Financial Markets, Instruments, and Institutions: A Comprehensive Overview

1/84

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

85 Terms

Financial market

A market in which financial assets (securities) such as stocks and bonds can be purchased or sold.

Liquid securities

Securities that can be easily liquidated without loss of value.

Illiquid securities

Securities that may require a large discount to attract buyers, making them difficult to find.

Treasury securities

Liquid securities due to their frequent issue by the Treasury, attracting numerous investors.

Debt securities

Represent debt (also called credit, or borrowed funds) incurred by the issuer.

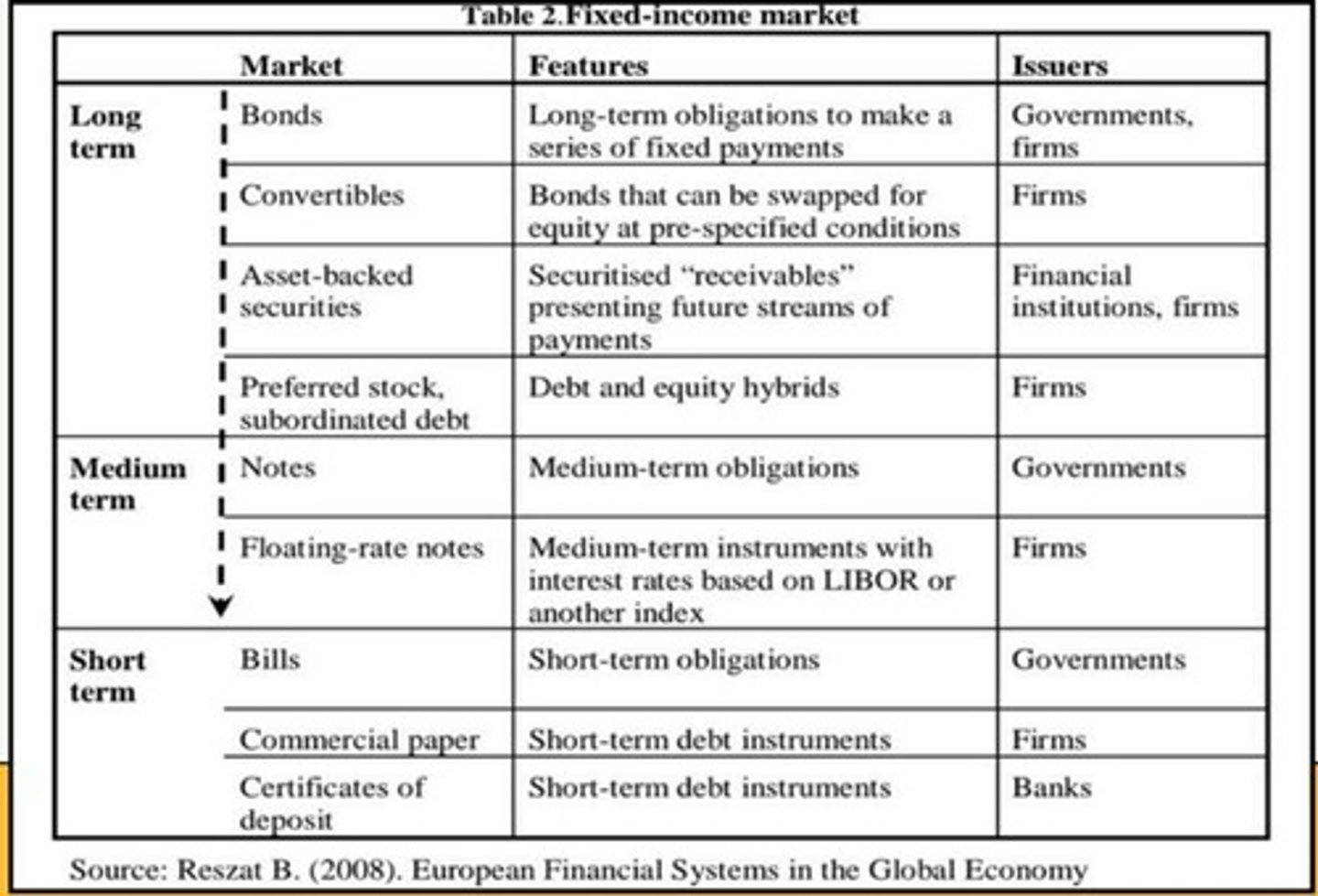

Money markets

Facilitate the sale of short-term debt securities by deficit units to surplus units.

Surplus Units

Participants who receive more money than they spend and provide their net savings to the financial markets.

Deficit Units

Participants who spend more money than they receive and access funds from financial markets.

Money market instruments

Low risk instruments that provide lower returns, reflecting their safety and liquidity.

Money market securities

Debt securities traded in the money market that have a maturity of one year or less.

Equity securities

Also called stocks, they represent equity or ownership in the firm.

Capital markets

Facilitate the sale of long-term securities by deficit units to surplus units.

Primary markets

Facilitate the issuance of new securities.

Capital market securities

The securities traded in the capital market.

