PRICE LEADERSHIP and COLLUSION/CARTELS

1/11

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

12 Terms

explain price leadership

firms set their own prices and move sequentially

the leader sets a price and the follower acts as a price taker

the leader may be dominant as it has lower costs and can win a price war

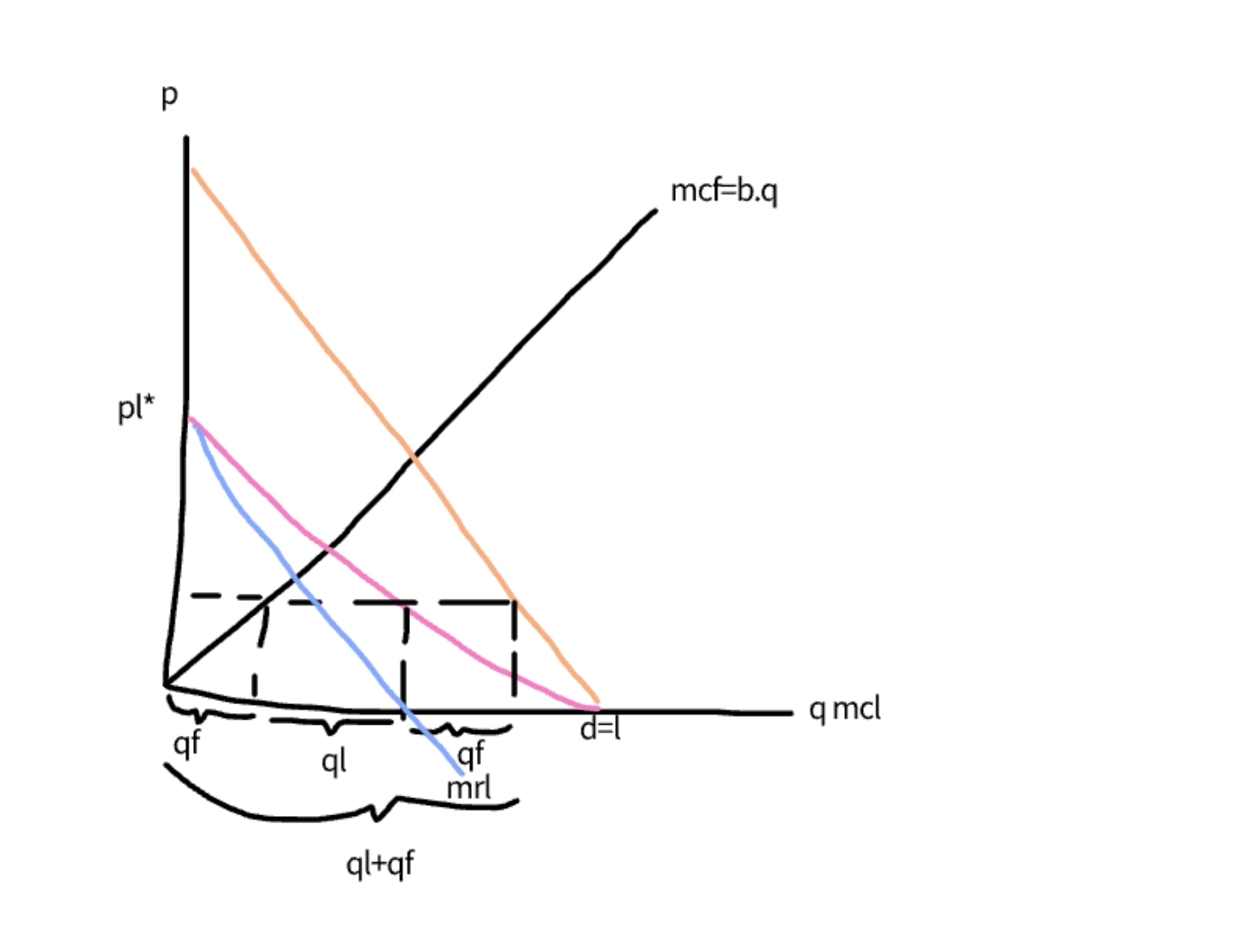

price leadership equilibirum

the leader is dominant as it has lower labour costs MCL=0 and MCF=1q>0

we solve via backwards induction

the follower takes the price set by the leader and sets P=MCf as MCf=P-MCf

to set a price L needs to work out the reaction of the follower for any price that it sets

the leader takes away this supply of the follower to find the leaders demand curve, this is the market demand-the reaction of the follower

