Indirect cost allocation - Blanket Rate

1/12

Earn XP

Description and Tags

These flashcards cover the key vocabulary related to overhead allocation and costing methods discussed in the lecture.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

13 Terms

direct cost

For mango juice of T3H, 2 mangoes are required for each juice bottle, and it takes 5 minutes to produce a juice. If price/mango is £0.50 and the labour cost/hour is £14, then the direct cost will be

Direct materials: 2 mangoes @ £0.50 = £1.00

Direct labour: 5 minutes @ £14 = £1.17

Direct cost = £1.00 + £1.17 = £2.17

cost allocation

Cost allocation is the process of identifying, accumulating, and assigning costs to costs centres such as departments, programs, and a branch of a company by using a parameter, called allocation base.

cost centre

A cost centre is a department that is responsible for the costs within their control.

There will be a manager assigned to every cost centre to ensure somebody is ultimately accountable for the state of affairs in that department.

A cost centre is a place where costs are collected and analysed

Main function is to track expenses/costs.

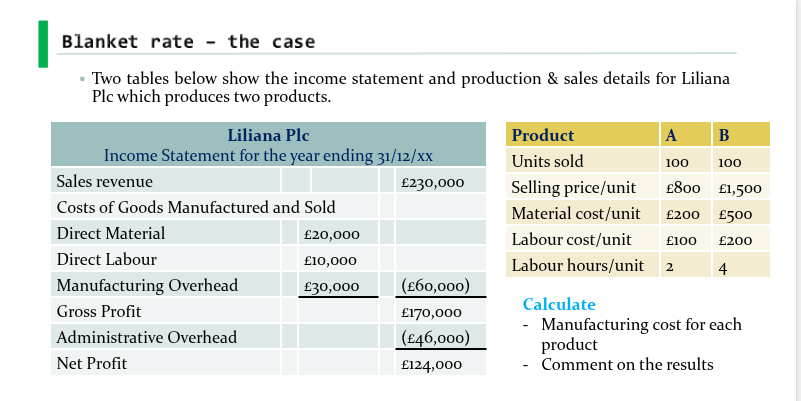

Blanket Rate

A method of absorbing overhead costs using the same absorption rate throughout the entire organization, regardless of product or department.

This simplifies budgeting and reporting by applying a single rate per unit produced or service provided, ensuring consistency across different cost centres.

to calculate blanket rate we use Overhead Absorption Rate (OAR)

OAR = manufacturing overhead / allocation base

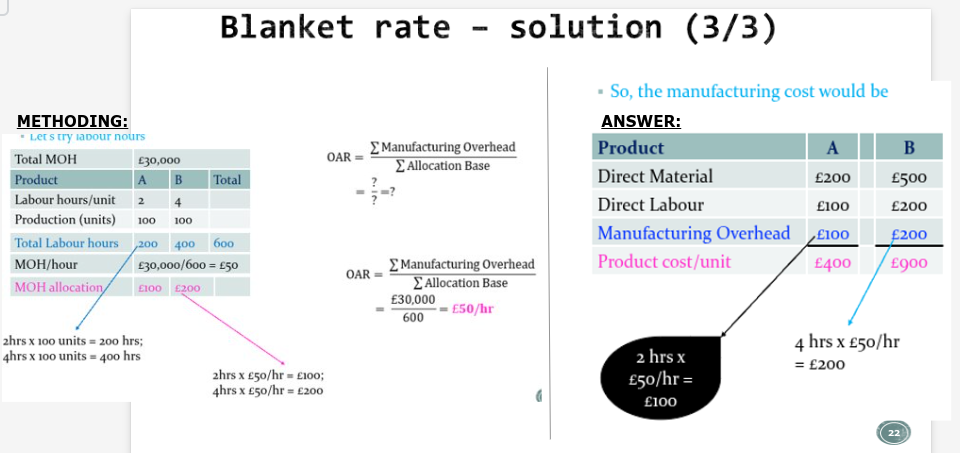

blanket rate - numerical explanation

Manufacturing Cost = DM + DL + MOH

We know:

MOH = £30,000

We need to allocate this amount to Products A and B

The question is how to do that

We need an allocation base = Units sold and labour hours

OAR = manufacturing overhead / allocation base

= 30,000 / 600 = £50 an hour

ANSWER = £100 MOH for product A and £200 MOH for product B

Cost Object

Any item for which costs are measured and assigned.

Contribution Margin

The difference between total revenue and total variable costs.

Cost Centre

A department or section responsible for controlling its costs.

Allocation Base

A measure used to assign costs to cost objects, such as machine hours or labour hours.

Activity-Based Costing (ABC)

A method of allocating overhead costs based on activities that drive costs.

Sales Value Method

A method of allocating administrative overhead based on a percentage of total revenue.

Overhead Absorption Rate (OAR)

A rate used to allocate manufacturing overhead costs to units produced.

Cost-Volume-Profit Analysis

A financial modeling tool used to analyze the relationship between costs, volume, and profit.