Macro Econ Exam 1

1/104

Earn XP

Description and Tags

Vocabulary/Concepts for Samuel Le's Marco Economics Class at Green River Community College in preparation for week 1-5 midterm test. Textbook is Economics by Dean Karlan, Jonathan Morduch

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

105 Terms

Economics

Study of how people manage resources

Microeconomics

the study of how individuals and firms manage resources

Macroeconomics

the study of the economy as a whole and how policy-makers manage the growth and behavior of the overall economy. Focuses on economic growth, unemployment, inflation. Talks about consumption, production, and prices in the aggregate and their effects at a national level.

Rational Behavior

When people make choices to achieve their goals in the most effective way possible given the resources they have

What 4 Questions do Economists ask when faced with a problem?

What are the wants and constraints of those involved in

What are the trade-offs?

How will others respond?

Are resources being allocated in the best way possible?

Scarcity

The condition of wanting more than we can get with available resources.

People want a lot of things but they are constrained by the limited resources.

Poverty

An income level below a certain standard based on the local economy.

Cost

What you give up, sacrifice

Investment

What you put in to generate a future benefit

Opportunity Cost

The value to you of what you have to give up in order to get something; the value you could have gained by choosing the next-best alternative

Marginal Decision Making

The idea that rational people compare the additional benefits of a choice against the additional costs without considering related benefits and costs of past choices

Sunk Cost

A cost that has already been incurred and cannot be recovered or refunded. Sunk costs should not have any bearing on your marginal decision about what to do next.

Incentive

Something that causes people to behave in a certain way by changing the trade-offs they face

(Positive) Incentive

Makes people more likely to do something

Negative Incentive (disincentive)

Makes them less likely to do something

Efficiency

Use of resources to ensure that people get what they most want and need given the available resources.

Resource

Anything that can be used to make something of value. When the economy is efficient resources are being used to create the greatest total economic value to society. From natural (ex; water and trees) to human resources (ex; talent and knowledge)

First 3 Economist Questions

Under normal circumstances, individuals and firms will act to provide the things people want. If not ask the first three economist questions:

have you misjudged people’s wants and constraints?

Have you miscalculated the trade-offs they face?

Have you misunderstood how people will respond to incentives?

Examples of Abnormal Circumstances

Innovation - explanation you’re hoping is correct. Your idea has not been used yet because it is too new.

Market Failure - People and Firms fail to take advantage of opportunities because something prevents them from capturing the benefits of the opportunity or imposes additional costs on them.

Intervention - if a powerful force—often the government—intervenes in the economy.

Unprofitable Idea - Idea won’t produce a profit. Individuals and governments have goals other than profit.

Correlation

When two variables have a consistent relationship

Positive Correlation

Both variables tend to move in the same direction

Negative Correlation

Two variables move in opposite directions

Uncorrelated

No consistent relationship between two variables

Causation

One variable causes the other making it appear that a casual relationship exists.

Correlation and Causation

Correlation and causation can be confused in 3 major ways

coincidence

omitted variables — two events may be extremely correlated due to a third event causing the two

reverse causation

Model

A simplified representation of a complicated situation.

A good model:

