FAR Chapter 15 : Group accounts CSFP

1/61

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

62 Terms

What is the w1 working for CSFP?

(w1) Group structure

Who is the parent?

Who is the sub?

How much of S (sub) does P own?

When did P acquire S?

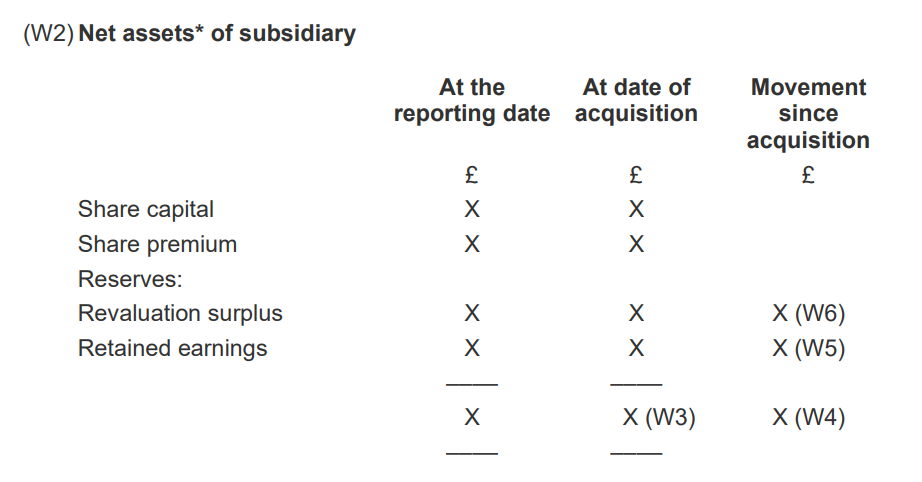

What is the w2 for CSFP?

(w2) Net assets of subsidiary

Figures at reporting date, acquisition date & movement since acq for:

Share capital

Share premium

Reval. surplus

Retained earnings

Net assets = equity (total assets - total liabs)

Movement for share cap and prem should always be 0

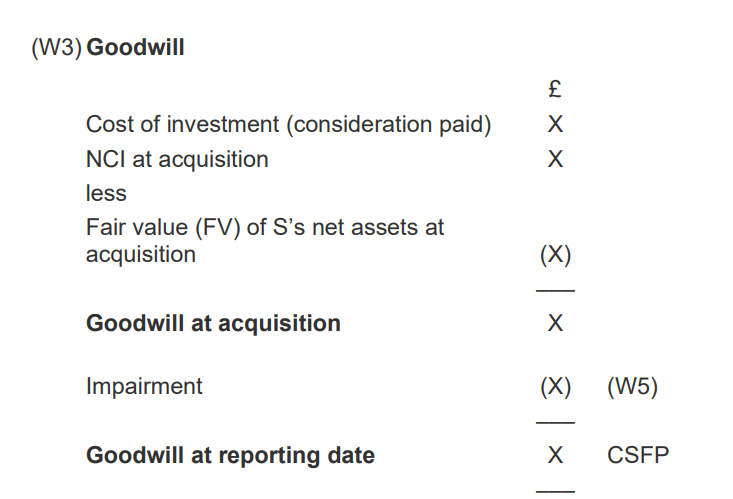

What is the w3 working for CSFP?

(w3) Goodwill

Cost of investment (consideration paid) X

NCI at acquisition X

Less:

Fair value (FV) of S’s net assets at acquisition (X)

Goodwill at acquisition X

Impairment of goodwill (X)

Goodwill at reporting date X

What are the 2 ways of valuing NCI in the goodwill calculation?

the proportionate (share of net assets) method

fair value (full goodwill) method.

Which basis should we use for measuring NCI at acquisition?

use the proportionate basis unless a question specifies the fair value basis

What will happen if goodwill is negative and what is the double entry?

there will be no asset on the consolidated statement of financial position (CSFP)

Negative goodwill is known as a gain on bargain purchase and is credited directly to the consolidated statement of profit or loss (CSPL) in the year of acquisition and to retained earnings (W5)

DR Goodwill

CR SPL

or

DR Goodwill

CR Group Retained earnings

What is goodwill?

the excess of the amount paid to acquire a subsidiary above the value of the subsidiary’s net assets

