ECON 0200 CH 13

1/55

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

56 Terms

Last chapter we learned

businesses require capital to start up and grow

to get this they need

investors with more money that they don’t immediately need to spend

Where do they put their savings? Into an investment that promises growth

any investment must be

someone’s savings

economics is concerned with real activity i.e. GDP, employment

but the 2008 crisis taught us finance can’t be separated from real activity

macrofinance studies this connection

financial system

the group of institutions in the economy that match those who wish to save with those seeking to borrow

the financial system moves

savers’ money to productive investments

The financial system broadly consists of two components

Financial markets

• Financial intermediaries

financial markets

financial institutions where savers provide funds directly to borrowers

The two largest financial markets in the US:

the stocks and bonds markets

A bond is

a debt certificate that specifies the:

principal - the size of the initial investment

2. interest rate

3. maturity - when repayment with interest is due

debt finance

Raising money through issuing bonds

2 types of bonds

Government bonds (i.e. national debt)

• Corporate bonds

interest is compensation to investors for

not being able to use their money

• taking on some risk that the investment fails

reasons for high interest rate

The bond matures in a long time (has a long term)

• The borrower is likely to not repay (high default risk)

• The bond is subject to taxes

• The bond is not protected from inflation

stock

a claim to partial ownership of a firm

equity finance

Raising money through issuing stocks

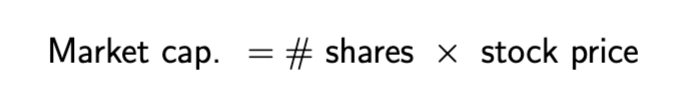

a firm’s value/market capitalization calculation

issuance

A firm chooses how many shares of their company are for sale

The price of a stock is just like anything else

driven by supply and demand

factors that affect stock demand

How profitable the firm is (paid to shareholders through dividends)

• How optimistic people feel about the firm’s future

In general, stocks are

more risky than bonds but offer greater returns

financial intermediaries

financial institutions where savers provide funds to borrowers indirectly

In a financial market, you are responsible for picking your investments

Financial intermediaries employ analysts to do the thinking for you

two common intermediaries:

banks and mutual funds

intermediary tradeoff

less risk through an intermediary, but lower potential returns

in terms of accounting GDP

Investment is what’s left of output after consuming and gov’t spending

definition of saving

the share of output we don’t spend

national saving

is the share of output left after consumption and government expenditures

saving calculation

every dollar invested

is a dollar saved

S = I

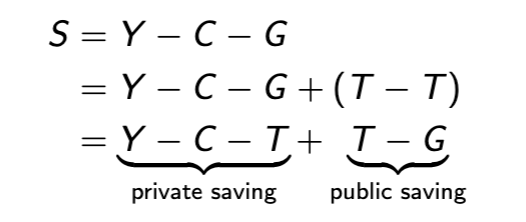

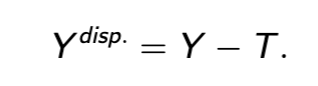

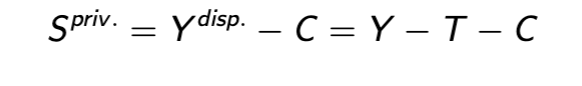

GDP decomposition involving taxes

disposable income

what’s left of output after taxes are collected

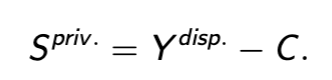

private saving

what’s left of disposable income after consumption

a nation’s income equals

its output

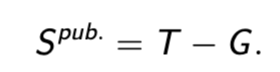

public saving

what’s left of government revenues after government expenditures

budget surplus

in the event of a surplus

They can pay down existing debts, issue a tax refund

budget deficit

in the event of a deficit

Issue debt in the form of bonds

building a market model

Savers supply funds, borrowers demand funds

• Where do they meet and determine the terms of trade? A market

market for loanable funds

the market where savers supply funds and borrowers demand funds for investment purposes

the interest rate

the price in the market for loanable funds

supply of loanable funds

Households’ and firms’ savings

How does the supply of loanable funds react to changes in the interest rate

supply of loanable funds S(r ) is increasing in r

demand of loanable funds

Households’ and firms’ investment

Households take out mortgages for new houses

• Firms issue debt/equity to acquire capital

How does the demand of loanable funds react to changes in the interest rate

demand of loanable D(r ) funds is decreasing in r

equilibrium interest rate

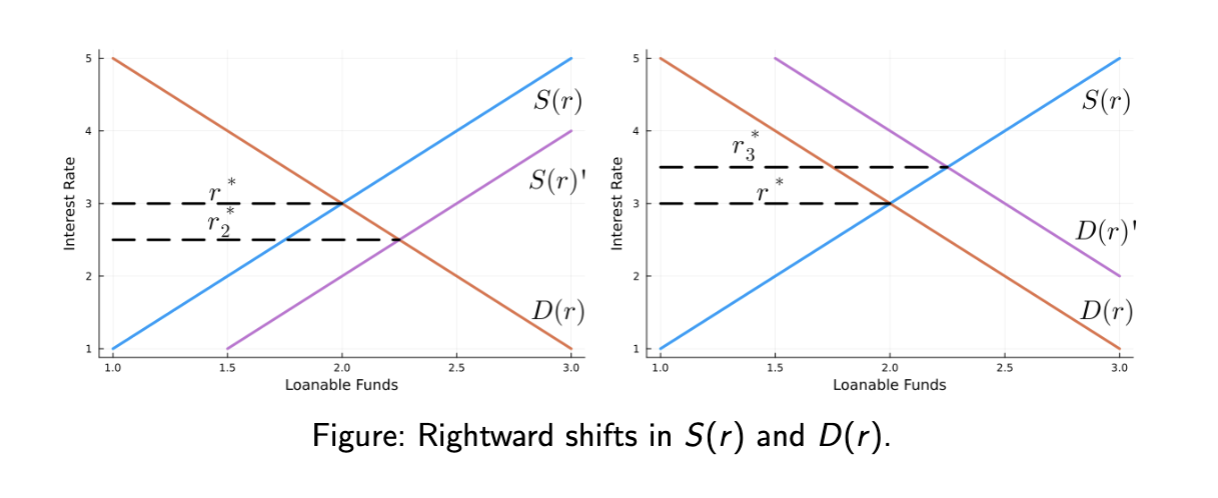

If S(r ) shifts right,

savers supply more for at given r than before

what causes a rightward shift in S(r )

Policies that incentivize saving (i.e. tax cuts/credits)

• An decrease in the government’s deficit (S = Spub. + Spriv ., Spub. ↑)

If S(r ) shifts right and D(r ) doesn’t move,

then r ∗ falls

For a leftward shift

flip all the information on the last 3 flashcards

If D(r ) shifts right

borrowers demand more for at given r than before

What can cause a rightward shift in D(r )?

• Policies that incentivize borrowing (i.e. tax cuts/credits)

If D(r ) shifts right and S(r ) doesn’t move,

then r ∗ rises

For a leftward shift

flip everything around on the last 3 flashcards

shifts graphically