Theme 2 Quick notes

1/112

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

113 Terms

Economic influence definition

When a business is impacted in any way by economic factors

Effect on businesses of changes in inflation:

Cost of supplies and materials goes up

Businesses may need to increase prices

Businesses may lower profit margins

Effect on businesses of changes in exchange rates:

Appreciation means the pound is stronger and can buy more of other currencies - depreciation is the opposite.

When the pound is stronger (appreciation) businesses will find it harder to export UK made goods abroad as they will appear more expensive to other countries.

When the pound is strong UK businesses that import materials from abroad will have cheaper costs

SPICED - Strong Pound Imports Cheaper Exports Dearer

Effect on businesses of changes in interest rates:

If interest rates rise then the cost of borrowing will rise and this will mean that the cost of supplies for a business may increase

A fall in interest rates means that the cost of lending falls which may lead to an increase in profits (costs less to borrow so less to pay back)

Effect on businesses of changes in taxation and government spending:

Lower taxes can result in more demand in the economy and lead to higher output and employment

If taxes are high then UK businesses will have higher costs

This makes them less competitive in a global marketplace

It may also mean unemployment rates may rise as businesses have to lay off extra staff due to the reduction in demand

Less government spending will affect businesses that supply goods and services to public organisations (e.g. the NHS, farmers or care home providers)

Effect on businesses of changes in the business cycle:

Boom - Increased demand as increased work, lower unemployment and higher wages.

Recession - Falling demand as consumers are saving as interest rates go up. Businesses will typically make redundancies to lower costs as demand falls.

Slump - Lowest spending, little investment in businesses and higher wages levels of unemployment.

Recovery - Demand increases again as unemployment falls.

The effect of economic uncertainty on the business environment:

Risk of unemployment so consumers delay purchase of goods

Demand falls

Manufacturers are reluctant to expand and grow which reduces supply of goods and services.

The effect of consumer protection on businesses:

Businesses must not give false or misleading information about products.

Unhappy customers can get a refund or replacement.

Consider cost, reputation and profitability.

The effect of employee protection on businesses:

Consider cost, reputation and profitability.

Gives sick pay/maternity leave

Minimum wage

The effect of environmental protection on businesses:

Consider cost, reputation and profitability.

Controls pollution in terms of business waste that is disposed of in the air, on land and in the sea.

The effect of competition policy on businesses:

Consider cost, reputation and profitability.

The competition and markets authority stops things like businesses agreeing to set prices really high for all products of one type.

The CMA also investigates mergers that restrict competition - gives consumers the right to choose.

The effect of health and safety on businesses:

Consider cost, reputation and profitability.

Businesses must provide health and safety training

Businesses must make work environment safe and prevent accidents

Factors affecting competitiveness in a market:

Growth rate of market

Level of regulation (legislation)

Type of business ownership

The products/services produced

The nature of product range

Seasonality

Pricing and pricing strategies

Marketing methods used.

The impact of competition of businesses

Fall in prices

Increased costs of promotion

Improved efficiency

Increased innovation

Wider product ranges

Productivity definition

The output per input (person or machine) per hour

Production definition

The total amount of output that is produced in a time period

The methods of production:

Job

Batch

Flow

Cell

Job production definition

When one single product is made at a time (e.g. a cake) for a specific client. Products are high quality and the production process can be slow and labour intensive.

Advantages of job production:

Products are unique and personal to the customer - can charge premium price

Disadvantages of job production:

Skilled labour and craftsmen are expensive

Hard to speed up if demand increases

A wide range of tools may be required

Batch production definition

When standardised components can be made in relatively large quantities, but the system can be modified or adjusted to the specification, like changing the size, colour or features. (e.g. In a bakery, making similar cupcakes that may have different icing, but are still the same).

Advantages of batch production:

Can be changed to meet customer needs or fluctuations in demand.

Standard productions of items means machinery can be used.

Lower skilled workforce than job production → lower wages can be paid

Disadvantages of batch production:

Smaller batch’s carry average unit costs (EOS)

Workers may be less motivated with repetitive work

Flow production definition

Production that uses production lines with continuous movements of items through the process in assembly lines (e.g. toothpaste).

Advantages of flow production:

Products are made in large quantities so business can bulk buy raw materials and save money (EOS)

Disadvantages of flow production:

High costs for factory + machinery

Low motivation of staff as repetitive

Break downs and lost production can be costly

Very inflexible

Cell production definition

Dividing up a production line into separate self contained areas that are each responsible for a section of work (e.g. a car assembly line where one group makes the engine, one makes the interior etc.)

