Investments Exam 1 Vocab

1/44

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

45 Terms

Fixed income securities

specific cash flow payments made over a specific period

Derivatice Securities

securities providing payments made depending on other assets

Equity securities

an ownership share of the corporation

Money Markets

involves the purchase and sale of large volumes of very short-term debt products, such as overnight reserves or commercial paper

Capital markets

financial markets that bring buyers and sellers together to trade stocks, bonds, currencies, and other financial assets.

Asset allocation

allocation of investment portfolios across broad spectrum of assets classes

Security Selection

choice in specific securities made in asset class

Efficient markets

refers to the degree to which market prices reflect all available, relevant information. If markets are efficient, then all information is already incorporated into prices, and so there is no way to "beat" the market because there are no undervalued or overvalued securities available.

Primary Markets

new securities issued for cash often through investments

Secondary markets

market for existing agents

Tranches

segments created from a pool of securities—usually debt instruments such as bonds or mortgages—that are divvied up by risk, time to maturity

Banker’s acceptance

a short-term issuance by a bank that guarantees payment at a later time

Euro-dollars

dollar-denominated deposits at a foreign bank or foreign branch of an American bank

SOFR

a benchmark interest rate of dollar-denominated derivatives or loans replacing LIBOR

Treasury Inflation Protected Securities (TIPS)

a type of treasury security issued by the U.S. government that protects investors’ purchasing power (in case of decline)

Agency Issues

conflict between managers and stockholders

Municipal bonds

a tax-exempt bond issued by a state or local government

American Depository Receipts (ADRs)

a negotiable certificate issued by U.S. depository banks that represents the number of shares of a foreign company’s stock

Market Index

index return equals weighted average of return of each security

Call Option

an option to buy assets at an agreed price on or before a particular date. are appealing because they can appreciate quickly on a small move up in the stock price.

Futures Contract

obliges traders to purchase or sell their assets at an agreed-upon price at a specific future date

Name a Market Index and tell what it is

S&P 500 index is a market capitalization index of 500 leading publicly traded companies in the U.S.; market capitalization of companies is adjusted according to the number of stocks available

Initial Public Offering (IPO)

The first sale made when a private company goes public

Shelf Registration (SEC Rule 415)

securities preregistered, offered within 2 years, 24 hour notice, introduced in 1982

Market Order

execute immediately at best price

Price Contingent orders

a limit order to buy or sell a security at a specified price or better. allow a trader to implement a strategy, or multiple positions, once the initial event occurs.

Dealer’s market

traders specialize in particular assets to buy and sell for their own accounts

Designated Market maker

a market maker designated by the exchange to commit its own capital to provide quotes and help maintain a “fair and orderly market” by trading from its own inventory of shares

Buying on Margin

sale of a security with money borrowed in part by a broker

Margin Call

notification from broker that additional funds or liquidated position are needed

Short Sale

occurs when you sell stock you do not own but borrowed through a broker. Investors who sell short believe the price of the stock will fall. If the price drops, you can buy the stock at the lower price and make a profit. If the price of the stock rises and you buy it back later at the higher price, you will incur a loss.

Insider Trading

trading done when based on nonpublic knowledge about the firm

Dark Pools

electronic trading networks when participants anonymously buy or sell large securities. Facilitates block trading by institutional investors who did not wish to impact the markets with their large orders and obtain adverse prices for their trades.

Gross Domestic Product (GDP)

the total monetary or market value of all the finished goods and services produced within a country's borders in a specific time period. Measures total income or total expenditure.

Unemployment Rate

The number of people who are unemployed in the labor market that are actively seeking a job

Inflation rate

the rate at which prices increases in a period of time

Interest rates

the amount charged on top of the principal by a lender to a borrower for the use of assets.

Federal Budget Deficit

when the government spends more than it receives in revenues

Business Cycle

The cycle of when the business expands and contracts

Fiscal policy

the use of government spending and taxing that influences the economy. Two major examples of expansionary fiscal policy are tax cuts and increased government spending. Both of these policies are intended to increase aggregate demand while contributing to deficits or drawing down budget surpluses.

