Edexcel Economics Theme 1

5.0(1)

5.0(1)

New

Card Sorting

1/105

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

106 Terms

1

New cards

Economics

The study of the allocation of scarce resources.

2

New cards

Economic Goods

Resources that are scarce.

3

New cards

Short Run

A time period where at least one factor of production is fixed.

4

New cards

Long Run

A time period where all factors of production are variable.

5

New cards

Productivity

The output per unit of input.

6

New cards

The Economic Problem

Resources are scarce but wants are infinite.

7

New cards

Scarcity

The world's resources are limited, there are only limited amounts of land, water, oil, food, etc..

Therefore, resources are scarce.

Therefore, resources are scarce.

8

New cards

Free Goods

Goods that are unlimited in supply and therefore have no opportunity cost.

9

New cards

Economic Agents

Consumer, Business and Governments.

Agents involved in Economic transactions.

Agents involved in Economic transactions.

10

New cards

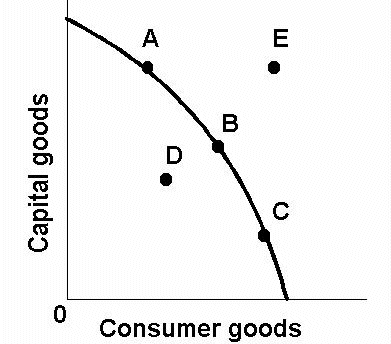

Production Possibility Frontier

The maximum potential output of a combination of goods an economy can achieve when all its resources are fully and efficiently employed, given the level of technology.

11

New cards

Opportunity Cost

The next best alternative foregone.

12

New cards

Economic Growth

Increase an economy's productive potential.

13

New cards

Capital Goods

Goods intended for use in production, rather than by consumers.

14

New cards

Consumer Goods

Goods designed for use by final consumers.

15

New cards

Renewable Resources

A resource whose stock level can be replenished naturally over a period of time.

16

New cards

Non-renewable Resources

A resource whose stock level decreases over time as it is consumed.

17

New cards

Ceteris Paribus

'All other things (factors) remaining the same'

The assumption that all other variables within a model remain constant whilst the change is being considered.

The assumption that all other variables within a model remain constant whilst the change is being considered.

18

New cards

Positive Statement

A statement based on facts which can be tested as true or false and are value-free.

19

New cards

Normative Statement

A statement based on value judgements which cannot be tested as true or false.

20

New cards

Adam Smith

The Father of Economics;

- The Invisible Hand (workings of the Price Mechanism)

- Specialisation

- Division of Labour

- The Invisible Hand (workings of the Price Mechanism)

- Specialisation

- Division of Labour

21

New cards

Division of Labour

Specialisation of workers on specific tasks in the production process.

22

New cards

Specialisation

The process of breaking down the production process into steps and then each worker is assigned a step. This would then increase labour productivity (Output per Worker).

23

New cards

Barter

An exchange of goods/services for other goods/services.

- Does not involve money.

- Double coincidence of wants.

- Does not involve money.

- Double coincidence of wants.

24

New cards

Money

Anything which is acceptable to a wide number of people and organisations as payment for goods and services.

25

New cards

Free Market Economy

Where all resources are privately owned and allocated via the price mechanism. There is minimal government intervention.

26

New cards

Command Economy

Where there is public ownership of resources and these are allocated by the government.

27

New cards

Mixed Economy

Where some resources are owned and allocated by the private sector and some by the public sector.

28

New cards

Market

A channel where goods and services are exchanged.

29

New cards

Utility

The capacity of a good or service to satisfy some human want.

30

New cards

Rational Decision Making

Where consumers allocate their expenditure on goods and services to maximize utility, and producers allocate their resources to maximize profits.

31

New cards

Demand

The quantity of goods or services that will be bought at any given price over a period of time.

32

New cards

Demand Curve

Shows the quantity of a good or service that would be bought over a range of different price levels in a given period of time.

Slopes downward - Price and Quantity have an inverse (negative) relationship.

Slopes downward - Price and Quantity have an inverse (negative) relationship.

33

New cards

Marginal Utility

The additional satisfaction that a consumer gains for consuming one additional unit of a product.

