AP Microeconomics Vocabulary

1/122

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

123 Terms

Scarcity

The fundamental economic problem of having seemingly unlimited human wants in a world of limited resources

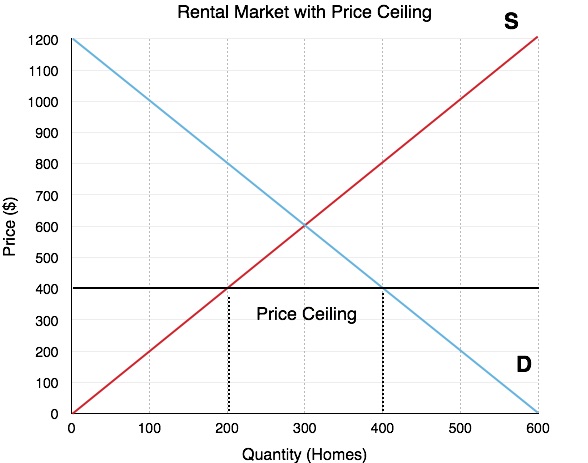

Shortage

When the quantity demanded of a product exceeds the quantity supplied

Labor

The effort of workers

Land

Resources that come from nature, such as timber, water, minerals, horses, etc.

Capital

Manufactured goods used to make other goods and services, such as machinery, buildings, tools, etc.

Entrepreneurship

The risk taking, innovation and organization of resources for production

Factors of Production

Land, Labor, Capital, and Entrepreneurship

Human Capital

Training and education of workers

Market Economy

Economy in which production and consumption are the result of decentralized decisions by many firms and individuals; defined by private ownership of resources

Command Economy

Economy in which industry is publicly owned and there is a central authority making production and consumption decisions

Traditional Economy

What is produced and how it is produced is based on custom

Microeconomics

The branch of economics concerned with how individuals make decisions and how these decisions interact; focuses on choices made by individuals, households or firms - the smaller parts that make up the economy as a whole.

Macroeconomics

Focuses on economic aggregates that summarize data across many different markets

Positive Economics

Economic analysis used to answer questions about the way the world works; no value judgements

Normative Economics

Economic analysis saying how the world should work; value judgements added

Opportunity Cost

The value of the foregone option

Economic Growth

An expansion of an economy’s production possibilities

Comparative Advantage

Varied opportunity costs between people or nations

Absolute Advantage

Being best at producing something

Explicit Costs

Expenses involving a monetary payment

Implicit Costs

Non-monetary costs

Marginal

Additional; all decisions are made on this basis

Utility

Satisfaction

Diminishing Marginal Utlity

As a consumer purchases more of a good, the additional satisfaction falls for each additional unit consumed

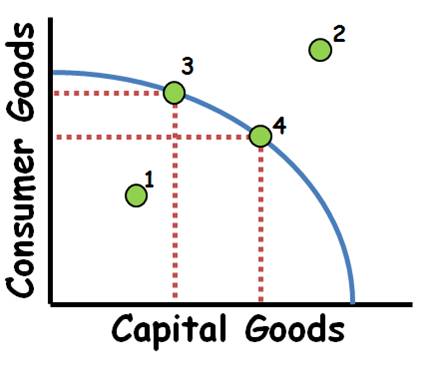

Productions Possibilities Curve (PPF)

Market

An institution or mechanism which brings buyers (demanders) and sellers (suppliers) of particular goods and services together

Law of Demand

(Other things being equal) as the price increases, the corresponding quantity demanded falls; the inverse relationship between price and quantity demanded

Substitution Effect

The tendency of consumers to swap a similar, lower-priced product for a product that is relatively more expensive

Income Effect

Any increase or decrease in a consumer’s purchasing power caused by a change in price

Law of Diminishing Marginal Utility

As one continues to consume a given product, one will eventually get less additional utility (satisfaction) from each unit consumed

Demand Shifters

Tastes, Related Goods Prices, Income, Buyers, Expectations

Complements

Goods typically consumed together

Normal Good

A product that people buy more of when their income is higher

Inferior Good

A product that people buy more of when income is lower

Law of Supply

(Other things being equal) as the price increases, the corresponding quantity supplied rises; the direct relationship between price and quantity supplied

Supply Shifters

Subsidies/Taxes, Technology, Other Related Goods Prices, Resource Costs, Expected Futures Prizes, Size of the Market

Price Elasticity

The measure of how responsive consumers/suppliers are to a change in price; %ΔQ/%ΔP

Total Revenue (TR)

Overall amount of money earned from the sale of a good or service; P * Qd

Price Effect

After a price increase, each unit sold sells at a higher price, which tends to raise revenue

Quantity Effect

After a price increase, fewer units are sold, which tends to lower revenue

Cross Price Elasticity of Demand

The effect of a change in a product’s price on the quantity demanded for another product; if positive, goods are substitutes, and if negative, complements; %ΔQdx/%ΔPy

Income Elasticity of Demand

Percentage change in quantity demanded which results from some percentage change in consumer incomes; if positive, normal goods, and if negative, inferior goods; %ΔQd/%ΔI