the leader takes the leader demand curve and maximisises its profits where MC=MR this gives us the output of the leader and tells us the price itll set

once we have the price we work out how much the follower will supply

this adds on and gives us the market demand cirve

what is collusion in oligopolies

oligopolies jointly produce more then monopolies output there is an incentive to collude

this is a cartel

these are feasible and illegal and tacit

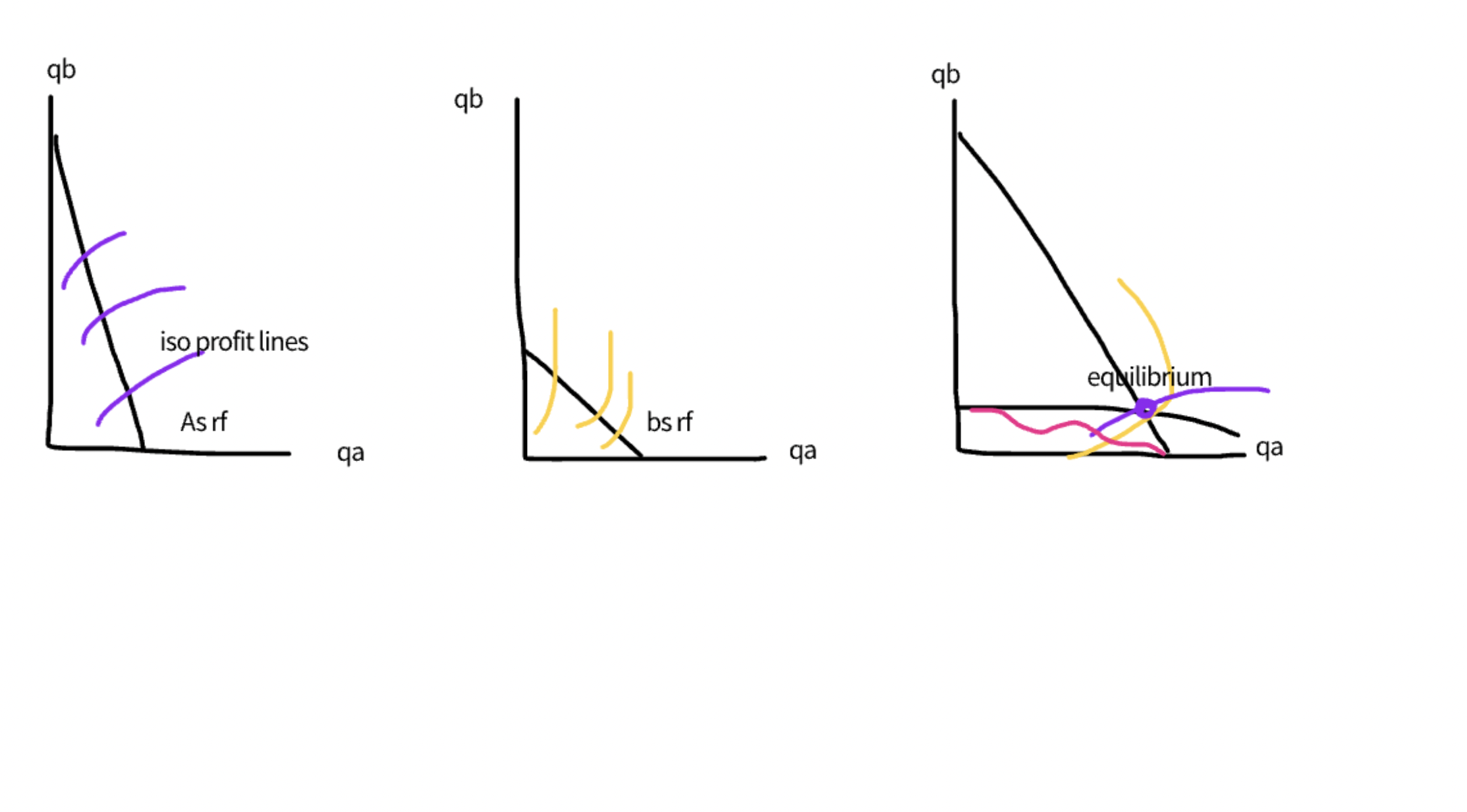

why is there incentive to collude in the cournot model

as theyll be on a higher iso profit line compared to their cournot equilibrium

to maximise the industry prift it is necessary that their iso profit lines are tangential

