Reporting equity: try it out

1/3

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

4 Terms

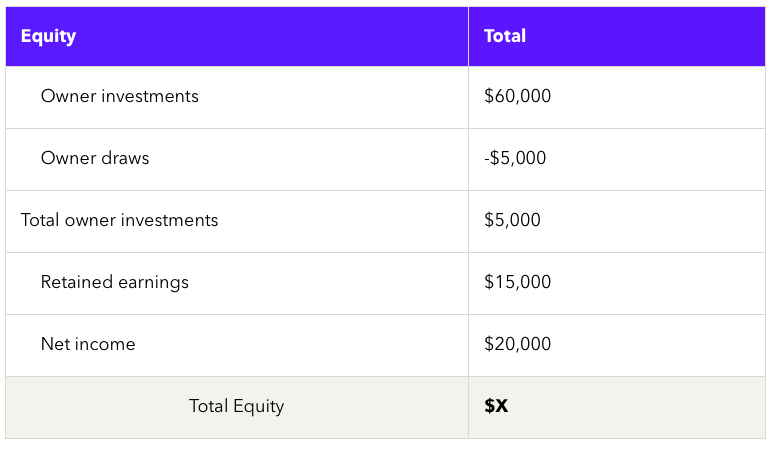

How much equity does the owner have?

$35,000

$55,000

$95,000

$125,000

$95,000

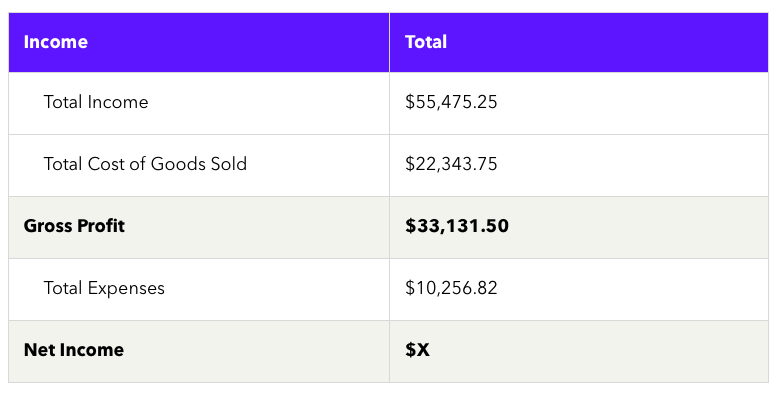

What is the net income for the month of June?

$67,562.18

$43,388.32

$22,874.68

$22,768.43

$22,874.68

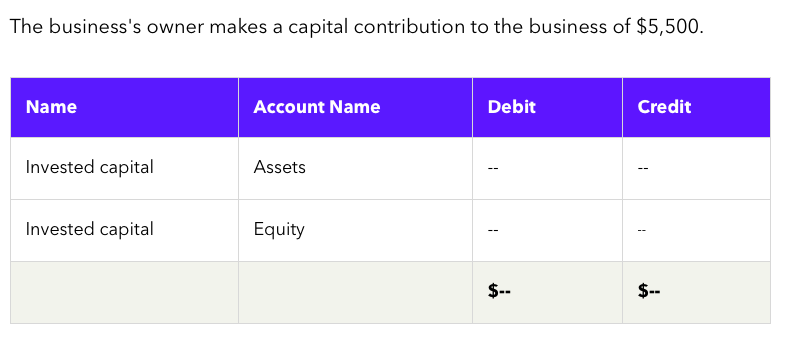

Based on the capital contribution of $5,500, which should be credited and debited?

Debit equity $5,500 and credit assets $5,500

Debit assets $5,500 and credit equity $5,500

Credit equity $11,000

Debit assets $5,500 and credit equity $5,500

Based on the owner keeping the payment, which accounts should be credited and debited?

Debit the owner’s draw by $4,567.12 and credit the consulting revenue account by $4,567.12

Credit the owner’s draw by $4,567.12 and debit the consulting revenue account by $4,567.12

Credit the owner’s draw $4,567.12 only

Debit the owner’s draw $4,567.12 only

Debit the owner’s draw by $4,567.12 and credit the consulting revenue account by $4,567.12