34

New cards

Diminishing Marginal Utility

As successive units of a good are consumed, the utility gained from each extra unit will fall.

35

New cards

% Change

y2 - y1 / y1 × 100

36

New cards

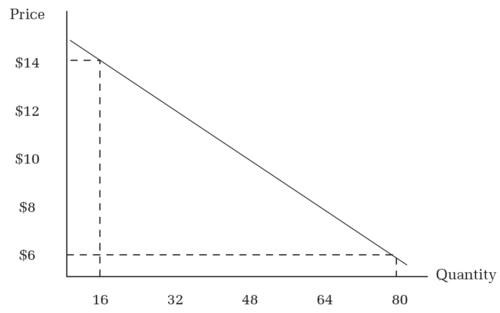

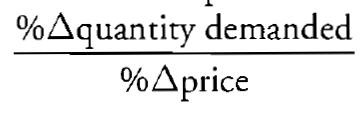

Price Elasticity of Demand (PED)

The responsiveness of demand to changes in price.

The value is always negative.

% ∆QD / % ∆P × 100

The value is always negative.

% ∆QD / % ∆P × 100

37

New cards

Unitary Price Elasticity (Ped)

Ped = 1

38

New cards

Perfectly Price Inelastic (Ped)

Ped = 0

39

New cards

Price Inelastic (Ped)

Ped is < 1

40

New cards

Perfectly Price Elastic (Ped)

Ped = ∞

41

New cards

Price Elastic (Ped)

Ped is > 1

42

New cards

Total Revenue

Price × Quantity

43

New cards

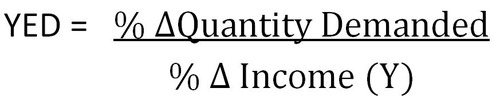

Income Elasticity of Demand (YED)

The responsiveness of demand to changes in income.

%∆QD / %∆Y × 100

Negative - Inferior Good (Y increases, QD decreases)

Positive - Normal Good (Y increases, QD increases).

%∆QD / %∆Y × 100

Negative - Inferior Good (Y increases, QD decreases)

Positive - Normal Good (Y increases, QD increases).

44

New cards

Negative Income Elasticity of Demand

Inferior Good (As income increases, QD decreases)

45

New cards

Positive Income Elasticity of Demand

Normal Good (As income increases, QD increases)

46

New cards

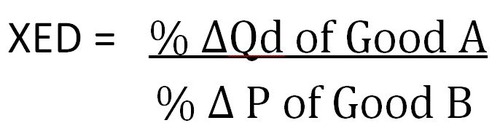

Cross Price Elasticity of Demand (XED)

The responsiveness of demand for one good to changes in the price of a related good. (Either substitutes or complements).

% ∆ inQD of Good A/ % ∆ in Price of Good B × 100

Negative Value - Complements (The 2 goods are in Joint Demand; as the Price of Good A increases the Demand of Good B decreases).

Positive Value - Substitutes (The 2 goods are in Competitive Demand; as the Price of Good A increases, the Demand of Good B increases.)

% ∆ inQD of Good A/ % ∆ in Price of Good B × 100

Negative Value - Complements (The 2 goods are in Joint Demand; as the Price of Good A increases the Demand of Good B decreases).

Positive Value - Substitutes (The 2 goods are in Competitive Demand; as the Price of Good A increases, the Demand of Good B increases.)

47

New cards

Negative Cross Price Elasticity of Demand

Complements (As the Price of one good increases, the Demand for the second good decreases)

The 2 goods are in Joint Demand.

The 2 goods are in Joint Demand.

48

New cards

Positive Cross Price Elasticity of Demand

Substitutes (As the Price of one good increases, the Demand for the second good increases)

The 2 goods are in Competitive Demand.

The 2 goods are in Competitive Demand.

49

New cards

Supply

The quantity of a good or service that firms are willing to sell at a given price over a given period of time.

