Trusts

1/31

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

32 Terms

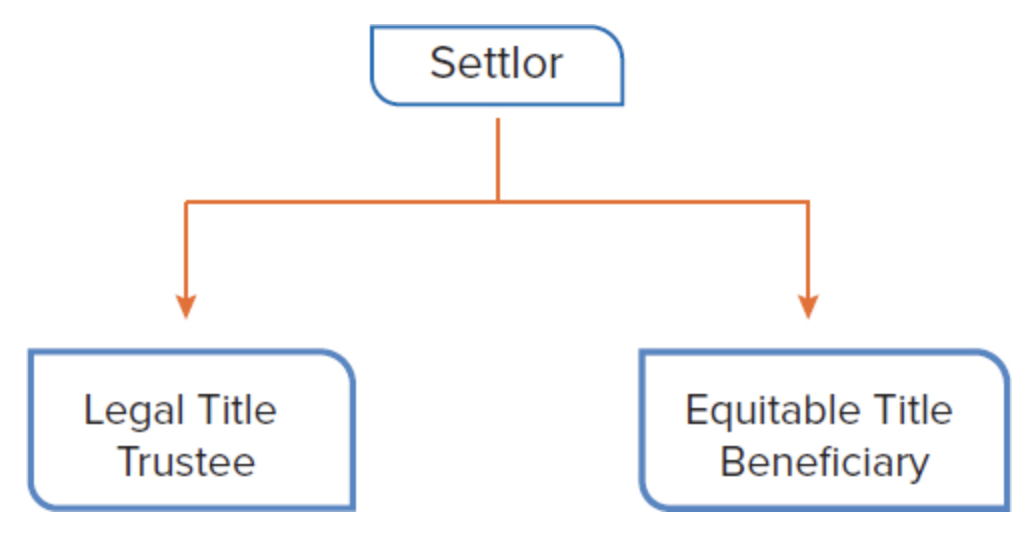

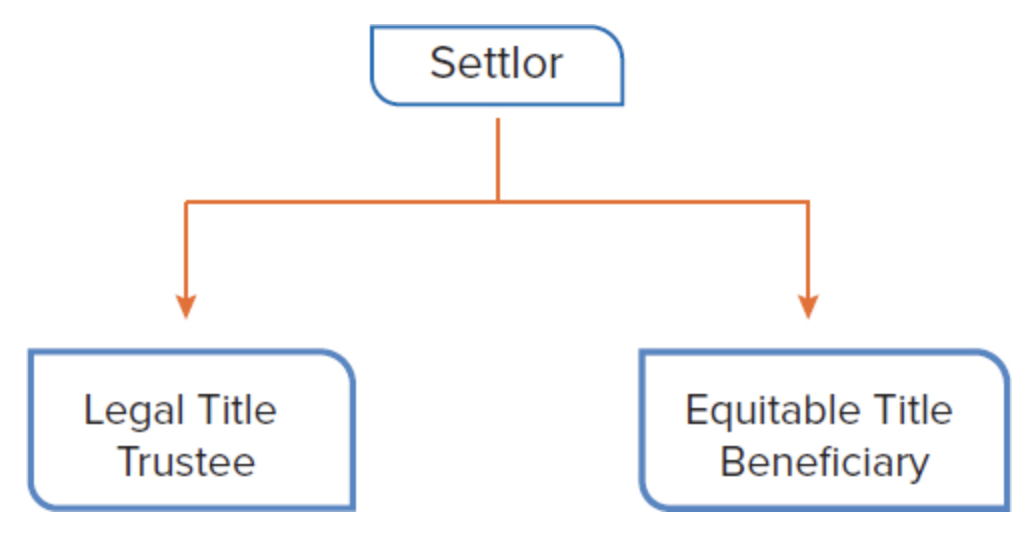

Trustee

Holds legal title

Owes fiduciary duties to beneficiaries

Duty of care and loyalty

Personally responsible if their conduct falls beneath required standards

Beneficiary

Holds equitable / beneficial title to property

Enforces fiduciary duties

Settlor

Creates the trust

May be called trustor, grantor, or donor

Trust Property Required

May be called principal, corpus, trust estate, or res

Purposes and Uses of Trusts

Protect and provide for beneficiaries

Flexibility of Asset Distribution

Protection Against Settlor’s Incompetence

Professional Management of Property

Probate Avoidance

Tax Benefits

Basic Classifications of Trusts

Express Trust

Trust created through express intent of settlor

Private → private beneficiaries

Charitable → charitable beneficiaries

Trusts created by Operation of Law

Resulting Trust

Attempt to carry out settlor’s intent

Constructive Trust

Equitable remedy

Trusts Validity

Trust not stated to be valid → ALWAYS start here

Requirements

Intent

Identifiable corpus

Ascertainable beneficiaries

Proper purpose

Trustee

Mechanics and formalities

Trusts Validity

Requirements

Intent

