1.4 Government intervention

1/14

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

15 Terms

7 methods of government intervention

Indirect taxation

Subsidies

Maximum + minimum prices

Trade pollution permits

State provision of public goods

Provision of information

Regulation

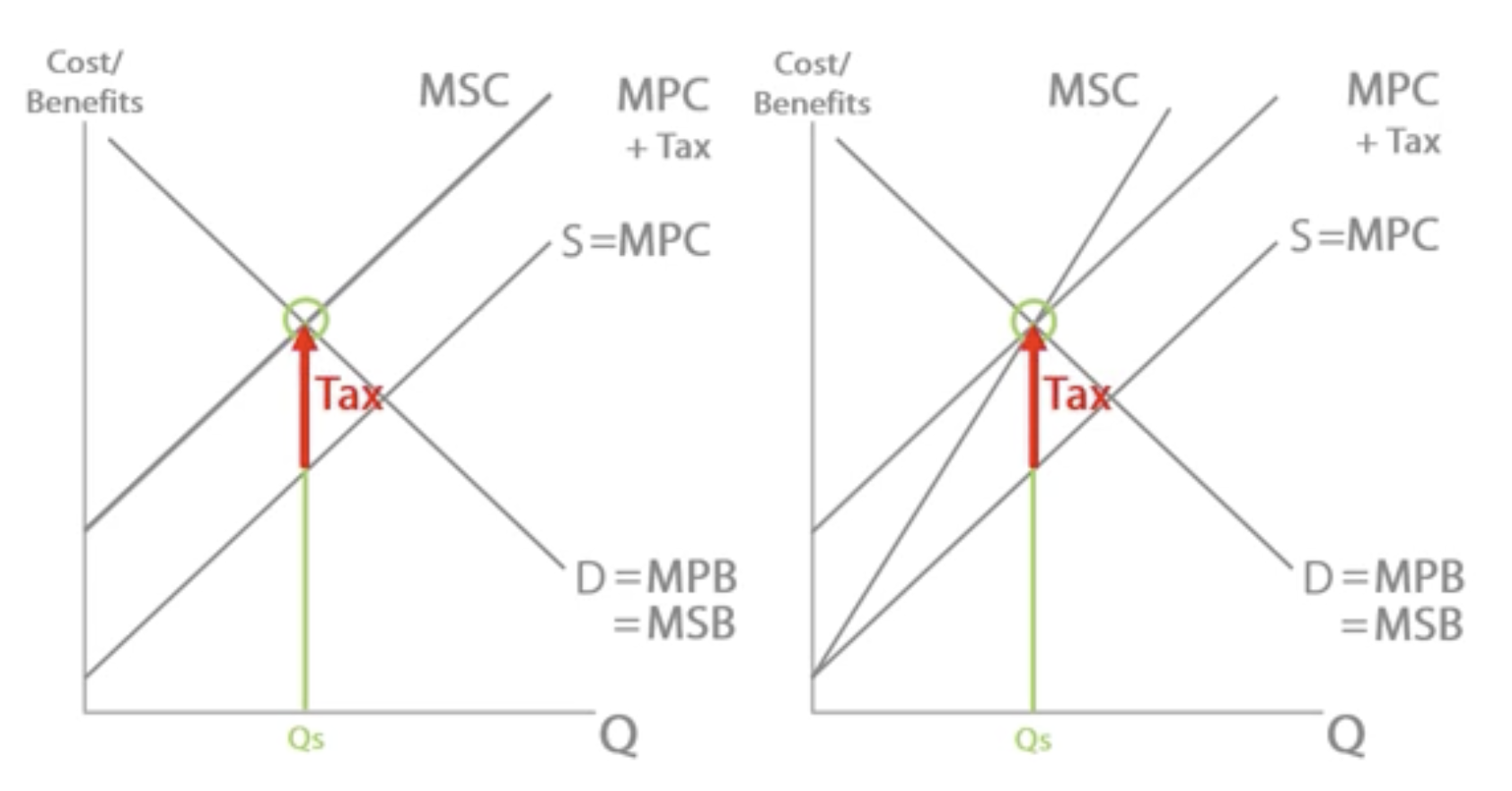

Indirect taxes (to solve negative externalities)

+ISSUES

Increases a firm’s CoP but can tax be transferred to consumers.

Increases CoP → internalises externality (externality is paid for in the price) which moves MPC to MSC → solves overconsumption/ production → promotes allocative efficiency (social welfare is maximised) whilst generating gov. revenue.

ISSUES

Price inelastic demand: Increasing price through tax won’t be responded to by consumers. Quantity may decrease towards social optimum but proportionally less than increase in price.