predicts cause and affect

States assumptions clearly

Describes the real world accurately

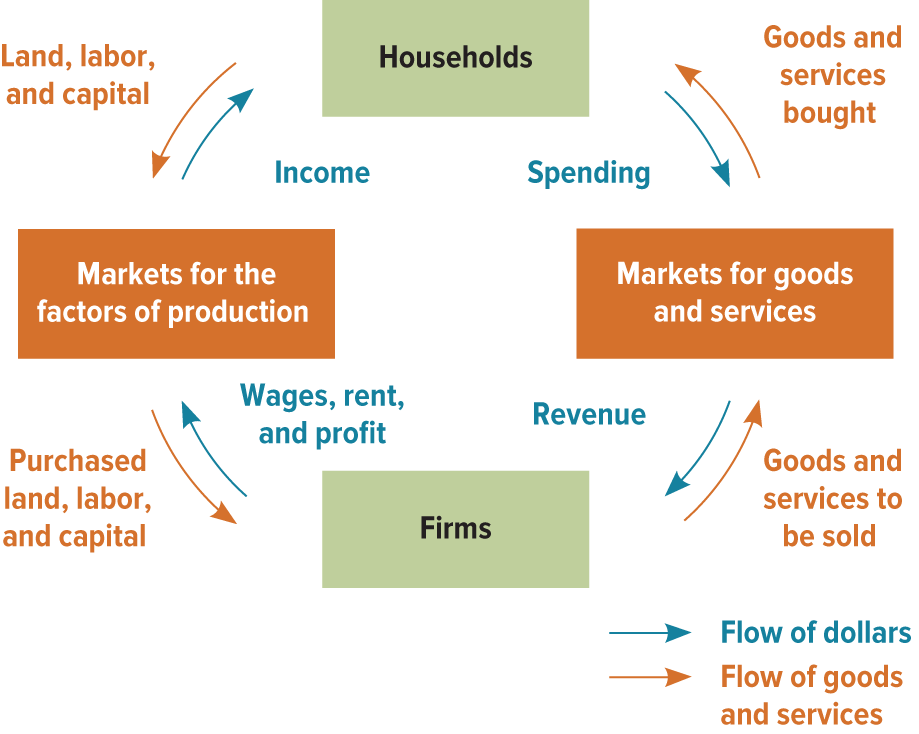

Circular flow model

—Houses supply land and labor to firms (+invest in capital firms) buy goods and services

—Firms do the opposite. Buy/rent land, labor, and capital supplied by households. Produce and sell goods and services.

—One is a loop of inputs and outputs.

Inputs: land, labor and capital firms use to produce goods. Outputs: Goods and services that firms produce using the factors of production

Market for/Factors of Production

Land, labor, capital. Households supply land, labor, capital and firms hire and purchase or rent these inputs.

Market for goods and services

All activity involved in buying goods in services. Households spend wages from labor and income from land and capital. firms earn revenue from selling their goods and services.

Positive Statement

Statement that makes a factual claim about how the world actually works.

Normative Statement

A statement that makes a claim about how the world should be.

