FT8

1/25

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

26 Terms

common stocks with no growth in dividends.

In terms of valuation, preferred stocks are most similar to…

negative side effects

Whenever a new product competes against a company's already existing products and reduces the sales of those products, _____ occur.

As a positive cash flow (or cash inflow) in the year the asset is disposed of.

How would the salvage value be treated in a capital budgeting analysis?

Project Y has a lower profitability index than Project X

A firm is evaluating two mutually exclusive projects of the same risk class, Project X and Project Y. Both have the same initial cash outlay and both have positive NPVs. Which of the following is a sufficient reason to choose Project X over Project Y?

Dividing the payment by the interest rate.

The present value of a perpetuity can be determined by…

A sole proprietorship

In which of the following organization would agency problems be least likely to occur?

decrease of net cash flow

An increase of $100,000 in inventory would result in a(n)

One of the disadvantages of the sole proprietorship form of organization is that there is unlimited liability

Which of the following statements is most correct?

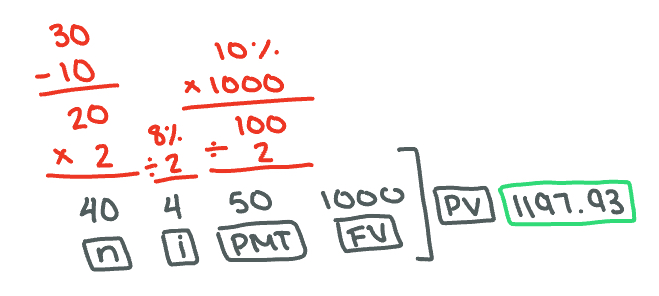

$1,197.93

Braxton Ltd issued a 30-year 10% coupon bond ten years ago. Braxton bonds have a maturity (face) value of $1,000 and make semiannual interest payments. If investors require an 8% nominal annual return (i.e., yield to maturity) on bonds with the same risk rating as Braxton, at what price should the bonds be selling for currently?

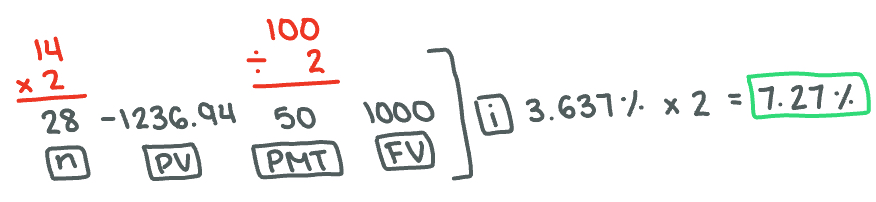

7.27%

The market price of a bond is $1,236.94, it has 14 years to maturity, a $1,000 face value, and pays an annual coupon of $100 in semiannual installments. What is the yield to maturity?

6.50%

The market price of a bond is $1,119.90; it has 4 years to maturity, a $1,000 par value, and pays a coupon of $100 every year. What is the yield to maturity? (assume the coupons are paid annually).

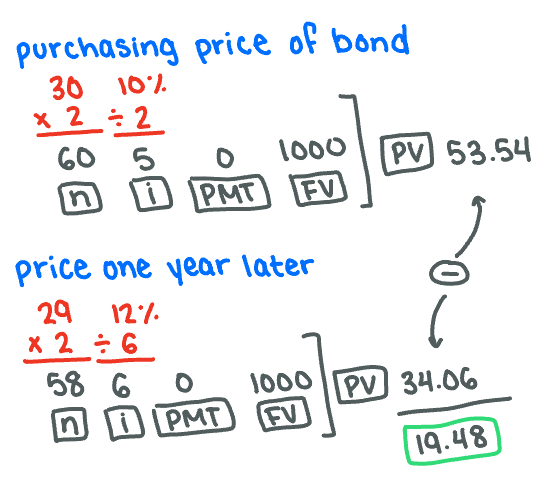

About $19.48

How much would an investor lose if she purchased a 30-year zero-coupon bond with a $1,000 par value and 10% yield to maturity, only to see market interest rates increase to 12% 1 year later? (Hint: How much would the price change from a year earlier?)