both firms must be better off under the agreement this may lead to side payments

what are the types of carteld

joint profit maximisation

market sharing agreement

price fixing in competitive tenders

these are investigated in the UK by the CMA

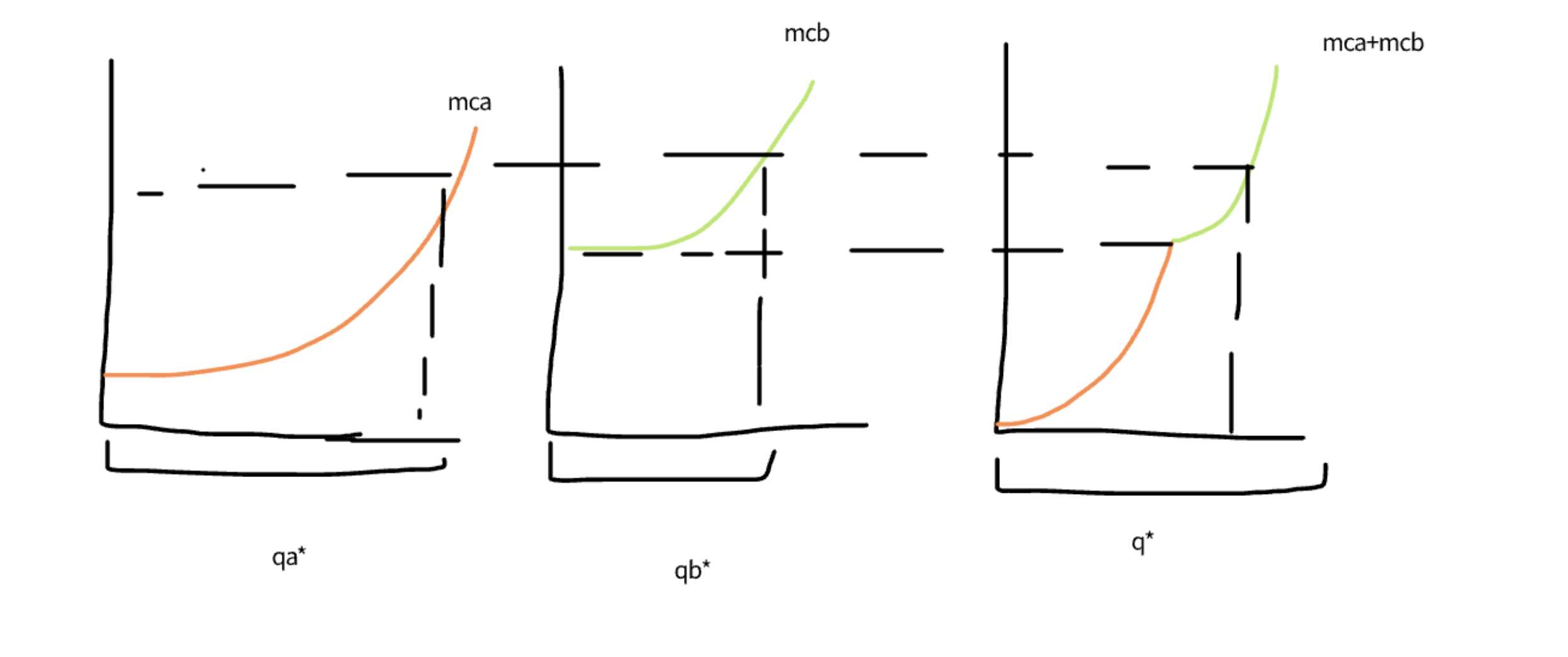

explain JPM

this is where firsm behave as a multiplant monopolist

they profit maximise where MR=MCA=MCB

there is formula for a share out side payment

this generates the same total otuput and price as a monopoly

this is formed by summing our MC curves horizontally

why is there an incentive to cheat in a cartel

cartels are unstable and at least one firm has an incentive to cheat on the agreement as collusion takes firms off their reaction functions

that is that the co-operative equilibrium isnt a nash equilibrium this relates to our prisioners dilemma

