3.3 costs and revenues

1/20

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

21 Terms

Price

is the amount customers are going to pay

Cost

is the expenditure in producing a product

Set up costs

down payment on e.g rent, buildings, furniture, capital equipment, installation of electrecity, legalities, recruitment costs

running costs

regular mortgage/rent, packaging material, repairs, other bills, marketing, wages & salaries

Fixed costs

costs of production that a business has to pay regardless of how much it produces or sells. (must pay even if there was no output)

ex. rent, interest payments, market research, wages

Variable costs

costs of production that change in proportion with the level of output or sales.

ex. raw materials

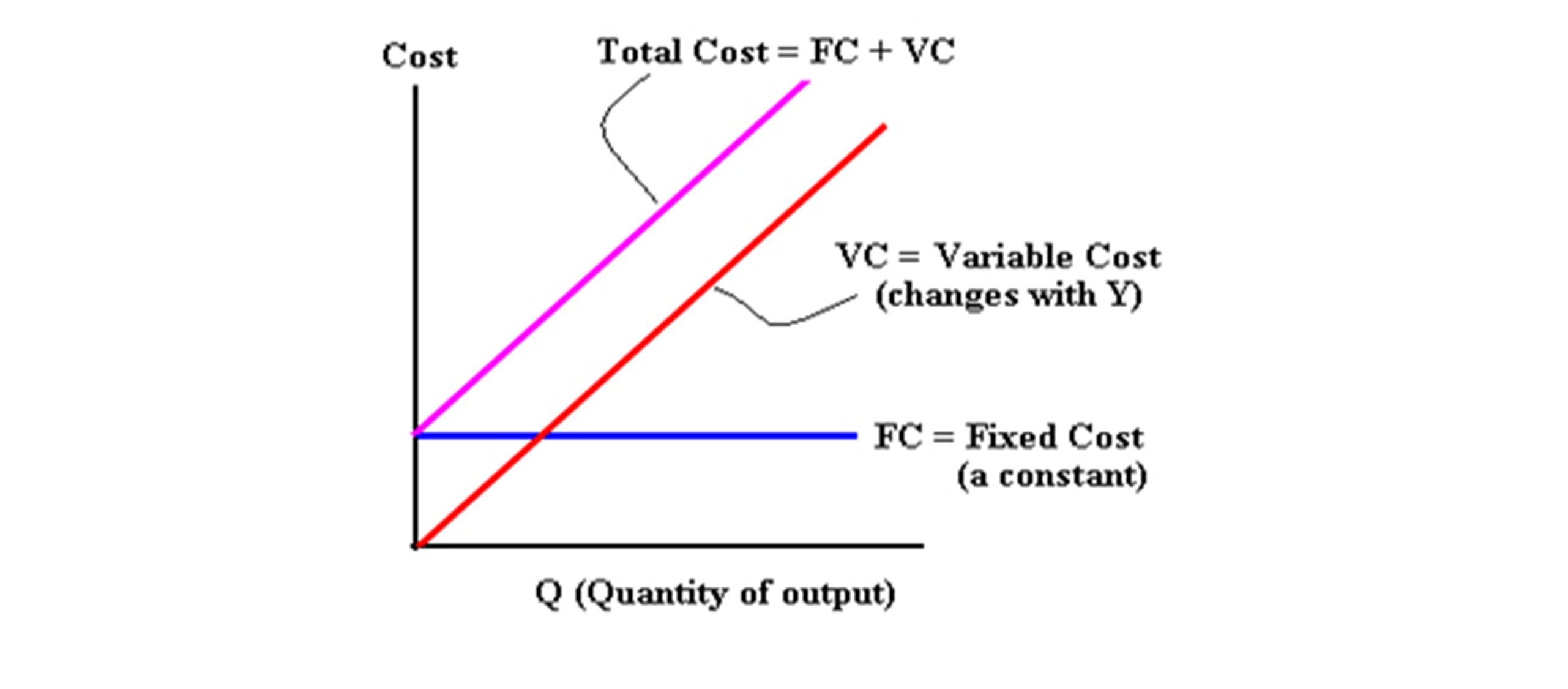

total cost (TC)

total fixed cost + total variable cost

Costs Formula

TC = TFC + TVC

TVC = AVC x Q

TFC = AFC x Q

curves

Semi-variable costs

•contain an element of both fixed and variable costs.

•They tend to change only when production or sales exceed a certain level of output.

•Example: mobile phone and internet service providers often allow a user to have a predetermined number of “free minutes” or a limit on data usage and charge extra when user exceeds the quota.

direct costs

costs specifically attributed to the production or sale of a particular good or service. It can Ex. variable costs such as raw materials.

indirect costs (overheads)

costs that are not directly linked to the production or sale of a specific product, e.g. rent, wages of cleaning staff, and lighting.