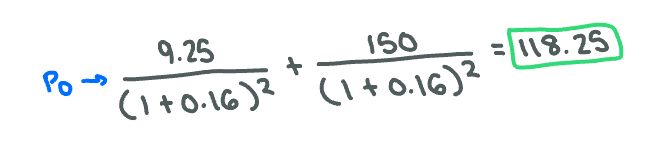

$118.35

Assume that you plan to buy a share of XYZ stock today and to hold it for 2 years. Your expectations are that you will not receive a dividend at the end of Year 1, but you will receive a dividend of $9.25 at the end of Year 2. In addition, you expect to sell the stock for $150 at the end of Year 2. If your expected rate of return is 16 percent, how much should you be willing to pay for this stock today?

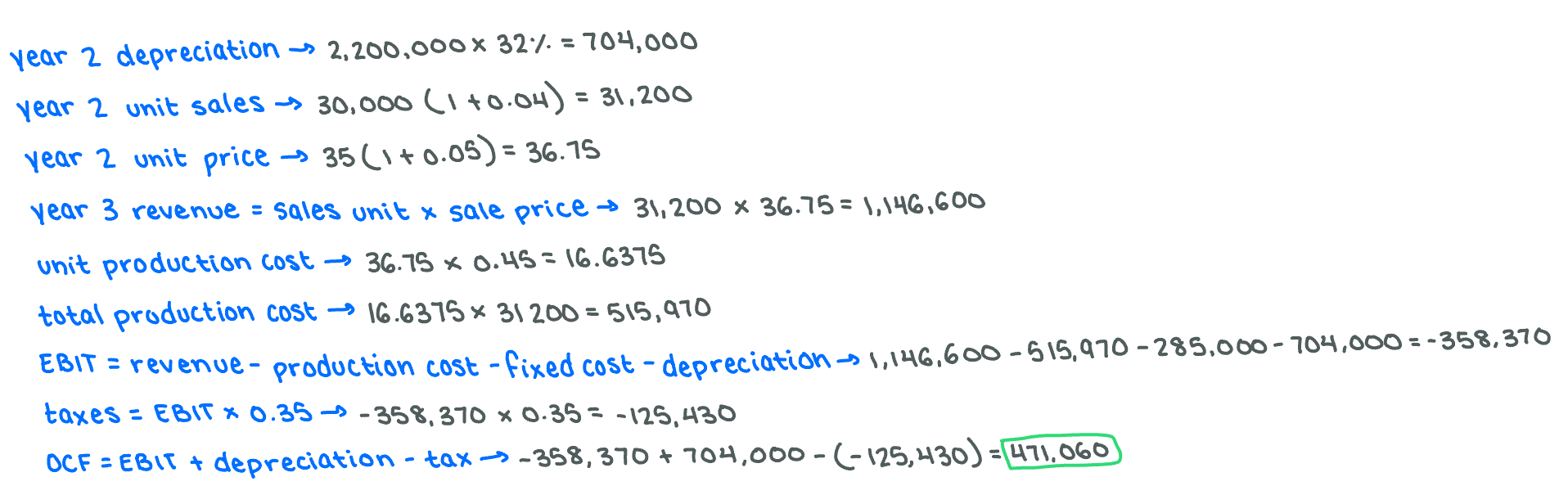

$471,060

Balik Ventures is looking at a project with the following forecasts:

the sales price per unit is $35.00 and will grow at 5% per year.

first-year sales quantity of 30,000 with an annual growth rate of 4% over the next 5 years

The unit production costs are expected to be 45% of the current year's sales price.

The manufacturing equipment to aid this project will have a total cost (including installation) of $2,200,000.

It will be depreciated using MACRS and has a five-year MACRS life classification (20% in year 1, 32% in year 2, 19.20% in year 3, 11.52% in year 4, 11.52% in year 5, and 5.76% in year 6).

Fixed costs are $285,000 per year. The firm has a tax rate of 35%.

What is the operating cash flow for this project in year 2?