50

New cards

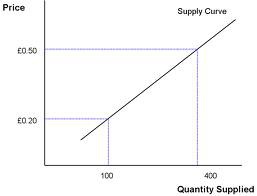

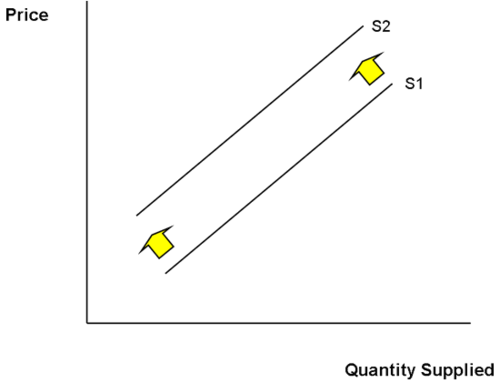

Supply Curve

Shows the quantity of a good or service that firms are willing to sell to a market over a range of different price levels in a given period of time.

An upward sloping curve - Price and Supply have a direct relationship.

An upward sloping curve - Price and Supply have a direct relationship.

51

New cards

Price Elasticity of Supply

The responsiveness of supply to changes in price.

Pes = %∆QS / %∆P

Pes = %∆QS / %∆P

52

New cards

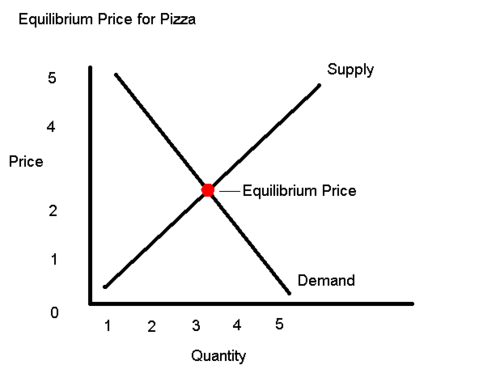

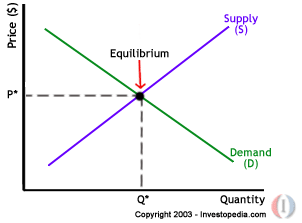

Equilibrium Price

The price at which the Quantity Demanded and Quantity Supplied are equal, ceteris paribis. "Market Clearing Price"

53

New cards

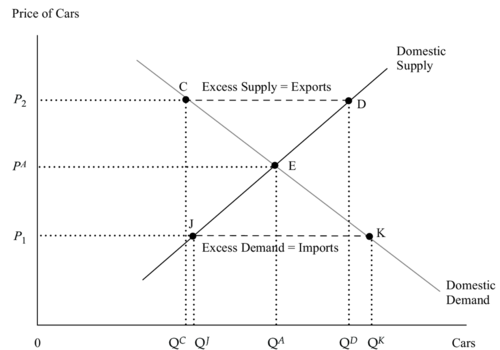

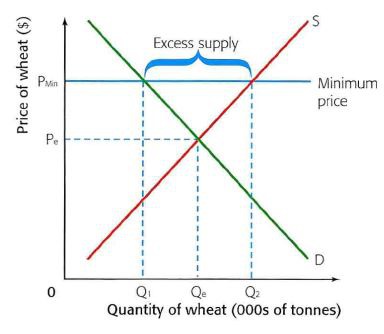

Excess Supply

Where the QS exceeds the QD for a good at the current market price.

QS > QD

QS > QD

54

New cards

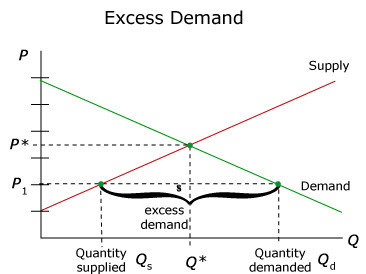

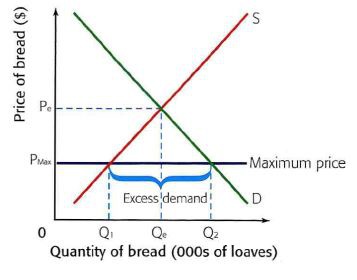

Excess Demand

When the QD exceeds the QS for a good at the current market price.

QD > QS

QD > QS

55

New cards

Adam Smith's Invisible Hand

A hidden hand of the market operating in a competitive market through the pursuit of self-interest allocated resources in society's best interest.

56

New cards

Price Mechanism

The use of market forces to allocate resources in order to solve the economic problem of what, how, and for whom to produce.