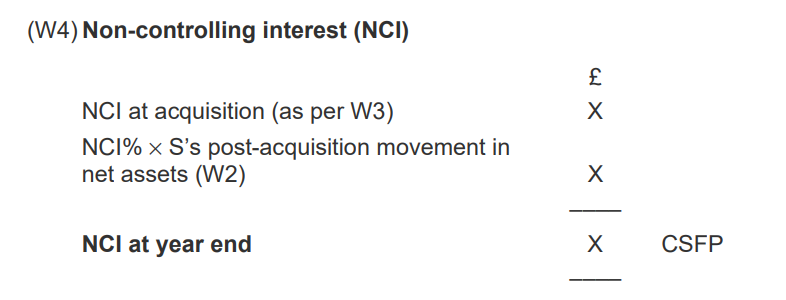

What’s the way to calculate NCI at year end using the proportionate basis? (w4)

NCI% × S’s net asset at the reporting date (W2)

What is the other way (not proportionate) way of calculating NCI at year end (w4)?

NCI at acquisition X

NCI% × S’s post-acquisition movement in net assets (W2) X

NCI at year end X

Which basis should we use to calculate NCI at year end if the question doesn’t say anything

Proportionate method

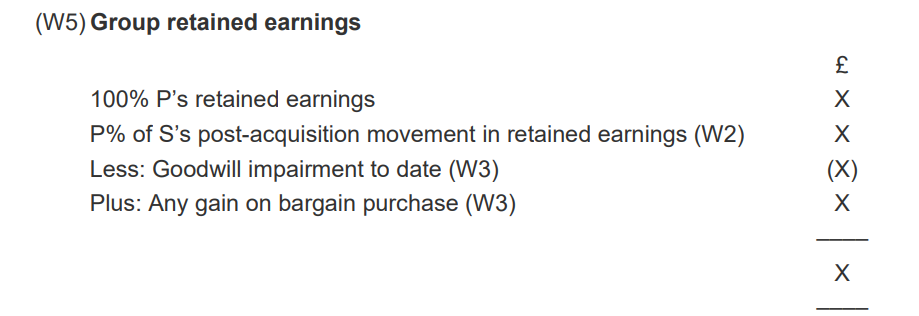

What is the working for w5 for CSFP?

(w5) Group retained earnings

100% P’s retained earnings X

P% of S’s post-acquisition movement in retained earnings (W2) X

Less: Goodwill impairment to date (W3) (X)

Plus: Any gain on bargain purchase (W3) X

Group retained earnings X

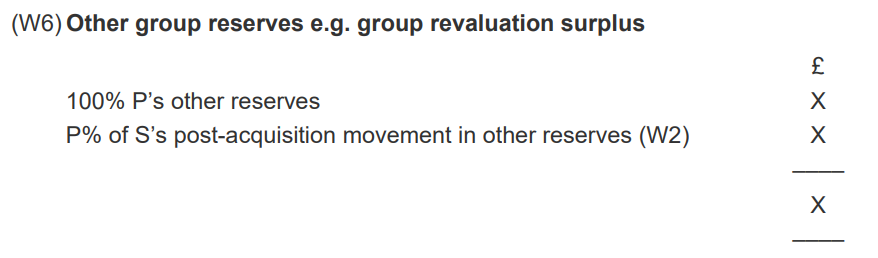

What is (w6) for CSFP?

(w6) Other group reserves

100% P’s other reserves X

P% of S’s post-acquisition movement in other reserves (W2) X

Other group reserves X

What should you do if you’re not given the subsidiary's reserves at acquisition?

You need to pro-rate S's profit for the year and either add it to the opening reserves or subtract it from the year-end reserves.

What should be done to the effect of intra-group transactions?

They need to be eliminated

How do we deal with intra group loans?

For group purposes: cancel the receivable in one company and the associated payable in the other.

DR Payables X

CR Receivables X

Like a contra

What do loans, debentures and preference shares attract? What will this result in and what needs to happen?

Loans, debentures and redeemable preference shares attract interest.

This may result in a finance cost in one group business and finance income in another.

If interest remains unpaid at the year end, this will also need to be removed.

What does a parent and a sub. trading with each other on credit lead to? What are the problems?

A receivables account in one company’s SFP and a payables account in the other company’s SFP

, there are two problems:

these are amounts owing within the group rather than outside the group and, therefore, they must not appear in the consolidated statement of financial position (similar to intra-group loans)

the two balances (receivable and payable) may not agree due to cash in transit or goods in transit.