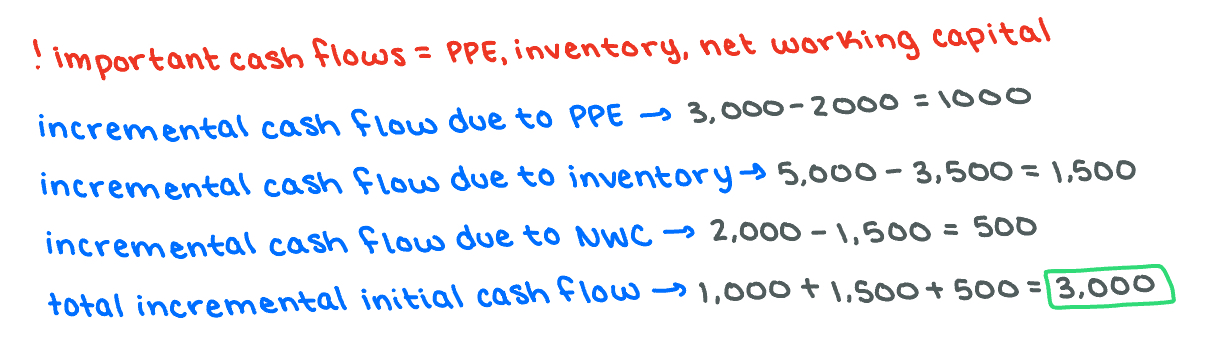

$3,000

You are considering a major expansion of your design-shoe business from the current one-shoe edition to two-shoe edition. To prepare for the business expansion, you attended a workshop recently to sharpen your business skill, costing $2,000. During the workshop, you made the following estimates.

If you decide to expand from one-shoe edition to two-shoe edition, what is the required initial cash outflow?

One-shoe edition | Two-shoe editions | |

Annual Revenues (year 1 to 5) | $20,000 | $35,000 |

Annual Expenses (year 1 to 5) | $7,000 | $10,000 |

Annual Depreciation Expenses (year 1 to 5) | Straight line | Straight line |

Plant, Property and Equipment required (year 0) | $2,000 | $3,000 |

Inventory required (year 0) | $3,500 | $5,000 |

Non-inventory Net Working Capital required (year 0) | $2,000 | $1,500 |

$10,000

Assume that a firm takes on a project that requires an initial investment in Year 0 of $20,000. Also assume that the project produces cash inflows of $1,800 in all future years (a perpetuity). If the required rate of return for this project is 6 percent, then what is the net present value for this project?

$42

The present value of $100 to be received 10 years from today, assuming an opportunity cost of capital of 9 percent, is (round to the nearest dollar)

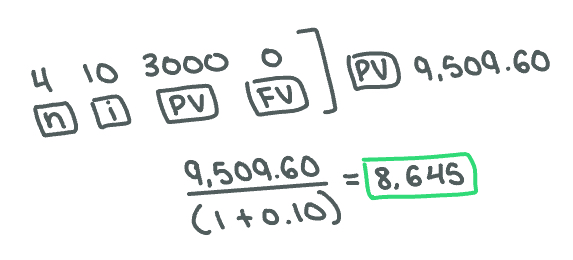

No; present value is $8,645.

A cash-strapped young professional offers to buy your car with four, equal annual payments of $3,000, beginning 2 years from today. Assuming you're indifferent to cash versus credit, that you can invest at 10%, and that you believe your car is worth $9,000 today, should you accept? (Round to the nearest dollar)

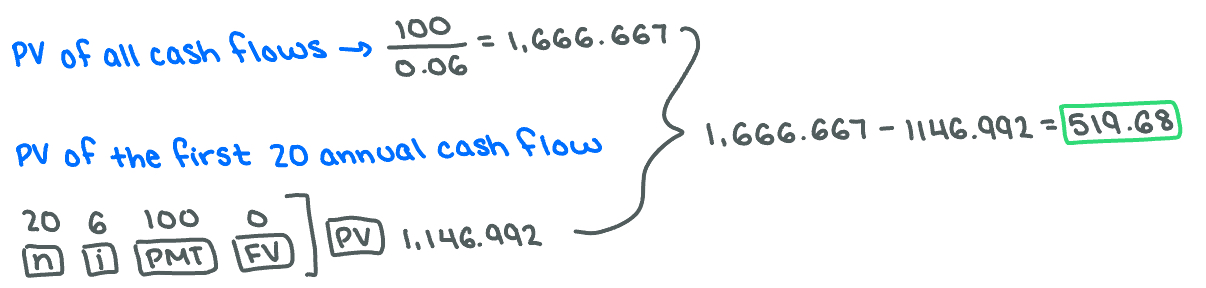

Yes, because the present value of the remaining cash flows is $519.68 and you are buying them for only $500.

