Corporate Law IBA 2025 Final

1/137

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

138 Terms

Public Law / Common Law

It is about the relationship between the state and its citizens.

Government involvement is key

Constitutional, administrative, and criminal law

Characteristic: You do not depend on legal books but more on judgement. It is about the legal verdicts of courts (shareholder oriented)

Private / Civil law

Rights and duties of natural persons towards each other

The government is typically not a party

Contract, tort, property, trusts, family

Characteristics: Primary source of the law is the law books. We still have verdicts that can also determine the determination of legal rights

Tort

It is a civil wrong, other than breach of contract, that causes a claimant to suffer loss or harm, resulting in legal liability for the person who commits the tortious act

Corporations

Legal forces where you can effectively organize your business activities.

It is a legal entity with limited liability

Most commonly used business form for larger economic activities

Closed / Private Corporations

Not traded on stock exchange, limited number of shareholders, less regulation

E.g., family businesses

Open / Public Corporations

Listed on stock exchange, many shareholders, stricter regulations, raises capital trough stock sales, such as Tesla and Apple

Main Actors Corperations

Shareholders, employees, the corporate board / directors, and creditors

Creditors

Have a priority claim so are paid first in case of bankruptcy.

No voting rights

Fix claim

General Partnership

Structure where two or more people co-own a business.

Unlimited liability

Everyone has the same authority

Limited Partnership

Partnership with at least one general partner and one or more limited partners.

General partners have unlimited liability,

Limited partners have limited liability

Limited Liability Partnership

All partners have limited liability

All partners can be involved in management

Limited Liability Limited Partnership

Has general and limited partners

Both have limited liability

Sole proprietorship

One person is responsible for all aspects of the business

Unlimited liability, so responsible for all debts and liabilities

Has full control over the business

Businesses are not taxed separately

Minimal regulation

Jurisdiction (US)

Legal authority that a specific country, state, or court has over a business entity

Federal government: Governs national laws and regulations

State governments: Handle laws specific to each state, including corporate law

Federal Court

Handles cases related to federal matters such as patents, securities, or interstate lawsuits, such as disputes that cross state lines

State Court

Handles most legal matters, such as corporate law, contracts, and business disputes

Example DGCL

Many multinational corporations are incorporated in Delaware due to its corporation-friendly policies and favorable tax policies

Example Sarbanes-Oxley Act

Federal US law that protects investors from fraudulent accounting activities by corporations

EU Regulation

A binding legislative act. It must be applied in its entirety across the EU. Most are useful and strict, as they bind the legal subjects

EU Directives

Set out a goal that all EU countries must achieve. However, it is up to the member states to devise their laws and how to reach these goals. Difference between minimum and maximum harmonisation

Minimum Harmonisation

The EU sets a basic standard that all member states must follow, but they are free to introduce stricter national rules if necessary. This allows each member state to adopt the directive to its own situation

Maximum Harmonisation

The EU sets a standard but leaves no room for stricter or flexible national rules. It fully harmonizes a particular area of law, and thus all MS must follow exactly the same rules

EU Recommendations

Not binding. A recommendation allows the institutions to make their views known and to suggest a line of action without imposing any legal obligation on those to whom it is addressed

Hard Law

Legally binding regulations, such as corporate laws and security laws (traffic lights)

Soft Law

Non-binding guidelines, principles, or best practices that companies are encouraged to follow but are not legally required to

Corporate governance code

A soft law. Sets of principles that outline the best practices for companies in areas such as transparency and shareholder rights

Many corporate governance codes operate under a flexible approach where companies can:

Comply: With the governance rules

Explain: Why they do not follow the rules

This allows businesses to adopt best practices to their specific needs

Incorporation

The formation of a company. Different documents need to be filed, including the Articles of Association. To be legally recognized, companies must be incorporated according to specific jurisdictional requirements

Articles of Association

The Articles of Association are a legal document that outlines the rules and regulations for the internal management and operation of a company. They serve as a contract between the company and its shareholders, directors, and officers.