The interaction of demand and supply to determine the market clearing price.

The interaction of demand and supply to determine the market clearing price.

57

New cards

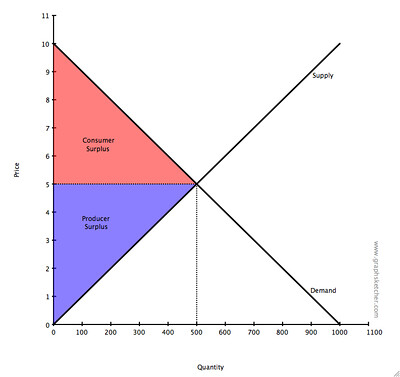

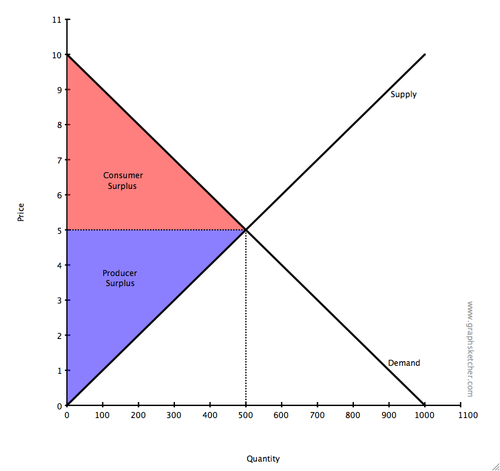

Consumer Surplus

The difference between how much buyers are prepared to pay for a good and what they actually pay.

It is represented by the area under the demand curve above the ruling market price.

It is represented by the area under the demand curve above the ruling market price.

58

New cards

Producer Surplus

The difference between the market price which firms receive and the price at which they are prepared to supply.

It is represented by the area below the ruling market price and above the supply curve.

It is represented by the area below the ruling market price and above the supply curve.

59

New cards

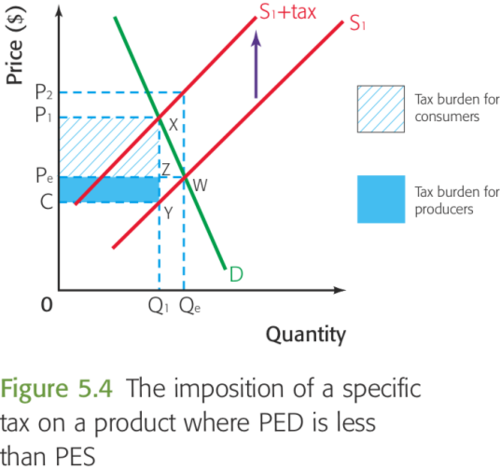

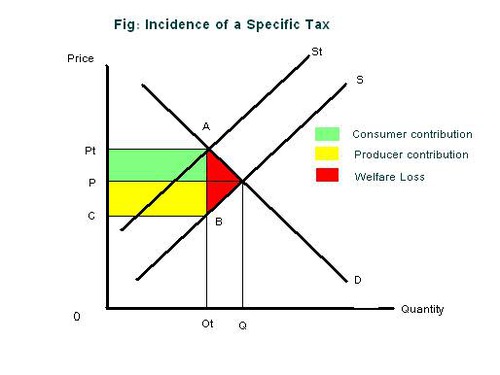

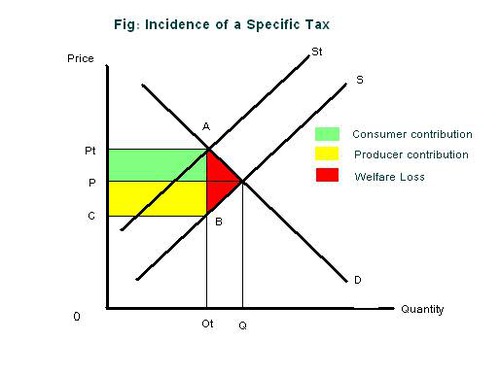

Tax Incidence when Demand is Inelastic

Consumer Tax Burden > Producer's Tax Burden

60

New cards

Tax Incidence when Demand is elastic

Consumer Tax Burden < Producer's Tax Burden

61

New cards

Tax Incidence when Supply is Inelastic

Consumer Tax Burden < Producer's Tax Burden

62

New cards

Tax Incidence when Supply is elastic

Consumer Tax Burden > Producer's Tax Burden

63

New cards

Direct Taxes

Tax paid on incomes or profits.