What are the general rules for cash or goods in transit?

treat the in-transit item as if it had been received in the statement of financial position of the recipient

once in agreement, cancel the intra-group outstanding balances

What are the 2 steps for cash in transit?

Assume the cash has been received

DR Cash X

CR Receivables X

Get rid of outstanding intra-group balances

DR Payables

CR Receivables

What are the 2 steps for goods in transit?

Assume the cash has been received

DR Inventory X

CR Payables X

Get rid of outstanding intra-group balances

DR Payables

CR Receivables

What does PURP stand for?

Provision for unrealised profits

How do we deal with profits made by members of a group on transactions with other group members?

recognised in the accounts of the individual companies concerned

in terms of the group, such profits are unrealised if the goods remain in the group, and must be eliminated from the consolidated accounts as a consolidation adjustment.

What adjustments may need to be made with unrealised profits on intra-group transactions?

Cancel current accounts

Remove unrealised profit

Write down inventory to cost to the group

When do unrealised profits need to be removed for intra-group transactions?

such profits are unrealised if the goods remain in the group, and must be eliminated from the consolidated accounts as a consolidation adjustment

What is the double entry for an inventory PURP?

DR Retained earnings X

CR Inventory X

What are the steps for inventory PURPS SFP?

Calculate the unrealised profit remaining in inventory

Determine the value of closing inventory included in an individual company’s accounts which has been purchased from another company in the group.

Use mark-up or gross profit percentage (gross margin) to calculate how much of that value represents profit earned by the selling company.

Step 2: Make the accounting entries to eliminate the PURP

If P sells to S

DR Group Retained earnings (W5) X

CR Group inventory on CSFP X

This is included in the parent company’s accounts and relates entirely to the group.

If S sells to P

DR Subsidiary earnings (W2) X

CR Group inventory CSFP X

This is included in the subsidiary company’s accounts and relates partly to the group, partly to the noncontrolling interests (if any).

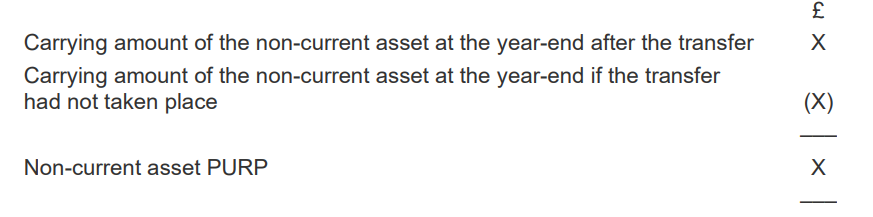

How do we calculate PURPs on non-current asset transfers?

Carrying amount of the non-current asset at the year-end after the transfer X

Less: Carrying amount of the non-current asset at the year-end if the transfer had not taken place (X)

Non- current asset PURP X

If one group member sells non-current assets to another group member, what adjustments must be made?

Adjustments to recreate the situation that would have existed if the sale had not occurred:

there would have been no profit on the sale

depreciation would have been based on the original cost of the asset to the group

What are the consolidation adjustments for NCA transfer PURPs?

DR Retained earnings of seller (w2 for sub) (w5 for parent) X

CR NCA on CSFP X

What is the fair value of an asset and a liability according to IFRS 13?

the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date’

What are the double entries for cash consideration paid immediately?

Dr Cost of investment X

Cr Cash X

What are the double entries for deferred cash consideration ?

Should be included at present value

Dr Cost of investment X

Cr Liabilities* X

*Unwind each year (doesn’t affect goodwill)

Dr Finance cost X

Cr Liabilities X

What are the double entries for share consideration issued immediately?

Should be included at the market value at acquisition date

Dr Cost of investment X

Cr Share capital X

Cr Share premium X

What are the double entries for deferred share consideration?

Should be included at the market value at acquisition date

Dr Cost of investment X

Cr Shares to be issued X

→ No cash leaves account, you would pay in number of shares

What is contingent consideration?

an amount which may be payable at a future date in respect of the purchase of an investment, dependent upon certain events.

For example, an extra amount may be paid for an investment in a subsidiary if it achieves a certain level of sales growth over 5 years.

Should contingent consideration be included as part of cost of investment? If so, what should it be measured at?

Yes and measured at fair value at the date of acquisition

What are the double entries for contingent cash?

Dr Cost of investment X

Cr Provision X

What are the double entries for contingent shares?

