WGU D101 unit test

1/80

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

81 Terms

Which items are included in work-in-process inventory?

Manufacturing overhead applied costs, direct labor costs, and raw materials used in production

3 multiple choice options

A manufacturing company performed the following five actions:

Purchased raw materials on account.

Used raw materials as indirect materials in the manufacturing process.

Applied overhead to the manufacturing process.

Transferred the completed goods to the finished goods warehouse.

Sold the completed goods.

What is the correct sequence of debits necessary in making the journal entries to record these five actions?

Raw materials inventory, manufacturing overhead, work-in-process inventory, finished goods inventory, cost of goods sold.

3 multiple choice options

Which journal entry is used to record the application of manufacturing overhead?

Credit manufacturing overhead.

3 multiple choice options

In a production facility, indirect labor and related wages include personnel, such as maintenance and repair employees. Assume that indirect labor wages are being accrued but have not yet been paid in cash.

Which journal entry is used to record the amount of indirect labor?

Debit manufacturing overhead.

3 multiple choice options

Which journal entry is used to record a transfer of completed products from a factory to the finished goods warehouse?

Debit finished goods inventory.

A manufacturing business determines the manufacturing overhead rate on the basis of direct labor hours and has estimated the following budget for Year 1:

Indirect materials $40,000

Indirect labor $15,000

Building rent* $60,000

Depreciation on production equipment $20,000

Direct labor $60,000

Direct materials $82,000

Machine hours 20,000 hours

Direct labor hours 40,000 hours

*1/4 of the building is for non-factory administrative offices.

The company allocated overhead based on direct labor hours.

What is this business's predetermined manufacturing overhead rate using the data above?

$3.00

3 multiple choice options

For a certain year, a bookstore had actual manufacturing overhead of $117,000 and applied manufacturing overhead of $100,000.

What should be included in the journal entry necessary to close the manufacturing overhead account?

Debit to cost of goods sold for $17,000.

3 multiple choice options

What is represented by the amount of cost of goods manufactured?

Total cost of items for which production was completed during the period.

3 multiple choice options

The data for a company for the year:

Direct materials purchased 355,000

Actual manufacturing overhead costs 284,000

Direct labor costs 290,000

Direct materials inventory, beginning balance 85,000

Work-in-process inventory, beginning balance 150,000

Applied manufacturing overhead costs 320,000

Finished goods inventory, ending balance 140,000

Direct materials inventory, ending balance 120,000

Work-in-process inventory, ending balance 180,000

Finished goods inventory, beginning balance 200,000

What is the total cost of goods manufactured for the company?

$900,000

3 multiple choice options

The data for a company for the year are as follows:

Direct materials purchased 355,000

Actual manufacturing overhead costs 284,000

Direct labor costs 260,000

Direct materials inventory, beginning balance 85,000

Work-in-process inventory, beginning balance 150,000

Applied manufacturing overhead costs 250,000

Finished goods inventory, ending balance 140,000

Direct materials inventory, ending balance 60,000

Work-in-process inventory, ending balance 125,000

Finished goods inventory, beginning balance 100,000

What is the adjusted cost of goods sold?

$909,000

3 multiple choice options

In which case is it appropriate to use job costing?

When the activities performed in each process center are different for all units produced

3 multiple choice options

Indirect materials costing $1,000 were transferred from a materials warehouse to be used in production. What should be included in the journal entry necessary to record this transaction?

Debit to manufacturing overhead for $1,000

3 multiple choice options

A company has accrued but has not paid direct labor wages in cash. What is part of the journal entry to record the amount of direct labor wages earned?

Debit work-in-process inventory

3 multiple choice options

What is the correct debit in a journal entry to record the allocation of manufacturing overhead to production?

Debit work-in-process inventory

3 multiple choice options

Which costs are included in the computation of total manufacturing costs?

Direct materials, direct labor, and applied manufacturing overhead

3 multiple choice options

For which process should process costing be used?

Making wood chopsticks

3 multiple choice options

Which costs are included in conversion costs when using process costing?

Direct labor and manufacturing overhead

3 multiple choice options

For which process in process costing is the number of equivalent units of production calculated for?

A single manufacturing process for a single period

3 multiple choice options

Which units are available to be transferred out to finished goods?

All units in beginning inventory plus all units started and completed this period

3 multiple choice options

From which three sources do the total cost of ending work-in-process inventory and units transferred out come from?

