Risk and Trade

1/20

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

21 Terms

Uncertainty

situations where the probability of certain occurrences is not known

Risk

when uncertainty can be quantified

2 Characteristics of a Risk Activity

likely outcome

degree of variation in the possible outcomes

Expected Value

the probability weighted average of the value from each possible outcome

average profit/cost if you play the lottery an infinite amount of times

if it is 0 then the lottery is fair

Expected Value Example

50% +£100

50% -£100

EV = (0.5x 100) + (0.5x (-100)) = 0

This lottery is fair

When is a Lottery Fair?

when the expected value is 0

Individual Attitudes to Risk

Risk neutral: A person who is only interested in whether the odds yield a profit on average e.g.

50% +£500

50% -£100

Risk averse: A person who will refuse a fair gamble e.g.

50% +£100

50% -£100

Risk loving: A person who bets even when the odds are unfavourable e.g.

10% +£500

90% -£100

The key issue is whether or not a person would accept a fair gamble

Asymmetric Information

A situation in which one side of an economic relationship has better information than the other.

Broadly speaking, there are two types of information that an economic decision maker might lack but desire:

Hidden characteristics

Hidden actions

Hidden Characteristics

Things that one side of a transaction knows about itself that the other side would like to know but does not know, either:

sellers are better-informed

buyers are better-informed

Hidden Actions

Actions taken by one side of an economic relationship that the other side of the relationship cannot observe

firms vs. employees

insurance companies vs. their customers

Adverse Selection

A phenomenon under which the uninformed side of a deal gets exactly the wrong people trading with it

The Market for Lemons (Low Quality Cars) Model

Developed by George Akerlof (1970) (Nobel Prize 2001)

Asymmetric information tends to reduce the average quality of goods offered for sale

People who have below average cars (lemons) are more likely to sell them

Buyers know that below-average cars are more likely to be on the market than good cars and lower their reservation prices

Because used car prices are low, people with good cars keep them longer

The average quality of used cars falls even further

Moral Hazard

People take fewer precautions when they know they are insured

Co-Insurance

A provision in an insurance policy under which the policyholder picks up some percentage of the bill for damages when there is a claim

Excess/Deductible

A provision in an insurance under which the person buying the insurance has to pay the initial damages up to some set limit

Opportunity Costs

the value of the next best alternative that must be forgone in order to undertake the opportunity

Absolute Advantage

One person has it over another if an hour spent in performing a task earns more than the other person can earn in an hour at the task.

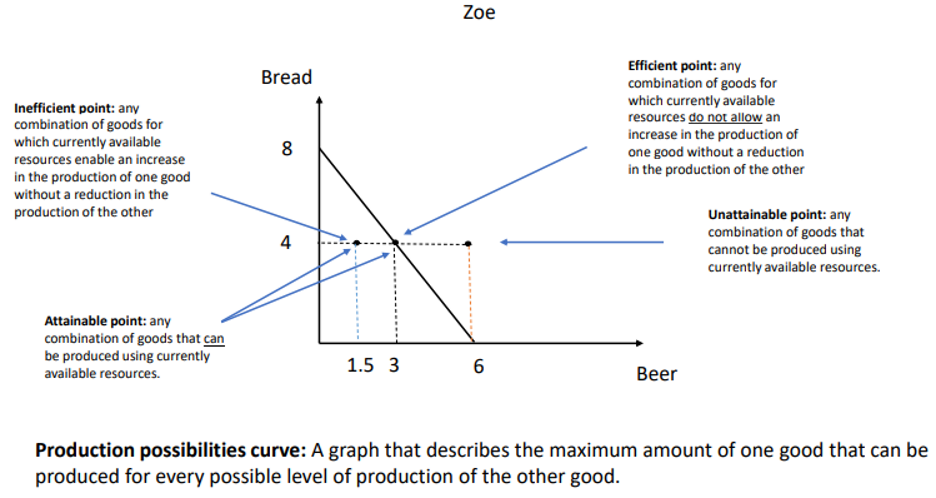

Production Possibilities

Comparative Advantage

One person has it over another in a task if his or her opportunity cost of performing a task is lower than the other person’s opportunity cost

What does International Trade on the basis of Comparative Advantage do?

improves global output

Tariffs

taxes on imports

distort the operation of the market and so lead to welfare loss