Topic 1

1/34

Earn XP

Description and Tags

Taxation

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

35 Terms

Marginal Tax Rate

The rate that applies to the next additional increment of a taxpayers income.

Progressive Tax Rate

Imposes an increasing marginal tax rate as the tax base increases. Ex. - Federal and most state’s income tax

Regressive Tax Rate

Imposes a decreasing marginal tax rate as the tax base increases.

Tax rate decreases as your income increases

Proportional Tax rate (Flat Tax)

Imposes a constant tax rate throughout the tax base

EX. Sales tax, excise tax

Horizontal

Two taxpayers in similar situation pay the same tax.

Vertical Equity

Taxpayers with greater ability to pay tax pay more tax than taxpayers with less ability to pay.

Certainty

Means that taxpayer’s should be able to determine when to pay the tax, where the pay the tax, and how to determine the tax

Convenience

Tax system should be designed to be collected without undue hardship to the taxpayer.

Takin taxes from my paycheck without me having to worry about it

Economy

Should minimize the compliance and administration costs associated w/ the tax system (simplicity)

US Constitution

Tax Law - Highest authority in the US

Legislative

Tax Law - Internal Revenue (Main statutory authority)

Administrative

Tax Law - Treasury Regulations (US Dept of Treasury)

Executive

Tax Treaties

Tax Avoidance

Legal act of arranging your transactions to minimize taxes paid

Tax Evasion

Willful attempt to defraud the government by not paying taxes legally owed

Examples of NON INCOME

Gifts

Inheritance

Interest on Municipal Bonds

Alimony

Winnings for personal injury suit

Correspondence Examinations

Type of Audit conducted by mail, request for supporting documents

Office Examinations

Type of Audit conducted in the local IRS office and tends to be broader in scope

Field Examinations

Type of audit Held at the taxpayer’s place of business and can last 5 months to years

Private Letter Rulings

Individual taxpayers ask and the IRS makes a determination for the taxpayer on their issue only.

Technical Advice Memorandums

Requested by IRS agent during audit to determine how to treat taxpayer issue

What Always come first in tax research?

FACTS

S Corporation

What type of corporation is considered a pass-through entity (Flow)

Suffiency

Type of tax law defines assessing the amount of tax the tax revenue collected to generate income to pay governmental expenditures

Must tax enough $$$ to pay for the government

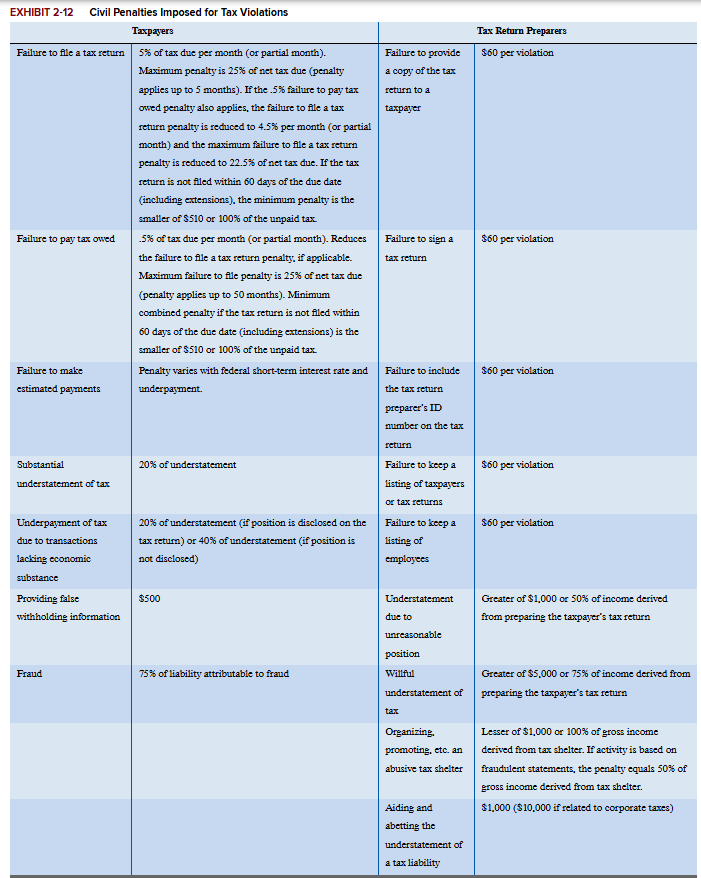

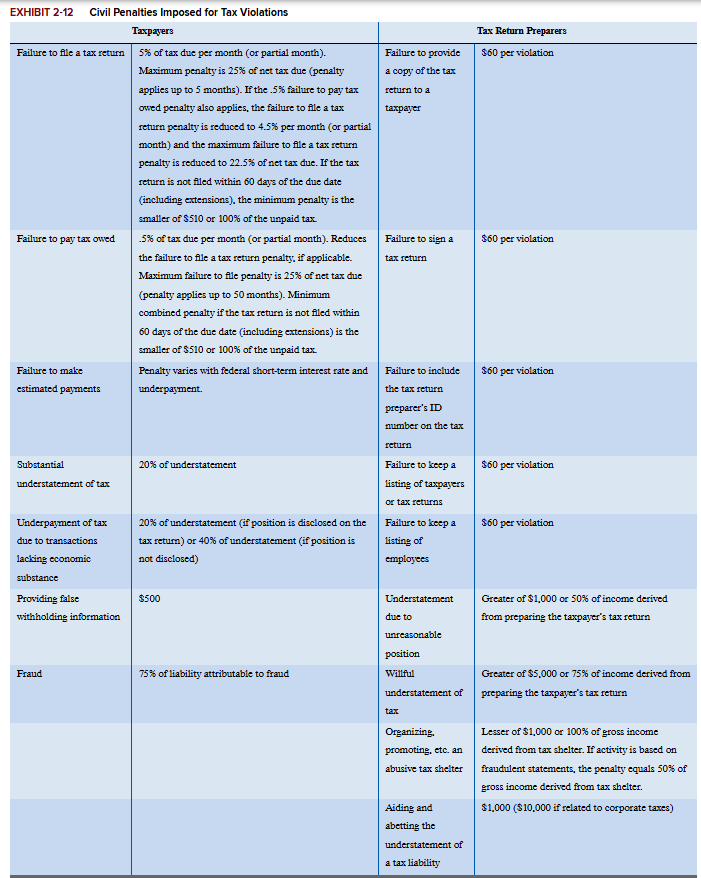

.5 failure to pay taxes owed, 5% when you don’t file

Equity

How tax burden should be distributed across taxpayers

Circular 230

Provides regulations governing tax practice, and applies to all persons practicing before the IRS.

%6.2

Oasdi/Social security tax rate

%12.4

Self employed tex rate

%1.45

Medicare tax rate for employees and employers

%2.9

Medicare tax rate for self employed

Open Facts

Which type of fact is more advantageous?

Progressive

U.S Tax system is what type of tax structure

Revenue Rulings

Less authoritative weight, but they provide a much more detailed interpretation of the code

Revenue Procedures

Explaining in great detail IRS practice and procedures in administering tax law.