M 3 - Share & Share Capital + Debentures

0.0(0)

0.0(0)

Card Sorting

1/59

Earn XP

Description and Tags

Last updated 8:39 AM on 8/8/23

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

60 Terms

1

New cards

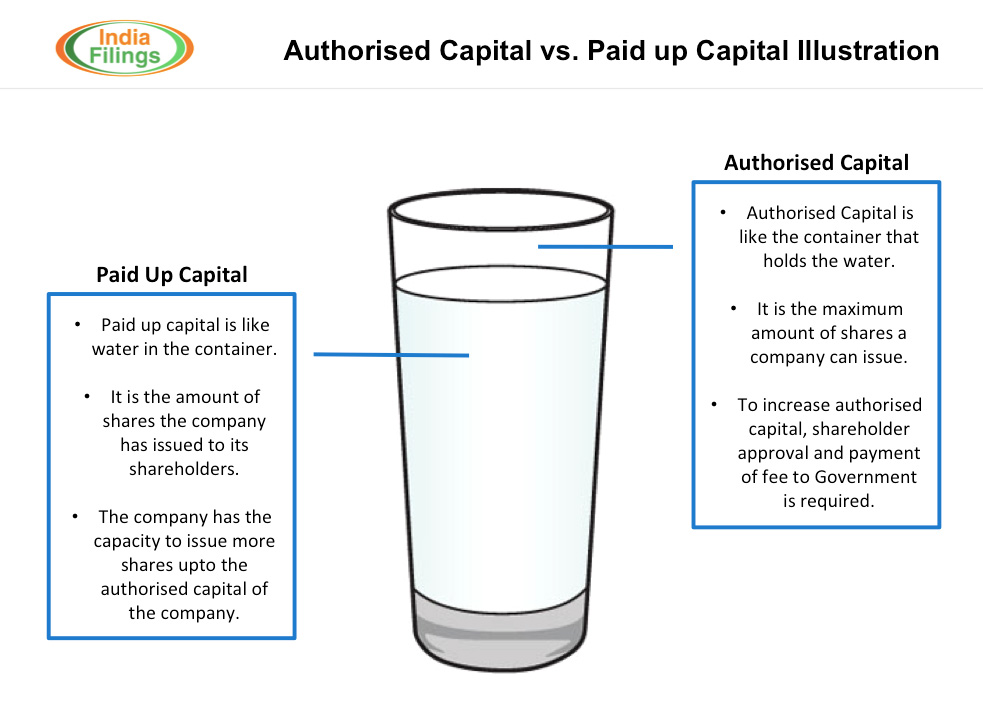

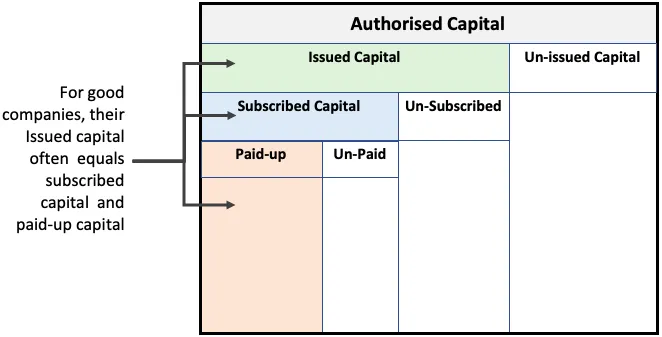

share capital

Share capital refers to the total amount of money that a company raises by issuing shares to investors or shareholders. It represents the ownership interest of shareholders in the company and is typically recorded in the company's balance sheet as a liability. Share capital can be raised through various means, such as initial public offerings (IPOs), private placements, or rights issues.

2

New cards

3

New cards

4

New cards

shares

capital of a company is divided into a **number of indivisible units of a fixed amount**. These units are known as ‘shares’.

According to **section 2(84)** of the Companies Act, 2013, a share is a share in the share capital of a company, and includes stock.

* **an interest measured by a sum of money and made up of diverse rights conferred on its holders** by the articles of the Company which constitute a contract between him and the Company

* a **right to participate in the profits made by a company**, while it is a going concern and **declares a dividend**, and in the assets of the company when it is wound up

According to **section 2(84)** of the Companies Act, 2013, a share is a share in the share capital of a company, and includes stock.

* **an interest measured by a sum of money and made up of diverse rights conferred on its holders** by the articles of the Company which constitute a contract between him and the Company

* a **right to participate in the profits made by a company**, while it is a going concern and **declares a dividend**, and in the assets of the company when it is wound up

5

New cards

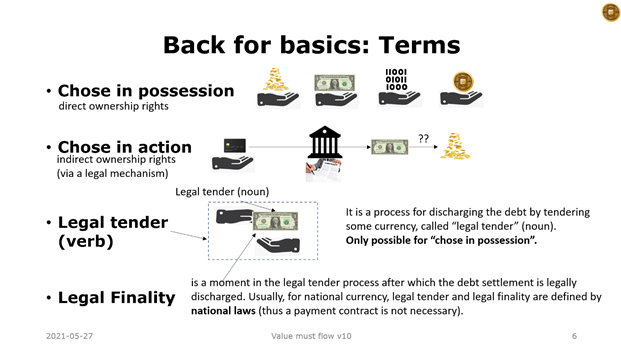

nature of a share

A share is a **chose-in-action**, which implies the **existence of some person entitled to the rights**, which are **rights in action** as distinct from rights in possession, and **until the share is issued no such person exists**.

* regarded as ‘goods’. **Section 2(7) of the Sale of Goods Act, 1930** defines ‘goods’ to mean **any kind of movable property other than actionable claims and money and includes stock and shares**.

* A share is an **expression of proprietary relationship** between a shareholder and the company

* It may be noticed that **certificate of shares is not the shares or a share.** Under **section 46** a certificate, under the common seal of the company, specifying any share or stock held by any member, **shall be a prima facie evidence of the title** of the **member to the shares or stock therein specified**. Hence, a **share certificate is not the share;** it is only a prima facie evidence of the title to the share

* regarded as ‘goods’. **Section 2(7) of the Sale of Goods Act, 1930** defines ‘goods’ to mean **any kind of movable property other than actionable claims and money and includes stock and shares**.

* A share is an **expression of proprietary relationship** between a shareholder and the company

* It may be noticed that **certificate of shares is not the shares or a share.** Under **section 46** a certificate, under the common seal of the company, specifying any share or stock held by any member, **shall be a prima facie evidence of the title** of the **member to the shares or stock therein specified**. Hence, a **share certificate is not the share;** it is only a prima facie evidence of the title to the share

6

New cards

share certificate?

* **Section 44** of the Companies Act, 2013 in this regard describes a share as a **movable property transferable in the manner provided by the articles of the company.**

* **Section 46,** on the other hand, describes a ‘**certificate of shares**’, to mean a certificate, under the common **seal of the company, specifying any shares held by any member**. Section 46 further suggests that a s**hare certificate shall be prima facie evidence of title of the member to such shares.**

* Thus, whereas **‘share’ represents property (movable)**, ‘share certificate’ is an **evidence (prima facie) of the title of the member to such property**. Thus, the share certificate being prima facie evidence of title, it gives the shareholder the facility of dealing more easily with his shares in the market. It enables him to sell his shares by showing at once marketable title

* **Section 46,** on the other hand, describes a ‘**certificate of shares**’, to mean a certificate, under the common **seal of the company, specifying any shares held by any member**. Section 46 further suggests that a s**hare certificate shall be prima facie evidence of title of the member to such shares.**

* Thus, whereas **‘share’ represents property (movable)**, ‘share certificate’ is an **evidence (prima facie) of the title of the member to such property**. Thus, the share certificate being prima facie evidence of title, it gives the shareholder the facility of dealing more easily with his shares in the market. It enables him to sell his shares by showing at once marketable title

7

New cards

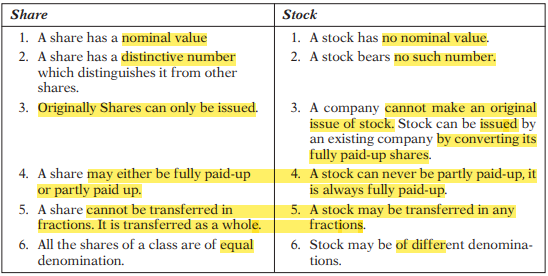

share v. stock

a share **represents a unit into which the capital of a company is divided.**

The term ‘stock’ on the other hand may be defined as the **aggregate of fully paid-up shares of a member merged into one fund of equal valu**e. It is a **set of shares put together** in a bundle. The ‘stock’ is expressed in terms of **money** and not as so many shares. Stock can be **divided into fractions of any amount and such fractions may be transferred like shares.**

A company **cannot make an original issue of the stock**. A company limited by shares may, if authorised by its Articles, by a resolution passed in the general meeting, **convert all or any of its fully paid-up shares into stock [Section 61]**

The term ‘stock’ on the other hand may be defined as the **aggregate of fully paid-up shares of a member merged into one fund of equal valu**e. It is a **set of shares put together** in a bundle. The ‘stock’ is expressed in terms of **money** and not as so many shares. Stock can be **divided into fractions of any amount and such fractions may be transferred like shares.**

A company **cannot make an original issue of the stock**. A company limited by shares may, if authorised by its Articles, by a resolution passed in the general meeting, **convert all or any of its fully paid-up shares into stock [Section 61]**

8

New cards

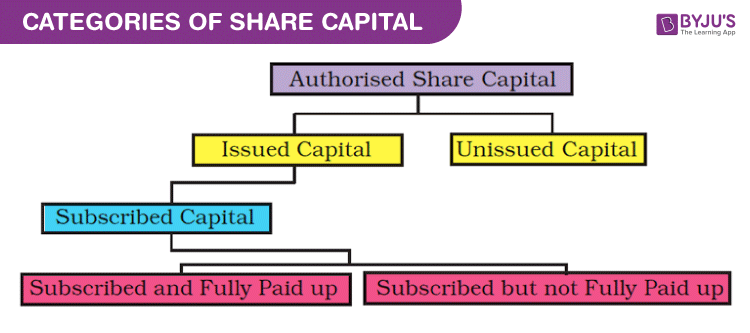

kinds of shares - s. 43

two kinds:

* **equity share capita**l - **with voting rights or with differential voting rights** as to dividend, voting or otherwise in accordance with such rules and subject to such conditions as may be prescribed

* **preference share capital**

\

may also issue global depository receipts - s. 41

* **equity share capita**l - **with voting rights or with differential voting rights** as to dividend, voting or otherwise in accordance with such rules and subject to such conditions as may be prescribed

* **preference share capital**

\

may also issue global depository receipts - s. 41

9

New cards

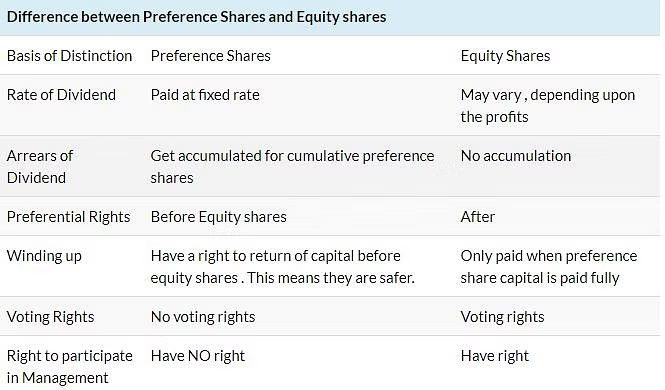

preference shares/preference share capital

requirements:

* **assured of a preferential dividend**. The preferential dividend may consist of a **fixed amount payable to preference shareholders before anything else is paid to the equity shareholders**, it may also be calculated on a fixed rate.

* on winding up of the company, **must carry preferential right to be paid,** i.e., amount paid up on preference shares must be **paid back before anything is paid to the equity shareholders**.

\

With respect to issue of shares with differential voting rights, the Ministry of Company Affairs has notified the **Companies (Share Capital and Debentures) Rules, 2014.** As per **Rule 4** of these rules, no company limited by shares shall issue equity shares with differential rights as to dividend, voting or otherwise, unless it complies with, inter alia, the some conditions.

* **assured of a preferential dividend**. The preferential dividend may consist of a **fixed amount payable to preference shareholders before anything else is paid to the equity shareholders**, it may also be calculated on a fixed rate.

* on winding up of the company, **must carry preferential right to be paid,** i.e., amount paid up on preference shares must be **paid back before anything is paid to the equity shareholders**.

\

With respect to issue of shares with differential voting rights, the Ministry of Company Affairs has notified the **Companies (Share Capital and Debentures) Rules, 2014.** As per **Rule 4** of these rules, no company limited by shares shall issue equity shares with differential rights as to dividend, voting or otherwise, unless it complies with, inter alia, the some conditions.

10

New cards

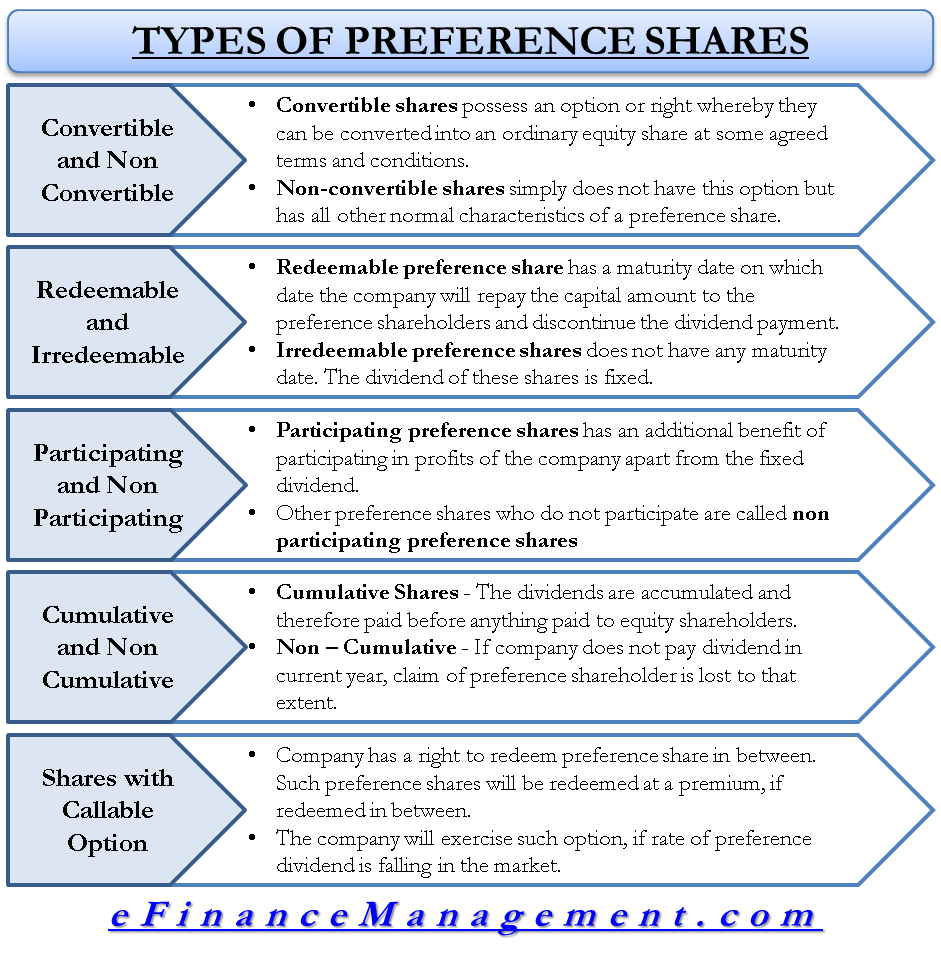

types of preference shares

* *participating* *or non participating*

* *cumulative and non cumulative*

* *Redeemable and Irredeemable Preference shares*

* *cumulative and non cumulative*

* *Redeemable and Irredeemable Preference shares*

11

New cards

participating or non participating

* **Participating preference shares** are those shares which are **entitled to a fixed preferential dividend** and, in addition, **carry a right to participate in the surplus profits** along with equity shareholders after dividend at a certain rate has been paid to equity shareholders. eg. participating preference shareholders **get additional share in the surplus assets of the company on being wound up.**

* non preference shareholders **get only the fixed preferential dividend and return of capital** in the event of winding-up out of realised values of assets after meeting all external liabilities and nothing more

* non preference shareholders **get only the fixed preferential dividend and return of capital** in the event of winding-up out of realised values of assets after meeting all external liabilities and nothing more

12

New cards

cumulative and non-cumulative shares

* A **cumulative preference share** confers a **right on its holder to claim dividend fixed at a sum or a percentage for the past and the current years out of future profits**. The fixed dividend **keeps on accumulating until it is fully paid**

* The non-cumulative preference share gives **right to its holder to a fixed amount or a fixed percentage of dividend out of the profits of each year**. If no profits are available in any year or no dividend is declared, the preference shareholders get nothing, nor can they claim unpaid dividend in any subsequent year

\

**Preference shares are cumulative unless expressly stated to be non-cumulative**. Dividends on preference shares, like equity shares, **can be paid only out of profits and on declaration of dividend for preference shares**.

* The non-cumulative preference share gives **right to its holder to a fixed amount or a fixed percentage of dividend out of the profits of each year**. If no profits are available in any year or no dividend is declared, the preference shareholders get nothing, nor can they claim unpaid dividend in any subsequent year

\

**Preference shares are cumulative unless expressly stated to be non-cumulative**. Dividends on preference shares, like equity shares, **can be paid only out of profits and on declaration of dividend for preference shares**.

13

New cards

redeemable and irredeemable preference shares

As per **Section 55** of the Companies Act, 2013:

1\. **No company limited by shares can issue** any preference shares which are **irredeemable**.

2\. A company limited by shares may, if so authorized by its articles, issue preference shares which are **liable to be redeemed within a period not exceeding twenty years from the date of their issue**

\

exception: **Rule 10 of the Companies (Share Capital and Debentures) Rules, 2014**, in this regard, provides that a **company engaged in the setting up of infrastructure projects** may issue preference shares for a period exceeding twenty years but not exceeding thirty years, subject to the **redemption of a minimum 10% of such preference shares per year** from the twenty first year onwards or earlier, on proportionate basis, at the option of the preference shareholders.

\

**conditions** for redeemable preference shares:

* No such shares **shall be redeemed except out of the profits of the company** which would otherwise be available for dividend or out of the proceeds of a fresh issue of shares made for the purposes of such redemption;

* **no such shares shall be redeemed unless they are fully paid**;

* there shall, out of such profits, be transferred, a sum equal to the nominal amount of the shares to be redeemed, to a reserve, to be called the Capital Redemption Reserve Account

\

**Rule 9 of the Companies (Share Capital and Debentures) Rules, 2014,** inter alia, provide:

1\. A company having a share capital may issue **preference shares only if so authorized by its articles.**

2\. A **special resolution in the general meeting** of the company must have been passed authorizing the issue.

3. A company **may redeem its preference shares only on the terms on which they were issued** or as varied after due approval of preference shareholders under section 48 of the Act. The preference shares may be redeemed: (a) at a fixed time or on the happening of a particular event; (b) any time at the company’s option; or (c) any time at the shareholder’s option.

\

**Where a company is not in a position to redeem any preference shares or to pay dividend**, if any, on such shares in accordance with the terms of issue (such shares hereinafter referred to as unredeemed preference shares), i**t may, with the consent of the holders of three-fourths** in value of such preference shares and with the approval of the Tribunal, on a petition made by it in this behalf, i**ssue further redeemable preference shares equal to the amount due**, including the dividend thereon, in respect of the unredeemed preference shares.

