Financial Statements 1: Profit and Loss

1/35

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

36 Terms

What is the main purpose of financial accounts?

to report:

in a regulated and standard way

the financial position of a business

to external creditors, investors and lenders

What is the main purpose of management accounting?

create organisation goals by identifying, measuring, analysing, interpreting, and communicating financial information to managers

In practice, will you mainly see financial or management accounts?

management accounts

What does management accounting focus on?

all accounting aimed at informing management about operational business metrics (measures/numbers)

What does management accounting use information relating to?

costs of products or services purchased by the company

What are budgets often used to do?

quantify decisions made in operational planning

What do management accountants use performance reports to look at?

difference between actual amounts and amounts estimated in the budget

What is the main difference between management accounting and financial accounting?

financial accounting = backwards looking

management accounting = forwards looking

Is financial accounting forwards or backwards looking?

backwards looking

Is management accounting forwards or backwards looking?

forwards looking

How does management accounting plan for the future?

compares actual amounts spent or earnt (often comparing it to the budgeted amount)

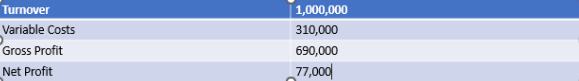

What are profit and loss statements also known as?

income statement

P&L

What is the profit and loss statement?

a financial statement that summarises the revenue, costs and expenses incurred during a specified period

What could the period of a profit and loss statement be?

monthly

quarterly

yearly

Is a profit and loss statement forwards or backwards looking?

backwards looking

Define ‘turnover’ (total sales, gross sales or revenue)

total value of work undertaken, and goods sold in the period

Define ‘fixed costs’ (overheads)

expenses that don’t vary with the level of income or activity of the business - ongoing expenses of running the business other than the cost of sales

Define ‘variable costs’ (cost of sales/direct costs)

expenses that change according to the level of activity of the business

Name examples of ‘variable costs’ in a vet business

drug and consumable costs that vary according to amount of patients that are treated according to amount of patients treated/seen

Define ‘gross profit’

calculated by deducting the cost of sales for the period from the turnover generated in the same period

Define ‘operating profit’

amount remaining after all trading expenses have been deducted from the total turnover including depreciation and amortization, but not including interest and tax costs and doesn’t include non-operating income

Define ‘net profit’

amount remaining after all trading expenses have been deducted from the total turnover (includes depreciation, amortization, interest and taxes and non-operating income)

Define ‘EBITA’

earnings before interest, taxes and amortization (also includes non-operating income)

Define ‘EBITDA’

earnings before interest, taxes, depreciation, and amortization (also includes non-operating income)

What do performance indicators measure?

how well a business is performing

How can performance indicators be calculated?

from profit and loss statement

What are common performance metrics (indicators)?

gross profit percentage

cost of sales/direct costs percentage

net profit percentage

staff cost/turnover

Gross profit percentage =

(gross profit/turnover) x 100

Cost of sales/direct costs percentage =

(cost of sales/turnover) x 100

What is gross profit percentage measuring the same thing as?

cost of sales/direct costs percentage

net profit percentage =

(net profit/turnover) x 100

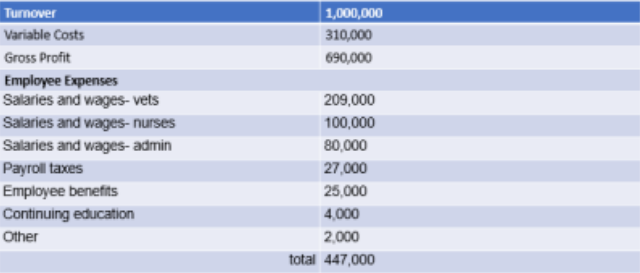

staff cost/turnover =

(staff cost/turnover) = 100

What is the normal gross profit percentage?

60-75% (70%)

What is the gross profit percentage for ABC Equine Practice?

69%

What is the net profit percentage for ABC Equine Practice?

7.7%

What is the staff cost as a percentage of turnover for ABC Equine Practice?

44.7%