Your neighbor owns a perpetuity of $100 per year that has a discount rate of 6% per year. He offers to sell to you all but the next 20 cash flows (the first to be received one year from today) for $500. In other words, he keeps the first 20 cash flows of his perpetuity and you get all of the rest. Is this a good price for you if the appropriate discount rate is 6%?

$17 million

A corporation declares $25 million in net income, $1 million in interest expenses, $1 million in preferred stock dividends, and $7 million in common stock dividends. By how much will shareholders' equity increase on the balance sheet?

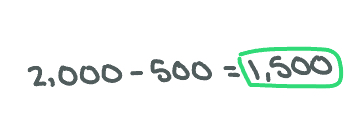

$1,500.

If a firm generates $2,000 in sales and has a $500 increase in accounts receivable during an accounting period, based on these two categories cash flow will increase by…

80%

The times interest earned ratio is 5.0. Based on this ratio, a creditor knows that EBIT must decline by more than _____ before the firm will be unable to cover its interest expense.

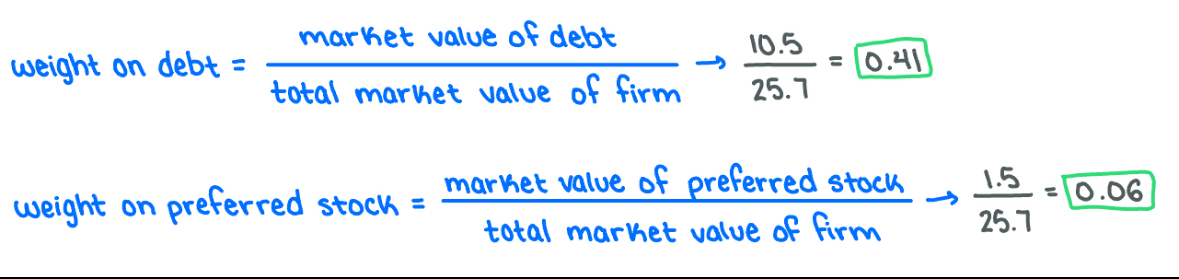

Weight on debt: 0.41; Weight on preferred stock: 0.06

Levenworth Industries has the following capital structure on December 31, 2006:

What are the weights on debt and preferred stock in the firm's capital structure?

security's beta measures its non-diversifiable (systematic, or market) risk relative to that of the market portfolio

Which of the following statement about equity beta is true?