1\. **No company limited by shares can issue** any preference shares which are **irredeemable**.

2\. A company limited by shares may, if so authorized by its articles, issue preference shares which are **liable to be redeemed within a period not exceeding twenty years from the date of their issue**

\

exception: **Rule 10 of the Companies (Share Capital and Debentures) Rules, 2014**, in this regard, provides that a **company engaged in the setting up of infrastructure projects** may issue preference shares for a period exceeding twenty years but not exceeding thirty years, subject to the **redemption of a minimum 10% of such preference shares per year** from the twenty first year onwards or earlier, on proportionate basis, at the option of the preference shareholders.

\

**conditions** for redeemable preference shares:

* No such shares **shall be redeemed except out of the profits of the company** which would otherwise be available for dividend or out of the proceeds of a fresh issue of shares made for the purposes of such redemption;

* **no such shares shall be redeemed unless they are fully paid**;

* there shall, out of such profits, be transferred, a sum equal to the nominal amount of the shares to be redeemed, to a reserve, to be called the Capital Redemption Reserve Account

\

**Rule 9 of the Companies (Share Capital and Debentures) Rules, 2014,** inter alia, provide:

1\. A company having a share capital may issue **preference shares only if so authorized by its articles.**

2\. A **special resolution in the general meeting** of the company must have been passed authorizing the issue.

3. A company **may redeem its preference shares only on the terms on which they were issued** or as varied after due approval of preference shareholders under section 48 of the Act. The preference shares may be redeemed: (a) at a fixed time or on the happening of a particular event; (b) any time at the company’s option; or (c) any time at the shareholder’s option.

\

**Where a company is not in a position to redeem any preference shares or to pay dividend**, if any, on such shares in accordance with the terms of issue (such shares hereinafter referred to as unredeemed preference shares), i**t may, with the consent of the holders of three-fourths** in value of such preference shares and with the approval of the Tribunal, on a petition made by it in this behalf, i**ssue further redeemable preference shares equal to the amount due**, including the dividend thereon, in respect of the unredeemed preference shares.

14

New cards

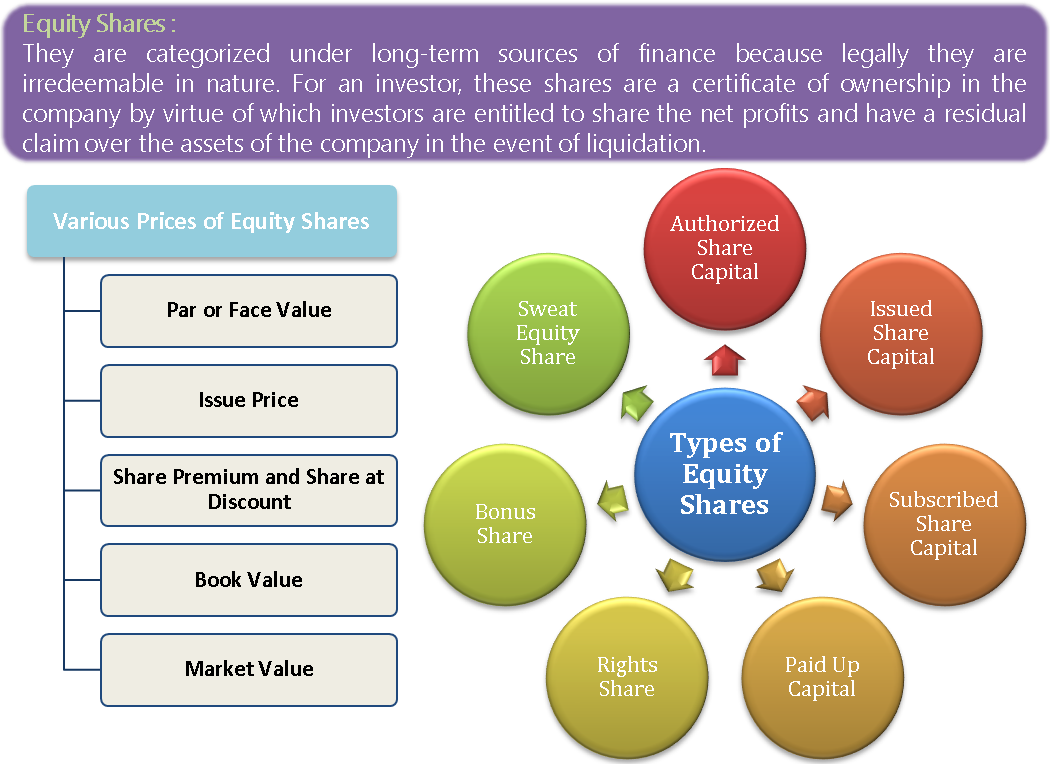

equity shares - s. 43

shares which **do not enjoy any preferential right in the matter of payment of dividend** or **repayment of capital**, are known as equity shares. After satisfying the rights of preference shares, the equity shares **shall be entitled to share in the remaining amount of distributable profits** of the company.

* The **dividend on equity shares is not fixed and may vary from year to year** depending upon the amount of profits available. The rate of dividend is recommended by the Board of directors of the company and declared by shareholders in the annual general meeting

* every member holding equity share capital shall have: **right to vote on every resolution & his voting rights, on a poll, shall be in proportion to his share** in the paid-up equity share capital of the company

the holders of **preference shares can vote only on such resolutions which directly affect the rights attached to the preference shares** and, any resolution for the winding up of the company or for the repayment or reduction of its equity or preference share capital.

Voting rights of a preference shareholder, on a poll, shall be in proportion to his share in the paid-up preference share capital of the company.

* The **dividend on equity shares is not fixed and may vary from year to year** depending upon the amount of profits available. The rate of dividend is recommended by the Board of directors of the company and declared by shareholders in the annual general meeting

* every member holding equity share capital shall have: **right to vote on every resolution & his voting rights, on a poll, shall be in proportion to his share** in the paid-up equity share capital of the company

the holders of **preference shares can vote only on such resolutions which directly affect the rights attached to the preference shares** and, any resolution for the winding up of the company or for the repayment or reduction of its equity or preference share capital.

Voting rights of a preference shareholder, on a poll, shall be in proportion to his share in the paid-up preference share capital of the company.

15

New cards

preference shares v. equity shares

* Preference shares are **entitled to a fixed rate/amount of dividend**. The rate of dividend on equity shares **depends upon the amount of net profit available after payment** of dividend to preference shareholders and the **fund requirements of the company for future expansion** etc.

* Dividend on the preference shares is **paid in preference to the equity shares**. In other words, the **dividend on equity shares is paid only after the preference dividend** has been paid

* If the preference shares are cumulative, the **dividend not paid in any year is accumulated** and **until such arrears of dividend are paid, equity shareholders are not paid any dividend**

* **voting rights of preference shareholders are restricted**. An equity shareholder can **vote on all matters affecting the company** but a preference shareholder can vote only when his **special rights as a preference** shareholder are being varied or their dividend is in arrears for at least two years

* Dividend on the preference shares is **paid in preference to the equity shares**. In other words, the **dividend on equity shares is paid only after the preference dividend** has been paid

* If the preference shares are cumulative, the **dividend not paid in any year is accumulated** and **until such arrears of dividend are paid, equity shareholders are not paid any dividend**

* **voting rights of preference shareholders are restricted**. An equity shareholder can **vote on all matters affecting the company** but a preference shareholder can vote only when his **special rights as a preference** shareholder are being varied or their dividend is in arrears for at least two years

16

New cards

non-voting shares

‘Non-voting shares’ as the term suggests are **shares which carry no voting rights**. These are contemplated as **shares which may carry additional dividends in lieu of the voting rights**. Section 43 allows issue of equity shares without voting rights

17

New cards

global depository receipts - s. 41

**Section 41 read along with Companies (Issue of Global Depository Receipts) Rules, 2014** allows a company which is eligible to do so in terms of the Scheme and relevant provisions of the Foreign Exchange Management Rules and Regulations to i**ssue depository receipts in any foreign country.** The depository receipts can be issued by way of **public offering or private placement** or in any other manner prevalent abroad and may be listed or traded in an overseas listing or trading platform.