It consists of:

Mandatory rules: Cannot be modified by contract. Usually aim to protect weaker parties (creditors)

Default rules: Applicable in case articles of association or another contract do not state otherwise

Basic legal characteristics

Legal personality

Limited liability

Transferability of shares

Delegated management under a board structure

Investor ownership (sometimes state ownership)

Legal Personality

Treats a company like a person, meaning it can own property, sign contracts, and act separately from its shareholders.

However, since it’s not a real person, it needs someone to represent it and make decisions on its behalf

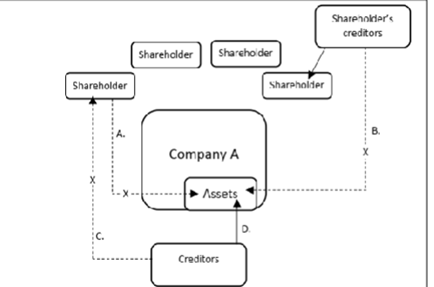

Entity Shielding

Because of legal personality, the company is the owner of the assets, and shield these from the shareholders

Liquidation Protection

The shareholders cannot withdraw the company’s assets at will, preserving the company’s ongoing value

Priority Rule

Ensure that the company’s creditors have the first claim on the corporation’s assets for any company debts before shareholders can claim any residual value

Separate Patrimony

Legal concept where a person or entity has a distinct pool of assets and liabilities that are legally separated from their personal or other business assets

Limited Liability

Shareholders are only liable up to their committed investment

Owner shielding

Shields the shareholders from the liabilities of the company

Advantages of limited liability

Effective capital markets; without limited liability, you wouldn’t invest in companies

Without it, there wouldn’t be any start-ups in the first place

Reduces the need for shareholders to monitor every step and facilitates the diversification strategies used by investors

Asset Partitioning

Assets of the corporation are separated from those of the shareholders

Tort victims

Creditors that become creditors unintentionally

Become creditors when there is a lawsuit and the judge grants them a claim

Cannot negotiate ex ante about the terms of their claims, and thus risk cannot be translated into better protection

Judgement Proof Problem

Occurs when companies limit their liability by structuring assets in a way that reduces what creditors can claim.

If a subsidary has low assets, creditors may not get full compensation, even if the corporate group as a whole is wealthy

Corporate Sustainability Due Diligence Directive (CSDDD)

A proposed EU law aimed at making companies responsible for their environmental and human rights impact throughout their supply chains. It requires large companies operating in the EU to identify, prevent, and address negative effects on people and the planet caused by their business activities.

Transferable Shares

Really crucial for a company’s continuity when ownership changes

Enhance the liquidity of shareholder investments because they make it easier for shareholders to maintain diversified portolios

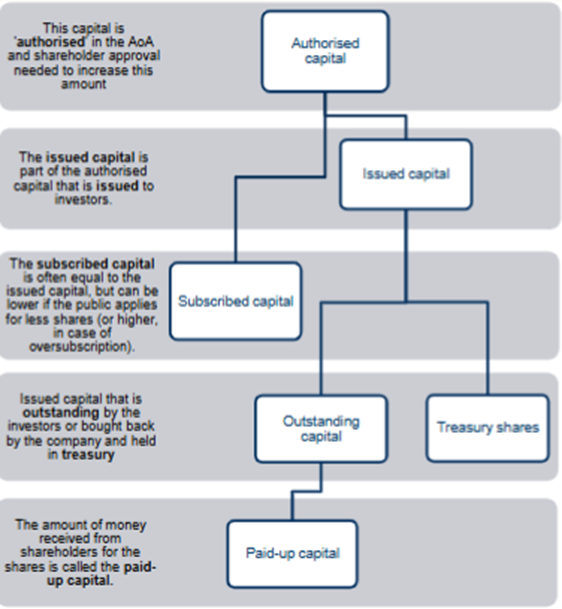

Authorized Capital

The maximum share capital that the company is allowed to issue which is stated in the articles of association. If it wants to increase this number, it needs to get approval of the existing shareholders

Issued Capital

Part of the authorised capital that is issued to investors

Treasury shares

Issued capital that is bought back by the company and held in treasury

Paid-up Capital

The amount of money actually received from shareholders for the shares

In-kind contributions

Shares can also be issued for non-monetary contributions, these need to be assessed