Secondary markets

Facilitate the trading of existing securities, allowing for a change in ownership.

Bonds

Long-term debt securities issued by the Treasury, government agencies, and corporations.

Mortgages

Long-term debt obligations created to finance the purchase of real estate.

Subprime mortgages

Mortgages offered to borrowers who do not have sufficient income to qualify for prime mortgages.

Secondary Market

A market where investors can sell securities they purchased in the primary market before maturity.

Liquidity

A crucial characteristic of securities traded in secondary markets, allowing them to be easily bought or sold.

Commercial Mortgages

Long-term debt obligations created to finance the purchase of commercial property.

Mortgage-Backed Securities

Debt obligations representing claims on a package of mortgages.

Stocks (Equity Securities)

Represent partial ownership in corporations and serve as a long-term source of funds without maturity.

Derivative Securities

Financial contracts whose values are derived from the values of underlying assets, such as debt or equity securities.

Nondepository Financial Institutions

Institutions that generate funds from sources other than deposits and play a major role in financial intermediation.

Finance Companies

Obtain funds by issuing securities and lend them to individuals and small businesses.

Mutual Funds

Sell shares to surplus units and use the funds to purchase a portfolio of securities.

Speculation

The act of investing in derivative securities to speculate on underlying asset value movements without purchasing them.

Risk Management

Using derivative securities as a tool to adjust the risk of investments, potentially offsetting losses on bonds.

Behavioral Finance

The application of psychology to make financial decisions, explaining why markets are not always efficient.

Depository Institutions

Accept deposits from surplus units and provide credit to deficit units through loans and purchases of securities.

Commercial Banks

The most dominant depository institution, offering a variety of deposit accounts and transferring funds to deficit units.

Federal Funds Market

Facilitates the flow of funds between depository institutions, including banks.

Savings Institutions

Also known as thrift institutions, including savings and loan associations and savings banks, focusing on residential mortgage loans.

Credit Unions

Nonprofit institutions that restrict their business to credit union members.

Securities Firms

Perform various functions in financial markets, including acting as brokers, dealers, underwriting, and advising.

Brokers

Execute securities transactions, with fees reflected in the difference between bid and ask quotes.

Dealers

Maintain an inventory of securities and earn income from the performance of their portfolio.

Investment Banking

Services provided by securities firms, including underwriting and advising.

Advisory Services

Services provided by securities firms on mergers and corporate restructuring.

Insurance Companies

Companies that offer policies to reduce financial burdens from death, illness, and property damage, charging premiums and investing funds in stocks or bonds.

Pension Funds

Financial intermediaries that manage contributions from employees and employers to corporations and government agencies, providing a retirement savings method.

Systemic Risk

The spread of financial problems among financial institutions and across financial markets that could cause a collapse in the financial system.

Financial Institutions

Entities that accept savings and transfer them to those that need funds.