Setting tax to right level: Assumes perfect info: there may be imperfect info on value of externality to the government. May overtax/ undertax leading to black markets (needs policing + ↓ tax rev.) + regressive taxes (widens income inequality), + externality is not internalised.

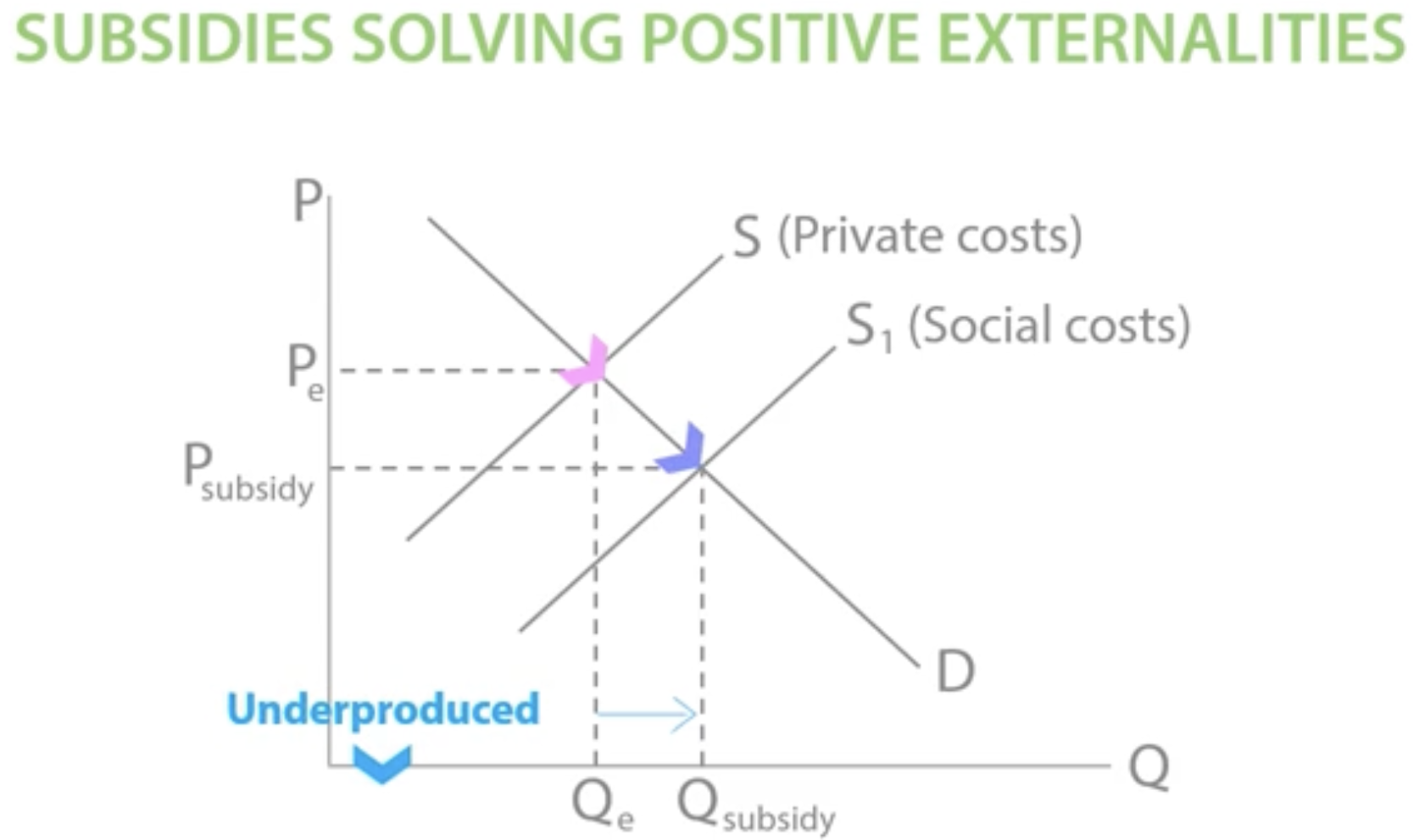

Subsidies

SOLVES POSITIVE EXTERNALITIES

Money grant given to producers by the government to lower CoP and encourage an increase in output.

Lowers CoP → decreases price and increases quantity → solves underconsumption/ production → allocative efficiency + welfare gain.

ISSUES

Cost: Larger cost of subsidies, opportunity cost: cost may be cut from gov. revenue towards education, healthcare. Debt interest has to be paid.

Setting subsidy at right level: Assumes gov. have perfect info on value of externality. May under/ over subsidise, so quantity will not reach social optimum. Over-subsidising will increase costs even more + increase firm’s dependency on subsidy.