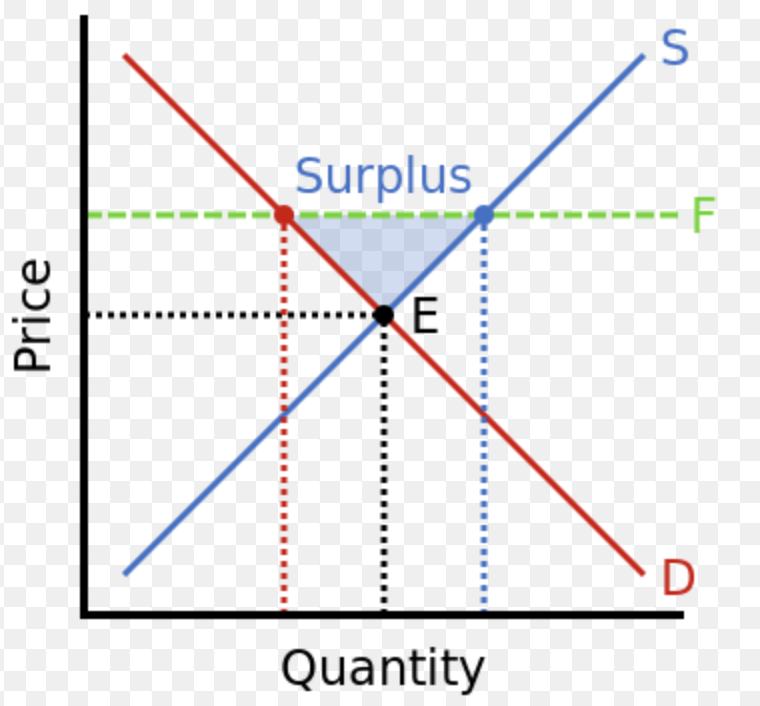

Consumer Surplus (CS)

The benefit buyers receive from paying less for a good than they were willing to; area above price and left of demand; Willingness to Pay - Price

Producer Surplus (PS)

Represents the benefit producers receive from selling goods or services at the market price, above the minimum price they would be willing to accept; below price and left of supply; P - Willingness to Sell

Economic Surplus

The total benefit to consumers and producers from a market transaction; CS + PS

Price Ceiling

The legal upper limit (maximum) on the price that can be charged in a market

Price Floor

The legal lower limit (minimum) on the price that can be charged in the market

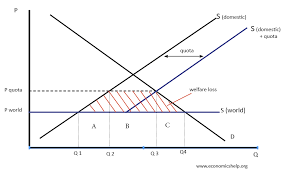

Quota

A restriction on the quantity that can be sold in the market

Deadweight Loss

Loss in economic efficiency and economic surplus

Tax

A financial charge a government imposes in a market

Excise Tax

Per-unit fee levied by the government

Lump-Sum Tax

Fee charged on a firm that is not dependent on quantity of units sold

Subsidy

A financial benefit given by the government to a firm or an individual

Tax Incidence

The division of the tax burden among affected parties

Variable Inputs

Factors of production that can be increased to increase production in the short run

Fixed Inputs

Factors of producation that cannot be increased in the short run to increase production, but can increase in the long run

Short Run

Time period that is too brief for a firm to alter its plant capacity

Long Run

A period of time long enough for a firm to change the quantities of all resources employed, including capital plant size.

Plant Capacity

A firm’s maximum potential level of output

Total Product (TP)

The total quantity of output produced by a certain amount of inputs

Marginal Product (MP)

The additional output produced by one more unit of a variable input, often labor; ΔTP/ΔQL

Average Product (AP)

The average quantity of output produced by one unit of a variable input, often labor; TP/L

Fixed Costs (FC)

Expenses whose total does not vary with changes in short-run output

Variable Costs

Expenses which change with the level of output

Total Cost (TC)

VC + FC

Marginal Cost (MC)

The additional expense of producing one more unit of output; ΔTC/ΔQ

Average Fixed Cost (AFC)

FC/Q

Average Variable Cost (AVC)

VC/Q

Average Total Cost (ATC)

AVC + AFC or TC/Q

Spreading Effect

The larger the output, the greater the quantity of output over which fixed cost is distributed, leading to lower AFC

The Diminishing Returns Effect

The larger the output, the greater the amount of variable input required to produce additional units, leading to higher AVC

Increasing Returns to Scale

Output is increasing at a faster rate than all inputs

Decreasing Returns to Scale

Output is increasing at a slower rate than all inputs

Constant Returns to Scale

Output is increasing at the same rate as all inputs

Economies of Scale

Long run ATC decreases as output increases

Diseconomies of Scale

Tong run ATC increases as output increases

Constant Returns to Scale

Long run ATC is constant as output increases

Sunk Cost

An expense that has been incurred in the past and cannot be recovered

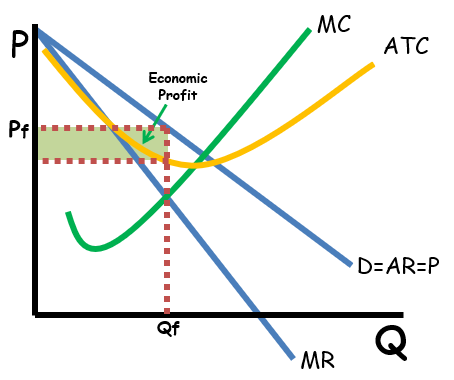

Profit (π)