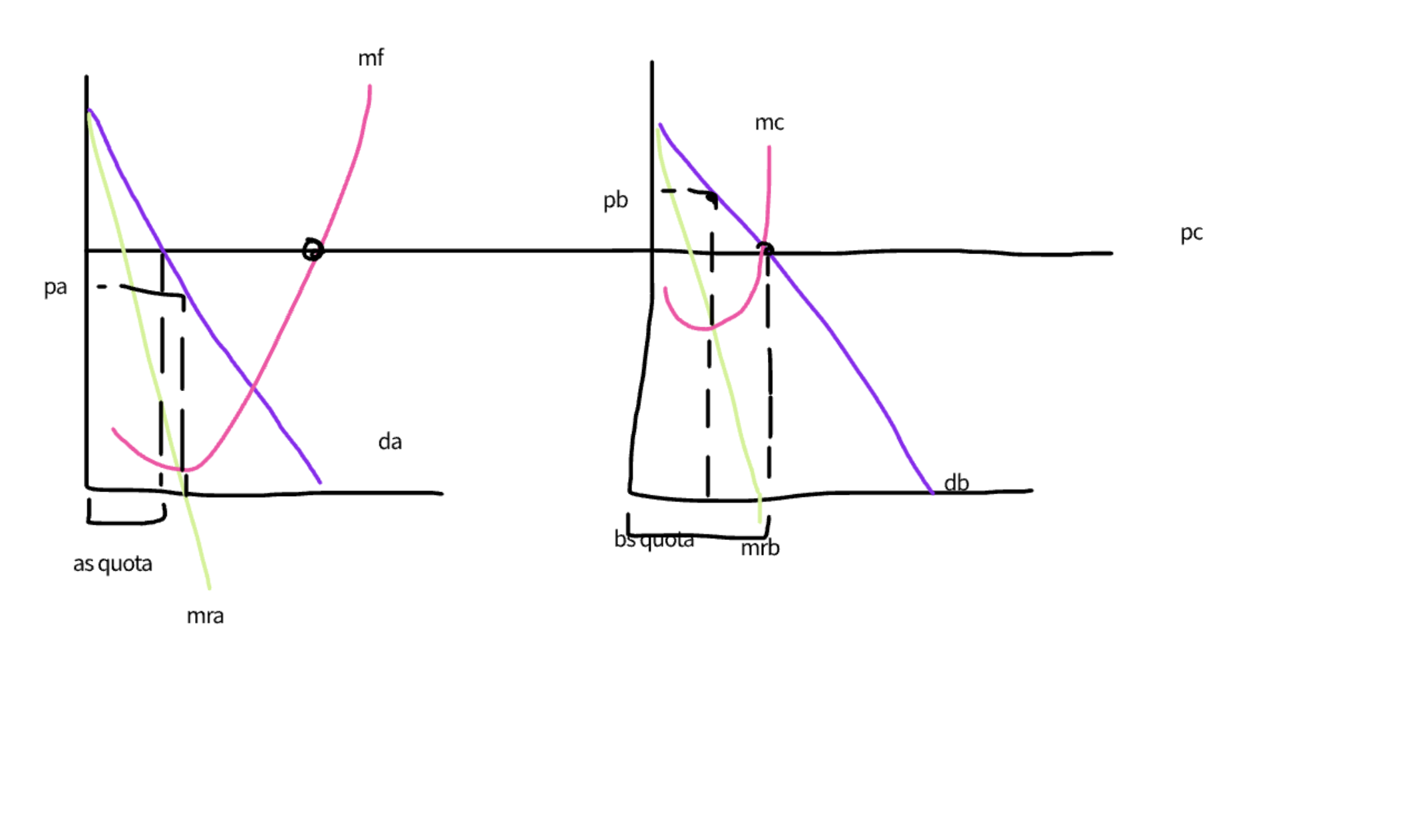

explain the market sharing agreemnet

there agreements operate geographically

the firms divide the market up and agree on a common price then produce according to their quotas

Da and Db represent the demand curves from dividing up the market

if they collude they agree on PC and produce Da and DB

costs in A are low and B are high

to maximise profits we produce at QA QB and PA PB when firms operate independantly and compete the price in B is greater then the price in A

if they collude they use PC this lies between pa and pb and depends on their bargining strength

they produce to support a and bs quotas

why is there incentive to cheat in the market sharing agreement

as we have perfectly elastic demand curves

both firms are thus price takers

pa has incentive to cheat as itll try sell units beyond the point as the P is above the MC

b will also have an incentive to cheat to rise their output above the quota

explain the stability of cartels

if a firm cheats it expands its output but the market price falls

this can be detectable and punishable

what are non price competition for cartels

sell at a higher quality

brand product to encourage loyalty

what is secret price competition

offer rebates that arent observes

set up a subsidary