How will firm use subsidy: May not pass lower costs onto consumers, money used towards paying debts/ savings. Quantity will not reach social optimum (underconsumption).

Price control: min prices (price floors)

SOVES DEMERIT GOODS (info gap) e.g. alcohol in Scotland

The minimum price suppliers of a good can sell for.

-this is so that prices kept high, causing a contraction in demand, reducing overconsumption.

ISSUES

Price inelastic demand: Consumers will not respond to ↑ in price. Quantity will not fall proportionally enough to the social optimum to solve market failure.

Setting min price to right level: Setting too high results in black markets (needs policing + ↓ tax rev.) + regressive nature (widens income inequality), set too low results in Q not being at social optimum.

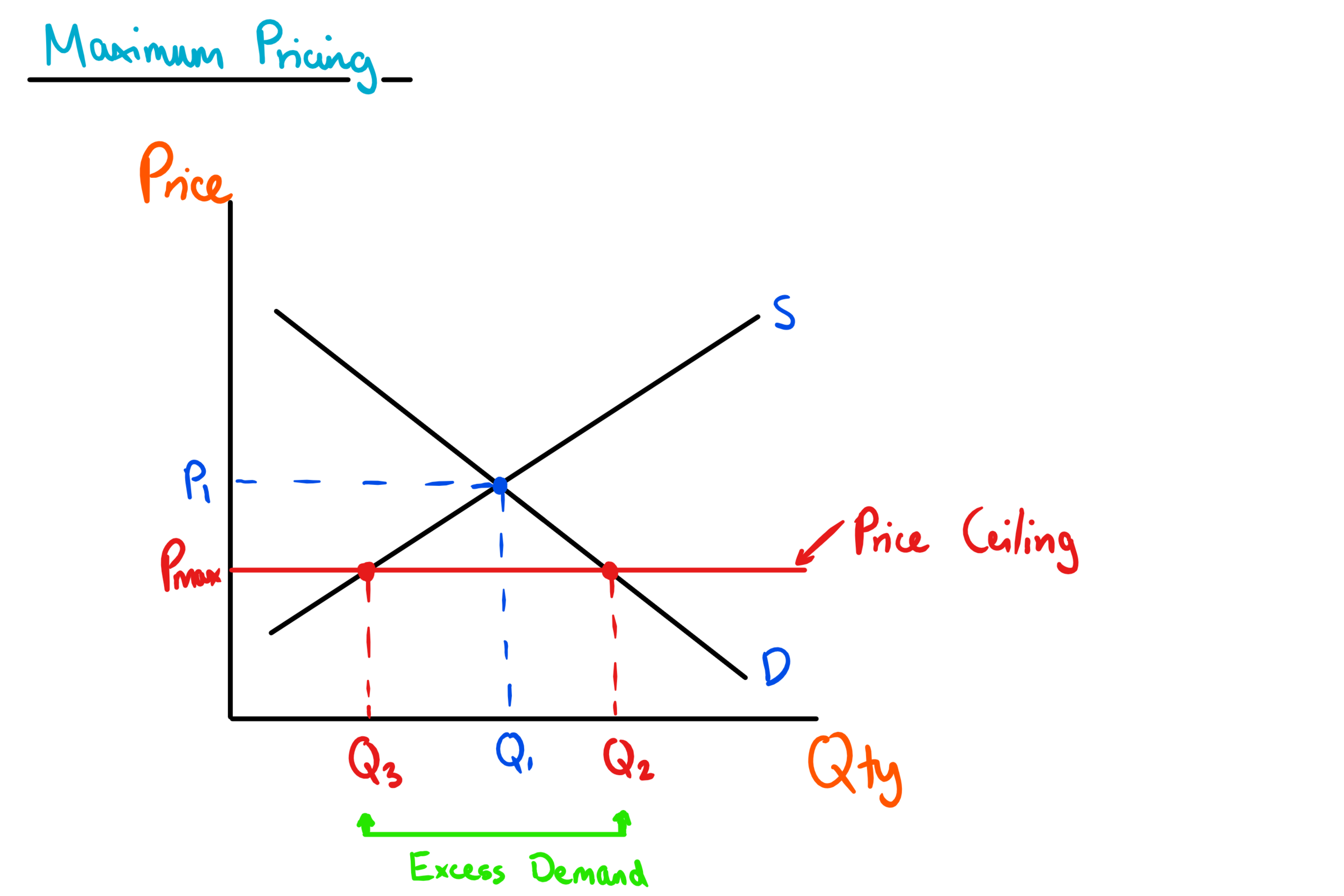

Price control: max prices (price ceilings)

SOLVES MERIT GOOD (info gap) e.g. energy price cap UK to limit cost of electricity+gas

The maximum price suppliers of a good can sell for.

