Commerce 2025 year 10 term 1

1/51

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

52 Terms

What is fiat money?

It is a currency that is issued by the government and is not backed by oil, gold etc.

The government achieves control by using fiat money, How?

Since it’s issued by the government and the price can be changed.

What is bartering?

Bartering is the exchange of goods and services without using money. It relies on mutual agreement between both parties and is on of the easiest form of trade.

What are some examples of bartering?

A farmer trades his milk for clothes, and there are many others. It just depends on the wants of the other person.

What is “coincidence of wants?”

A common denominator between both parties that for example person A wants what person B has and vice versa.

What is a medium of exchange?

In bartering the medium of exchange is the goods and services themselves. Instead of using the standard medium of exchange money.

Is bartering a sunset or sunrise industry?

Bartering is seen between friends and online bartering options. There is 12 billion in the bartering industry, this industry is a sunrise industry.

What is a sunrise industry?

A sunrise industry, is an industry that goes up.

What is a sunset industry?

A sunset industry, is an industry that is going down.

What are the four main functions of money, and how does each one help facilitate trade?

Unit of account, store of value, medium of exchange and deferred payment.

In what ways does money act as a unit of account?

Since money is divisible and interchangeable for other goods unlike bartering which only can be exchanged between two parties, but they require double coincidence of wants.

Why is the store of value function important for long-term saving?

It is important since it doesn’t lose value over time like money which does but somethings that do store value are gold.

How does the standard of deferred payment function support lending and borrowing?

Money is considered a standard of deferred payment because it allows people to agree on a value today for a transaction that will be completed in the future.

When you borrow money, you agree to repay it later — often with interest.

The amount you repay is measured in money, making it a standard for future obligations.

It provides trust and consistency, as both parties know how much is owed and in what form.

For example, if you take a loan of $1,000 today and agree to repay it in a year, the dollar serves as the standard by which that future payment is measured.

what is deferred payment.

In short:

Money is a standard of deferred payment because it is accepted for settling debts and financial agreements that are to be paid in the future.

List six characteristics of effective money and explain why each one is important.

divisible, portable, acceptable, scarce, durable, and stable in value.

Why must money be scarce in order to retain its value?

Too much money chasing after too little goods result in inflation. Coconut example: 3 coconuts 3 dollars adding more money into the 3 coconuts for 6 dollars meaning each coconut is now 2 dollars each now. though hyper-inflation is more like this 3 coconuts for 30 dollars making each coconut 10 dollars.

How does uniformity in money help maintain trust in an economy?

people can easily recognize the currency, making it easier and accept them in transactions.

What is the “double coincidence of wants” and how does it limit the efficiency of barter systems?

it limits the power of bartering because if both parties don’t have the same thing the other wants then the trade is off the double coincidence of wants can be difficult to come across.

Why is bartering considered less effective in modern economies?

maybe since it is not considered a proper exchange and the value varies with different people. Bartering lacks a common unit of account, making it difficult to determine the relative value of different goods and services.

How does the use of money overcome the limitations of bartering?

since it is a common unit of account making it easy to purchase and make transactions unlike bartering which needs to please both parties “double coincidence of wants”

Can you think of modern examples where barter might still be used today?

in the example of Venezuela. when the people lost trust in the government’s currency due to hyper- inflation.

What is fiat money, and how is its value maintained without a physical backing?

it is backed by the government and is government issued and it holds value because of trust and legal recognition.

What is commodity money, and how does it differ from fiat money?

as it says in the name it is backed by a commodity such as gold or something tangible that has intrinsic value where fiat money does not have intrinsic value.

what is an intrinsic value?

the cost of printing. what is the material? what is the production?

what is face value?

is what is printed on the note e.g. an 100 on a 100 dollar note. (fiat money). perceived value is the value people believe it has.

What are some historical examples of commodity money?

gold, silver, tea, alcohol, and seashells

Why do people continue to accept fiat currency even though it has no intrinsic value?

fiat money holds value because governments declare it legal tender. This means you must accept it for goods, services, and debt payments—not because it has inherent worth, but because the government enforces its use.

What role does government authority play in maintaining trust in fiat money?

Fiat money is backed entirely by the full faith and trust in the government that issued it. This has merit because governments demand that you pay taxes in the fiat money it issues. This is why Venezuela’s money lost its value so quickly and resort to bartering.

What is inflation, and how does it affect the purchasing power of money?

your pay is the same but the prices went up meaning that with the money you currently earn is not enough for the how much it costs after inflation.

What economic conditions or government actions typically cause inflation?

excessive printing of money. is just one example,

What is hyperinflation, and what are the potential effects on individuals and businesses?

This happened in Venezuela, In extreme cases, people may turn to barter systems or adopt foreign currencies to avoid holding the local currency, which loses its value quickly. this is only one example

What is deflation, and how can it influence consumer behaviour and economic growth?

Deflation refers to a lower overall cost of goods and services. When the inflation rate falls below 0%, depreciation increases the actual value of money over time. Deflation can initially increase a consumer's purchasing power, but prolonged deflation can lead to events like the Great Depression. Extended deflation creates higher unemployment rates and leads to default on debt obligations.

