Non-Profit Organizations (NPOs)

1/34

Earn XP

Description and Tags

Flashcards about Non-Profit Organizations (NPOs)

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

35 Terms

Non-Profit Organizations (NPOs)

Civic organizations, colleges and universities, cultural institutions, hospitals, labor unions, private foundations, professional organizations, religious organizations, cooperatives and social and country clubs. They do not include governmental units.

Accounting Standards for NPOs

Adopted from the guidelines issued by the American Institute of Certified Public Accountants (AICPA) applicable to all NPOs.

Financial Statements of NPOs (FASB Statement No. 117)

Statement of Financial Position

Statement of Activities

Statement of Cash Flows

Notes to the financial statements.

Statement of Financial Position (NPOs)

Shall report the following:

Amounts of the organization’s total assets, total liabilities, and total net assets.

Amounts for each of the three classes of the organization’s net assets:

Permanently restricted net assets

Temporarily restricted net assets

Unrestricted net assets.

Statement of Activities (NPOs)

Shall report the following:

Gross amounts of revenues and expenses of the organization. Expenses by functional classifications such as program services and supporting services.

Amount of the change in the organization’s net assets for the period.

Amount of the changes in each of the three classes of the organization’s net assets: permanently restricted, temporarily restricted, and unrestricted.

Unrestricted Net Assets

Usually are those in the unrestricted (or general) fund.

Temporarily Restricted Net Assets

Generally are those in restricted funds, loan funds, and plant funds. These are expected to be released from restriction due to passage of time or the performance of some act by the NPO.

Permanently Restricted Net Assets

Ordinarily arise from permanent endowments funds.

Donor-imposed restrictions

Restrictions placed on the use of assets, liabilities, revenues, or expenses. The restrictions can be temporary or permanent.

Expenses

Reported by their functional classification such as major classes of program activities and supporting activities.

Program Activities

Goods and services provided to beneficiaries or customers that fulfill the purpose of the organization.

Supporting Services

All activities of the organization other than the program services, such as general and administrative expenses, and fund-raising costs.

Unrestricted Fund

This fund includes all the assets of a NPO that are available for use as authorized by the board of directors and not restricted for specific purposes.

Hospital's Sources of Unrestricted Fund Revenues

Patient services, unrestricted donations, and unrestricted income from endowment funds.

College and University's Sources of Unrestricted Fund Revenue

Student tuition fees, government grants, donations and private grants, and unrestricted income from endowment fund.

Nonprofit Organization's Total Revenues

Reported in the period in which services are rendered, even though part or all of the revenues is to be waived or reduced.

Contractual Adjustments

Show the unique feature of nonprofit hospitals. Accounts receivables are collectible from a third-party payor, rather than from the patient. Among the third-party payors are the Philippine Health, Medicare, and private medical insurance companies. For colleges and universities, the comparable tuition adjustment is debited to Expenditures - Student Aid account.

In the Statement of Activities, these accounts are to be deducted from the total service revenue for the month.

Allowance for Doubtful Accounts

A deduction from the Accounts Receivable in the balance sheet.

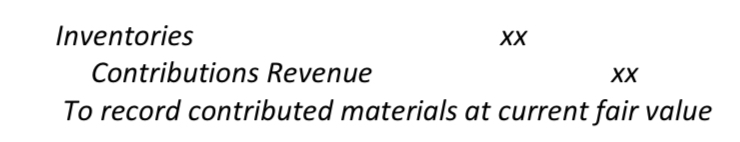

Contributed Material

Recorded in the Inventories account at its current fair value, with a corresponding credit to a revenue account in an unrestricted fund.

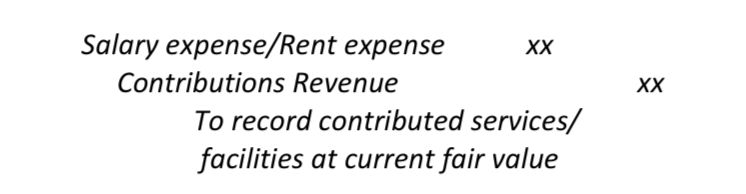

Contributed Services and Facilities

Debited to an unrestricted fund as Salary Expense for contributed services and Rent Expense for contributed facilities, with a corresponding credit to Contributions Revenue account.

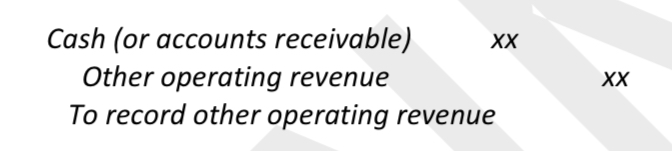

Other Operating Revenues

These represent income derived from other related activities, other than service revenues of nonprofit organizations.

Examples are proceeds from gift shops, cafeterias, snack bars, newsstands and parking lots, are all recorded as other operating revenues.

Pledges (promise to give)

A commitment by a prospective donor to contribute a specific amount of cash or property to an NPO on a future date or in installments. Those due in the future accounting periods or having restrictions as to their use are accounted for in a restricted fund.

Depreciation

Required on all the property and equipment of nonprofit organizations, except for individual works of art or historical treasures having extraordinary long economic lives.

Typical Assets of an Unrestricted Fund

Cash, investments, accounts receivable, inventories, and prepaid expense.

Liabilities of an Unrestricted Fund

Payables, accrued expenses, and deferred revenues.

Restricted Fund

NPOs establish this fund to account for assets received from donors. These assets are available for current use but expendable only as authorized by the donor of the assets.

Temporarily Restricted Funds

(1) specific- purpose funds, (2) time-restricted funds, and (3) plant replacement and expansion funds.

Permanently Restricted Funds

Assets that are to be held for an indefinite period of time and generally are included in an endowment fund.

Permanent Endowment Fund

One in which the principal must be maintained indefinitely in revenue-producing investments.

Statement of Cash Flows (NPOs)

Similar to that of a for-profit business in format (direct method or indirect method). It reports the organization's change in its cash and cash equivalents during the accounting period.

Net Cash from Operating Activities (NPOs)

All unrestricted donations are presented under operating activities. Program and support expenses are reported under operating activities.

Net Cash from Investing Activities (NPOs)

Reports the amounts spent to purchase long-term assets such as equipment, vehicles, and long-term investments. Reports the amount received from the sale of long- term assets.

Net Cash from Financing Activities (NPOs)

All temporarily or permanently restricted donations are presented under financing activities. Reports the amounts received from borrowings and any repayments.

Revenues and gains of unrestricted fund

Derived from a number of sources including membership dues, dividends and gains from investments in debt and equity securities.

Revenues derived from the endowment funds

Are accounted in accordance with the instruction of the donor to the board of directors. If there are no restrictions in its use, it is transferred to the unrestricted fund. Otherwise, these are transferred to an appropriate restrictedn fund.