TR-TC

Explicit Cost (a.k.a accounting costs)

An expense that involves actually laying out money

Implicit Costs

Does not require an outlay of money; it is measured by the value, in dollar terms, of the benefits that are foregone

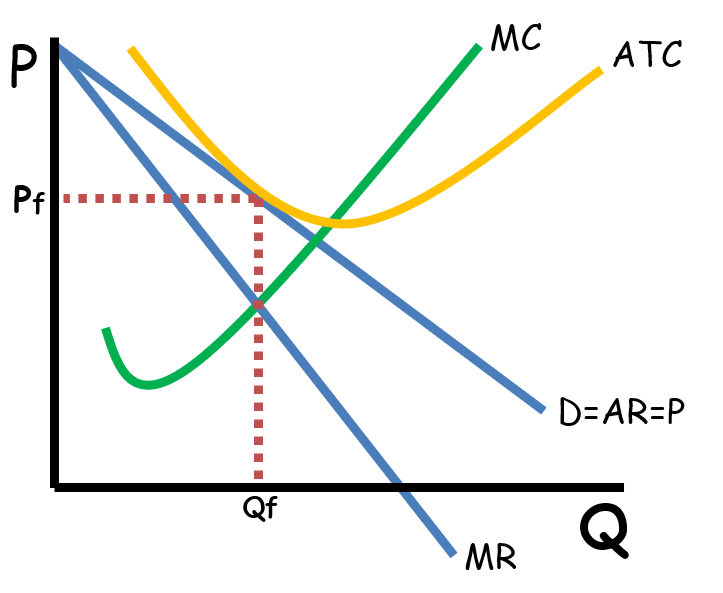

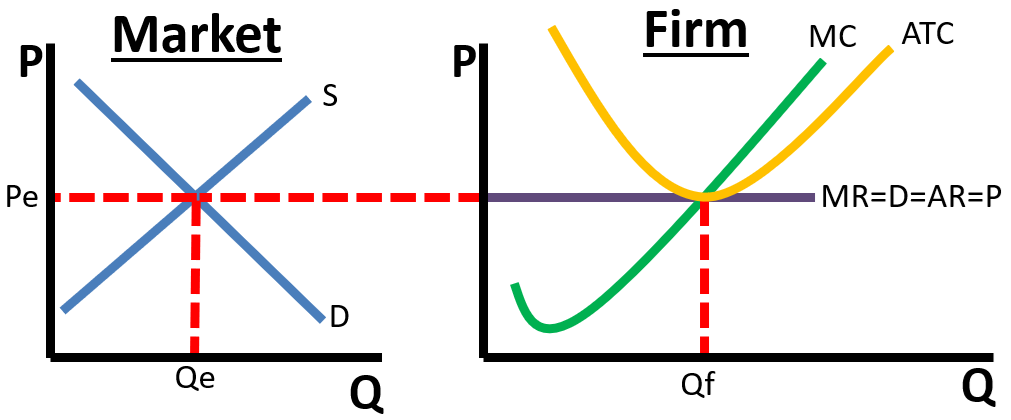

Normal Profit (a.k.a. zero profit)

When economic profit is equal to zero

Monopoly

A firm that is the only producer of a good has no close substitutes in that market; high barriers to entry; price makers; unique products; allocatively and productively inefficient

Natural Monopoly

Economies in which there is a sole provider of a good; experiences economies of scale; allocatively and productively inefficient

Oligopoly

A few large firms produce almost all of the total output of the industry; products may be identical or differentiated; high barriers to entry; top 4 firms need a Concentration Ratio of 40% or higher to be considered one; allocatively and productively inefficient

Monopolistic Competition

Market with no barriers to entry; limited price control; differentiated products; and many competitors

Perfect Competition

Market with perfectly elastic demand; no barriers to entry; price taking; differentiated product; and many competitors; allocatively and productively efficient

Allocative Efficiency

Everyone who wants a product gets it; P = MC

Productive Efficiency

When a firm produces a good at the lowest possible price; P = min of ATC

Excess Capacity

The difference between what a firm produces and what it is capable of producing (i.e. productive efficiency)

Interdependence

When the actions of one firm affect those of another

Cartel (Overt Collusion)

Members openly join and scheme to restrict output and gain monopoly prices

Tacit Collusion

Unspoken understanding that firms will act together

Game Theory

Arises from interdependence; companies must take the possible responses of other companies into account when planning a course of action

Dominant Strategy

A choice that maximizes satisfaction regardless of the other’s action

Nash Equilibrium

Outcome where each has made the best decision possible, given the actions of the other

Payoff

Outcome of a strategic decision

Best Outcome

Combination of strategies that yields the highest joint profit

Price Differentiation

When the same product is sold to different consumers at different prices; P = MR

Marginal Factor/Resource Cost (MFC/MRC)

The additional expense paid by the firm when it hires an additional worker or other resources; W *