What is the difference between nominal interest rates and real interest rates?

Nominal and real interest rates differ in that nominal rates are the stated interest rate, while real rates account for inflation and reflect the true return on investment or cost of borrowing in terms of purchasing power.

How do you calculate real interest using inflation and nominal interest rates?

If the nominal interest rate is 5% and the inflation rate is 3%, the real interest rate is approximately 2% (5% - 3%).

How does inflation impact consumers in terms of their ability to afford goods and services?

Inflation erodes the purchasing power of consumers, meaning that the same amount of money buys fewer goods and services then before.

Why are savers often disadvantaged during periods of high inflation?

As inflation rises, the purchasing power of the dollar can shrink. Not only does this affect everyday purchases, it also erodes the value of savings, potentially making it harder to reach financial goals.

What effect can inflation have on workers’ wages and real income?

weaken purchasing power, since their salary will most likely stay the same and in some cases might reduce due to inflation. companies might not be able to afford to pay you as much as you they used to because there isn’t enough supply and demand.

In what ways does inflation impact the cost structure and profits of businesses?

Inflation impacts businesses by increasing costs, challenging pricing strategies, and creating cash flow strains.

Who tends to benefit from unexpected inflation, and why?

borrowers with fixed-rate loans, and the government, because they repay debt with money that has decreased in purchasing power. This is due to the fact that the real interest rate they pay on fixed-rate loans effectively decreases.

Why is gold often used as a hedge against inflation?

Gold is often used as a hedge against inflation because its price tends to rise when the value of fiat currencies decreases, making it a way to preserve wealth during inflationary periods. Unlike paper money, gold is a physical asset with intrinsic value, making it a store of value that is less susceptible to the effects of inflation.

How does the scarcity and durability of gold support its use as a store of value?

because it has intrinsic value unlike paper money and when the value of fiat currency goes down gold tends to go up.

What happens to the demand for gold during periods of high inflation?

During periods of high inflation, the demand for gold typically increases as it is seen as a hedge against the erosion of purchasing power. Gold's value tends to rise alongside inflation, making it a valuable store of value.

Why might investors shift from fiat currencies to commodities like gold?

Investors may shift from fiat currencies to commodities like gold due to concerns about inflation, currency devaluation, and the stability of fiat money. Gold is seen as a safe haven asset that can preserve wealth during economic uncertainty and is not subject to the same inflationary pressures as fiat currencies.

What is leverage in financial terms, and how can it magnify gains or losses?

Leverage refers to using debt or borrowed funds to amplify returns from an investment or project. Companies can use leverage to invest in growth strategies. Some investors use leverage to multiply their buying power in the market.

How can an investor use a small deposit to control a large asset?

An investor can use a small deposit to control a large asset through leverage, a strategy that involves borrowing money to amplify investment returns. This can be achieved through mechanisms like margin accounts for stocks, or by leveraging loans for property investments,

How do you calculate the return on investment (ROI) from a capital gain?

It's calculated by subtracting the initial cost of an investment from its final value and then dividing the resulting number by the cost of the investment multiplying it by 100.

How would you compare the financial implications of short-term vs long-term loan repayments?

Short-term loans have higher monthly repayments, but less total interest over the loan's lifespan, while long-term loans have lower monthly payments but a higher total interest cost.

Why does the total interest paid increase with longer loan terms, even if monthly payments are lower?

Longer loan terms, while offering lower monthly payments, result in higher total interest costs because you're essentially borrowing the money for a longer period, increasing the time over which interest is calculated and accrued. This means more of your repayments are dedicated to interest, rather than the principal loan amount.

How does rental income affect the cash flow of a leveraged investment?

The surplus from rental income over expenses contributes to regular cash inflow, enhancing the investor's financial stability. Positive cash flow properties generate surplus income that can be used to cover these mortgage payments. Positive cash flow is a buffer, providing a safety net during challenging times.

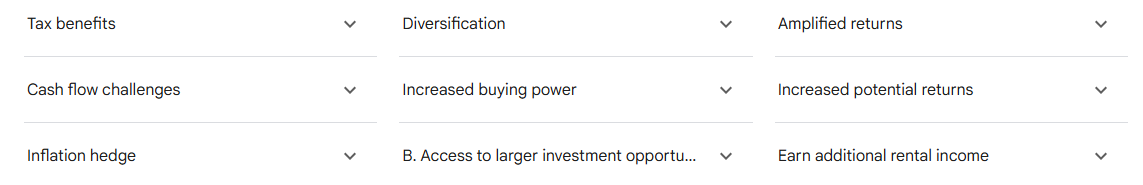

What are two key benefits of using leverage to invest in property?

What are two financial risks that come with borrowing to invest?

you can loose more or the value of it all together could go down.

What does it mean for an investment to be positively or negatively geared, and what are the possible financial implications for the investor?

Positive gearing – Your property is positively geared if the income from your investment is more than your interest payments and outgoings like maintenance and repair costs. Negative gearing – Your property is negatively geared if the income from your investment is less than your interest payments and outgoings.