European minimum capital rule

Minimum capital is 25,000 euros according to the European Capital Directive, but member states may set higher amounts

Main arguments against minimum capital requirements

Does not provide meaningful protection for creditors

The assets that are bought with the share capital can decline in value, whereas the legal capital stays fixed

There is no actual relationship between the minimum capital and the business activities or funding needs of a public company

The same requirement for both small and large firms

The liabilities of any company are well beyond this minimum capital requirement

Creditors can be better protected in other ways

The minimum capital may increase the costs of starting a public company, which may limit entrepreneurship and innovation

Delegated Management under a board structure

Principal authority over corporate affairs: generally elected by shareholders

This structure allows a company to operate efficiently by centralizing decision-making authority within a corporate board

Capital rights

Financial rights:

Dividends

Sale of shares

Control rights

Decision-making rights:

Essential rights for shareholders to influence corporate governance

Vote

Question the board

Certain information rights

Manager-Shareholder conflict

Managers have more information and potentially different interests than shareholders, leading to decisions that may not always align with what shareholders want

Different interests include FCF problems, risk appetite, different time horizons, and on-the-job consumption

The Majority-Minority Shareholder Conflict

In firms with controlling shareholders, majority owners may make decisions that benefit themselves at the expense of minority shareholders

Self-dealing transactions, excessive executive pay, or strategic dilution of minority stakes

Legal solutions include disclosure requirements, independent board oversight, and judicial review of related-party transactions

The Shareholder-Creditor Conflict

Shareholders may pursue riskier projects to maximize returns, knowing that creditors bear much of the downside risk

Firms may issue excessive debt, prioritize dividend payments over loan obligations, or take on high-risk ventures without regard for creditor interests

Protective legal mechanisms include capital maintenance rules, creditor rights in bankruptcy, and financial disclosure regulations

Legal Strategies

Mitigate the vulnerability of principals to the opportunism of their agents

Regulatory strategies: Agent constraining = Focus in US

Governance strategies: Principal empowering = Focus in Europe

Appointment Rights and Decision Rights

Selection and Removal / Initiation and Veto: Shareholder appointment rights, decision-making rights, and shareholder and management proposals

Exit rights

Investors and creditors can sell shares, trigger covenants, or seek legal remedies if corporate governance failures become evident

Unitary Boards

Common in the US and UK

A single board oversees management

Executive and non-executive directors together in one board

Two-Tier Boards

Seperates board members into two seperate boards

Supervisory board: Elected by the shareholders, in the German model also by employees. They oversee the management board

Managing board: Similar to the executive board members in the one-tier board model. Responsible for the company’s day to day operations

Options for shareholders to share their dissatisfaction with the management

They can sell their shares and thus exit the company

They can use their voting rights and other decision-making rights to influence the corporate governance of the company directly

Fundamental decisions for shareholders

Appointment rights: Appoint board members who are in charge of strategic decision-making

Decision rights: Voting on M&A, changes to the corporate charter, and changes to Articles of Association

Management proposals (veto/ratification): The board suggests these to the AGM, where shareholders can vote on these proposals

Shareholder proposals

Annual General Meeting (AGM)

A formal decision-making body where shareholders use their voting rights. Shareholders can individually or collectively make decisions that are legally valid and shape the direction of the company

Appointment Rights

It’s a ratification right. The board usually nominates its own candidates, and shareholders can then approve or disapprove of these at the AGM

It includes the removal of shareholder-appointed directors, which can only be removed by shareholders, usually without a valid cause and at any time

Decision-making rights

Increasing the share capital

Waiver of pre-emption rights

Repurchase of shares

Nachgründung

These four are related to share capital and mostly belong to shareholders in Europe. In the US the board of directors is mostly in charge of these

Amending articles of association (charter amendments)

Large transactions, mergers, and demergers

Related to external auditor

Annual financial statements

Dividends

Say on Pay

RPT (related-party transaction)

