Imports

1/13

Earn XP

Description and Tags

Imports

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

14 Terms

Imports General relief

The VAT (Imported Goods) Relief Order - 1984.

Sch1 - UN goods

Sch2 - Lists groups including capital goods/ goods for examination, charities etc.

Small non-commercial consignments relief

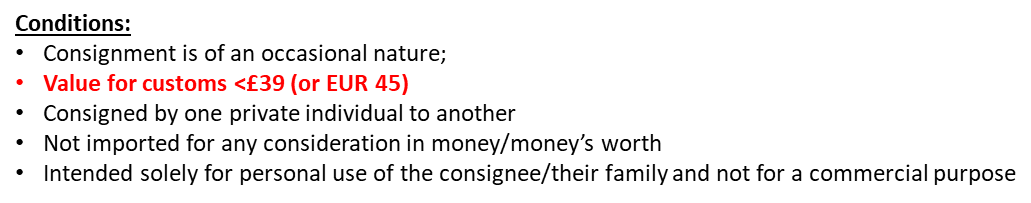

Conditions:

•Consignment is of an occasional nature;

•Value for customs <£39 (or EUR 45)

•Consigned by one private individual to another

•Not imported for any consideration in money/money’s worth

•Intended solely for personal use of the consignee/their family and not for a commercial purpose

Onwards supply relief - i.e import goods into NI that will go onto EU MS.

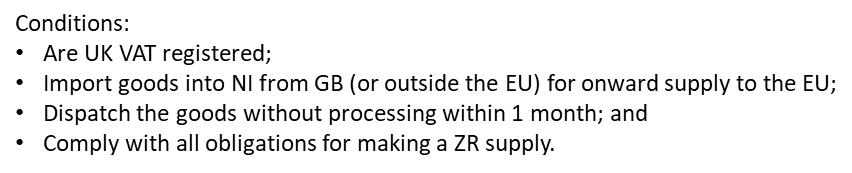

Conditions:

•Are UK VAT registered;

•Import goods into NI from GB (or outside the EU) for onward supply to the EU;

•Dispatch the goods without processing within 1 month; and

•Comply with all obligations for making a ZR supply.

Returned goods relief

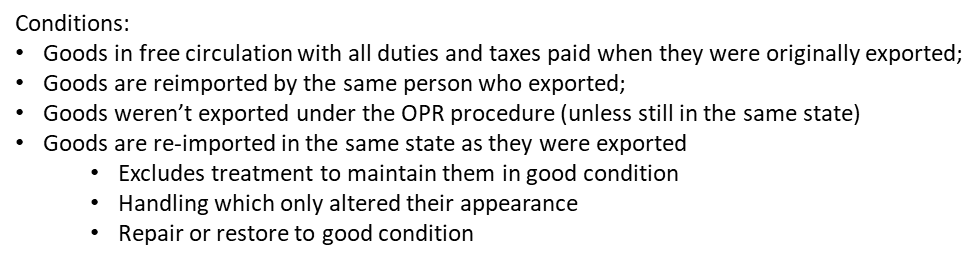

Conditions:

•Goods in free circulation with all duties and taxes paid when they were originally exported;

•Goods are reimported by the same person who exported;

•Goods weren’t exported under the OPR procedure (unless still in the same state)

•Goods are re-imported in the same state as they were exported

•Excludes treatment to maintain them in good condition

•Handling which only altered their appearance

•Repair or restore to good condition

reimportation after exporting for treatment (OPR) - treat as though services were provided in the UK

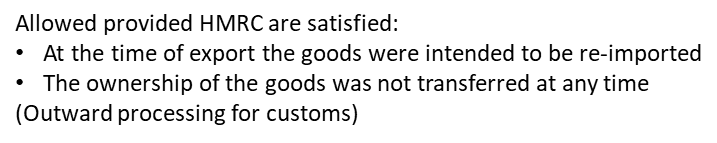

Allowed provided HMRC are satisfied:

•At the time of export the goods were intended to be re-imported

•The ownership of the goods was not transferred at any time

(Outward processing for customs)

Rejected goods relief

Goods have to be rejected because, at the time of declaration to Customs they:

•Are defective;

•Do not comply with the terms of the contract imported under; or

•Damaged before being cleared by customs.

Notify HMRC on form C&E1179 at least 48 hours before the goods are packed for re-exportation/destruction

IMport VAT suspension - customs special procedures

Import VAT and duty only due when the goods are released into FC under these arrangements:

•Temporary admission (total relief)

•Inward processing

•External/Internal Transit

•Customs warehousing

•Free Zones

•Temporary Storage

Import VAT - evidence

C79 - monthly download from CDS

Import VAT - reclaim form

C285

Import VAT - ownership

Only the owner of the goods can recover VAT as it will be used in their business. Toll operators (Piramial Healthcare), should not be the owner of the goods.

Import - Postal goods

If B2B:

<EUR 1,000 - Royail mail will ask for VAT payment. Business to keep charge label and attach to claim with customs declaration (CN22 or CN23).

>EUR 1,000 - Declaration made on C88, business will need to pay import VAT before goods released.