lessor (company collecting payments).

(Slide 248 / 315)

Under IFRS, virtually all leases with few exceptions are accounted for as _________ leases, while US GAAP classifies leases as either _________ or _________.

finance ; finance leases ; operating leases

(Slide 248 / 315)

What are the criteria that US GAAP uses to classify a finance lease?

NOTE: If any of the criteria are met, the lease is a finance lease.

Does ownership of the asset transfer to the lessee by end of the lease term?

Lessor grants lessee an option to purchase the assets that the lessee is reasonably certain to exercise.

Lease term is for major part of asset’s remaining economic life.

PV (present value) of lease payments is substantially all the asset’s fair value.

Asset is so specialized that it is expected to have no alternative use to lessor.

(Slide 249 / 315)

Finance Leases

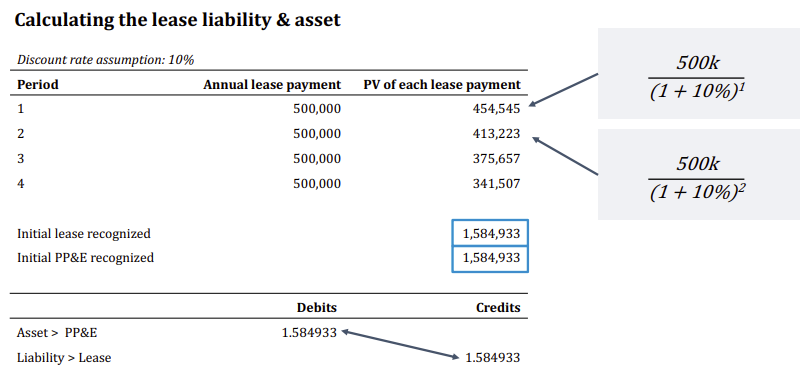

An accounting approach that recognizes lease as debt (a liability) and the underlying asset as PP&E on the B/S. However, unlike debt, the interest fees are implied and baked into the total lease expense. Companies must estimate the initial liability as the PV of all future lease payment using discount rate assumption.

(Slide 250 / 315)

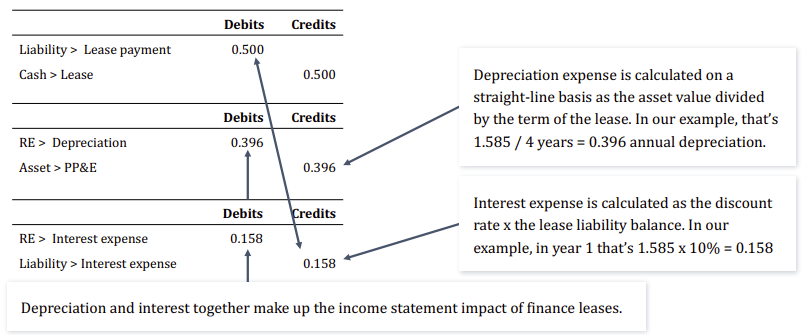

Over the life of the lease, the asset is __________ over its useful life (i.e. _________), while the lease liability accrues _________ during the year and is then reduced by _________ (like principal payments with debt). This is reflected on the I/S as a __________ expense and an __________ expense, which reduce __________.

depreciated ; interest ; lease payments ; depreciation expense ; implied interest ; net income

(Slide 253 / 315)

Finance Leases: In summary, the B/S treats the lease as a __________ and the underlying asset as an __________. Over the life of the lease, the I/S impact doesn’t capture the rent; it breaks up the lease payments into two components: ___________ and ___________. Compared to the lease expense, the overall depreciation + interest expense will be ___________ early in the lease and ___________ later in the lease because the interest expense is ___________ when the “principal” (i.e. lease liability) is ___________.

debt-like liability ; owned asset ; interest ; depreciation fees ; higher ; lower ; higher ; high

(Slide 254 / 315)

Operating lease accounting applies to leases where ___________.

the lessee really doesn’t have economic ownership of the lease

(Slide 256 / 315)

How are operating leases initially recognized on the B/S?

The same as finance leases: a liability on the B/S (like debt) with the corresponding asset as PP&E.

(Slide 257 / 315)

In operating lease accounting, the I/S is simply reduced by the __________. For example, if a 5-year lease calls for the annual lease payment of $500,000, the annual rent expense recognized on the I/S will simply be $500,000 per year.

rent (‘lease”) expense

(Slide 257 / 315)

For operating leases: if lease payments grow each year, the I/S will recognize an annual straight-line expense. For example, if a 2-year lease calls for $1 million in lease payments in year 1 and $1.2 million in year 2, the I/S will recognize an annual lease payment of _________ (which is the ________ of the two), creating a disconnect between the cash outlay and accrued expense recognized.

$1.1 million ; average

(Slide 257 / 315)

List and define the different types of equity.

Preferred Stock—stock that has special rights and takes priority over common stock.

Common Stock—represents capital received by a company when it issues shares.

Treasury Stock—common stock that has been issued and then reacquired by a company.

Retained Earnings—total company earnings/losses since its inception less all dividends.

(Slide 260 / 315)

Preferred Stock

A class of stock that takes priority over common stock and has special rights such as priority over dividends and claims on assets in bankruptcy.

Often structured to include the possibility of conversion into common stock at pre-set exchange rates, enabling investors to benefit from a set dividend, but participate in the upside if the company’s common equity value increases.

(Slide 261 / 315)

Common Stock (and Additional Paid in Capital, APC)

The sale (issuance) of common stock (equity) or shares in the company; a primary way for companies to raise capital quickly (for growth, acquisitions, etc.).

Common stock par value: represents some nominal value to an issued share (e.g. $0.10 / share)

Additional paid in capital (APC): represents the excess value of the share issued over par value

(Slide 262 / 315)

Treasury Stock

Shares once issued but subsequently repurchased by the company; a contra equity account to capture the value of common stock that was once issued but then repurchased by the company.

(Slide 264 / 315)

Why might companies want to repurchase stock?

Usually boosts EPS since the interest expense to repurchase is usually < the advantage of reducing share count (repurchase of shares reduces total shares outstanding).

(Slide 264 / 315)

Why might treasury stock have a larger amount on the B/S than common stock and APIC?

Common stock and APIC cannot be written up (historical cost principle and conservatism).

(Slide 266 / 315)

All common and preferred dividends __________ retained earnings.

decrease (debits)

(Slide 269 / 315)

Other Comprehensive Income (OCI)

An equity line item on the B/S that captures the accumulation of income or loss that a company has recognized over time that is not recognized directly on the I/S and thus not captured in RE. OCI includes:

Gains and losses from foreign currency translations

Unrealized gains and losses on available for sale securities

Etc.

A full breakdown of gains and losses categorized as OCI are often reported in a separate financial statement called the “Statement of Comprehensive Income.”

(Slides 271, 273 / 315)

In addition to equity issuances, equity issued to employees through stock-based compensation (such as stock options and restricted stock) __________ the common stock and APIC balance. There is no cash impact.

also increases

(Slide 274 / 315)