Example; Income Tax and Corporation Tax.

Example; Income Tax and Corporation Tax.

64

New cards

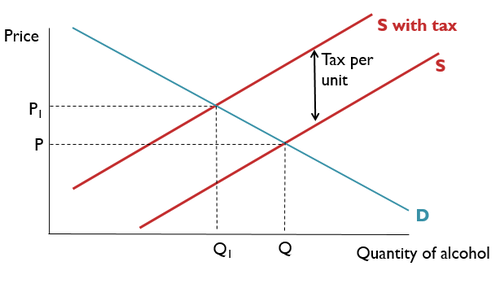

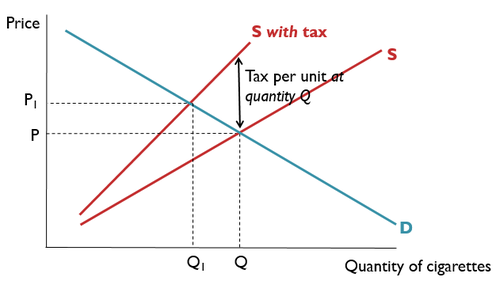

Indirect Taxes

A tax levied on the purchase of goods and services. It includes both specific and Ad Valorem taxes.

Its shown by an inward shift of the supply curve.

Its shown by an inward shift of the supply curve.

65

New cards

Specific Tax

The amount of tax levied does not change with the value of the goods but with the amount or volume of goods purchased (Excise Duties)

- Parallel to the 1st Supply Curve

- Parallel to the 1st Supply Curve

66

New cards

Ad Valorem Tax

Tax levied increases in proportion to the value of the tax base. (VAT)

- Steeper Gradient relative to the original Supply Curve.

- Steeper Gradient relative to the original Supply Curve.

67

New cards

Incidence of Tax

The distribution of the tax paid between consumers and producers.

68

New cards

Consumer Tax

Below the new EQ and above the original EQ.

69

New cards

Producer Tax

Below the original EQ and above the original supply curve.

70

New cards

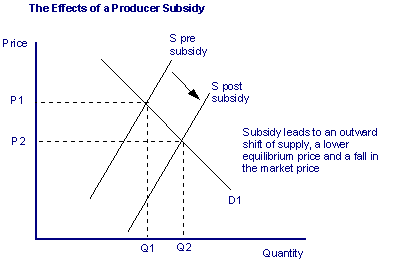

Subsidy

A government grant to firms, which reduces production costs and encourages an increase in output.

Its shown as an outward shift of the Supply Curve.

Its shown as an outward shift of the Supply Curve.

71

New cards

Market Failure

A misallocation of resources caused by the Market Mechanism.

72

New cards

Reasons for Market Failure

- Missing Markets ( Merit Goods and Public Goods)

- Lack of Competition in the market.

- Externalities

- Imperfect Market Information

- Factor Immobility

- Inequality

- Lack of Competition in the market.

- Externalities

- Imperfect Market Information

- Factor Immobility

- Inequality

73

New cards

Demerit Goods

A good which is over provided by the Market Mechanism and tends to yield more costs to individuals than they realize.

Examples; Tobacco, Drugs, Alcohol, etc..

Examples; Tobacco, Drugs, Alcohol, etc..

74

New cards

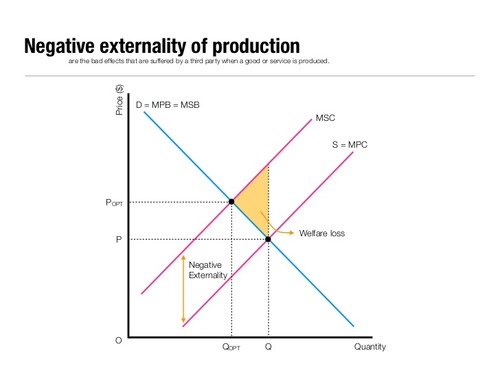

Externalities

The costs or benefits that are external to an exchange. They are 3rd party effects ignored by the Market Mechanism.

