ECON1120 Prelim 2

1/45

Earn XP

Description and Tags

SPR2025

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

46 Terms

Nominal GDP

GDP measured in current dollars Current Price x Current Quantity

Real GDP

GDP measured in reference to a base year to account for overall price changes. Base Price x Current Quantity

GDP Deflator

A measure of price changes/inflation over time

Inflation Rate (GDP Deflator)

Real GDP Growth Rate

How much the value of all goods and services a country produces is growing over time, after removing the effects of inflation.

Nominal GDP Growth Rate

measures the percentage increase in a country's gross domestic product without adjusting for inflation

CPI (Consumer Price Index)

Price index using a basket

Inflation Rate (CPI)

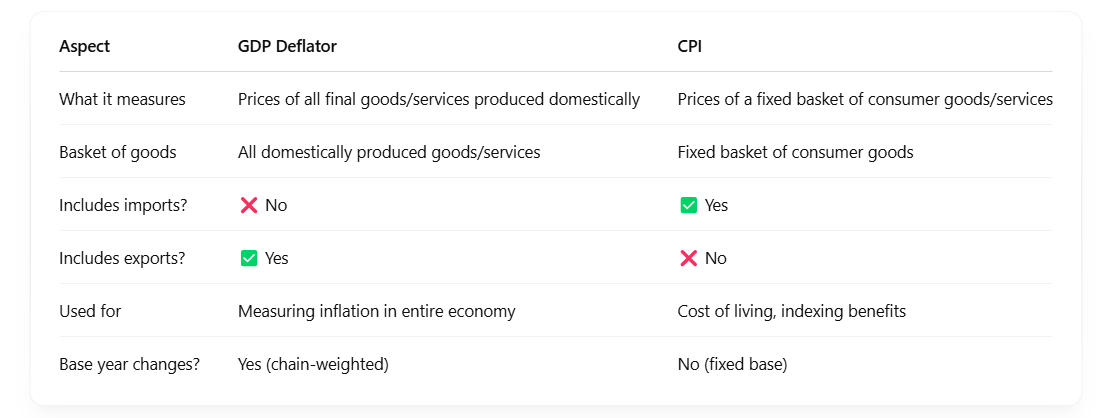

Difference CPI and GDP Deflator for Inflation

CPI overestimates (doesn’t account for substitution of basket goods), GDP Deflator underestimates (averages all goods and services, including ones with slower price increases like tech)

Chain-weight Procedure

A method used to measure GDP by calculating growth rates in successive years and averaging them.

Unemployment Rate

Labor Force Participation Rate

Frictional Unemployment

Unemployment that occurs due to the normal workings of the labor market, often short-term. Example, new grads

Structural Unemployment

Unemployment resulting from changes in the economy's structure, leading to job loss in specific industries. Ex. AI replacing jobs

Cyclical Unemployment

Unemployment that arises from recessions or economic downturns, created by swings of the business cycles

Natural Part of Unemployment

Structural + Frictional = (usually around 4-6%)

Aggregate Output/Expenditure Equation

Income Formula (Y)

Y (Income) = C + S (Consumption + Savings)

Desired vs Actual Investment (Id)

Desired/Planned investment: planned addition to inventory by a firm

Actual investment: actual amount of investment that takes place (unplanned changes in inventories)

Desired > Actual — Firms desire to invest but do not have ability (blocked by high interest rates or low profits)

Actual > Desired — Firms invest more than they want (didn’t sell as much product as they thought, etc.)

Income vs Desired Aggregate Expenditure

Marginal Propensity to Consume (MPC)

The fraction of additional income that households spend on consumption

Consumption Function

Co – autonomous consumption aka consumption @ Y = 0

c – MPC ∆C/∆Y

Yd – disposable income

Marginal Propensity to Save (MPS)

The fraction of additional income that is saved rather than spent. ∆S/∆Y

Savings Function

S = So + MPS(Yd)

So = - Co

Savings Function

S=−C0+(1−c)Y

Multipliers

How much total spending (or output) changes when there’s a change in initial spending.

Paradox of Thrift

When households save more/consume less, overall spending decreases so Y* decreases. Households end up consuming less, but they have not saved any more!

