Financial Accounting -- PPE and Intangible Assets

1/34

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

35 Terms

Tangible assets

physical substances such as land, land improvements, buildings, equipment, natural resources

intangible assets

non-physical substance and existence of which is often based on legal contract, such as patents, trademarks, copyrights, franchises and goodwill

debit current assets within

12 months

tangible assets recorded at

cost PLUS all costs necessary to get the asset ready for its intended use

basket purchases

purchase of more than one asset at the same time for ONE purchase price, and allocates total purchase price based on the relative fair values of the individual assets (record land, building, equipment in separate accounts)

record as expense when

if the asset benefits only the CURRENT period

record expenditures as an asset and CAPITALISE THEM when

if the asset benefits both current and future periods

an item is said to be material when

it is large enough to influence a decision

when an expenditure is not material

item is typically recorded as an expense regardless of its expected period of benefit

depreciation

allocation of an asset’s cost to expense over time

accounting depreciation is NOT

a decrease in value of an asset

book value

cost of the equipment less the accumulated depreciation of it

factors used in calculating depreciation

service life, residual value, depreciation method

service life (useful life)

the estimated use the company expects to receive from the asset before disposing of it

residual value (salvage value)

amount the company expects to receive from selling the asset at the end of its service life

depreciation methods

straight line, declining balance, and activity based

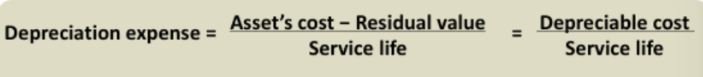

straight line depreciation equation

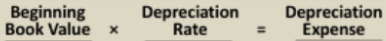

declining balance

activity based

asset disposal methods

most common: sale; retirement: when a long-term asset is no longer useful but cannot be sold; exchange: when two companies trade long-term assets

intangible assets are acquired through

purchase or developed internallyg

goodwill

portion of the purchase price that exceeds the fair value of the identifiable net assets, recorded only when one company acquires another company, and arises when purchase price > net assets

net assets =

assets acquired - liabilities assumed

recording purchased intangible assets

record at their original cost PLUS all other costs necessary to get the asset ready for use

recording intangible assets developed internally

record as most of the costs as expense in the income statement in the period we incur those costs

amortisation of intangible assets

allocating cost of most intangible assets to expense

return on assets definition

indicates the amount of net income generated for each dollar invested in assets

return on assets equation

= net income / average total assets

average total assets =

(beginning assets + ending assets) / 2

higher return on assets =

generates higher profit, more efficient in utilising assets for production of income as it generates more revenus even though the profit margin for each product is relatively lower

alternate return on assets equation

= profit margin x asset turnover

profit margin definition

indicates the earnings per dollar of sales

profit margin equation

= net income / net sales

asset turnover definition

measures sales per dollar of assets invested

asset turnover equation

= net sales / average total assets