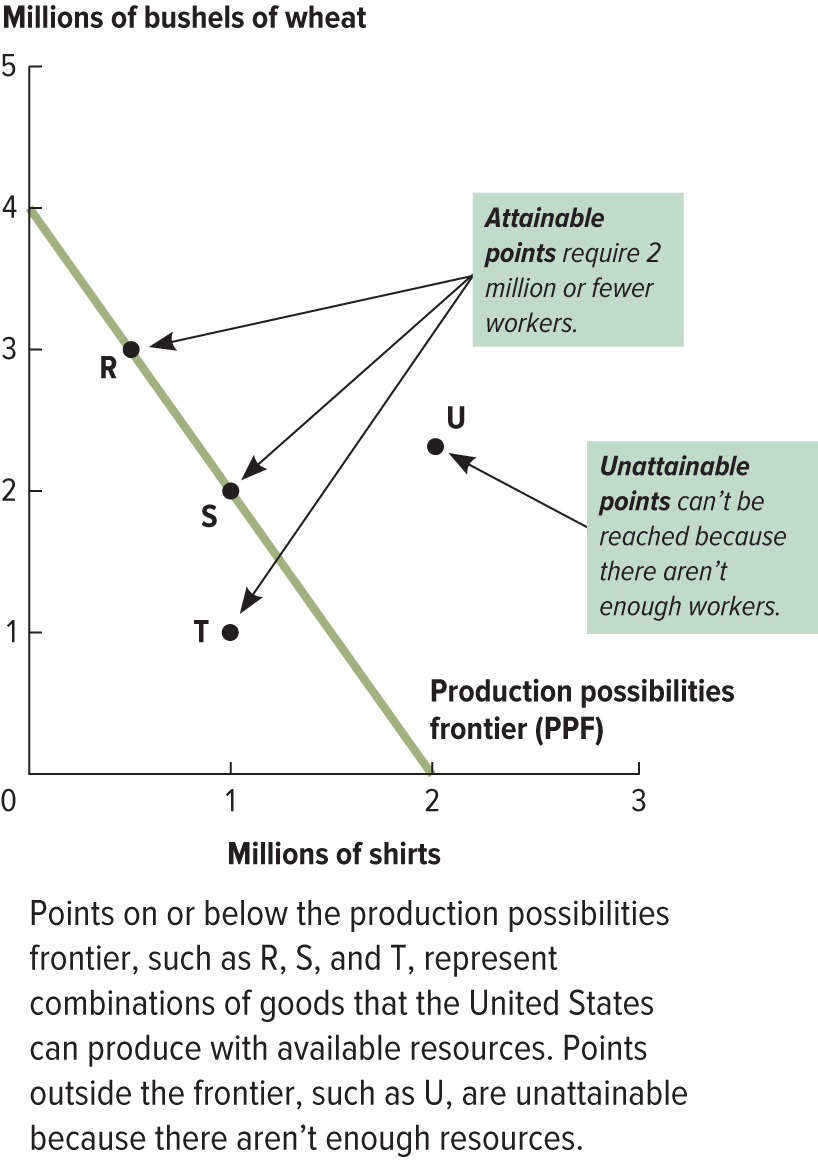

Production Possibilities Frontier (PPF)

A line or curve that shows all the possible combinations of two outputs that can be produced using all available resources.

Helps answer “What are the wants and constraints of those involved” and “What are the trade offs?”

Points that line on the line are efficient, outside are not possible, within inefficent