18

New cards

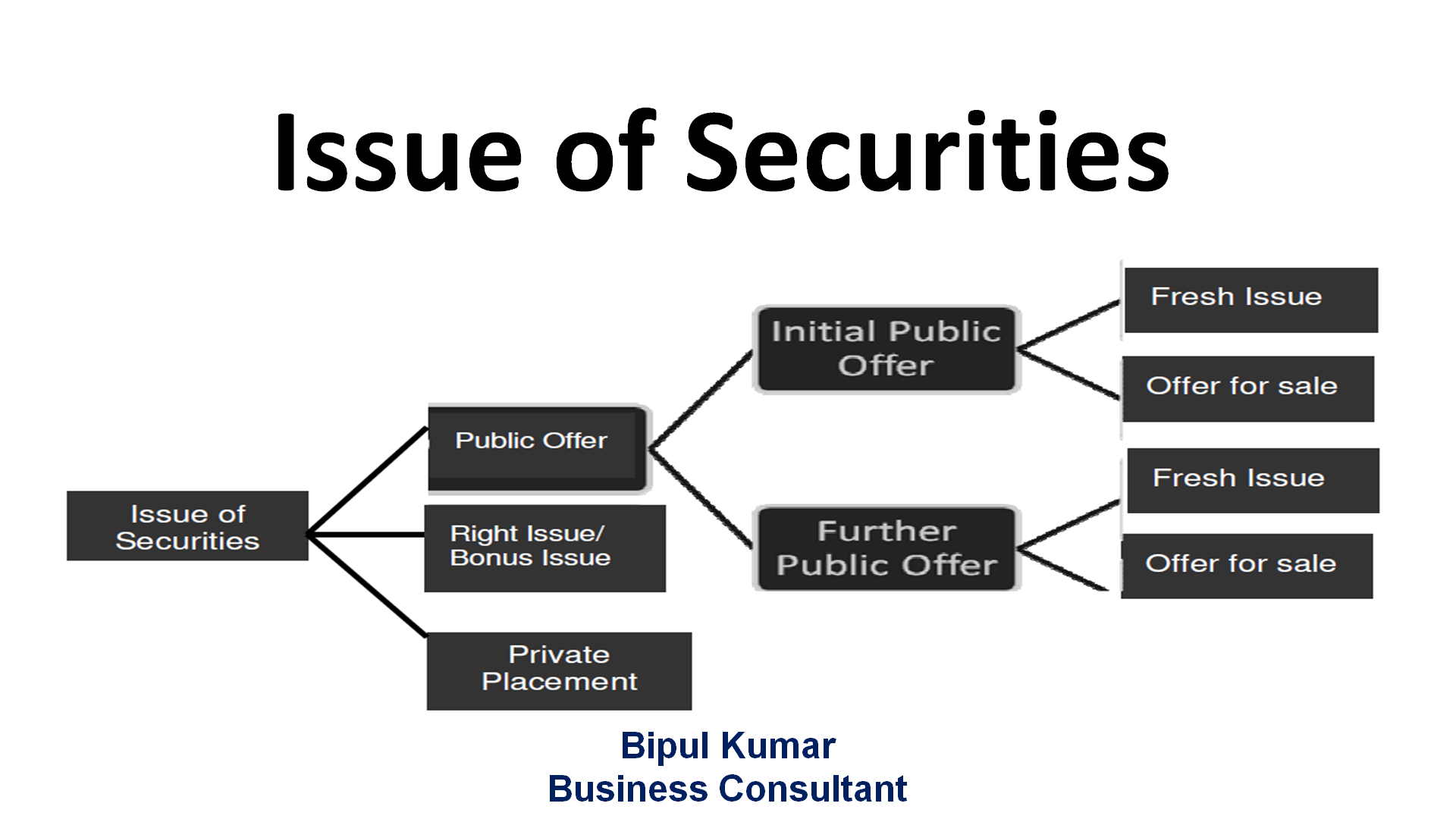

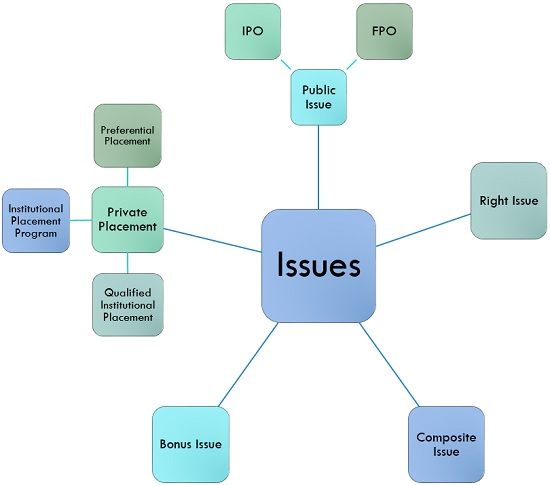

RAISING OF CAPITAL/ISSUANCE OF SHARES

. Issue of shares may be made in 3 ways :

(i) By private placement of shares;

(ii) By allotting entire shares to an ‘Issue-House’, which in turn, offers the shares for sale to the public; and

(iii) By inviting the public to subscribe for shares in the company through a prospectus

(i) By private placement of shares;

(ii) By allotting entire shares to an ‘Issue-House’, which in turn, offers the shares for sale to the public; and

(iii) By inviting the public to subscribe for shares in the company through a prospectus

19

New cards

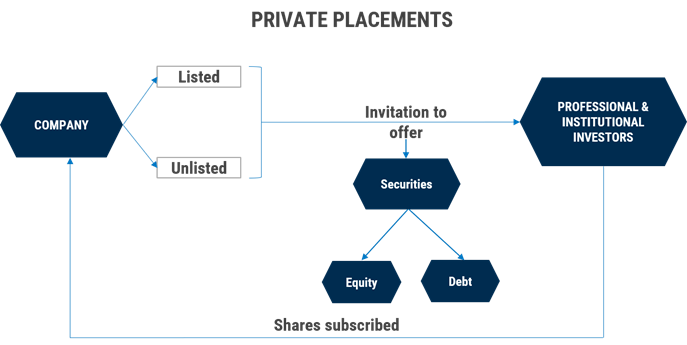

1. private placement of shares (s. 42 r/w companies (prospectus and allotment of securities) rules)

**Explanation I to section 42** defines “private placement” to mean **any offer or invitation to subscribe or issue of securities to a select group of persons by a company (other than by way of public offer)** through private placement **offer-cum application**.

If a company, listed or unlisted, makes an **offer to allot or invites subscription, or allots, or enters into an agreement to allot, securities to more than the prescribed number of persons**, whether the **payment for the securities has been received or not or whether the company intends to list its securities or no**t on any recognised stock exchange in or outside India, the same **shall be deemed to be an offer to the public and shall be governed accordingly**.

\

**conditions**:

* subject to **section 42**

* company shall not make an offer or invitation to subscribe to securities through private placement unless the **proposal has been previously approved by the shareholders of the company, by a special resolution for each of the offers or invitations**

* **shall be made only to a select group of persons who have been identified by the Board (herein referred to as “identified persons”),** whose number **shall not exceed fifty or such higher number as may be prescribed, 200**, as per the Rules

* shall **issue private placement offer and application in such form and manner as may be prescribed to identified persons, whose names and addresses are recorded by the company in such manner as may be prescribed:** However, the private placement offer and application shall not carry any right of renunciation.

* A company making an offer or invitation under this section shall **allot its securities within sixty days from the date of receipt of the application money for such securities** and if the company is not able to allot the securities within that period, it shall repay the application money to the subscribers within fifteen days from the expiry of sixty days and if the company fails to repay the application money within the aforesaid period, it shall be liable to repay that money with interest at the rate of twelve per cent per annum from the expiry of the sixtieth day

* company making any allotment of securities under this section, s**hall file with the Registrar a return of allotment within fifteen days from the date of the allotment in such manner as may be prescribed**

* A P**ublic Company can also raise its capital by placing the shares privately and without inviting the public** for subscription of its shares or debentures. In this kind of arrangement, an **underwriter or a broker finds persons**, normally his clients who wish to buy the shares.

If a company, listed or unlisted, makes an **offer to allot or invites subscription, or allots, or enters into an agreement to allot, securities to more than the prescribed number of persons**, whether the **payment for the securities has been received or not or whether the company intends to list its securities or no**t on any recognised stock exchange in or outside India, the same **shall be deemed to be an offer to the public and shall be governed accordingly**.

\

**conditions**:

* subject to **section 42**

* company shall not make an offer or invitation to subscribe to securities through private placement unless the **proposal has been previously approved by the shareholders of the company, by a special resolution for each of the offers or invitations**

* **shall be made only to a select group of persons who have been identified by the Board (herein referred to as “identified persons”),** whose number **shall not exceed fifty or such higher number as may be prescribed, 200**, as per the Rules

* shall **issue private placement offer and application in such form and manner as may be prescribed to identified persons, whose names and addresses are recorded by the company in such manner as may be prescribed:** However, the private placement offer and application shall not carry any right of renunciation.

* A company making an offer or invitation under this section shall **allot its securities within sixty days from the date of receipt of the application money for such securities** and if the company is not able to allot the securities within that period, it shall repay the application money to the subscribers within fifteen days from the expiry of sixty days and if the company fails to repay the application money within the aforesaid period, it shall be liable to repay that money with interest at the rate of twelve per cent per annum from the expiry of the sixtieth day

* company making any allotment of securities under this section, s**hall file with the Registrar a return of allotment within fifteen days from the date of the allotment in such manner as may be prescribed**

* A P**ublic Company can also raise its capital by placing the shares privately and without inviting the public** for subscription of its shares or debentures. In this kind of arrangement, an **underwriter or a broker finds persons**, normally his clients who wish to buy the shares.

20

New cards

2. offer of sale

the c**ompany allots or agrees to allot shares or debentures at a price to a financial institution or an Issue-House** for sale to the public. The Issue House **publishes a document called an offer for sale, with an application form attached**, offering to the public shares or debentures for sale at a **price higher than what is paid by it or at par**. This **document is deemed to be a prospectus [Section 25].**

21

New cards

3. by inviting public through prospectus

The company **invites offers from members of the public to subscribe for the shares or debentures through prospectus**. An investor is expected to study the prospectus and if convinced about the prospects of the company, may apply for shares.

22

New cards

PUBLIC ISSUE OF SHARES

Public Issue of shares means the **selling or marketing of shares for subscription by the public by issue of prospectus.** For raising capital from the public by the issue of shares or debentures, a public company has to **comply with the provisions of the Companies Act, the Securities Contracts (Regulation) Act, 1956** including the Rules made thereunder and the regulations and instructions issued by the concerned Government authorities, the Stock Exchange and the Securities and Exchange Board of India (SEBI), etc.

23

New cards

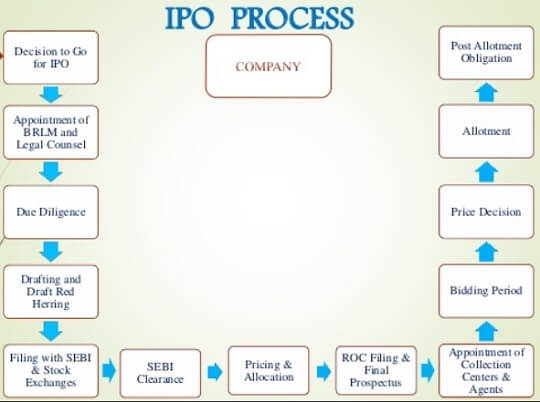

book building

Book Building is defined to mean **a process by which demand for the securities proposed to be issued by a body corporate** is elicited and **built-up and the price for such securities is assessed for the determination of the quantum of such securities to be issued** by means of a notice, circular, advertisement or other document.