Costs in beginning work-in-process inventory from the prior period, costs to complete beginning inventory, and costs of units made and finished during the current period

3 multiple choice options

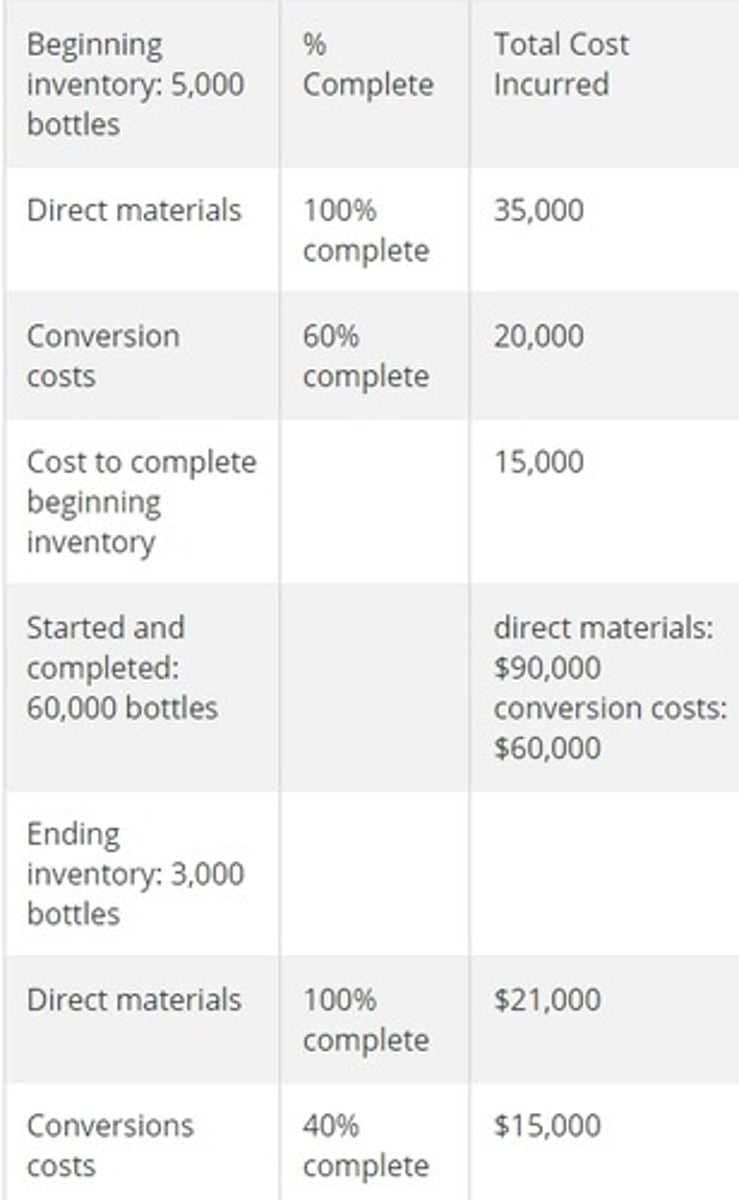

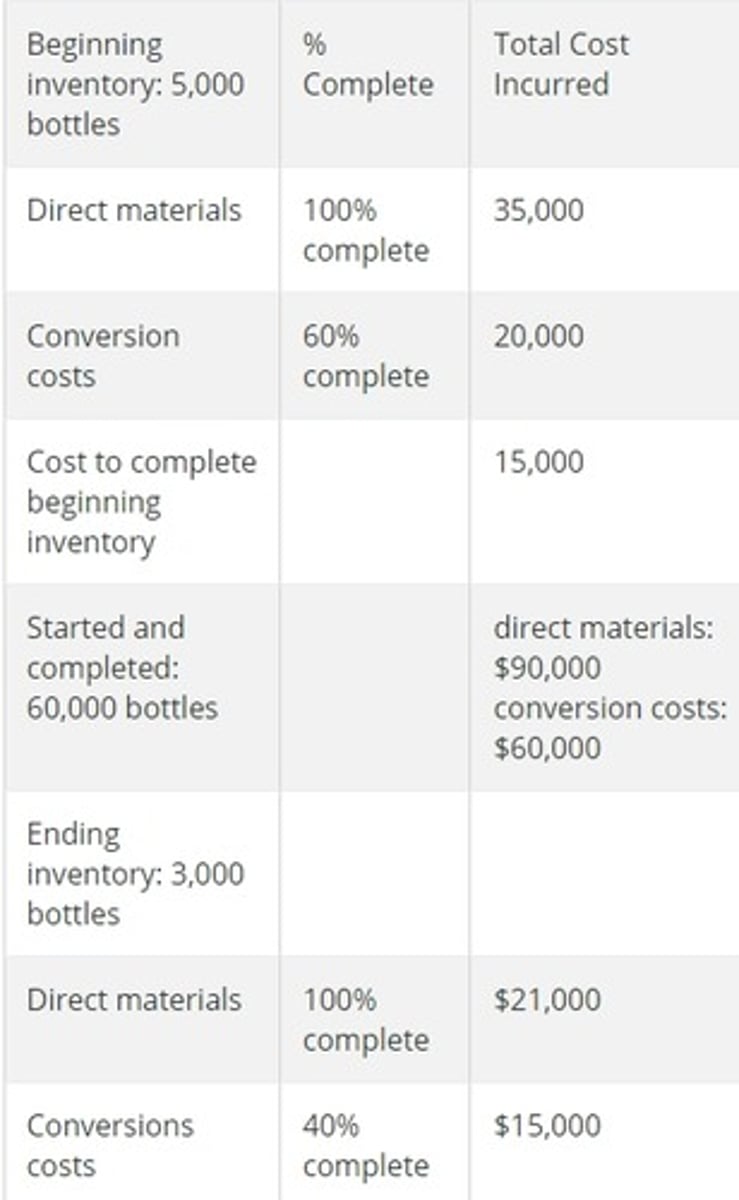

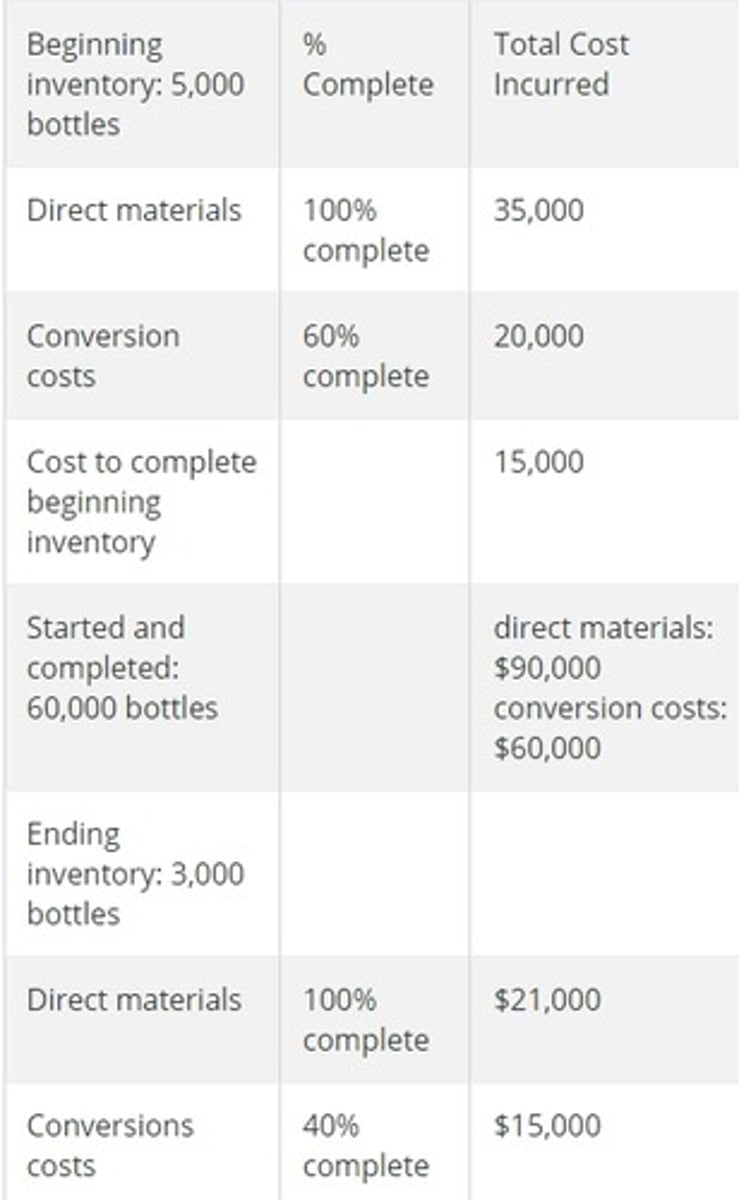

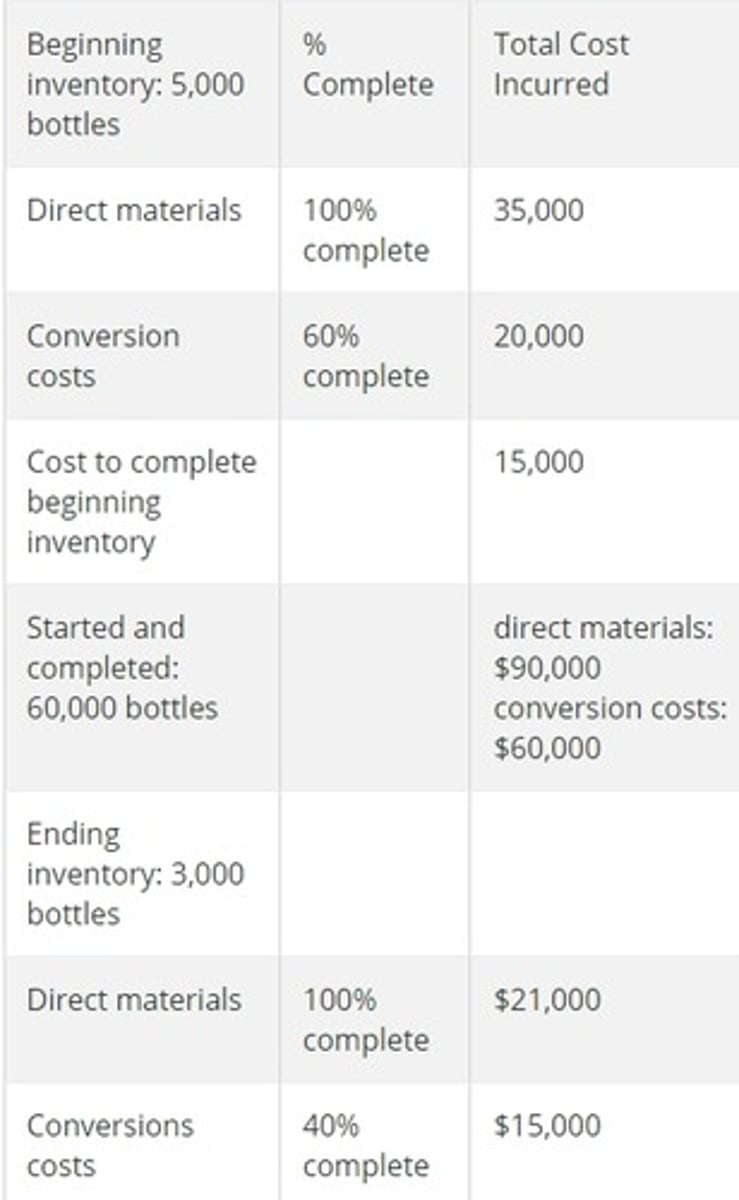

What is the soft drink company's equivalent units for direct materials beginning inventory?

0 bottles

3 multiple choice options

What is the total cost of the soft drink company's units completed and transferred out this period?

$220,000

3 multiple choice options

What is the soft drink company's equivalent number of units for conversion costs for this period?

63,200 bottles

3 multiple choice options

What is the soft drink company's total cost of ending inventory of 3,000 bottles of soft drinks?

$36,000

3 multiple choice options

What is the soft drink company's equivalent number of units in ending inventory for this period?

3,000 bottles for direct materials and 1,200 bottles for conversion costs

3 multiple choice options

Which manufacturer should use process costing ?

A concrete manufacturer

Which costs would be introduced into a process costing activity center first ?

Direct materials costs

What is another name for the " work done " or " work performed " during a period under process costing ?

Equivalent units of production