Dr Cost of investment X

Cr Shares to be issued X

How are professional fees and similar incremental costs incurred directly in making the acquisition recognised?

as expenses in the period in which they are incurred, NOT capitalised

Where are share issue costs recognised?

They are debited to the share premium account

Column in the SOCIE saying shares to be issued - not sure

How are changes in fair value of contingent consideration treated?

fair value of the contingent consideration at acquisition could be different to the actual consideration paid.

Any differences are normally treated as a change in accounting estimate and adjusted prospectively in accordance with IAS 8

When is the only time that a change in FV of contingent consideration would be treated retrospectively with a corresponding adjustment to goodwill?

if the change related to conditions that existed at the acquisition date and occurred within one year of the date of acquisition

How should changes in the FV of contingent share consideration be treated?

it should not be remeasured but its subsequent settlement should instead be recognised as part of equity.

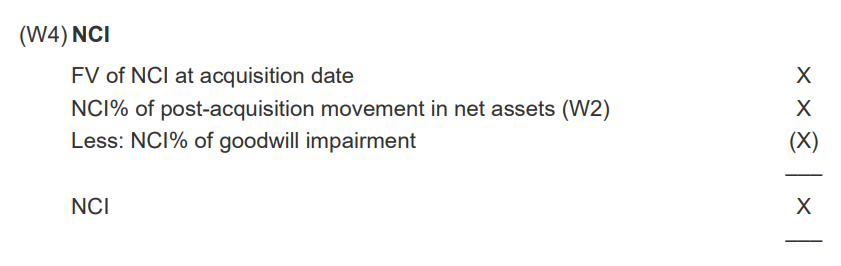

What’s the w4 working under the Fair Value method?

FV of NCI at acquisition date X

NCI% of post-acquisition movement in net assets (W2) X

Less: NCI% of goodwill impairment (X)

NCI at year end X

What are the double entries for goodwill impairment under proportionate method and the fair value method?

Proportionate (parent)

Goodwill impairment goes all to parent

DR Group retained earnings (w5) X

CR Goodwill X

Fair value

NCI pay their % of impairment and so do parent

DR Group retained earnings (w5) X

DR NCI NCI% (w4) X

CR Goodwill X

What should the acquirer recognise?

the identifiable assets, liabilities and contingent liabilities of the acquiree

at fair value

at the date of acquisition.

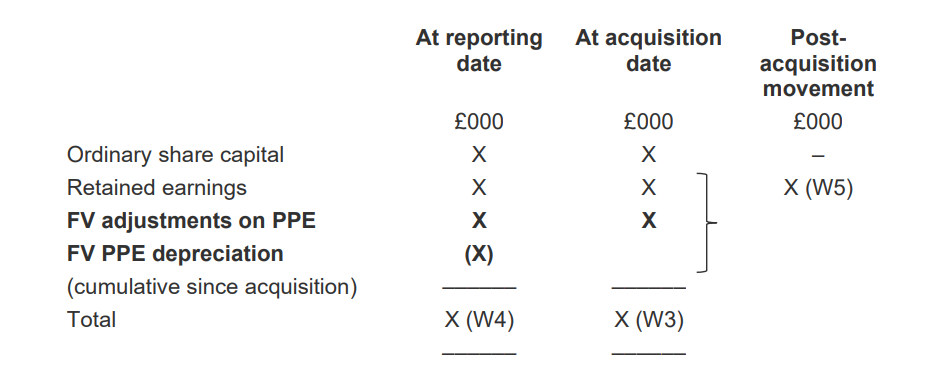

How do you process a fair value adjustment in a consolidation question?

you must consider the impact both at the acquisition and at the reporting date in (W2)

At acquisition put an adjustment into the net assets working (W2) to bring the net assets to fair value (this will then affect the goodwill working (W3)).

At the reporting date account for the adjustment on the face of the CSFP and in the net assets working (W2) (this will affect the NCI working (W4))

What is depreciation charged on regarding a fair value uplift?

Only on the uplift

What is a fair value uplift not?