2 Types

Intent to split legal and equitable title

Intent to impose enforceable duties on holder of legal title

Issues

Settlor Must Have Capacity

Capacity required to create an inter vivos trust → same as to make an inter vivos gift

Capacity to make a testamentary trust → same as that required to make a will

Intent may be manifested by written or spoken words or by the conduct of the settlor

Unless the Statute of Wills or the Statute of Frauds applies

No formal words required

Communication of intent to the beneficiaries is not necessary

Settler must have present intent to create trust

Promise to create trust in future is unenforceable unless there is binding contract

Once an outright transfer of property occurs, it is too late for the alleged settlor to go back and claim the transfer was really one in trust

Precatory Language: expression of hope, wish, or suggestion

Generally doesn’t create trust

Trusts Validity

Requirements

Intent

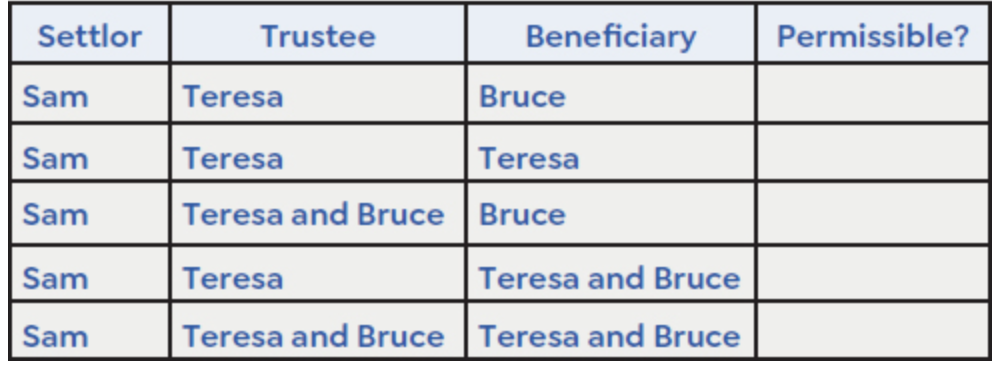

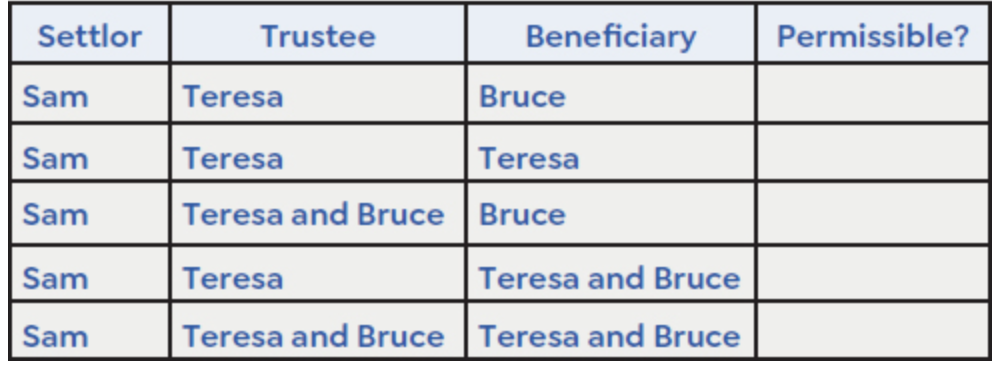

Split of Title

Any split of title into legal and equitable portions is permissible if the same person doesn’t own all the legal and equitable title

Sole trustee and sole beneficiary are the same person → equitable and legal title merges → trust terminates

Example:

Yes

No

Yes

Yes

Trusts Validity

Requirements

Identifiable corpus

Property must be ascertainable with certainty

Any property the settlor can transfer can be held in trust

Property settlor can’t transfer or doesn’t yet own can’t be trust property

Must be separated from other property

But it can be a portion of specific property

Trusts Validity

Requirements

Ascertainable beneficiaries

Qualified Beneficiary: beneficiary who is current or first line remainder beneficiary

Any person or entity capable of taking and holding title to property

Need not be competent

May disclaim interest if they haven’t accepted any benefits

Anti-Lapse Statutes

Some States → apply to interest in trusts

If requirements are met, trust interest will go to predeceased beneficiary’s descendants

Final Divorce

Revokes all trust provisions in favor of ex-spouse

Class Gifts

Beneficiaries may be unascertainable when trust created

But must be ascertainable when property is to be distributed

Settler may allow trustee or third party to select which class members receive benefits

Failure to exercise the power gives rise to a resulting trust in favor of the settlor or their successors

Trusts Validity

Requirements

Proper purpose

Any purpose that is not

Illegal

Against public policy

Impossible to achieve

Intended to defraud the settlor’s creditors or based on illegal consideration

Doesn’t violate the Rule of Perpetuities

Trusts Validity

Requirements

Trustee

Trust will not fail for lack of trustee because court can appoint one

Acceptance of Trusteeship

Must sign trust instrument or written acceptance

If person starts acting like trustee, they will be deemed to have accepted

Must have real powers and duties

Compensation

Trust instrument can indicate compensation

If instrument is silent, trustee usually entitled to reasonable compensation

Removal

Grounds for removal include:

a serious breach of trust;

serious lack of cooperation among co-trustees;

unfitness, unwillingness, or persistent failure to administer; or

a substantial change in circumstances

Court has power to remove and appoint new one

Successor Trustee

all of the rights, powers, and privileges of the original trustee

subject to all of the original trustee’s duties, liabilities, and responsibilities

Trusts Validity

Requirements

Mechanics and formalities

Creation Methods

Inter Vivos Trust (Living Trust)

Declaration of Trust

Settlor and trustee are same person

Transfer or Conveyance in Trust

Settlor transfers legal title to someone else

Testamentary Trust (Created by Testator’s Will)

Secret Trust

Settlor agrees with will beneficiary that beneficiary will hold property in trust for someone else

Will does not state trust nature of gift

Courts allow trust beneficiary to present extrinsic evidence and seek constructive trust remedy

Semi-Secret Trust

Will makes gift in trust but fails to state beneficiary

Gift fails → trustee must give legal title back to settlor’s succession in interest (resulting trust)

Trusts Validity

Requirements

Mechanics and formalities

Requirement

Requirement: Convey the Property

Declaration of Trust

Personal Property → property segregated and identified

Real Property → deed land from settlor as individual to settlor as trustee

Conveyance in Trust

Real Property → deed land to trustee

Personal Property → physically deliver property to trustee

Pour Over Gift from Will to Trust

Will contains provision leaving property to inter vivos trust

Property governed by terms of trust → trust amendments govern poured-over property

Poured-over property can be initial trust funding if trust identified in will and trust executed before testator’s death

Trusts Validity

Requirements

Mechanics and formalities

Writing

But are there times when you can have a valid will without a writing?

Most states do not require a writing for a trust of personal property.

Oral trusts may be established only by clear and convincing evidence

If the holder of the legal title acts as if they are a trustee, part performance will preclude the Statute of Frauds defense

Transfer of Beneficiary’s Interest

General Rule: Interests freely transferable

Voluntary Transfers—Gifts and Sales

Involuntary Transfers—Creditors

Transfer of Beneficiary’s Interest

Discretionary Trust

Trustee determines how much beneficiary receives

Beneficiary has nothing to transfer until trustee decides to distribute money

So there is nothing for creditors to reach

Exception: claims for child or spousal support

Transfer of Beneficiary’s Interest

Spendthrift Provision

Characteristics

Beneficiary can’t transfer interest

Once the trustee pays the beneficiary, the beneficiary may transfer the property received

Creditors can’t attach beneficiary’s interest

Once the trustee pays the beneficiary, the creditors may reach the property

Limitations

Ineffective if settlor is beneficiary

Minority Rule: allow self-settled spendthrift trusts

Ineffective against certain claims such as child or spousal support

Transfer of Beneficiary’s Interest

Support Trusts

Use of trust property limited to beneficiary’s support

May be mandatory or discretionary

Impliedly spendthrift

Issues

Standard of support if not in instrument → lifestyle to which beneficiary accustomed