The beginning inventory for a company is 100 units at 30 % complete .

A total of 5,000 units were started and completed during the period .

Ending inventory is 400 units at 60 % complete .

How much is the company's equivalent units for the period ?

5,310 units

When determining the cost per unit of units produced in a processing center , which statement is true ?

Separate costs are calculated per unit for direct materials and conversion costs for both beginning work - in - process inventory and current period costs

What is the name of the cost associated with the completed units ?

Cost of goods manufactured

What are the total processing dollars spent during a period in a process center equal to ?

The sum of the cost of goods transferred out and the cost of ending work - in - process inventory

Assume there are 3,000 units in ending work - in- process inventory , the unit cost for direct materials is 2.00 , and the unit cost for conversion costs is $ 3.00 . If the ending inventory is 100 % complete as to direct materials and 60 % complete as to conversion costs what is the cost of ending work - in - process inventor ?

$ 6,000 for direct materials and $ 5,400 for conversion costs for a total of $ 11,400

Which of the following are always considered 100 % complete when calculating equivalent units ?

Units started and completed during the period .

When computing the costs transferred out of a department or processing center , which of the following is true ?

The costs to complete direct materials in beginning work - in - process inventory are added to the costs to complete conversion of the beginning work - in - process , and the total is added to the total costs of the started and completed inventory for the period .

Which statement is correct with respect to an activity - based costing ( ABC ) system ?

Implementing an ABC system requires a more careful analysis of the factors that create overhead costs .

What describes when an activity - based costing ( ABC ) overhead allocation system is appropriate ?

The production process for each different product , project , or process uses infrastructure support services in very different ways .

What is a cost pool in an ABC system ?

The collection of overhead costs associated with a specific overhead cost activity

Which category of overhead activities are costs such as inspections , machine setups , and movement of and accounting for materials ?

Batch

Implementation of an ABC system requires that each individual overhead cost be analyzed to determine which fraction of that cost is caused by each identified overhead cost activity .

The cost of this step can be high .

What is the proper treatment of facility support overhead costs in an activity - based costing ( ABC ) system ?

Common costs

What is the first step in implementing an ABC overhead system?

Determine exactly which activities cause overhead costs.