Discharge

Amending articles of association

Always need a shareholder vote to change articles of association

In most countries a quality majority is needed, a higher majority than simply 50% (e.g., 2/3). Exceptions are Delaware and The Netherlands

Discharge

Very common in continental Europe. Is the declaration or the statement of shareholders to not hold their board members liable for everything they disclosed to them in a certain financial year

Pre-emption rights

Allow existing shareholders to be the first to buy new shares that will be issued by the company. Mandatory in Europe, shareholders from the US do not possess these rights

Nachgründung

A right that involves transactions with founders or major shareholders. The shareholders have the right to approve or disapprove these transactions within a certain timeframe

Rule 14a-8 of the Exchange Act

Allows shareholders to make shareholder proposals, which the corporate board must include in the proxy statements

Proxy Statements

The invitations that include the information about the shareholder meeting

Resubmission thresholds

Ensures that a proposal that gets repeatedly rejected must gain increasing support over time to be reconsidered

Proxy fights / contests

The party seeking to gain control over the company through the corporate board proposes its own board members for election at the shareholder meeting.

For this, an own proxy campaign needs to be started.

Can be considered a takeover strategy

3 of the 13 grounds of exclusion of Rule 14a-8

The nomination of a specific individual in the company’s proxy materials for election to the board of directors

A proposal that deals with a matter relating to ordinary day-to-day business operations

A shareholder proposal that micromanages the company: If it is too prescriptive, limiting the discretionary powers of the board of directors

Proxy access

The shareholder right to include its own nominees with the company’s proxy materials without having to circulate their own proxy materials

Contral Enhancing Mechanisms

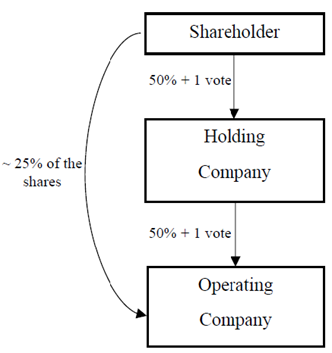

Mechanisms that allow shareholders with minimal stake to have majority control (i.e., controlling minority). Pyramid Structure and Dual-Class Firms

Pyramid Structure

Controlling minority shareholders that holds a controlling stake in a holding company that, in turn, holds a controlling stake in an operating company

Private Benefits of Control (PBC)

The gain resulting from exercising control for controlling shareholders at the expense of noncontrolling shareholders

Tunneling

The transfer of resources out of a company to its controlling shareholder

At the expense of minority shareholders

Blockholders can use the firm’s funds for their own gains

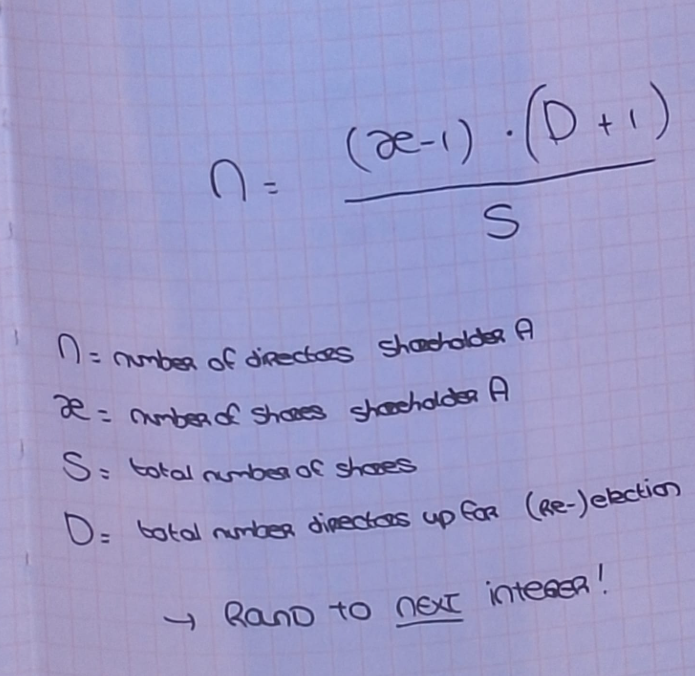

Cumulative Voting

With cumulative voting, votes are collected for all directors that can be elected, and shareholders can distribute their votes in any manner they choose

