Chapter 13

4.0(1)

Card Sorting

1/29

There's no tags or description

Looks like no tags are added yet.

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

30 Terms

1

New cards

**__**__**___ _____**__ have a physical presence; they can be seen and touched.

Tangible assets

2

New cards

\

______ _______ are rights or privileges. They cannot be seen or touched.

______ _______ are rights or privileges. They cannot be seen or touched.

Intangible assets

3

New cards

\: Sometimes called plant assets or fixed assets. We depreciate these assets over their useful life.

Property, Plant, and Equipment

4

New cards

\: Land is considered a component of Property, Plant, and Equipment. It has an infinite life, and as such, land is not subject to depreciation.

Land

5

New cards

\: Mineral deposits, oil and gas reserves, timber stands, coal mines, and stone quarries are some examples of natural resources. We deplete these assets over their useful life.

Natural Resources

6

New cards

\: patents and copyrights. Amortize the cost of each over its useful life.

Intangible Assets with Identifiable Useful Lives

7

New cards

\: renewable franchises, trademarks, and goodwill. The cost of these assets is not expensed unless it can be shown that there has been an impairment in value.

**Intangible Assets with** ***Indefinite*** **Useful Lives**

8

New cards

Buildings

* Purchase price

* Sales taxes

* Title search and transfer document costs

* Realtor’s and attorney’s fees

* Remodeling costs

* Sales taxes

* Title search and transfer document costs

* Realtor’s and attorney’s fees

* Remodeling costs

9

New cards

**Equipment**

* Purchase price (less discounts)

* Sales taxes

* Delivery costs

* Installation costs

* Costs to adapt for intended use

* Sales taxes

* Delivery costs

* Installation costs

* Costs to adapt for intended use

10

New cards

Land

* Purchase price

* Sales taxes

* Title search and transfer document costs

* Realtor’s and attorney’s fees

* Costs of removal of old buildings

* Grading costs

* Sales taxes

* Title search and transfer document costs

* Realtor’s and attorney’s fees

* Costs of removal of old buildings

* Grading costs

11

New cards

The life cycle of operational assets has four phases in a continuous loop that are used to account for and define the operational asset throughout its lifetime. These functions, in order, are:

1. Acquiring funding

2. Buying the asset

3. Using the asset

4. Retiring the asset

12

New cards

Depreciation refers to the **_____** __of the cost of a fixed asset (PP&E) to__ ____**_** over the years the organization expects to use it ***(expense deferral)***

Allocation; Expense

13

New cards

***______*** is a generic term referring to the spreading out of a cost over a period of time

Ammortization

14

New cards

The __**____ _____**__ of accounting requires that firms use depreciation and amortization

matching principal

15

New cards

As a long-term asset is **__**__, we allocate a portion of the original cost as an__ ____**_** in each year

Used; expense

16

New cards

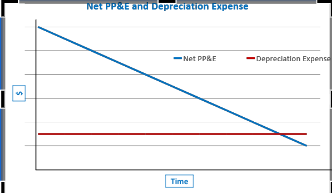

This graph demonstrates what happens under the __**________**__ method

Straight-line

17

New cards

Assets are depreciated based on their **_____**

cost

18

New cards

*Asset valuation for depreciation:*

*Includes costs incurred to put the asset* ***____ ___***

*Includes costs incurred to put the asset* ***____ ___***

into use

19

New cards

*Ordinary repairs and maintenance are* ***________***

Expensed

20

New cards

*Extraordinary repairs, replacements, additions, and improvements are* ***________***

capitalized

21

New cards

*Expensed means the costs are charged to the __*__*__ _____*__ *in the period they are incurred*

income statement

22

New cards

Capitalized means they are added to the value of the asst and depreciated over the asset’s __*____ ____*__

remaining life

23

New cards

*Depreciable Base*

*This is the full amount that will be depreciated* ***_***__*___ ___ ___*__*of the asset*

Cost - Salvage Value

*This is the full amount that will be depreciated* ***_***__*___ ___ ___*__*of the asset*

Cost - Salvage Value

over the life

24

New cards

*Accumulated Depreciation*

*The total amount of depreciation taken on an asset* __***__ __***__

*Shown on the balance sheet, reduces* ***_*__*__ ____*__**

*The total amount of depreciation taken on an asset* __***__ __***__

*Shown on the balance sheet, reduces* ***_*__*__ ____*__**

to date; Net PPE

25

New cards

*Depreciation Expense*

* *The depreciation taken in the* __***____ ___***__

* *Shown on the income statement, reduces* ***_*__*__ ____*__**

* *The depreciation taken in the* __***____ ___***__

* *Shown on the income statement, reduces* ***_*__*__ ____*__**

*current period; net income*

26

New cards

\: The same amount is depreciated each accounting period.

**Straight-line method**:

27

New cards

\: Produces more depreciation expense in the early years of an asset’s life, with a declining amount of expense in later years.

Double-declining-balance

28

New cards

\: Produces varying amounts of depreciation in different accounting periods depending upon the number of units produced.

Units-of-production

29

New cards

There are many depreciation methods, and some are more **____** than the straight-line method (accelerated)

aggressive

30

New cards

Similar to the various inventory costing methods (*FIFO/LIFO; we’ll discuss later*), different methods can produce ____ _____acct numbers!

Significantly different