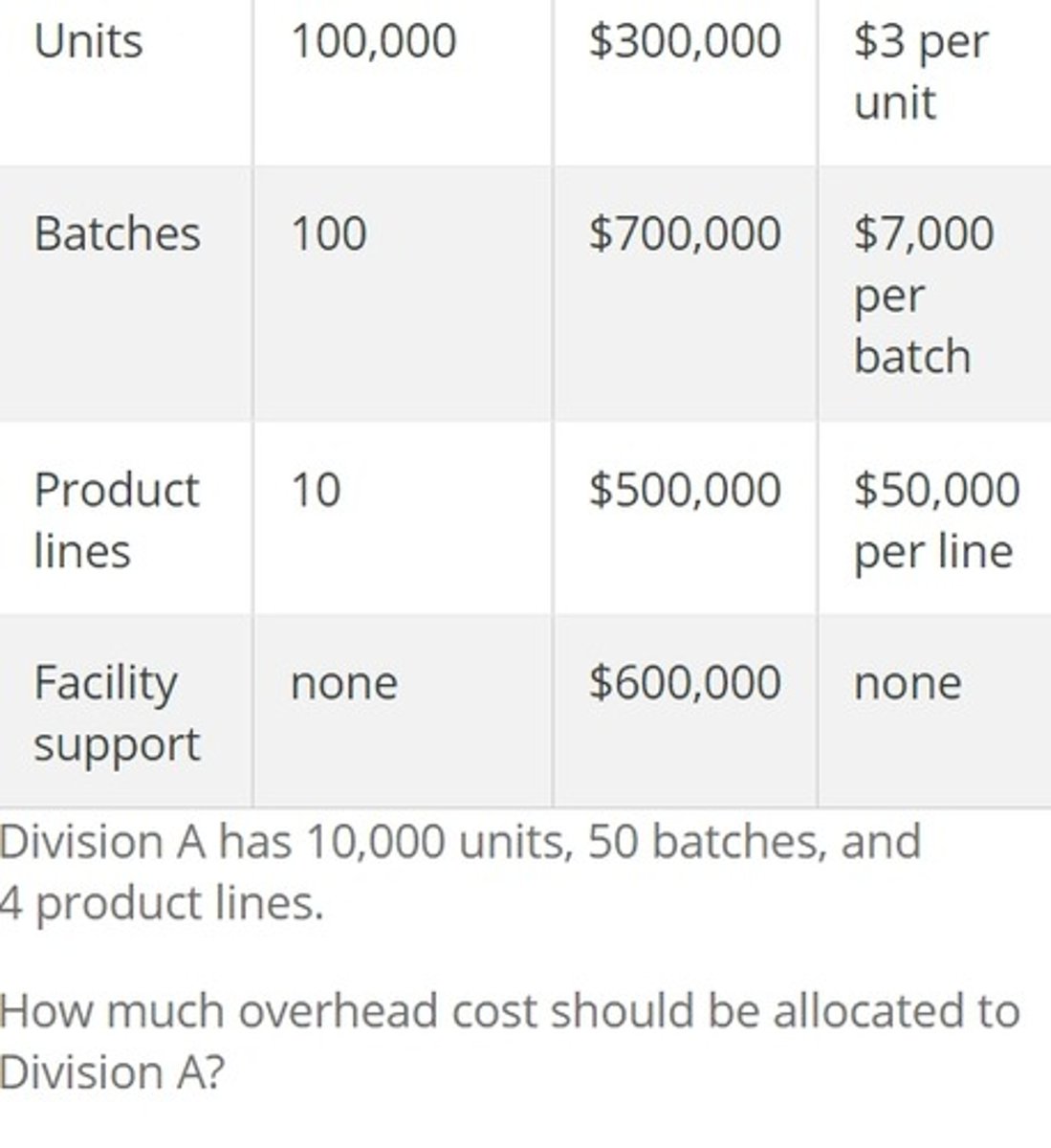

Division A has 10,000 units, 50 batches, and 4 product lines.

How much overhead cost should be allocated to Division A?

$580,000

Which statement is correct with respect to overhead with an activity - based costing ( ABC ) system ?

With an ABC system , some routine overhead costs are allocated based on direct labor hours

What statement describes when a traditional overhead allocation system is appropriate ?

The production process for each different products project or process is basically the same

How are the costs belonging to a cost pool identified in an ABC system ?

Careful analysis of overhead allocated using a traditional technique .

An ABC system is being implemented at a certain factory . An analyst finds that one of the cost drivers for overhead costs relates to manufacturing staff time . Which information needs to be gathered next to properly allocate overhead costs in this situation ?

Employee time logs and employee interviews

What would activities such as machine setups , consumed power , and purchase orders be considered as when using ABC costing ?

Cost drivers

What is a cost driver ?

The numerical measure reflecting the amount of a cost associated with a particular overhead cost activity

In which setting is the use of an ABC overhead allocation system appropriate ?

When operations involve a variety of different products and processes

What is relevant range ?

The range of volume over which the variable cost per unit is expected to remain the same

Data for a marketing company are as follows :

Variable cost ratio : 35 %

Number of units sold : 30,000

Net income : $ 130,000

Fixed cost : $ 65,000

What is the marketing company's calculated break - even number of sales units ?

10,000 units

Data for a company are as follows :

Price per unit : $ 25

Fixed cost : $ 12,000

Break - even number of units : 1,000

What is the company's computed variable cost per unit ?

$ 13 per unit

In a CVP graph , what is represented by the slope of the total cost line ?

Variable cost per unit

A toy company reported these data for its operations for the most recent year :

Sales : $ 5,000,000 Total

fixed cost : 1,000,000

Net income : 800,000

The toy company has five stores . Each store is open an average of 12 hours per day each day of the year . The average sales amount per customer is $ 2 . How many customers must visit each store per hour for the toy company to break even for the year ?

About 64

A company sells two different products . The company's average monthly data for the two products over the past year are as follows :

Product A

Sales quantity : 60,000 units

Price per unit : $ 10

Contribution margin percentage : 40 %

Product B

Sales quantity : 90,000 units

Price per unit : $ 4

Contribution margin percentage : 80 %

Monthly fixed costs are $ 398,750

Assuming the sales mix stays the same , what is the break - even point for the company in terms of total sales per month ?