75

New cards

Consumption Externality

An external cost or benefit arising from a consumption activity.

76

New cards

Production Externality

An external effect of production, which neither harms nor benefits the person or firm controlling the production.

77

New cards

External Costs

Negative 3rd Party effects that are excluded from the Market Mechanism.

78

New cards

Private Costs

Cost internal to a market transaction, which are therefore taken into account by the Market Mechanism.

79

New cards

Social Costs

External Costs + Private Costs.

80

New cards

External Benefits

Positive 3rd Party effects that are excluded from the Market Mechanism.

81

New cards

Private Benefits

Benefits internal to a market transaction, which are therefore taken into account by the Market Mechanism.

82

New cards

Social Benefits

External Benefits + Private Benefits.

83

New cards

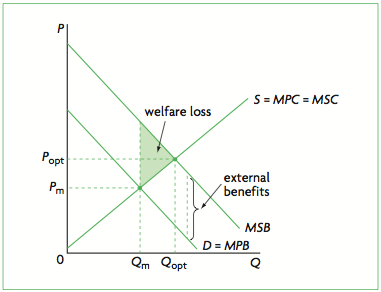

Market Equilibrium Level

Marginal Private Costs (MPC) = Marginal Private Benefits (MPB)

84

New cards

Social Optimum Level

Marginal Social Costs (MSC) = Marginal Social Benefits (MSB)

This is where society should be.

This is where society should be.

85

New cards

Welfare Loss

The excess of social costs over social benefits for a given output.

A situation where MSB is ≠ to MSC and society does not achieve maximum utility.

A situation where MSB is ≠ to MSC and society does not achieve maximum utility.

86

New cards

Welfare Gain

The excess of social benefits over social costs.

87

New cards

Negative Production Externality

88

New cards

Positive Consumption Externality

89

New cards

Internalising the Externality

Eliminating the externality by bringing it back into the framework of the Market Mechanism.

= Creating a market for the Externality.

Examples; Tradable Pollution Permits, Extending Property Rights, Taxes, Regulation, etc..

= Creating a market for the Externality.

Examples; Tradable Pollution Permits, Extending Property Rights, Taxes, Regulation, etc..

90

New cards

Public Goods

Those goods that have non-rivalry and non-excludability by their consumption.

Non Rivalry; Consumption of goods by one person does not reduce the amount available for consumption by another.

Non-Excludable; Once provided, no person can be excluded from benefiting.

Examples; Defense, Police Service, Street Lighting, Judiciary and Prison Service.

Non Rivalry; Consumption of goods by one person does not reduce the amount available for consumption by another.

Non-Excludable; Once provided, no person can be excluded from benefiting.

Examples; Defense, Police Service, Street Lighting, Judiciary and Prison Service.

91

New cards

Private Goods

Those goods that have rivalry and excludability in their consumption.

92

New cards

Free Rider Problem

If left to the free market, public goods would not be adequately provided for.

The market fails because firms cannot withhold the goods and services from people who refuse to pay.

The market fails because firms cannot withhold the goods and services from people who refuse to pay.

93

New cards

Information Gaps

Where consumers, producers or the government have insufficient knowledge to make rational economic decisions.

94

New cards

Symmetric Information

Where consumers and producers have access to the same information about a good or service in a market.

95

New cards

Asymmetric Information

Where consumers and producers have unequal access to information about a good or service in the market.

96

New cards

Maximum Price

A ceiling price set by the government on a good or service, above which it cannot rise. It may be enforced through government legislation.

97

New cards

Minimum Price

A floor price set by the government on a good or service, below which it cannot fall. It may be enforced through government legislation.

98

New cards

Guaranteed Minimum Price

Where the surplus output created is purchased by a government agency at the minimum price. The main aim of such a scheme is to protect producer incomes.

99

New cards

Tradable Pollution Permits

Pollution permits that can be bought and sold in a market. They are an attempt to solve the problem pf pollution by creating a market for it.

100

New cards

Extending Property Rights

Water companies are given the right to charge companies which dump waste into the rivers or the sea.

A way of internalising the externality.

A way of internalising the externality.