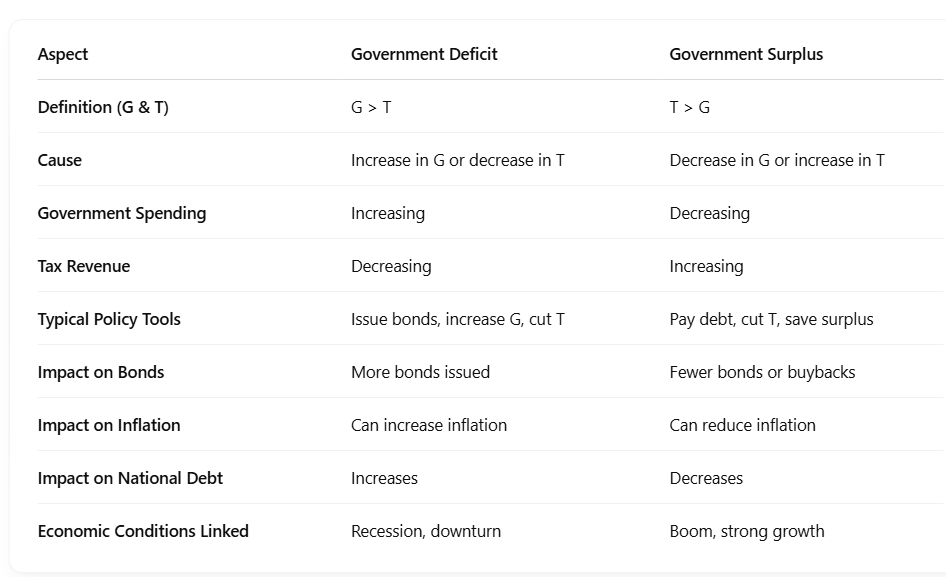

Government Budget Deficit

Fiscal Policy

Government policy concerning taxation and spending to influence the economy.

Monetary Policy

Actions taken by the Federal Reserve to manage the money supply.

Required reserve ratio: how much banks must keep in reserves

Discount rate: interest rate that Fed charges banks

Open Market Operations: buying and selling securities

IORB Interest on Reserve Balances: incentive to keep money at Fed (making interest on money at Fed)

Multiplier Effect

The proportional amount of increase in final income that results from an injection of spending.

∆Y* = multiplier x ∆variable (like investment or gov spending)

What is the Federal Reserve and its key roles?

Federal Reserve: US central bank

Board of Governors (7), Federal Reserve Banks (12), Federal Open Market Committee (set interest rate and money supply at the Open Desk Market in NY)

Fed’s Key Roles:

Monetary Policy: control money supply

Central Banking: banker’s bank

Banking Regulation

Ways the Fed Increase Money Supply (Expansionary Monetary Policy)

Decrease Required Reserve Ratio: banks can loan out more money

Decrease Discount Rate: more loans getting taken out

Discount rate: amount banks pay fed on a loan

Buy securities in Open Market Operations: giving money to bank (and therefore economy)

Decrease Interest on Reserve Balance: (reserve balance is money bank keeps at fed in a bank account). They are going to want to have money at their bank → so they’re loaning it out

Ways the Fed Can Decrease Money Supply (Contractionary Monetary Policy)

Increase Required Reserve Ratio: banks must keep more money

Increase Discount Rate: less loans, banks are less inclined to take a loan

Sell securities: bank gives fed money (not in economy anymore)

Increase Interest on Reserve Balance: bank’s want to keep money at fed (tied up).

Implication of open economy multiplier

Government in an economy with high m (spend a lot of income on import) has less control over fiscal policy (changing G does not change Y* as much).

Government Surplus vs Deficit

(parts of this chart are wrong — please review)

Commodity Money

Money that has intrinsic value, such as gold or silver.

Fiat Money

Currency that has value because the government maintains it and people have faith in its value.

M1 vs M2

M1: most liquid form of money — meaning it’s ready to spend right now

Demand Deposits (Checking account)

Cash

Savings deposits (Savings account)

M2: M1 plus near monies (not instantly accessible)

M1 + CDs (time deposits) + retail money market funds

What is not included:

US treasury bonds

Bank’s Balance Sheet

Assets: Cash on hand, loans, deposits in the Federal Reserve, securities (bonds), reserves

Things they own or what they are owed

Liabilities: Deposits

Things they must pay back

Bank’s Balance Sheet: Assets = Liabilities + Net Worth

Required Reserves + Required Reserve Ratio

Reserves: balances that a bank has deposited at its Federal Reserve bank plus the bank’s cash on hand

Required reserve ratio (rr): the percentage of total deposits at the bank that the bank must keep as reserves

Required Reserves = rr x demand deposits

Money Multiplier

Money Multiplier: how much money increases

∆MS = K$ x deposit

Present vs Face Value of a Bond

Face Value: stated value of bond

Present Value: market price of bond

Money Demand (what happens when r goes up and down?)

Speculation Motive for Money: people hold onto bonds during higher interest rates (lower present value) and sell during low interest rates (higher present value)

Money Demand Curve

Movement Along Md curve: change in r

Shift of Md curve: change in price level Y* and aggregate output

r > r* – market prices of bonds rise and interest rates fall

r* > r – market prices of bonds drop and interest rates rise

Potential GDP (YFE)

The maximum output of an economy when all resources are fully used but not overused.