Investments - Formulas

1/24

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

25 Terms

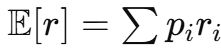

Expected return - E[r]

Excel: =SUMPRODUCT(p_range; r_range)

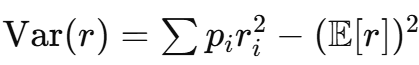

Variance - σ2

Excel: =SUMPRODUCT(p; r2) - (SUMPRODUCT(p; r))2

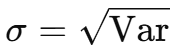

Standard deviation from variance - σ

=SQRT(variance_cell)

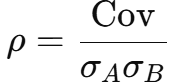

Covariance

Excel: =COVARIANCE.S(rA_range; rM_range)

Correlation (sample, time series)

Excel: =CORREL(rA; rB)

Mean vs geometric mean

Arithmetic: =AVERAGE(r); Geometric for periodic simple returns: =PRODUCT(1+r)^(1/n)-1

Sharpe Ratio

Excel: =(E[r]-rf)/sigma

![<p>Excel: <code>=(E[r]-rf)/sigma</code></p>](https://knowt-user-attachments.s3.amazonaws.com/8805e912-606f-4a78-a480-a4a1786dd81c.png)

Implied rfr_frf from Sharpe and (μ, σ)

rf = μ − S σ

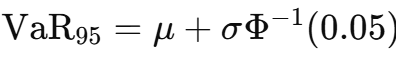

Normal VaR at 95% (returns)

Excel: =mu + NORM.S.INV(0.05)*sigma

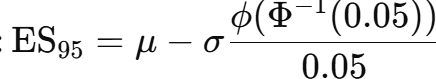

Normal ES at 95%

Excel: =mu - sigma*NORM.S.DIST(NORM.S.INV(0.05);FALSE)/0.05

Historical VaR at q

Excel: =PERCENTILE.EXC(r; q)

Interpreting VaR number

95% VaR of −12%: on a typical day you lose ≤ 12%; 5% chance you lose more

Interpreting ES number

Average loss conditional on being in worst 5% outcomes

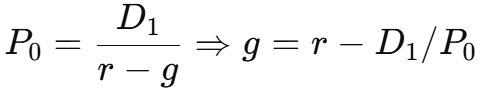

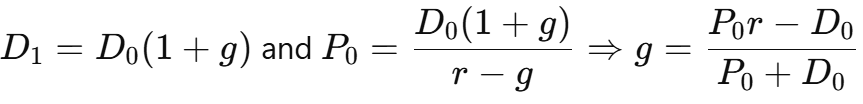

Gordon with next dividend D1

Gordon when given D0

Multi-stage DDM — structure

PV of each stage’s dividends + terminal

Excel — PV of years 1–5 constant D1_5

=SUM(D1_5/(1+r)^{SEQUENCE(5)})

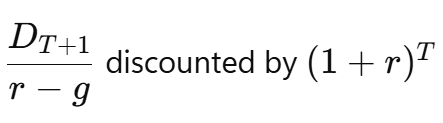

Terminal value at T with perpetual growth g

TVT = CF_{T+1}/(r-g)

Multi-stage DDM (years 1–5 = D15; 6–10 = D610; then g)

Stage 1 annuity PV:

=PV(r; 5; D1_5; 0; 0)Stage 2 annuity PV at t=5:

=PV(r; 5; D6_10; 0; 0)then PV today:=PV(r; 5; 0; -that; 0)TV at t=10:

=D6_10*(1+g)/(r-g)then PV today:=PV(r; 10; 0; -TV; 0)Fair price = sum of three PVs

DDM when given D0

D1 = D0*(1+g); P0 = D1/(r-g). Solve g: = (P0*r - D0)/(P0 + D0)

HPR with dividends and split

=(P1*Shares*Split + Shares*Div - Shares*P0)/(Shares*P0)