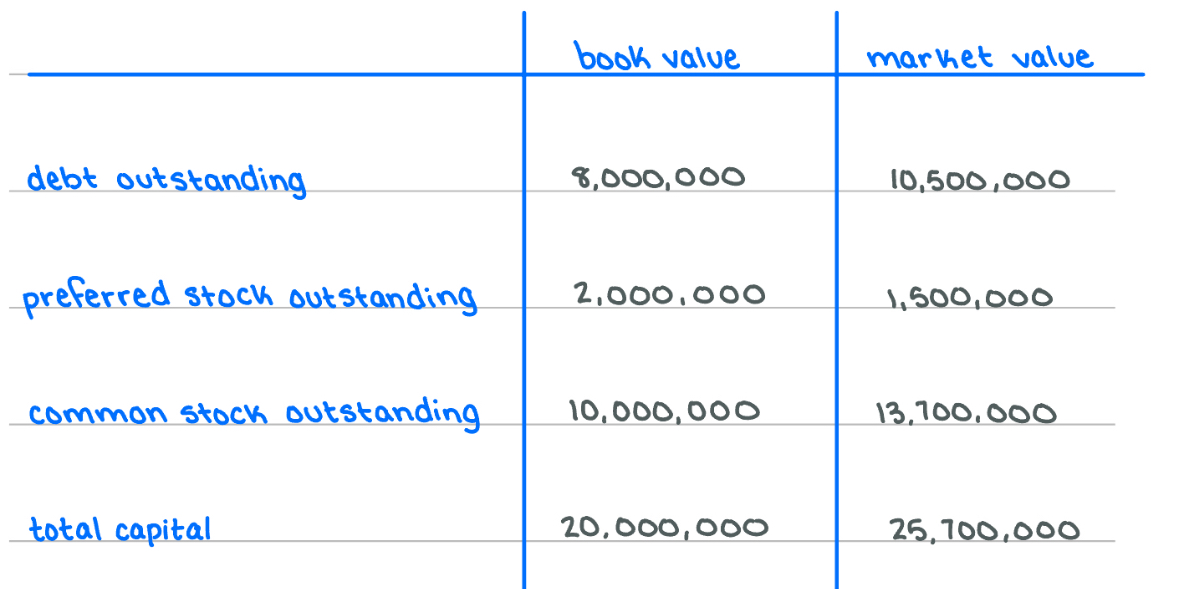

10.0%

Company A's stock has an estimated beta of 1.4, and its required rate of return is 13 percent. Company B's stock has a beta of 0.8, and the risk-free rate is 6 percent. Determine the required rate of return on Company B's stock.

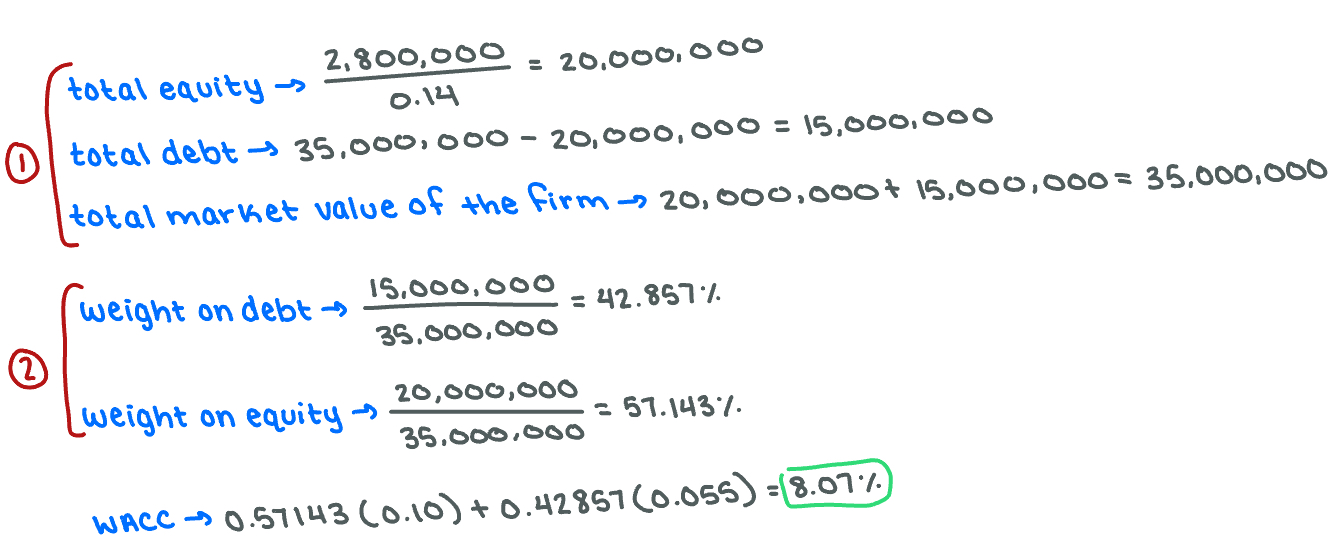

8.07%

Americas Inc., a glass manufacturer, reports a return on equity of 14% for the last year. The company's financial statements contain the following information: $35 million of total assets; $2.8 million of net income; an increase of $250,000 in net working capital from the previous year. The company's market-to-book ratio is 1.0. The after-tax cost of debt last year was 5.5% while the cost of equity was 10%. The market value of the company's debt equals its book value, and the company does not have other sources of financing except debt and equity. What is the company's weighted average cost of capital (WACC)?