\

Advantages of Book-building - Advantages of book-building include: (i) **the demand for security proposed to be issued by a body corporate may be created and built-up**. (ii) **the quantum of security to be issued may be determined with a certain degree of accuracy**

\

Advantages of Book-building - Advantages of book-building include: (i) **the demand for security proposed to be issued by a body corporate may be created and built-up**. (ii) **the quantum of security to be issued may be determined with a certain degree of accuracy**

24

New cards

INITIAL PUBLIC OFFER

An **Initial Public Offering (IPO)** is the **first time a company offers its shares to the public for purchase, allowing it to raise capital from public investors.**

entities **not eligible** to make IPO

* if **any of the promoters or directors of the issuer is a promoter or director of any other company which is debarred from accessing the capital market** by the Board.

* if the issuer or any of its promoters or directors is a **wilful defaulter.**

* if any of its promoters or directors is a **fugitive economic offender.**

* An issuer shall not be eligible to make an initial public offer if **there are any outstanding convertible securities or any other right which would entitle any person with any option to receive equity shares of the issuer**

\

**ELIGIBILITY**:

* it has **net tangible assets of at least three crore rupees, calculated on a restated and consolidated basis**, in each of the preceding **three full years (of twelve months each)**, of which not more than fifty per cent are held in monetary assets.

* it has an **average operating profit of at least fifteen crore rupees, calculated** on a restated and consolidated basis, during the preceding three years (of twelve months each), with operating profit in each of these preceding three years;

* it has a **net worth of at least one crore rupees in each of the preceding three full years** (of twelve months each), calculated on a restated and consolidated basis;

* if it has **changed its name within the last one year, at least fifty per cent of the revenue, calculated on a restated and consolidated basis**, for the preceding one full year has been earned by it from the activity indicated by its new name

\

**GENERAL CONDITIONS FOR IPO:**

**the issuer has to assure that**

* it has **made an application to one or more stock exchanges to seek an in principle approval for listing** of its specified securities on such stock exchanges and has **chosen one of them as the designated stock exchange**;

* it has **entered into an agreement with a depository for dematerialisation** of the specified securities already issued and proposed to be issued

* **all its specified securities held by the promoters are in dematerialised form** prior to filing of the offer document;

* all its **existing partly paid-up equity shares have either been fully paid-up or have been forfeited**;

* it has made **firm arrangements of finance through verifiable means towards seventy five per cent of the stated means of finance for a specific project proposed to be funded from the issue proceeds**, excluding the amount to be raised through the proposed public issue or through existing identifiable internal accruals.

**offer of sale** - additional requirements

* **Only such fully paid-up equity shares may be offered for sale to the public, which have been held by the sellers for a period of at least one year prior to the filing of the draft** offer document.

* In case the **equity shares received on conversion or exchange of fully paidup compulsorily convertible securities** including depository receipts are being offered for sale, the **holding period of such convertible securities, including depository receipts, as well as that of resultant equity shares together shall be considered for the purpose of calculation** of **one** year period referred in this sub-regulation.

* If the equity shares arising out of the conversion or exchange of the fully paid-up compulsorily convertible securities are being offered for sale, **the conversion or exchange should be completed prior to filing of the offer documen**t (i.e. red herring prospectus in the case of a book built issue and prospectus in the case of a fixed price issue)

\

**Promoters Contribution**

* The **promoters of the issuer shall hold at least twenty per cent of the post issue capital.** In case the post-issue shareholding of the promoters is less than twenty per cent, alternative investment funds or foreign venture capital investors or scheduled commercial banks or public financial institutions or insurance companies registered with Insurance Regulatory and Development Authority of India may contribute to meet the shortfall in minimum contribution, subject to a maximum of ten per cent of the post-issue capital

* The **promoters shall contribute twenty per cent as stipulated in sub-regulation (1)** either by way of equity shares or by way of subscription to convertible securities

* The **promoters shall satisfy the requirements of this regulation at least one day prior** to the date of opening of the issue.

* In case the promoters have to subscribe to equity shares or convertible securities towards minimum promoters’ contribution, the amount of **promoters’ contribution shall be kept in an escrow account with a schedule commercial bank, which shall be released to the issuer along with the release of the issue proceeds.**

\

The entire pre-issue capital held by persons other than the promoters shall be l**ocked-in for a period of one year from the date of allotment in the initial public offer**

entities **not eligible** to make IPO

* if **any of the promoters or directors of the issuer is a promoter or director of any other company which is debarred from accessing the capital market** by the Board.

* if the issuer or any of its promoters or directors is a **wilful defaulter.**

* if any of its promoters or directors is a **fugitive economic offender.**

* An issuer shall not be eligible to make an initial public offer if **there are any outstanding convertible securities or any other right which would entitle any person with any option to receive equity shares of the issuer**

\

**ELIGIBILITY**:

* it has **net tangible assets of at least three crore rupees, calculated on a restated and consolidated basis**, in each of the preceding **three full years (of twelve months each)**, of which not more than fifty per cent are held in monetary assets.

* it has an **average operating profit of at least fifteen crore rupees, calculated** on a restated and consolidated basis, during the preceding three years (of twelve months each), with operating profit in each of these preceding three years;

* it has a **net worth of at least one crore rupees in each of the preceding three full years** (of twelve months each), calculated on a restated and consolidated basis;

* if it has **changed its name within the last one year, at least fifty per cent of the revenue, calculated on a restated and consolidated basis**, for the preceding one full year has been earned by it from the activity indicated by its new name

\

**GENERAL CONDITIONS FOR IPO:**

**the issuer has to assure that**

* it has **made an application to one or more stock exchanges to seek an in principle approval for listing** of its specified securities on such stock exchanges and has **chosen one of them as the designated stock exchange**;

* it has **entered into an agreement with a depository for dematerialisation** of the specified securities already issued and proposed to be issued

* **all its specified securities held by the promoters are in dematerialised form** prior to filing of the offer document;

* all its **existing partly paid-up equity shares have either been fully paid-up or have been forfeited**;

* it has made **firm arrangements of finance through verifiable means towards seventy five per cent of the stated means of finance for a specific project proposed to be funded from the issue proceeds**, excluding the amount to be raised through the proposed public issue or through existing identifiable internal accruals.

**offer of sale** - additional requirements

* **Only such fully paid-up equity shares may be offered for sale to the public, which have been held by the sellers for a period of at least one year prior to the filing of the draft** offer document.

* In case the **equity shares received on conversion or exchange of fully paidup compulsorily convertible securities** including depository receipts are being offered for sale, the **holding period of such convertible securities, including depository receipts, as well as that of resultant equity shares together shall be considered for the purpose of calculation** of **one** year period referred in this sub-regulation.

* If the equity shares arising out of the conversion or exchange of the fully paid-up compulsorily convertible securities are being offered for sale, **the conversion or exchange should be completed prior to filing of the offer documen**t (i.e. red herring prospectus in the case of a book built issue and prospectus in the case of a fixed price issue)

\

**Promoters Contribution**

* The **promoters of the issuer shall hold at least twenty per cent of the post issue capital.** In case the post-issue shareholding of the promoters is less than twenty per cent, alternative investment funds or foreign venture capital investors or scheduled commercial banks or public financial institutions or insurance companies registered with Insurance Regulatory and Development Authority of India may contribute to meet the shortfall in minimum contribution, subject to a maximum of ten per cent of the post-issue capital

* The **promoters shall contribute twenty per cent as stipulated in sub-regulation (1)** either by way of equity shares or by way of subscription to convertible securities

* The **promoters shall satisfy the requirements of this regulation at least one day prior** to the date of opening of the issue.

* In case the promoters have to subscribe to equity shares or convertible securities towards minimum promoters’ contribution, the amount of **promoters’ contribution shall be kept in an escrow account with a schedule commercial bank, which shall be released to the issuer along with the release of the issue proceeds.**

\

The entire pre-issue capital held by persons other than the promoters shall be l**ocked-in for a period of one year from the date of allotment in the initial public offer**

25

New cards

Further Public Offer - FPO

**not eligible**:

issuer not eligible when

* a) if the **issuer, any of its promoters, promoter group or directors, selling shareholders are debarred from accessing the capital market by the Board;**

* if **any of the promoters or directors of the issuer is a promoter or director of any other company which is debarred from accessing the capital market by the Board;**

* if the **issuer or any of its promoters or directors is a wilful defaulter** ;

* if **any of its promoters or directors is a fugitive economic offender**.

\

**eligibility**

* An issuer may make a further public offer, if **it has changed its name within the last one year, at least fifty per cent of the revenue for the preceding one full year has been earned by it from the activity indicated by its new name.**

* An issuer not satisfying the condition stipulated in sub-regulation (1) **may make a further public offer only if the issue is made through the book-building process and the issuer undertakes to allot at least seventy five per cent of the net offer, to qualified institutional buyers** and to refund full subscription money if it fails to make the said minimum allotment to qualified institutional buyers

\

**general conditions**

* An issuer making a further public offer shall ensure that—

* (a) **it has made an application to one or more stock exchanges to seek an in principle approval** for listing of its specified securities on such stock exchanges and has chosen one of them as the designated stock exchange, in terms of Schedule XIX;

* (b) it has **entered into an agreement with a depository for dematerialisation of specified securities already issued and proposed to be issued**;

* (c) all its **existing partly paid-up equity shares have either been fully paidup or have been forfeited;**

* (d) it has **made firm arrangements of finance through verifiable means towards seventy five per cent of the stated means of finance for the specific project** proposed to be funded from the issue proceeds, excluding the amount to be raised through the proposed public issue or through existing identifiable internal accruals.