Cumulative voting example:

100 votes in total

A has 60 votes

B has 40 votes

3 Directors up for election

So A has 180 votes in total and B 120 votes

A can choose 2 directors and B can choose 1

Slate voting

A slate is a group of candidates that run in multi-seat or multi-position elections on a common platform (all are members of a political party or have the same policies)

Trusteeship Strategy: Independent Directors

Originated in the US

Seeks to remove conflicts of interests ex ante

Do not profit from opportunistic behaviour

Not tied by financial incentives but motivated by ethical and reputational concerns

Criticism against the trusteeship strategy of independent directors

Arbitrary criteria

No conclusive evidence of the effect on firm performance

Their role during the financial crisis has been criticised

Shareholders are the owners of the company. True or False

True, but it depends on what you call ownership. They have capital and control rights. It is different than the type of ownership you have of an object

The Dodd-Frank Act

Granted the SEC the power to make rules facilitating the inclusion of shareholder nominations in the corporate proxy materials. Leading to the SEC adopting rule 14a-11

Rule 14a-11

The Rule holds that a shareholder (or shareholders jointly) holding 3% of the voting share capital for 3 years can include its own nominees with the company’s proxy materials

In 2011, the D.C. Circuit ruled against this rule. But shareholders may still file shareholder proposals seeking proxy access, which are non-binding

Full structured regime: special structure in The Netherlands

Used for all types as long as the following criteria are met for 3 consecutive years

Capital and earnings amount to 16 million euros

Legal obligation to appoint a work council

At least 100 employees in the Netherlands

Weakened structured regime: special structure in The Netherlands

Apply to companies of which at least half of the issued capital is held by a legal entity whose majority of employees work outside the Netherlands

Types of directors

One-tier board

Executive directors

Non-executive directors

Non-executive directors (grey directors): Representatives of major shareholders or employees, former executives

Non-executive independent directors: No relationship with the company other than board membership

Two-tier board

Independent supervisory board members

The Companies Act (Belgium)

A director in a listed company is to be considered independent if she does not maintain a relationship with the company or with a major shareholder that jeopardizes her independence

Corporate Governance Code (Germany)

The Supervisory Board shall include what it considers to be an appropriate number of independent members from the group of shareholder representatives. Independent if they are independent from the company’s Management board and of any controlling shareholder

Listing Rules of a Stock Exchange (Nasdaq)

Majority Independent Board: A majority of the board of directors must be comprised of Independent Directors

Co-determination in Germany

More than 2000 employees

Half of supervisory board = employee representatives

Chairman (usually shareholder representative)

500-2000 employees

One third of supervisory board = employee representatives

Board of directors: gender diversity

Germany: Supervisory board shall be composed of atleast 30% men and 30% women

France: Atleast 40% of both genders in stock exchange-listed companies

Which form, one-tier or two-tier, is preferable? Usual Arguments:

The one-tier board structure results in a closer relation and better information flow between the supervisory and managerial directors

The two-tier board structure encompasses a clearer, formal seperation between the supervisory body and those being supervised

Convergence between one-tier and two-tier boards

One-tier boards make use of delegation to the management and monitoring the exercise of delegated powers becomes their main task

Both board structures depend on management information

The use of independency requirements for the non-executive/supervisory board members, making them more separated

Tasks and board committees, including a nomination committee

The board of directors: other committees

CSR and Sustainability Committee

Audit Committee

Nomination & Compensation Committee

Corporate Management Committee

Securityholders Relationship Committee

Independent Directors Committee

Role of the board

Running the company

Monitoring (non-executives, supervisory board): Overseeing day-to-day operations

Executing the strategy (executives, management board): Day-to-day operaionts

Execute duties described by the company law & not doing what is forbidden by the law

Representing the company

Board Duties

Constraint Strategy —> Legal constraints:

Duty of Care

Duty of Loyalty

The constraints strategy

A regulatory strategy that limits the board members in their behavior to restrict shareholder-manager agency problems