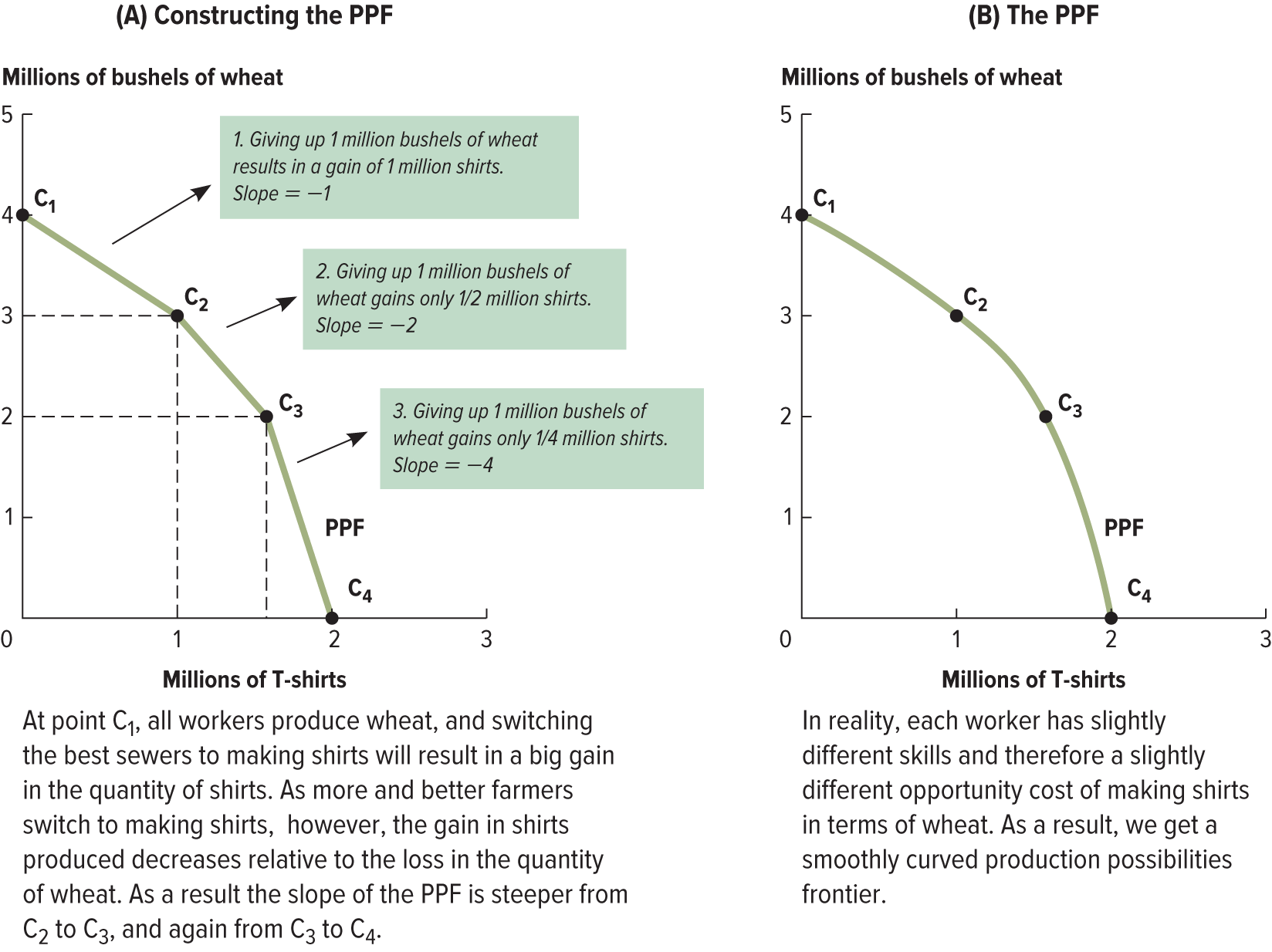

Convex PPF

The increased opportunity cost creates a curve that bows out (a concave curve instead of a straight line). Each point represents the opportunity cost of getting more wheat or more shirts based on the skills of the next worker who could switch.