* The amount for general corporate purposes, as mentioned in objects of the issue in the draft offer document and the offer document, shall not exceed twenty five per cent of the amount being raised by the issue

issuer not eligible when

* a) if the **issuer, any of its promoters, promoter group or directors, selling shareholders are debarred from accessing the capital market by the Board;**

* if **any of the promoters or directors of the issuer is a promoter or director of any other company which is debarred from accessing the capital market by the Board;**

* if the **issuer or any of its promoters or directors is a wilful defaulter** ;

* if **any of its promoters or directors is a fugitive economic offender**.

\

**eligibility**

* An issuer may make a further public offer, if **it has changed its name within the last one year, at least fifty per cent of the revenue for the preceding one full year has been earned by it from the activity indicated by its new name.**

* An issuer not satisfying the condition stipulated in sub-regulation (1) **may make a further public offer only if the issue is made through the book-building process and the issuer undertakes to allot at least seventy five per cent of the net offer, to qualified institutional buyers** and to refund full subscription money if it fails to make the said minimum allotment to qualified institutional buyers

\

**general conditions**

* An issuer making a further public offer shall ensure that—

* (a) **it has made an application to one or more stock exchanges to seek an in principle approval** for listing of its specified securities on such stock exchanges and has chosen one of them as the designated stock exchange, in terms of Schedule XIX;

* (b) it has **entered into an agreement with a depository for dematerialisation of specified securities already issued and proposed to be issued**;

* (c) all its **existing partly paid-up equity shares have either been fully paidup or have been forfeited;**

* (d) it has **made firm arrangements of finance through verifiable means towards seventy five per cent of the stated means of finance for the specific project** proposed to be funded from the issue proceeds, excluding the amount to be raised through the proposed public issue or through existing identifiable internal accruals.

* The amount for general corporate purposes, as mentioned in objects of the issue in the draft offer document and the offer document, shall not exceed twenty five per cent of the amount being raised by the issue

26

New cards

ALLOTMENT OF SHARES

\

27

New cards

allotment

* **Offer for shares are made on application forms supplied by the company. When an application is accepted, it amounts to an allotment**

* It means and implies a **division of share capital into defined shares of a particular value or of different classes and assignment of such shares to different persons**

* It means and implies a **division of share capital into defined shares of a particular value or of different classes and assignment of such shares to different persons**

28

New cards

General Principles regarding allotment

**proper authority**

* The allotment should be **made by proper authority**, i.e., **the Board of Directors of the company or a committee authorised** to allot shares on behalf of the Board. An allotment made without proper authority will be invalid.

**allotment against application only**

* **No valid allotment can be made on an oral request. Section 2(55) provides that for becoming a member, a person should agree in writing.** Thus, no allotment can be made without a written application for allotment.

**allotment not to be in contravention of any other law**

* If shares are issued **in a manner prohibited by foreign exchange regulations, the issue would be invalid and void and confer on the allottee no title** whatsoever to the shares. If shares are allotted on the application of a minor, the allotment will be void.

**reasonable time**

* Allotment **must be made within a reasonable period of time; otherwise, the application lapses**. What is reasonable time must remain a question of fact in each case. On the expiry of reasonable time, section 6 of the Contract Act becomes applicable and the applications must be deemed to have been revoked.

**communication**

* The **allotment must be communicated to the applicant. A contract of allotment of shares is like any other contract.** There is no fallacy in likening the contract, between a company and a person who makes an application to become a member, to an ordinary contract; the circumstances are different but the principles are identical. There must be the consent of the two parties. There must be acceptance of the offer by words or conduct to the knowledge of the person who made the offer. That is required in the case of an application for shares, just as in the case of any other contract.

**absolute and unconditional**

* The allotment must be **absolute and unconditional, i.e., must be made on the same terms as stated in the application.**

* The allotment should be **made by proper authority**, i.e., **the Board of Directors of the company or a committee authorised** to allot shares on behalf of the Board. An allotment made without proper authority will be invalid.

**allotment against application only**

* **No valid allotment can be made on an oral request. Section 2(55) provides that for becoming a member, a person should agree in writing.** Thus, no allotment can be made without a written application for allotment.

**allotment not to be in contravention of any other law**

* If shares are issued **in a manner prohibited by foreign exchange regulations, the issue would be invalid and void and confer on the allottee no title** whatsoever to the shares. If shares are allotted on the application of a minor, the allotment will be void.

**reasonable time**

* Allotment **must be made within a reasonable period of time; otherwise, the application lapses**. What is reasonable time must remain a question of fact in each case. On the expiry of reasonable time, section 6 of the Contract Act becomes applicable and the applications must be deemed to have been revoked.

**communication**

* The **allotment must be communicated to the applicant. A contract of allotment of shares is like any other contract.** There is no fallacy in likening the contract, between a company and a person who makes an application to become a member, to an ordinary contract; the circumstances are different but the principles are identical. There must be the consent of the two parties. There must be acceptance of the offer by words or conduct to the knowledge of the person who made the offer. That is required in the case of an application for shares, just as in the case of any other contract.

**absolute and unconditional**

* The allotment must be **absolute and unconditional, i.e., must be made on the same terms as stated in the application.**

29

New cards

Statutory Regulations regarding allotment

**registration of prospectus (s. 26(4))**

* A **copy of the prospectus signed by every person who is named therein as a director or proposed director** of the company or by his duly authorized attorney shall be d**uly filed with the Registrar** for registration on or before the date of its publication.

**application money (s. 39(2))**

* An **amount payable on application on each share shall not be less than 5% of the nominal amount of the share** or such other percentage or amount, as may be specified by the Securities and Exchange Board by making regulations in this behalf.

**minimum subscription (s. 39(1 & 3))**

* **No allotment of any securities of a company offered to the public for subscription shall be made unless the amount stated in the prospectus as the minimum amount has been subscribed and the sums payable on application for the amount so stated have been paid to and received by the company by cheque or other instrument**

* If the stated minimum amount has not been subscribed and the sum payable on application is not received within a period of thirty days from the date of issue of the prospectus, or such other period as may be specified by the Securities and Exchange Board, the amount received under sub-section (1) shall be returned within such time and manner as may be prescribed.

**closing of the subscription list**

* Although Companies Act is silent as to the time for which the subscription list must be kept open, SEBI’s Regulations, 2018 provide that the s**ubscription list for public issue must be kept open for at least 3 working days and for not more than 10 working days.**

* In case of revision of price bond, the **issuer shall extend the bidding (issue) period for a minimum period of three working days**. In case of rights issue, the issue shall remain open for a minimum period of 15 days and cannot remain open beyond 30 days.

**permission to deal on a stock exchange (s. 40)**

* Every company making public offer shall, **before making such offer, make an application to one or more recognised stock exchange or exchanges and obtain permission for the securities to be dealt with in such stock exchange or exchanges.**

* A **copy of the prospectus signed by every person who is named therein as a director or proposed director** of the company or by his duly authorized attorney shall be d**uly filed with the Registrar** for registration on or before the date of its publication.

**application money (s. 39(2))**

* An **amount payable on application on each share shall not be less than 5% of the nominal amount of the share** or such other percentage or amount, as may be specified by the Securities and Exchange Board by making regulations in this behalf.

**minimum subscription (s. 39(1 & 3))**

* **No allotment of any securities of a company offered to the public for subscription shall be made unless the amount stated in the prospectus as the minimum amount has been subscribed and the sums payable on application for the amount so stated have been paid to and received by the company by cheque or other instrument**

* If the stated minimum amount has not been subscribed and the sum payable on application is not received within a period of thirty days from the date of issue of the prospectus, or such other period as may be specified by the Securities and Exchange Board, the amount received under sub-section (1) shall be returned within such time and manner as may be prescribed.

**closing of the subscription list**

* Although Companies Act is silent as to the time for which the subscription list must be kept open, SEBI’s Regulations, 2018 provide that the s**ubscription list for public issue must be kept open for at least 3 working days and for not more than 10 working days.**

* In case of revision of price bond, the **issuer shall extend the bidding (issue) period for a minimum period of three working days**. In case of rights issue, the issue shall remain open for a minimum period of 15 days and cannot remain open beyond 30 days.

**permission to deal on a stock exchange (s. 40)**

* Every company making public offer shall, **before making such offer, make an application to one or more recognised stock exchange or exchanges and obtain permission for the securities to be dealt with in such stock exchange or exchanges.**

30

New cards

return as to allotment

Whenever a company having a share capital makes any allotment of securities, it **shall file with the Registrar a return of allotment in such manner as may be prescribed [Section 39(4)]**. In case of any default, the company and its officer who is in default s**hall be liable to a penalty, for each default, of one thousand rupees for each day** during which such default continues or one lakh rupees, whichever is less.

31

New cards

underwriting

according to palmer, it is a **contract by which a person (known as an underwriter) agrees (usually for a commission) that if the shares, debentures or debenture stock about to be offered for subscription or some specified proportions thereof, are not, within a specified time, taken up by the public, or by that Section of the public to which they are to be offered, he will himself take them up and pay for what the public do not take up or some specified proportions thereof.**

SEBI Regulations, 2009 define underwriting to **mean an agreement with or without conditions to subscribe to the securities of a body corporate when the existing shareholders of such body corporate or the public do not subscribe to the securities offered to them**

**Section 26** of the Companies Act, 2013 read along with **Rule 13** of the Companies (Prospectus and Allotment of Securities) Rules, 2014 require a **prospectus to state the details about underwriting of the issue including the names, addresses, telephone numbers, fax numbers and e-mail addresses of the underwriters and the amount underwritten by them**. Further, Rule 13 provides that a company **may pay commission to any person in connection with the subscription or procurement of subscription to its securities, whether absolute or conditional, subject to conditions.**

SEBI Regulations, 2009 define underwriting to **mean an agreement with or without conditions to subscribe to the securities of a body corporate when the existing shareholders of such body corporate or the public do not subscribe to the securities offered to them**

**Section 26** of the Companies Act, 2013 read along with **Rule 13** of the Companies (Prospectus and Allotment of Securities) Rules, 2014 require a **prospectus to state the details about underwriting of the issue including the names, addresses, telephone numbers, fax numbers and e-mail addresses of the underwriters and the amount underwritten by them**. Further, Rule 13 provides that a company **may pay commission to any person in connection with the subscription or procurement of subscription to its securities, whether absolute or conditional, subject to conditions.**

32

New cards

Buy-back/Purchase of Own shares by a company

**Section 67(1) of the Companies Act, 2013 provides that a company limited by shares or a company limited by guarantee having a share capital cannot buy its own shares.** The restriction is **applicable to all companies having share capital, whether public or private**\*. However, **Section 68 allows a company to purchase its own shares or other securities subject to certain condition**s.