Creditors of the trustee cannot reach trust property to satisfy their claims

Have only a personal claim against the trustee

Modification and Termination of Trusts

General

Terminate automatically upon

the expiration of the term specified in the instrument OR

when all of the purposes of the trust have been accomplished or have become unlawful, contrary to public policy, or impossible to achieve

Duty Of Trustee Upon Termination

Trustee’s powers do not end immediately upon trust termination

May continue to exercise powers for a reasonable period of time necessary to wind up the affairs of the trust

Must then timely distribute trust property to the appropriate remainder beneficiaries

Modification and Termination of Trusts

Types

By express terms

By the settlor

May modify or revoke trust for any reason

Unless trust instrument expressly states it’s irrevocable

Some states → may revoke an irrevocable trust upon written consent of all living persons with vested or contingent interests

By the beneficiaries

With settlor’s consent → permitted

Without settlor’s consent → may if

All beneficiaries agree

Changes would not upset material trust purpose

Examples:

Support of beneficiary

Spendthrift provision

Payment at certain ages

Payment at certain dates

Discretionary trust

By operation of law

Property has been exhausted or if the legal and equitable titles have merged

By the court

Trust’s purpose accomplished, illegal, or impossible

Unanticipated circumstances

Value of trust too low

Some States → fix mistake if shown by clear and convincing evidence

By the trustee

Terminate uneconomic trust

Trust property is less than $50,000 and the amount is insufficient to justify the cost of administration

Combine or divide trusts

Powers of the Trustee

Sources of the Trustee’s Power

Express powers granted by settlor in trust instrument

Powers provided by state statute

Powers granted by court

Implied powers necessary or appropriate to carry out terms of trust

Examples:

Sell trust property (How else invest?)

Lease trust property (How else earn income?)

Incur reasonable expenses (How else carry out trust?)

Hire agents (How else carry out trust?)

Mortgage trust property (How else borrow money?)

Repair (How else keep trust property valuable?)

Joint Powers

Trustees can exercise power by majority decision

Types of Powers

Mandatory Power → trustee must exercise it

Discretionary Power → trustee may exercise power as trustee sees fit

Trustee liable only for abuse of discretion or failure to exercise discretion

No such thing as absolute discretion

Duties of the Trustee

Duty to Administer Trust

Duty to administer trust in good faith and in a prudent manner, according to its terms

Duty of Loyalty

Avoid self-dealing

Trustees cannot

Personally benefit from trust

Purchase property from trust

Sell own property to trust

Borrow from trust

Claim excessive compensation

Trustee’s good faith or fairness irrelevant

Duty to Report

Provide the qualified beneficiaries with the trustee’s name, address, and telephone number and

Respond to beneficiary requests for information about the trust’s administration and provide a copy of the trust instrument if requested; and

Furnish an annual accounting of the trust

Duty to Separate Trust Property and Keep Records

No Commingling

“Earmark” trust property by labeling it as trust, rather than individually owned, property

Duty to Enforce Claims and Defend Trust from Attack

Duty to Preserve Trust Property and Make It Productive

Investments

Prudent Investor Rule

Trustee must invest in same manner as prudent investor

Reasonable care, skill, and caution when investing and managing trust assets

Following phrases in a trust invoke the prudent investor rule:

“Prudent person rule”

“Prudent man rule”

“Legal investments”

What if the trustee has higher or lower skills?

Higher skills → duty to use those skills

Lower skills → must comply with prudent investor rule

Portfolio Approach: view investments together in context of entire trust portfolio and part of overall investment strategy

Factors considered in making investment decisions

Trust purposes

Economic conditions

Tax consequences

Role of each investment in portfolio

Income and appreciation

Other resources of beneficiaries

Need for liquidity, regularity of income, or preservation of capital

Asset’s special relationship to beneficiary

Must diversify investments

Unless trust purposes are better served without diversification

Duty to review trust property

Review of Conduct

Facts and circumstances existing at the time of the trustee’s decision or action

Loyalty and Impartiality

Must administer trust exclusively for beneficiary’s interest

Must act impartially and not favor one beneficiary over another

Delegation

May delegate investment and management functions

Protected from liability if acted prudently in

Selecting agent

Establishing scope and terms of delegation

Periodically reviewing agent’s actions

Liabilities of Trustee

Remedies

Damages Recoverable for Breach (Money Damages - Most Common)