A revaluation so don’t think about reval. surpluse

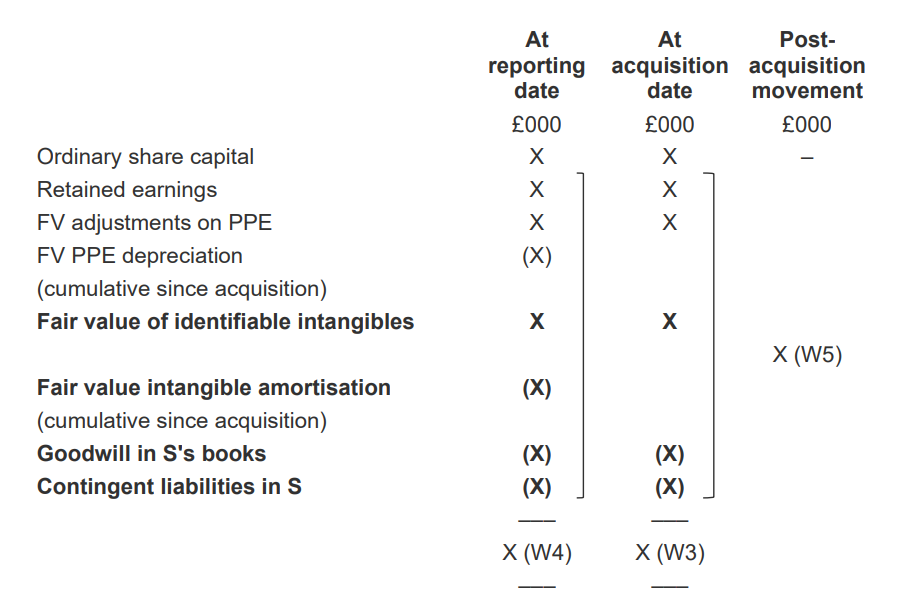

What does the w2 working look like with a fair value uplift adjustment?

How should we account for goodwill in S’s accounts?

Any goodwill in S's accounts (e.g. from the purchase of a sole trader) should not appear on the CSFP as it is not identifiable. → can’t be sold separately

Therefore, it must be removed from net assets in (W2) and must not appear on the face of the CSFP

→ Although goodwill is an intangible asset, it’s only really for CSFP as you can’t really sell goodwill

How do we account for intangibles not recognised in S?

There may be intangibles in S which are not recognised on S's SFP as they do not meet the criteria of IAS 38 Intangible Assets.

Upon consolidation, the FV of these intangible assets should be recognised on the CSFP (in the brackets) and in (W2)

→ We can then reliably measure the goodwill, then we can bring it on face of the CSFP

How do we account for contingent liabilities disclosed in S’s books?

In S's individual accounts, S may disclose contingent liabilities.

Contingent liabilities of S existing at acquisition should be included on the face of the CSFP and in (W2) at FV. (net assets of sub. will decrease)

The FV will be given in the exam.

What does the w2 working look like with goodwill, contingent liabilities and fair value uplift in intangibles?

How should any adjustments to those provisional fair values be dealt with?

If they are made within the measurement period (less than 12 months from acquisition date), an adjustment is made retrospectively and goodwill is recalculated

If they are made outside the measurement period (i.e. more than 12 months from the acquisition date):

they are treated as a change in accounting estimate and adjusted for prospectively

an impairment review is performed.

What choice does UK GAAP offer for measurement of NCI?

The only method is the proportionate (share of NA) method

What are the UK GAAP and IFRS differences between amortising goodwill?

UK GAAP: goodwill is amortised. There is a rebuttable presumption that the useful life should not exceed 10 years.

IFRS: Goodwill not amortised but tested annually for impairment

How are acquisition costs treated with IFRS and UK GAAP?

UK GAAP: acquisition costs are included within consideration

IFRS: Acquisition costs are treated as an expense in the period in which they are incurred

How is negative goodwill treated in IFRS vs UK GAAP?

UK GAAP: a negative goodwill balance is recognised as a negative asset and amortised over its useful life (releasing a credit to the P&L each period)

IFRS: recognising a gain on bargain purchase directly in P&L on acquisition.

When does UK GAAP require the identifiable intangible assets of the acquiree to be recognised separately from goodwill?

If:

they meet recognition criteria (probable economic benefits will flow and the FV can be measured reliably),

AND

they are separable,

AND

they arise from contractual or other legal rights

What’s the IFRS and UK GAAP difference between recognising identifiable intangible assets of the acquiree(company being bought)?

UK GAAP permits a choice of recognition if:

the intangible asset meets the recognition criteria AND is either separable or arises from contractual or other legal rights.

The choice is made by class of intangible asset and must be applied to all business combinations.

IFRS requires all identifiable intangible assets of the acquiree to be recognised separately from goodwill