Financial Markets

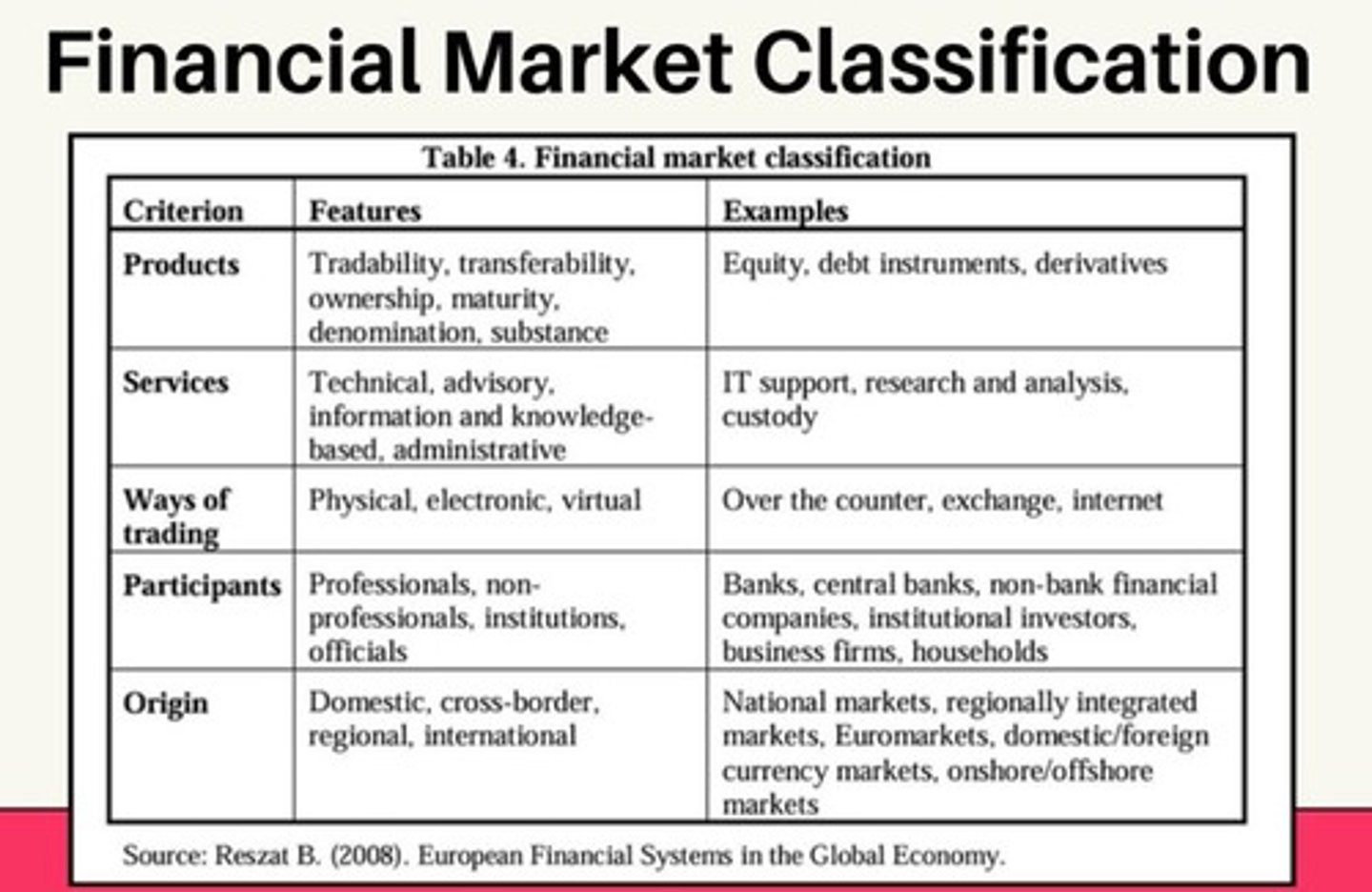

Organized forums in which suppliers and demanders of various types of funds can make transactions.

Private Placement

An unstructured nature of liquidity that provides an opportunity for investors to sell a financial instrument.

Transaction Costs

Costs charged and/or borne by financial market participants when trading a financial instrument.

Financial Instrument

Monetary contracts between parties that can be created, traded, modified, and settled.

Fixed Income Instrument

Debt investments, such as bonds and certificates of deposit, where the issuer promises to pay a fixed rate of interest and return the principal at a specified maturity date.

Individuals

Net suppliers of funds because they save more than they borrow.

Businesses

Net demanders of funds because they borrow more than they save.

Government

Net demanders of funds because they borrow more than they save.

Investment Banks

Institutions that assist companies in raising capital and advise firms on major transactions such as mergers or financial restructurings.

Glass-Steagall Act

An act of Congress in 1933 that created the federal deposit insurance program and separated the activities of commercial and investment banks.

Shadow Banking System

A group of institutions that engage in lending activities like traditional banks but do not accept deposits and are not subject to the same regulations.

Price Discovery

The process where transactions between buyers and sellers of financial instruments determine the price of the traded asset.

Information & Knowledge-Based Services

Services that provide data, research, and market analysis so investors can make informed decisions.

Administrative Services

Services that handle the record-keeping, settlement, and safekeeping of financial assets.

Physical Trading

Trading that happens face-to-face in a physical location.

Electronic Trading

Trading that happens through computerized systems or online platforms.

Virtual / Internet Trading

Trading that happens through the internet or apps, accessible to individual investors directly.

Equity Instrument

Represents ownership in a company.

Tradability

Easily tradable in stock exchanges.

Transferability

Can be transferred from one investor to another.

Maturity

No fixed maturity date; you own it as long as the company exists or until you sell.

Denomination

Usually in shares.

Substance

Ownership security.

Debt Instrument

A financial instrument representing a loan made by an investor to a borrower.

Professionals

People who are trained and licensed to work in financial markets.

Non-Professionals

Ordinary people or households who invest their own money.

Institutions

Large organizations that handle huge amounts of money.

Ownership in Debt Instruments

No ownership rights; you are a lender, not an owner.

Maturity in Debt Instruments

Has a fixed maturity date.

Substance in Debt Instruments

Borrowing/lending contract.

Derivatives

Contracts whose value is derived from another asset (stock, commodity, currency).

Domestic Markets

All transactions happen within one country.

Cross-Border Markets

Transactions that involve two countries.

Regional Markets

Markets that connect or integrate countries in a specific region.

International Markets

Trading happens on a global scale without borders.

Technical Services

Services that provide specialized knowledge and expertise to support the effective use, maintenance, and improvement of technology and technical systems.

Federal Deposit Insurance Corporation

An agency created by the Glass-Steagall Act that provides insurance for deposits at banks and monitors financial institutions to ensure their safety and soundness.

Gramm-Leach-Bliley Act

A law that allows business combinations—such as mergers—between commercial banks, investment banks, and insurance companies.

Securities Act of 1933

A law that regulates the sale of securities to the public through the primary market, ensuring transparency and investor protection during initial offerings.

Securities Exchange Act of 1934

A law that governs the trading of securities—such as stocks and bonds—in the secondary market, focusing on fair practices and disclosure requirements.

Securities and Exchange Commission

The primary government agency responsible for enforcing federal securities laws and overseeing the integrity of financial markets in the United States.