-prices kept low, causing an expansion in demand, reducing underconsumption.

ISSUES

Shortage: D>S at the max price, so consumers may lose out on the merit good. This creates black markets selling lower quality good for higher price, so consumers do not lose out.

Cost: Costly to increase supply and solve the shortage. Opportunity cost: money can go towards other merit goods.

Regulation e.g. legal age for smoking is 18

Rule/ law enacted by the government that must be followed by economic agents to encourage a change in behaviour.

-needs enforcement of command: bans, limits, caps, compulsory and control: enforcement, punishment (policing)

-gives the incentive to change behaviour → solve issues in free market → allocative efficiency + welfare gain

ISSUES

Cost: administrating + enforcing costs.

Setting the right regulation: determining the right level strictness- may result in unintended consequences + black markets (if too strict).

Tradable pollution permits

SOLVES NEGATIVE EXTERNALITIES

Gov. sets a cap on pollution at socially optimum Q → gov. gives out permits to match cap → firm invests in green tech or buys spare permits → internalises externality or polluter pays in the most efficient way → pollution reduces to social optimum + AE is reached → LR incentive to invest in green tech to increase profit through selling permits + so they’re not burdened when permit price rises.

ISSUES

Cost of enforcement: Level of technology may not be able to accurately measure emissions. Firms need to be monitored to ensure they are adhering to rules.

Imperfect info: Gov. may not be aware of social optimum, so cap may be too tight/ too lacked. Cap too tight may result in unintended consequences like firms shutting down/ leave country due to high CoP or being passed onto consumers via higher prices.

State provision of public goods

SOLVES UNDERCONSUMPTION OF PUBLIC GOODS

Direct provision of goods/ services by the gov. free at the point of consumption.

Gov. allocated resources at socially optimum quantity → free at point of consumption → solves underconsumption/ production and inequity given universal access → solve missing markets → allocative efficiency + welfare max.

ISSUES

Excess demand: gov. can’t ration excess demand, so some can access good + some can’t, leads to larger queues, longer waiting lists e.g. healthcare

Cost: Money to provide public goods may be from higher taxes, cost cuts in certain spending areas, debt interest to be paid, opportunity cost.

Provision of information

SOLVES INFO GAPS

Government funded information provision through adverting, education, to encourage or discourage consumption.

Demand shifts (MPB shifts towards MSB which is socially optimum level) → consumers make rational decisions knowing true MPB → solves under/ over consumption of merit + demerit goods → allocative efficiency.

ISSUES

Costs: Gov. funded- cost cutting in other areas, opportunity cost as there is no guarantee of success if consumers ignore policy or if policy is of poor quality.

LR not SR: Policy will take a while to be taken in by consumers + change their consumption habits. Advertising takes a while to be listened to.

Government failure

When the costs of intervention outweigh the benefits the intervention. The end result is a worsening of the allocation of scarce resources harming social welfare (net welfare loss)

Causes of government failure

Distortion of price signals

Unintended consequences

Excessive administrative costs

Information gaps

Distortion of price mechanism

Distorted prices may not reflect true supply + demand conditions, leading to over/under production of goods + therefore misallocation of resources.

Max prices: Leads to lower prices, reducing incentive to supply + creating excess demand (shortage). Leads to underproduction of goods.

Min prices: Leads to higher prices, creating excess supply, leading to overproduction of goods. e.g. the EU’s CAP for agricultural goods has led to overproduction of wine + dairy products

Subsidies: Leads to lower prices, leading to overproduction of goods. e.g.

Unintended consequences

Consequences may arise due to government overlooking policies + not carefully considering them.

e.g. black markets- may arise due to minimum prices + taxation for goods like cigarettes, impact on poor households- arise due to minimum prices + regressive taxation, impact on firms- may shut down/ decrease in size due to taxation + regulation.

APP: EU fishing quota to reduce overfishing led to fishermen catching as much as possible before quota was reached, leading to surge in fishing activity.

Excessive administration + enforcement costs

Special regulators must be hired to monitor companies in making sure they are adhering to regulations, price controls, etc. The cost of monitoring may end up being more than the benefit gained for putting these in place.

Regulation, subsidies, state provision, price controls.

APP: excessive regulation + bureaucracy led to high admin costs in NHS- divert resources away from core services.

Information gaps

Externalities may not be valued accurately e.g. underestimating costs of cigarettes, resulting in policies that are too strict or too lacked, making it ineffective as costs outweigh benefits.

APP: environmental regulations, due to inadequate info on most significant pollution emitters, led to inefficiencies+failure to achieve goals.