33

New cards

sources to buy back

A company can buy its own shares and other specified securities out of :

(i) its **free reserves; or**

**(ii) the securities premium account**; or

(iii) the **proceeds of any shares or other specified securities**. However, no buyback shall be made out of the proceeds of an earlier issue of the same kind of shares or same kind of other specified security

(i) its **free reserves; or**

**(ii) the securities premium account**; or

(iii) the **proceeds of any shares or other specified securities**. However, no buyback shall be made out of the proceeds of an earlier issue of the same kind of shares or same kind of other specified security

34

New cards

Conditions for buy-back

**A.** **Section 68(2)** provides that n**o company shall purchase its own shares or other specified securities unless** :

(a) the **buy-back is authorised by its articles**;

(b) a s**pecial resolution has been passed at a general meeting of the company authorising the buy-back.** However, buy-back up to ten per cent of the total paid-up equity capital and free reserves of the company may be affected by passing a resolution at a meeting of the Board of directors of the company; SEBI regulations, as amended up to 1-8-2014, provide that the resolution of the Board of directors must be filed with SEBI and the stock exchanges where the shares or other specified securities of the company are listed, within two working days of the date of the passing of the resolution. ‘Working day’ means any working day of SEBI.

(c) **the buy-back is twenty-five per cent or less of the aggregate of paid-up capital and free reserves of the company**

\

**B.** The **notice of the meeting at which special resolution is proposed to be passed shall be accompanied by an explanatory statement containing specified particulars.**

**C.** Every buy-back shall be **completed within a period of one year from the date of passing the Special resolution /Board’s resolution under sub-section (2) of Section 68.**

**D.** Buy-back shall be permissible: (a) **from the existing shareholders or security holders on a proportionate basis; (b) from the open market; (c) by purchasing the securities issued to employees of the company pursuant to a scheme of stock option or sweat equity.**

(a) the **buy-back is authorised by its articles**;

(b) a s**pecial resolution has been passed at a general meeting of the company authorising the buy-back.** However, buy-back up to ten per cent of the total paid-up equity capital and free reserves of the company may be affected by passing a resolution at a meeting of the Board of directors of the company; SEBI regulations, as amended up to 1-8-2014, provide that the resolution of the Board of directors must be filed with SEBI and the stock exchanges where the shares or other specified securities of the company are listed, within two working days of the date of the passing of the resolution. ‘Working day’ means any working day of SEBI.

(c) **the buy-back is twenty-five per cent or less of the aggregate of paid-up capital and free reserves of the company**

\

**B.** The **notice of the meeting at which special resolution is proposed to be passed shall be accompanied by an explanatory statement containing specified particulars.**

**C.** Every buy-back shall be **completed within a period of one year from the date of passing the Special resolution /Board’s resolution under sub-section (2) of Section 68.**

**D.** Buy-back shall be permissible: (a) **from the existing shareholders or security holders on a proportionate basis; (b) from the open market; (c) by purchasing the securities issued to employees of the company pursuant to a scheme of stock option or sweat equity.**

35

New cards

benefits/objectives of underlying buy-back of shares

(i) **return of surplus cash to the shareholder**s, when paid up share capital appears to be more than necessary,

(ii) **increase of current share price** of the company, (

iii) **support to share price when company activities are on a reduced scale**,

(iv) **maintaining a revised capital structure**,

(v) **discourage unwelcome takeover bids,**

**(vi) increase in dividend rate,**

**(vii) increase in earning per share**,

(viii) **more efficient use of the corporate resources**, and

(ix) i**ncrease in promoters’/controlling shareholders’ stake** in the company by resorting to open market purchase or selective buy-back.

(ii) **increase of current share price** of the company, (

iii) **support to share price when company activities are on a reduced scale**,

(iv) **maintaining a revised capital structure**,

(v) **discourage unwelcome takeover bids,**

**(vi) increase in dividend rate,**

**(vii) increase in earning per share**,

(viii) **more efficient use of the corporate resources**, and

(ix) i**ncrease in promoters’/controlling shareholders’ stake** in the company by resorting to open market purchase or selective buy-back.

36

New cards

SEBI Regulations regarding buy-back

Buy-back shall be permissible:

(a) **from the existing shareholders or security holders on a proportionate basis: Provided that 15% of the number of securities which the company proposes to buy back or number of securities entitled as per their shareholding, whichever is higher, shall be reserved for small shareholders**. A ‘small shareholder’ means a shareholder the market value of whose shares is not more than two lakh rupees;

(b) from the open market through— (**i) book-building process, (ii) stock exchange;**

(c) **by purchasing the securities issued to employees of the company pursuant to a scheme of stock option or sweat equity.**

\

If a company makes default in complying with the provisions of Section 68 or any rules and regulations made thereunder, **the company shall be punishable with fine which shall not be less than one lakh rupees.**

(a) **from the existing shareholders or security holders on a proportionate basis: Provided that 15% of the number of securities which the company proposes to buy back or number of securities entitled as per their shareholding, whichever is higher, shall be reserved for small shareholders**. A ‘small shareholder’ means a shareholder the market value of whose shares is not more than two lakh rupees;

(b) from the open market through— (**i) book-building process, (ii) stock exchange;**

(c) **by purchasing the securities issued to employees of the company pursuant to a scheme of stock option or sweat equity.**

\

If a company makes default in complying with the provisions of Section 68 or any rules and regulations made thereunder, **the company shall be punishable with fine which shall not be less than one lakh rupees.**

37

New cards

prohibition of buy-back in certain circumstances (s. 70)

No company shall, directly or indirectly, purchase its own shares or other specified securities:

(a) **through any subsidiary company including its own subsidiary companies;**

**(b) through any investment company or group of investment companies**; or

(c) **if a default, is made by the company, in the repayment of deposits accepted either before or after the commencement of the Companies Act, 2013, interest payment thereon, redemption of debentures or preference shares or payment of dividend to any shareholder, or repayment of any term loan or interest payable thereon to any financial institution or banking company**. However, the buy-back shall be permissible after a period of three years from the date such default ceased to subsist.

In the following cases, however, a company is not taken to have purchased its own shares:— (a) where it redeems its preference shares; (b) forfeits its shares for non-payment of calls; (c) accepts a valid surrender of shares.

(a) **through any subsidiary company including its own subsidiary companies;**

**(b) through any investment company or group of investment companies**; or

(c) **if a default, is made by the company, in the repayment of deposits accepted either before or after the commencement of the Companies Act, 2013, interest payment thereon, redemption of debentures or preference shares or payment of dividend to any shareholder, or repayment of any term loan or interest payable thereon to any financial institution or banking company**. However, the buy-back shall be permissible after a period of three years from the date such default ceased to subsist.

In the following cases, however, a company is not taken to have purchased its own shares:— (a) where it redeems its preference shares; (b) forfeits its shares for non-payment of calls; (c) accepts a valid surrender of shares.

38

New cards

issue of shares at a discount (s. 53)

If the buyer of shares is required to pay less than face value of the share, for example, Rs. 9 on a share of Rs. 10, then the **share is said to be issued or sold at a discount. The issue of shares at a discount is regulated by law and Section 53 provides that except as provided in section 54, a company shall not issue shares at a discount.** Section 54 **allows only ‘sweat equity shares’ to be issued at a discount and that too subject to compliance of the specified conditions**. Any share issued by a company at a discount shall be void.

39

New cards

issue of sweat equity shares (s. 54)

“Sweat equity shares” means such equity shares as are i**ssued by a company to its directors or employees at a discount or for consideration, other than cash, for providing their know-how or making available rights in the nature of intellectual property rights or value additions,** by whatever name called \[Section 2(88)\].

Sweat equity shares are thus **issued to employees or directors, as aforesaid. These are issued at a discount (to market price) or for providing knowhow or making available rights in the nature of intellectual property rights or value additions**. A company can issue sweat equity shares only of a class of shares already issued.

Besides, for issue of sweat equity shares, Section 54, inter alia, requires to ensure that: (a) The issue is authorized by a special resolution passed by the company. A**s per Rule 8 of the Companies (Share Capital and Debentures) Rules, 2014, the special resolution authorizing the issue of sweat equity shares shall be valid for making the allotment within a period of not more than twelve months from the date of passing of the special resolution.**

Rule 8 provides that **a company shall not issue sweat equity shares for more than 15% of the existing paid up equity share capital in a year or shares of the issue value of rupees five crores, whichever is higher. In no case the issuance of sweat equity shares in the company can exceed 25% of the paid up equity capital of the company at any time.**

Sweat equity shares are thus **issued to employees or directors, as aforesaid. These are issued at a discount (to market price) or for providing knowhow or making available rights in the nature of intellectual property rights or value additions**. A company can issue sweat equity shares only of a class of shares already issued.