Advantages of cell production:

Wastage through movement of materials is reduced

Time waiting for stock to arrive is reduced

Bottlenecks in production process are reduced (where everything builds up waiting to go to the next stage)

Increased worker commitment and motivation

Disadvantages of cell production:

Any breakdown of machinery will stop production

Needs more staff to supervise than a continuous flow

Expanding can be hard as space may be limited

Factors affecting productivity:

Quality of inputs (workers, machines)

Having the right no. staff at peak times - stretched staff are demotivated by being overloaded

No. machines/staff - machines can work 24/7, staff can’t and become demotivated

The link between productivity and competitiveness:

To make a business more competitive, the business can produce more with the same levels of resources by:

Training staff

Introducing financial incentives

Maintaining machines

Improving working practices

This means that costs will be lowered so prices can be lowered, meaning:

You can undercut competitors’ prices

You can gain market share

You can improve your brand recognition

Profit is increased

You can invest in ways to improve productivity - this ends up reducing costs, making a cycle

Efficiency definition

Try to produce goods at the minimum unit or average cost

Factors influencing efficiency:

Standardisation of the production process

Relocation or downsizing

Investment in capital equipment

Organisational restructuring

Outsourcing

Adoption of lean production techniques

Distinction between labour and capital intensive production

Labour intensive means making products using mostly human effort, capital intensive means making products using mostly machines and equipment

Capacity utilisation calculation

Capacity utilisation = (Current output/Maximum possible output) *100

Implications of over-utilisation:

Can damage reputation of business

Can put too much strain on resources

Staff may do too much overtime and have accidents when tired

No time to maintain machinery or train staff

Quality suffers as mistakes are made

Implications of under-utilisation:

Higher fixed costs per unit

Unmotivated staff

Impact on brand image (e.g. empty restaurant)

Business may need to rationalise:

Can mean redundancies

Sale of assets

Hiring temporary staff instead of full time permanent

Reduction in overtime hours

Partial shutdown

Increases flexibility of business:

Able to accept a non-standard order

Have time to maintain machinery or update tech

Have time to train staff

How to improve capacity utilisation:

Increase demand through a price cut sale or promotion

Make staff redundant

Sell assets such as machinery and lease is back when needed

Lease capacity out to other businesses

Move to smaller premises and rationalise

Increase sales (cut prices) or increase usage (off peak travel)

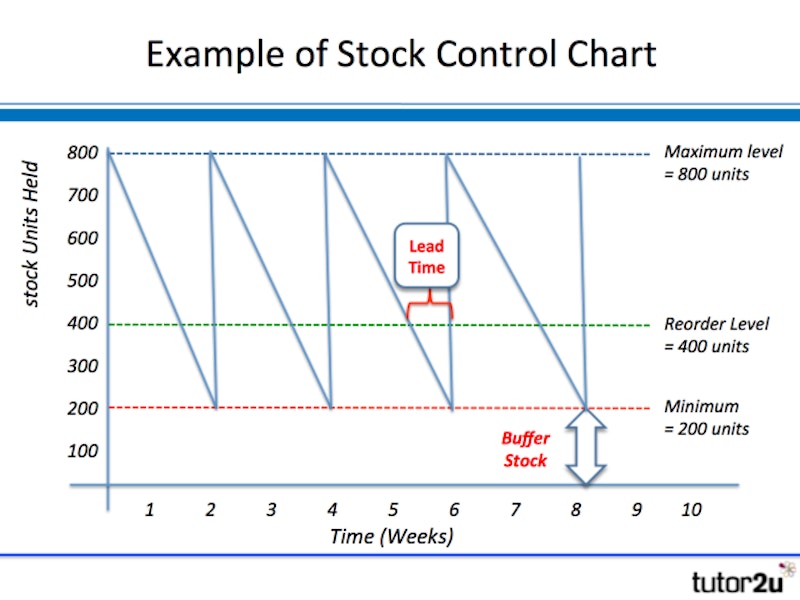

The stock control diagram:

Buffer stock definition

Stock that is held in case there is an unforeseen rise in demand or a problem with supply

Implications of poor stock control:

Loss of customer goodwill

Loss of sales revenue

Damage to reputation

Disruption to production

Just in time (JIT) management of stock definition

When a business does not keep stock and instead orders parts from the supplier on the same day the product is ordered. It is a form of lean manufacturing.

Impacts of waste minimisation

Improves efficiency

Reduces unit costs of production

Improves the public image of the business - more eco friendly

Can have large legal fines for non-compliance.

Competitive advantage of lean production:

Improved customer service through delivering exactly what is wanted when it is wanted

Improved productivity

Quality improvements through reduction in defects

Shorter lead times

Reduced waste

Safer work environment as production is more organised.

Quality definition

How well a product or service does what it was designed to do

Quality control definition

The traditional way of managing quality. It is concerned with checking and reviewing work that has already been done. Done at the end.

Quality assurance definition

About how a business can design the way a product or service is produced or delivered to minimise the chances that the output will be sub-standard. Done at the design/development stage.

Quality circle definition

A group of employees who meet on a regular bases to talk about quality problems that are relevant to the part of the process that they work on.

Total quality management (TQM) definition

A management approach that puts quality at the heart of everything in the business. Includes “putting the customer first” in customer service.

Continuous improvement (Kaizen):

A policy of constantly introducing small changes in a business to improve quality and/or efficiency.

Assumes that employees are the best people to identify room for improvement

Ideas come from workers themselves so are easier to implement

Competitive advantage from quality management:

Competitive advantage through quality.

Consumers willing to pay more

Customers may repeat purchase products which have the best of most consistent quality.