$ 725,000

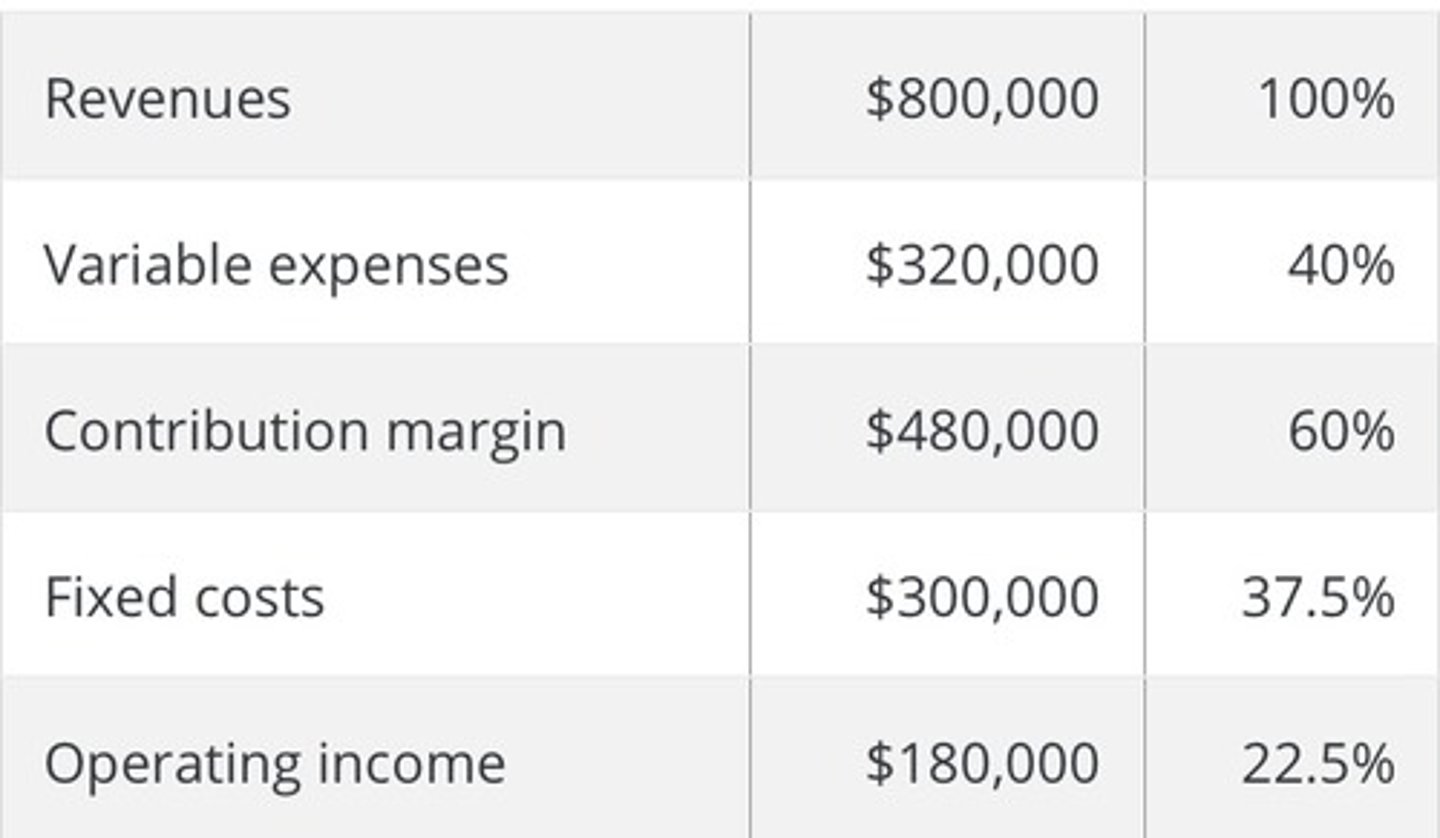

A company makes bicycles for intense mountain biking . The company's financial results for the past year were as follows :

Based on the past year's financial performance , what is the company's break - even point and current margin of safety in dollars ?

Break - even point $ 500,000 ; margin of safety $ 300,000

A coffee company sells a wide variety of products , some with high contribution margin ratios and some with low contribution margin ratios .

Data for the coffee company are as follows :

• Break - even sales volume : $ 200,000

• Average contribution margin percentage : 25 %

What is the sales amount the coffee company needs in order to achieve a target net income of $ 46,000 ?

$ 384,000

Quality Apple is a subsidiary of a large company with five operating divisions . This week the chief financial officer ( CFO ) will attend a meeting with all five operating divisions . The CFO has been told to come prepared to discuss Quality Apple's operating leverage .

Data for Quality Apple are as follows :

• Sales : $ 200,000

• Operating income : 70,000 F

Fixed operating costs : 80,000

Variable operating costs : 50,000

What is Quality Apple's computed degree of operating leverage ?

2.14 .

Data for a tech company are as follows :

• Operating income : $ 50,000

• Degree of operating leverage : 4.0

Assuming sales go down by 10 % , what is the tech company's operating income ?