Besides, for issue of sweat equity shares, Section 54, inter alia, requires to ensure that: (a) The issue is authorized by a special resolution passed by the company. A**s per Rule 8 of the Companies (Share Capital and Debentures) Rules, 2014, the special resolution authorizing the issue of sweat equity shares shall be valid for making the allotment within a period of not more than twelve months from the date of passing of the special resolution.**

Rule 8 provides that **a company shall not issue sweat equity shares for more than 15% of the existing paid up equity share capital in a year or shares of the issue value of rupees five crores, whichever is higher. In no case the issuance of sweat equity shares in the company can exceed 25% of the paid up equity capital of the company at any time.**

40

New cards

share certificate (s. 56)

An allottee of shares is **entitled to have from the company a document, called share certificate, certifying that he is the holder of the specified number of shares in the company**.

Section 56 (4) provides that every company shall, unless prohibited by any provision of law or any order of Court, Tribunal or other authority, **deliver the certificates of all securities allotted, transferred or transmitted— (a) within a period of two months from the date of incorporation, in the case of subscribers to the memorandum; (b) within a period of two months from the date of allotment, in the case of allotment of any of its shares; (c) within a period of one month from the date of receipt by the company of the instrument of transfer, or of the intimation of transmission.**

Section 46 gives the object of the share certificate. It reads, “a share certificate under the Common Seal of the company, specifying any shares held by any member, shall be prima facie evidence of the title of the member to such shares”. Thus, the share certificate being prima facie evidence of title, it gives the shareholder the facility of dealing more easily with the share in the market.

Section 56 (4) provides that every company shall, unless prohibited by any provision of law or any order of Court, Tribunal or other authority, **deliver the certificates of all securities allotted, transferred or transmitted— (a) within a period of two months from the date of incorporation, in the case of subscribers to the memorandum; (b) within a period of two months from the date of allotment, in the case of allotment of any of its shares; (c) within a period of one month from the date of receipt by the company of the instrument of transfer, or of the intimation of transmission.**

Section 46 gives the object of the share certificate. It reads, “a share certificate under the Common Seal of the company, specifying any shares held by any member, shall be prima facie evidence of the title of the member to such shares”. Thus, the share certificate being prima facie evidence of title, it gives the shareholder the facility of dealing more easily with the share in the market.

41

New cards

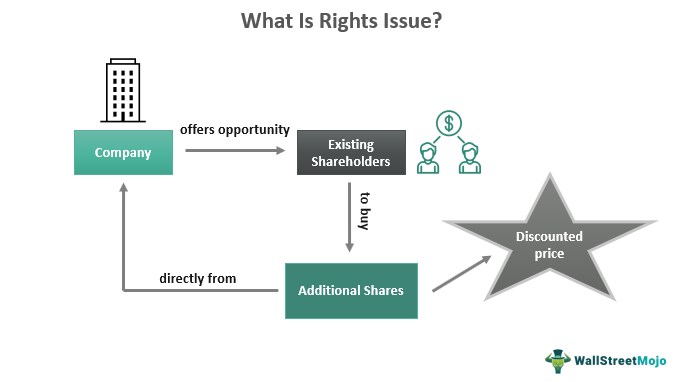

Rights shares/further issue of capital (s. 62)

* A company limited by shares can **increase its share capital by issuing new shares provided it is authorised by the Articles.**

* The companies generally do not issue the whole of its authorised capital at once.

* When the directors feel the **need for additional funds for expansion, diversification or modernisation, they may issue further shares.** However, the power to issue further shares need not be used only when there is a need to raise additional capital.

* the directors cannot issue the new shares at their discretion. Because, if allowed, they may allot the new shares to their relations, friends or their nominees. In order to overcome such a misuse, **section 62 of the Act lays down certain conditions for further issue of shares. Since section 62 provides for the further issue of shares to be first offered to the existing members of the company, such shares are known as ‘right shares’ and the right of the members to be so offered is called the ‘right of pre-emption’.**

* Section 62 of the Companies Act, 2013 provides that **where at any time, a company having a share capital proposes to increase its subscribed capital by the issue of further shares, such shares shall be offered to persons who, at the date of the offer, are holders of equity shares of the company in proportion, as nearly as circumstances admit, to the paid-up share capital on those shares.**

* The companies generally do not issue the whole of its authorised capital at once.

* When the directors feel the **need for additional funds for expansion, diversification or modernisation, they may issue further shares.** However, the power to issue further shares need not be used only when there is a need to raise additional capital.

* the directors cannot issue the new shares at their discretion. Because, if allowed, they may allot the new shares to their relations, friends or their nominees. In order to overcome such a misuse, **section 62 of the Act lays down certain conditions for further issue of shares. Since section 62 provides for the further issue of shares to be first offered to the existing members of the company, such shares are known as ‘right shares’ and the right of the members to be so offered is called the ‘right of pre-emption’.**

* Section 62 of the Companies Act, 2013 provides that **where at any time, a company having a share capital proposes to increase its subscribed capital by the issue of further shares, such shares shall be offered to persons who, at the date of the offer, are holders of equity shares of the company in proportion, as nearly as circumstances admit, to the paid-up share capital on those shares.**

42

New cards

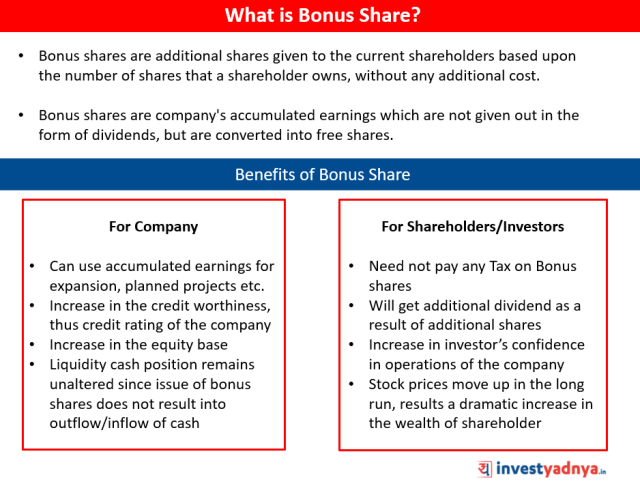

Bonus Shares

The provisions with respect to issue of bonus shares are contained in **section 63 of the Companies Act, 2013**. Besides, in case of listed companies SEBI Regulations, 2018 shall also be required to be complied with.

Section 63 provides that: (**1) A company may issue fully paid-up bonus shares to its members, in any manner whatsoever, out of— (i) its free reserves; (ii) the securities premium account; or (iii) the capital redemption reserve account: However, no issue of bonus shares shall be made by capitalising reserves created by the revaluation of assets.**

(2) **No company shall capitalise its profits or reserves for the purpose of issuing fully paid-up bonus shares** under sub-section (1), unless— (a) it is authorised by its articles; (b) it has, on the recommendation of the Board, been authorised in the general meeting of the company; (c) it has not defaulted in payment of interest or principal in respect of fixed deposits or debt securities issued by it; (d) it has not defaulted in respect of the payment of statutory dues of the employees, such as, contribution to provident fund, gratuity and bonus; (e) the partly paid-up shares, if any outstanding on the date of allotment, are made fully paid-up; (f) it complies with such conditions as may be prescribed.

(3) The **bonus shares shall not be issued in lieu of dividend**

Section 63 provides that: (**1) A company may issue fully paid-up bonus shares to its members, in any manner whatsoever, out of— (i) its free reserves; (ii) the securities premium account; or (iii) the capital redemption reserve account: However, no issue of bonus shares shall be made by capitalising reserves created by the revaluation of assets.**

(2) **No company shall capitalise its profits or reserves for the purpose of issuing fully paid-up bonus shares** under sub-section (1), unless— (a) it is authorised by its articles; (b) it has, on the recommendation of the Board, been authorised in the general meeting of the company; (c) it has not defaulted in payment of interest or principal in respect of fixed deposits or debt securities issued by it; (d) it has not defaulted in respect of the payment of statutory dues of the employees, such as, contribution to provident fund, gratuity and bonus; (e) the partly paid-up shares, if any outstanding on the date of allotment, are made fully paid-up; (f) it complies with such conditions as may be prescribed.

(3) The **bonus shares shall not be issued in lieu of dividend**

43

New cards

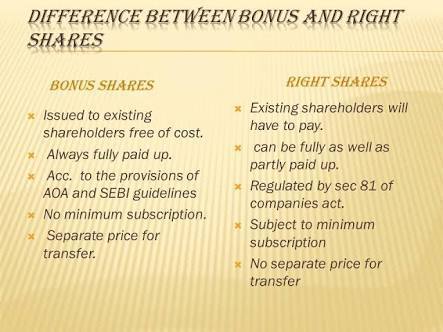

difference between bonus shares and rights shares

RIGHTS SHARES

* **To be paid for** - It only confers a **privilege on the existing shareholders to have a claim on the shares offered after the first public issue.**

* Partly paid- The **existing shareholding of the members as well as rights shares may be partly paid.**

* Minimum subscription- In the **event of a company failing to receive a minimum of 90% subscription, the company shall have to return the entire money received.**

* Right to renounce - Right shares may be r**enounced in favour of his nominee.**

\

BONUS SHARES

* Bonus shares are **issued to the existing members free of charge**

* Bonus shares are **always fully paid**

* There is no such requirement.

* **No such facility** is available in case of bonus shares.

* **To be paid for** - It only confers a **privilege on the existing shareholders to have a claim on the shares offered after the first public issue.**

* Partly paid- The **existing shareholding of the members as well as rights shares may be partly paid.**

* Minimum subscription- In the **event of a company failing to receive a minimum of 90% subscription, the company shall have to return the entire money received.**

* Right to renounce - Right shares may be r**enounced in favour of his nominee.**

\

BONUS SHARES

* Bonus shares are **issued to the existing members free of charge**

* Bonus shares are **always fully paid**

* There is no such requirement.

* **No such facility** is available in case of bonus shares.

44

New cards

REDUCTION OF SHARE CAPITAL