Gross profit calculation

Gross profit = Sales revenue - Cost of sales

Profit definition

The financial gain of a business through trading and can be found by deducting expenditure from income

Types of profit:

Gross profit

Operating profit

Net profit (profit for the year)

Operating profit calculation

Operating profit = Gross profit - Expenses

Net profit calculation

Net profit = Operating profit - Interest

Gross profit margin calculation

Gross profit margin = (Gross profit/Sales revenue) * 100

Operating profit margin calculation

Operating profit margin = (Operating profit/Sales revenue) * 100

Net profit margin calculation

Net profit margin = (Net profit/Sales revenue) * 100

Ways to improve profitability (by either increasing revenue or reducing costs):

Having a sale (reducing prices but increasing no. sales)

Advertising more

Promoting the products more

Restructuring, delayering and redundancies

Automating production

Distinction between profit and cash:

Profit:

Recorded straight away

A business can trade for years without profit

Cash:

Cash is not recorded until it is paid out or received which could be in a different trading year

A profitable business may go bust if it runs out of cash to pay a supplier or wages of staff

If owners introduce cash via savings or a loan this will not affect the profit figure.

Liquidity definition

The ability of a business to turn its assets into cash to pay its current liabilities

Ways of measuring liquidity:

Current ratio

Acid test ratio

Current ratio calculation

Current ratio = Current assets:Current liabilities (in its simplest form)

Acid test ratio calculation

Acid test ratio = (Current assets - Inventory):Current liabilities

The purpose of the acid test ratio

It compares a company’s assets and liabilities to see if it can meet its short-term debts. It removes inventory which can be difficult for it to liquidate quickly.

Ways to improve liquidity:

Reduce the amount of stocks the business holds, so the finished goods need to be dispatched faster to customers.

Reduce the credit period offered to customers, for example insist that customers pay in 30 days not 90

Pay suppliers later

Increase borrowing long term and clear short term debts

Working capital definition

The day-to-day finance needed to trade in a business

Working capital calculation

Working capital = Current assets - current liabilities

The working capital cycle:

Cash

Cash paid by debtors for goods or services bought (current assets)

Sales

Stock purchased from suppliers on credit (current liabilities)

Repeat

The importance of cash:

Cash and the working capital of the business is the finance available for the business to meet its short term debts.

Working capital is the finance required to pay day-to-day expenses to keep the business running

Business failure definition

When a business ceases to trade or when a business does not trade in a profitable way or when a business makes a terrible decision

Liquidation definition

The process of closing an Ltd or PLC. There will be a sale of assets and the company (as it stands) is dissolved

Administration definition

When a business that is failing is bought by another business

Financial causes of business failure:

Cashflow problems (e.g. allowing too much trade credit) - Internal

Economic conditions (e.g. inflation) - External

Non-financial causes of business failure:

Competition - External

Legislation (e.g. minimum wage increases) - External

Market conditions (e.g. consumer trends) - External

Poor planning - Internal

Poor marketing - Internal

Lack of skills - Internal

Sales forecast definition

An estimate of the volume or value of future sales using market research or past sales data.

The purpose of sales forecasts:

To avoid cashflow problems

To free up management time

To manage production capacity

To employ more workers

To help start a promotional activity

Factors affecting sales forecasts

Consumer trends

Economic variables (e.g. interest rates, inflation rate, unemployment rate etc.)

Actions of competitors

Difficulties of sales forecasting:

Dynamic markets

Not useful for businesses that operate over a time period longer than a year (e.g. ship building)

No guarantees that it will be correct as it is an estimate

Sales revenue definition

Cash that buyers pay you for goods

Profit definition

When total revenue is more than costs

Sales volume calculation

SV = Sales revenue/Selling price

Fixed costs definition

Costs that do not vary with the level of output (e.g. rent)

Variable costs definition

Costs that do vary with level of output

Total variable costs calculation

Total variable costs = Average variable cost * Quantity sold

Total costs calculation

Total costs = Variable costs + Fixed costs

Contribution calculation

Contribution = Selling price - Variable costs per item

Contribution definition

The amount that each unit produced ‘contributes’ towards the fixed costs of the business (or the profit made per item)

Break even definition

The point at which revenue equals cost, so the business is making neither a profit or a loss

Break even point calculation

Break even point (expressed as an amount of units) = Fixed costs / Contribution per unit

Margin of safety definition

The difference between the break-even point and the current sales

Margin of safety calculation

Margin of safety = Actual sales - Breakeven level of safety

Limitations of break even:

Break-even does not take into account any sales discounts if customers buy in bulk

Break-even assumes everything that is made is sold, and this is not always the case

The break-even calculations are only as accurate as the data they are based on

Budget definition

An estimate of income or expenditure for a set period of time (usually a month or a year of trading)

The purposes of budgets:

Planning

Forecasting

Communication

Motivation

Types of budget:

Historical budget

Zero based budget

Historical budget definition

A budget set for the business using current financial figures and based on historical performance of the business

Zero-based budget definition

A budget set for a business by using figures based on potential performance. It takes away all historical assumptions and starts with a clean slate.

Variance definition

The difference between estimated budget vs the budget that actually happens