Lost profits

Depreciation in value of trust property

Trustee’s profits from breach

Remedies for Self-Dealing

Affirm transaction if trust profitied

Set aside transaction if trust lost money

Trace profits from trustee

Removal of Trustee (Common Remedy)

Grounds

Incompetence

Unfit

Serious breach of duty

Serious conflict of interest

Insolvency

Extreme hostility between trustee and beneficiaries

Refusal to post bond

Refusal to account

Courts will consider the settlor’s intent

Liabilities of Trustee

Trustee Not Liable for Breach When:

Reasonably relied on terms of trust

Beneficiaries consented or ratified transaction

Settlor or instrument allowed conduct

Exculpatory clause relieves trustee from liability for breaches

Generally exculpate only negligent conduct

Liabilities of Trustee

Liability of Co-Trustees

Not liable for act of co-trustee if

trustee did not join in the action and exercised reasonable care in preventing the breach or compelling the co-trustees to redress it

Liabilities of Trustee

Trustee’s Liability to Third Parties

Contracts → trustee personally liable

But can avoid liability by contract provision or indicating role as trustee by signature

Trustee entitled to indemnification or reimbursement from trust

Tort → liable if personally at fault

Liability Of Third Parties To The Trust

Court can set aside transactions that are breaches of trust if

the property is not in the hands of a bona fide purchaser

Knowing participant in a breach of trust is liable for the resulting loss

Allocation Of Receipts And Expenses Between Income And Principal Accounts

Uniform Principal and Income Act

Describes how principal and income should be allocated

Settlor can alter rules

Trustee has adjustment power

Must consider many factors

Can’t be made if

Prohibited by trust instrument

Trustee is also beneficiary

It would cause adverse tax consequences

Allocation of Receipts

Principal

Money from selling asset

Eminent domain awards

Insurance proceeds if principal is destroyed

Stock dividend, stock split, or shares received because of reorganization

Sale of underproductive property

Income

Rent

Interest on trust investment

Cash stock dividend

Both

“Wasting assets” → 10% Income & 90% Principal

Allocation of Expenses

Principal

Capital gains tax

Extraordinary repairs and capital improvements

Income

Ordinary income tax

Ordinary repairs

Depreciation

Both

Trustee compensation and accounting expenses → 50% income & 50% Principal

Charitable Trust

Must have a purpose considered to benefit the public

Charitable purposes include:

The relief of poverty

The advancement of education or religion

The promotion of health

The accomplishment of government purposes (such as parks, museums, and playgrounds)

Settlor must be sufficiently altruistic in supplying benefits

May not be so narrow as to only benefit a few individuals whom the settlor wishes to aid personally

Just because some family members might be benefited does not keep the trust from being charitable.

Court can select a charitable purpose or beneficiary if none is specified in the trust instrument

So long as the selection is consistent with the settlor’s ascertainable intention

Cy Pres (“as near as possible”) Doctrine

If charitable purpose cannot be carried out, court may select alternate by ascertaining settlor’s primary purpose

Rule Against Perpetuities does not apply to charitable trusts

Enforcement

State AG enforces

Honorary Trust

No human beneficiaries and not for charitable purpose

Common example: trust to care for pet

Resulting Trust

Arise by implication from settlor’s conduct

Beneficiaries: settlor or settlor’s successors in interest if settlor has died

Purpose is to do what settlor would have done

Situations Giving Rise to Resulting Trust

Failure to create express trust

Express trust corpus and no provision for remainder

Purchase money resulting trust: supplier of purchase money gives money to seller who gives title to property to third party

Explanations why 3rd Party has title instead of purchaser

Gift

Law presumes gift when parties closely related

Loan

Purchase money resulting trust

Constructive Trust

Not a trust

But an equitable remedy to prevent unjust enrichment resulting from wrongful conduct

Must be requested as remedy in court action

Must show particular property was involved in improper conduct

Constructive Trustee’s Duty

Give legal title back to person who would have owned it but for wrongful conduct

Grounds to Impose

Fraud, duress, mistake, or breach of fiduciary duty

Homicide

In states that lack slayer statute

Abuse of confidential relationship

Can include attorney-client, doctor-patient, business partners, family relations, and friendships

Breach of promise