1 advertising - fixed

2 airport charges - fixed

3 fuel is - variable

4 meals onboard - variable (depends on passenger amount yk)

5 ground staff - fixed

6 pilots & yk - fixed

In this context, direct costs are directly attributed to flying the plane: airports charges, fuel, pilot wage. indirect costs are not directly linked to flying the plane but is necessary for overall operation: advertising, ground staff salary.

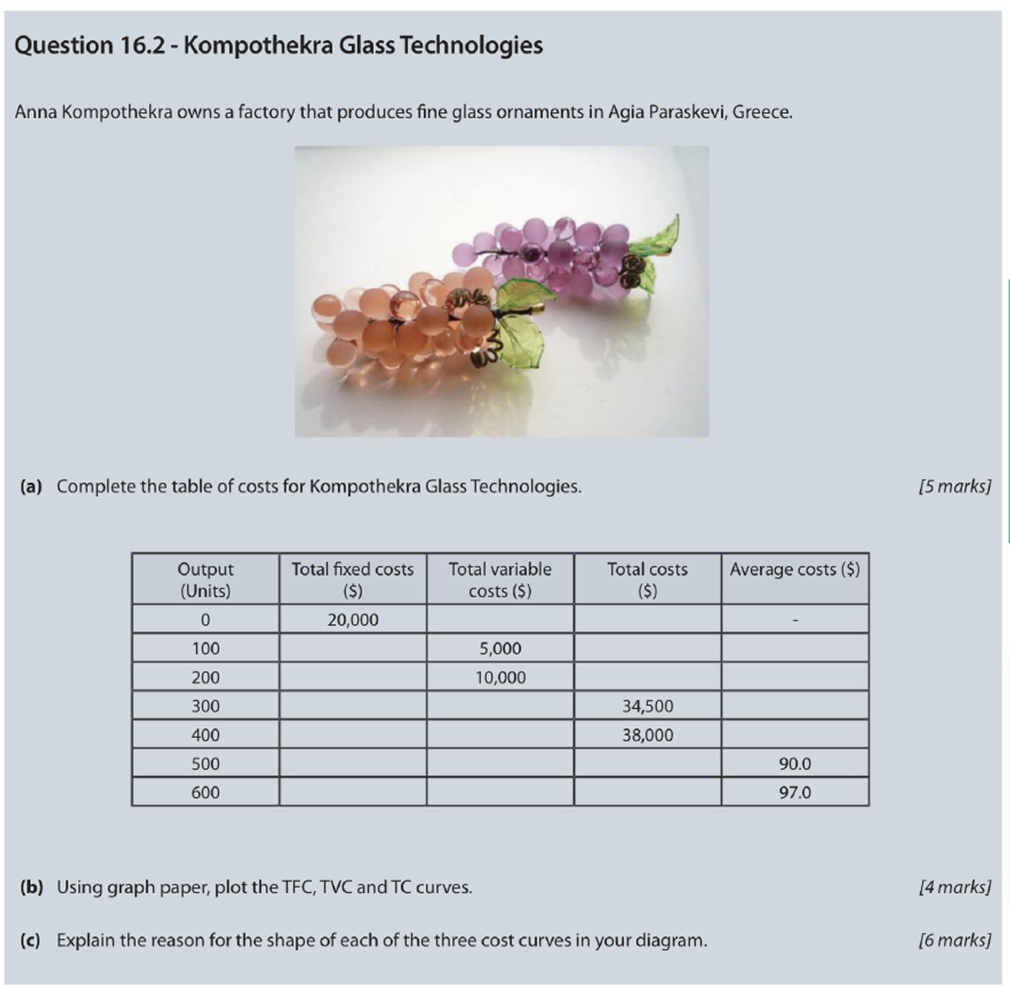

a)

b)

c)

Revenue

money that a business collects from the sale of its goods and services.

formula: price x quantity sold

Revenue formulas

tr = p x q

ar = tr / q

p = tr / q

ar = p

sales volume

total quantity of units sold by a business over a period of time.

a) sales volume is the total quantity of units sold by a business over time.

b) TR = (31 790 - 10%) x 6.50 = 28611 × 6.5 = 185 972

1 wholesale market is

2 rent, power and lighting costs = indirect

3

revenue streams

•money coming into a business from its various business activities, e.g. sponsorship deals, merchandise, membership fees and royalties.

it does not only come from the sale of goods and services. Money can come into a firm from other means depending on the type of firm and its activities.

ex. donations, merch, subscriptions, franchise costs & roylaties