$ 30,000

1What is a stepped fixed cost ?

OA cost that remains constant in total for a substantial change in the level of activity and then changes in a large amount when a certain threshold of activity is reached

Data for a dessert company are as follows

Price per unit : $ 10

Variable cost per unit : $ 7

Fixed cost : $ 2,400

What is the dessert company's computed break - even number of units ?

800 units

A company reports these data

Price per unit : $ 10

Variable cost per unit : $ 7

Fixed cost $ 1,300

Number of units sold : 1,000

What is the company's computed net income ?

$ 1,700

In a CVP graph , what is represented by the slope of the total revenue line ?

Price per unit

A company sells two different products .The monthly revenues and costs for the two products are as follows : Product A

Sales quantity : 30,000 units

Price per unit : $ 10

Contribution margin percentage : 70 %

Product B

Sales quantity : 20,000 units

Price per unit : $ 5

Contribution margin percentage : 40 %

Total fixed costs are $ 500,000 .

Assuming the product mix stays the same , what is the company's break - even level of total sales dollars ?

$ 800,000

Data for a company are as follows :

Price per unit : $ 20

Fixed cost : $ 6,000

Break - even number of units : 1,000

What is the company's computed variable cost per unit ?

$ 14

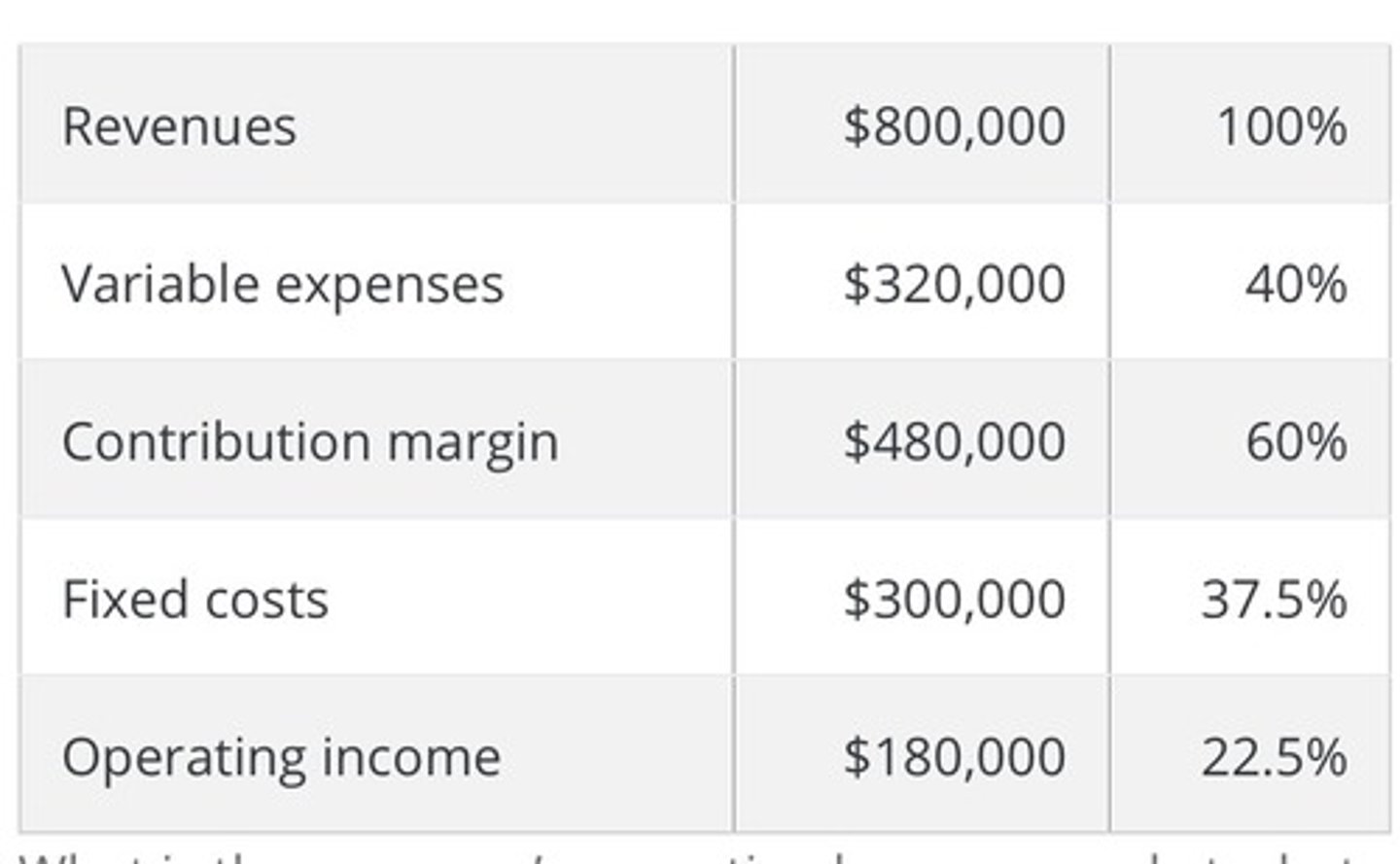

A company makes bicycles for intense mountain biking . The company's financial results for the past year are as follows : What is the company's operating leverage , and at what level of sales would operating income be $ 400,000 ?