Monetary Policy

comprises the Federal Reserve's actions and communications to promote maximum employment, stable prices, and moderate long-term interest rates

Leading/Lagging indicators

indicators that help business predict the future outcomes or lagging indicators in which you look at past outcomes

Industry Life Cycle

the life cycle when the industry experiences growth or decline of growth. Five stages: development, expansion, growth, maturity, decline

Supply side policy

measures governments take to increase the availability or affordability of goods and services

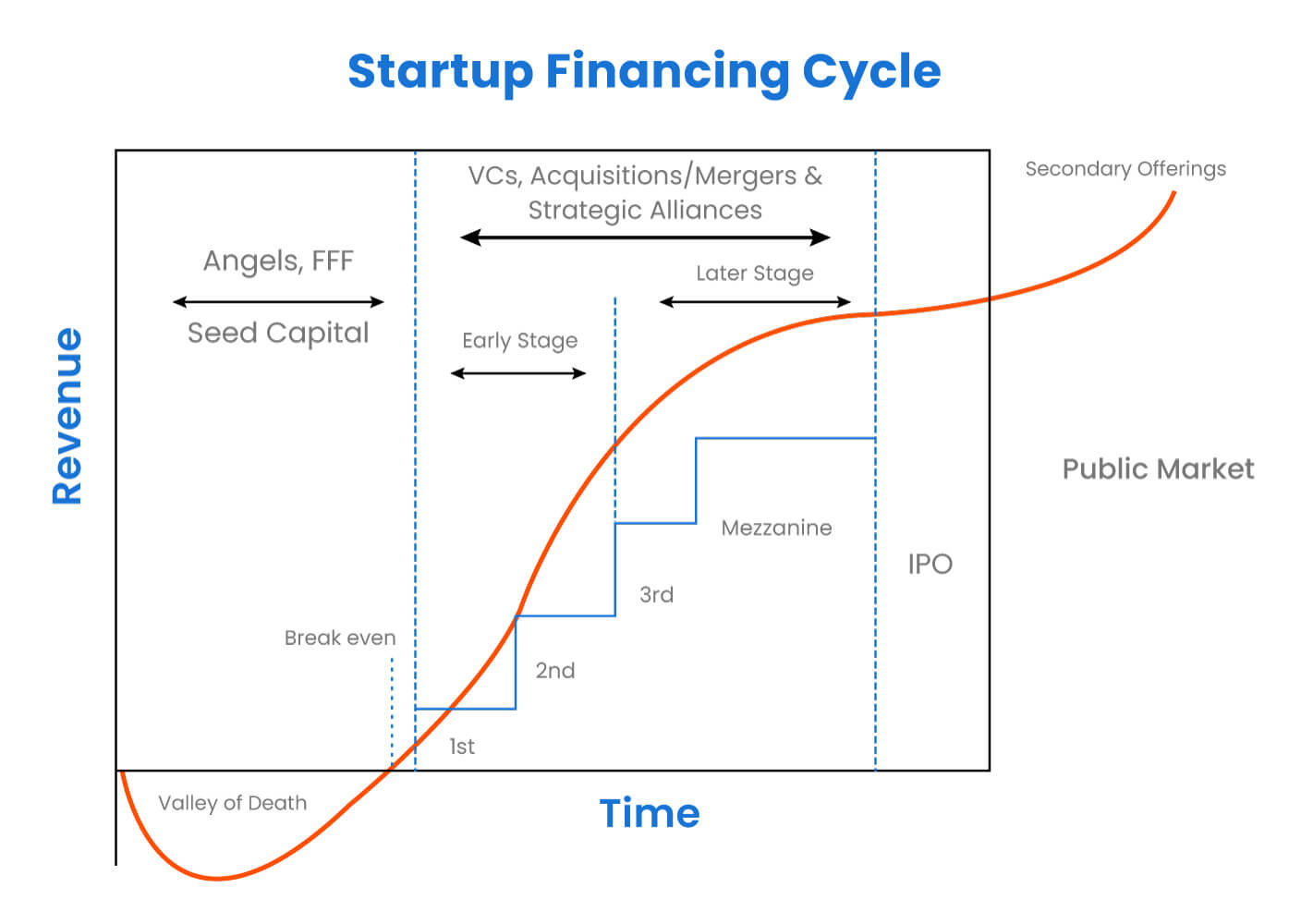

Startup financing cycle