Subsidies

1/15

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

16 Terms

subsidies

Government support, usually financial, to suppliers that cover some of their costs.

They increase the supply of the good by artificially reducing the cost of production.

E.g. Agricultural subsidies to food producers, or apprenticeship schemes.

For the A-level, we assume all subsidies shift the supply curve outward and maintain gradient.

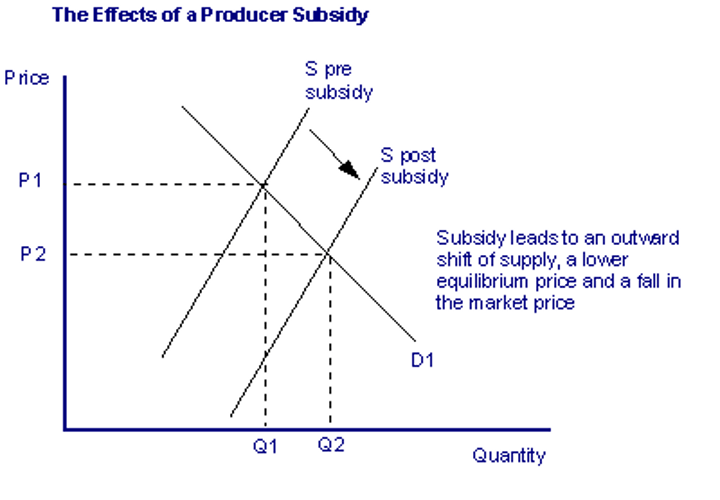

subsidy diagram

Guaranteed payment on the factor cost of a product

Governments pay producers a guaranteed minimum price based on the product's cost, e.g. the old-style EU Common Agricultural Policy (CAP).

Input subsidies

Subsidises the cost of inputs used in production - e.g. an employment subsidy for taking on more workers.

Government grants to cover losses

Governments may give loss making firms money to keep their output high for the benefit of consumers and workers e.g. grants to loss making rail firms or airlines.

Bail-outs

The provision of financial help to firms which otherwise would be on the brink of bankruptcy e.g. for financial organisations in the wake of the credit crunch.

Start-up assistance

Grants and cheap loans for new businesses, especially in areas of high unemployment - e.g. as part of a regional policy to 'level-up'

Impact of Subsidies

Subsidies lead to a lower price and increased quantity traded of the good or service

Why would a government want to implement a subsidy?

To keep prices down and control inflation

To encourage consumption of merit goods and services

Reduce the cost of capital investment projects

Subsidies to slow-down the long term decline of an industry

Subsidies to boost quantity demanded for industries during a recession

costs and benefits of subsidy

cost - DWL

benefits consumers - more CS

benefits suppliers - more PS

In total, the subsidy increases CS and PS, but not by the same value as the subsidy costs the government

There is hence a DWL, equal to the amount of government spending that does not become new welfare, shown by the red triangle

Impacts of a subsidy and PED

Elastic PED: Producers get most of the benefit

Perfectly Elastic PED: Producers get all the benefit!

Inelastic PED: Consumers get most of the benefit

Perfectly Inelastic PED: Consumers get all the benefit!

Limitations of Subsidies

Productivity effects

Can be ineffective

Funding

Risk of Fraud

Productivity effects

If the subsidy is too generous, it can lead firms to become over reliant on government support.

Inefficient and high cost 'zombie' businesses can persist into the long run when their resources could have been better used elsewhere.

The operation of the free market is distorted.

Can be ineffective

If demand is inelastic, subsidies have little effect on the amount consumed.

The subsidy represents a large opportunity cost to the government with limited gains for producers.

Funding

Sometimes a subsidy can be self funding, if the improved revenue for businesses can generate more tax revenue for the government.

However, this won't always be the case, particularly for struggling industries.

A subsidy could hence create an expensive extra burden for taxpayers.

Risk of Fraud

Ever-present risk of fraud when allocating subsidy payments.

E.g. The system of CAP farm subsidies have been heavily criticised for the level of fraud involved.

Limits the extent to which CS and PS are both increased.