Operating leverage 2.67 ; $ 1,166,667 sales .

A company has a bank loan covenant that requires

it to maintain a profit level of $ 48,000 or more . If the company's income falls below $ 48,000 , the company must either repay its bank loan or renegotiate the loan at a higher interest rate . Data for the company are as follows : Price per unit : $ 20

Fixed cost : $ 16,000

Variable cost per unit : $ 12

How many units must the company sell in order to reach a target profit of $ 48,000 ?

8,000

Data for an auto company are as follows :

Sales : $ 200,000

Operating income : 70,000

Fixed operating costs : 50,000

Variable operating costs : 80,000

What is the auto company's computed degree of operating leverage ?

1.71

Data for a computer company are as follows :

Operating income : $ 100,000

Degree of operating leverage : 5.0

Assuming sales go up by 10 % , what is the computer company's operating income ?

$ 150,000

The cost data for a company are as follows : Actual results Number of material pounds used in production : 5,000 lbs . Number of units produced : 200

units Total cost of purchasing material : $ 50,000

Number of material pounds purchased : 6,000 lbs .

The company has established the following standards : Standard price per pound of materials : $ 8.00 per lb. Number of pounds of material to produce one unit : 20 lbs .

What is the company's computed materials quantity variance ?

$ 8,000 U

The cost data for a company are as follows :

Actual results Total cost of purchasing material : $ 30,000

Number of material pounds purchased : 4,000 lbs . Number of material pounds used in production : 4,500 lbs .

Number of units produced : 200 units

The company has established the following standards : Price per pound of materials : $ 8.00 per lb.

Number of pounds of material to produce one unit : 20 lbs .

What is the company's computed materials price variance ?

$ 2,000 F

The cost data for a company are as follows :

Actual results Number of material pounds used in production : 5,000 lbs .

Number of units produced : 200 units

Total cost of purchasing material : $ 60,000

Number of material pounds purchased : 7,000 lbs .

The company has established the following standards : Price per pound of materials : $ 8.00 per lb.

Number of pounds of material to produce one unit : 30 lbs .

What is the company's computed materials quantity variance ?

$ 8,000 F

The cost data for a company are as follows : Actual results Number of material pounds purchased : 13,000 lbs . Number of material pounds used in production : 10,000 lbs . Number of units produced : 300 units Total cost of purchasing material : $ 150,000 The company has established the following standards : Price per pound of materials : $ 11.00 per lb. Number of pounds of material to produce one unit : 30 lbs . What is this company's computed materials price variance ?

$ 7,000 U

The plant manager for a company has been concerned recently with the way in which workers have been assigned to different projects . The plant manager has observed highly trained workers working on relatively simple jobs . The plant manager has also looked at the time records and has seen a lot of extra money being paid for overtime hours . The plant manager has asked to see the labor rate variance . Actual results Number of units produced : 500 units Number of labor hours worked : 2,300 hours Total labor cost : $ 85,000 The company has established the following standards : Number of labor hours to produce one unit : 4 hours Standard labor rate : $ 35.00 per hour What is the company's computed labor rate variance ?

$ 4,500 U

The cost data for a company are as follows : Actual results Number of units produced : 500 units Total labor cost : $ 101,000 Number of labor hours worked : 2,300 hours The company has established the following standards : Number of labor hours to produce one unit : 5 hours Standard labor rate : $ 40.00 per hour What is the company's computed labor efficiency variance ?

$ 8,000 F

The cost data for a tech company are provided below : Actual results Number of labor hours worked : 1,000 hours Total labor cost : $ 48,000 Number of units produced : 300 units The tech company has established the following standards : Standard labor rate : $ 50.00 per hour Number of labor hours to produce one unit : 3 hours What is this tech company's computed labor rate variance ?

$ 2,000 F

What is a common cause for a labor rate variance

Overtime wages

The cost data for a company are provided below : Estimated data as of the beginning of Year 1 : Estimated total manufacturing overhead : $ 225,000 Estimated direct labor hours : 15,000 hours Actual data for Year 1 : Actual total manufacturing overhead : $ 220,000 Actual direct labor hours : 13,000 hours The number of units produced during Year 1 was 1,000 . The standard number of direct labor hours to be worked to produce each unit is 14 . What is this company's computed variable manufacturing overhead efficiency variance ?

$ 15,000 F

Cost data for a company are provided below : Estimated and standard data as of the beginning of Year 1 : Estimated total manufacturing overhead : $ 450,000 Estimated direct labor hours : 30,000 hours Actual data for Year 1 : Actual total manufacturing overhead : $ 550,000 Actual direct labor hours : 34,000 hours The number of units produced during Year 1 was 1,000 . The standard number of direct labor hours to be worked to produce each unit is 30 . What is this company's computed variable manufacturing overhead spending variance ?

$ 40,000 U

What is a common cause for a labor efficiency variance ?

Machinery breakdowns