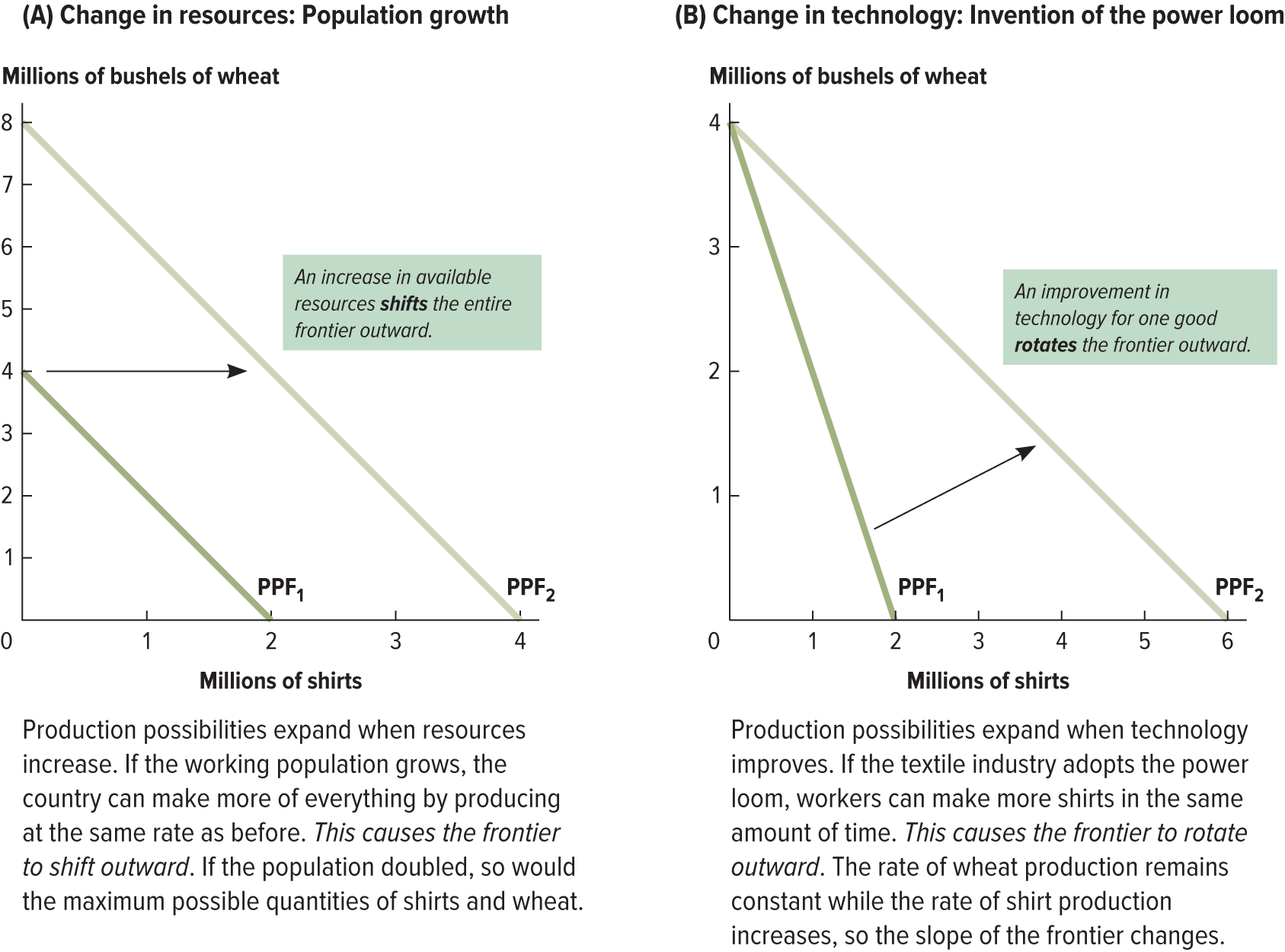

Shifting the PPF

In the United States economy, the factors that change its PPF

Number of workers (shifts the entire frontier outward)

Changes in Technology (improvement rotates it outward)

Absolute Advantage

A producer generating more output than another with a given amount of resources.

Comparative Advantage

When a producer can make a good at a lower opportunity cost than another producer. It is mathematically impossible for one country to have a comparative advantage at producing both goods

Specialization

Practice of spending all of your resources producing a particular good in which an entity has a comparative advantage. This increases total production using the same number of works and tech.

Gains from Trade

The Improvement in outcomes that occurs when specialized producers exchange goods and services.

Overall there is room for trade as long as:

The 2 Countries differ in their opportunity to produce a good

They set a favorable trading price

Invisible Hand

No government intervention is required to coordinate production. Thought of by Adam Smith.

National Income Accounting

System created by Simon Kuznets and Richard stone which adds up all economic activity to arrive at an overall value for the economy without double-counting items by ignoring the price of intermediate goods and services (goods and services used only to produce something else)

Gross Domestic Product (GDP)

Sum of the market values of all final goods and services produced within a country in a given period of time. Typically at a quarterly basis (US)

Regardless of how we calculate it

National Production = National Expenditure = National Income

Gross National Income/ Gross National Product (GNI/GNP)

Value produced by all companies of a nationality regardless of location.

Expenditure Approach

1/3 ways to measure GDP which highlights the importance of consumer spending versus government purchases. One way of calculating the GDP is adding up all the money people spend buying final goods and services.

Consumption (C) + Investment (I) + Government Purchases (G) + Net Exports (NX) =total expenditure = total production

Income Approach

2/3 ways to measure GDP. It emphasizes information about the relative importance of different factors of production. Every transaction has a buyer and a seller. Therefore we can measure GDP by adding up everyone’s income.

wages earned by workers

interest earned on capital investments

rents earned on land and property

profits earned by firms

National Income = Wages + Interest + Rental Income + Profits

In an economy without imports or export… this will equal the total we get using the expenditure approach.

Value-added Approach

Look at all transaction only counting the value they add to the economy. Especially useful for tracking how goods are sold and resold.

Consumption (C)IGNX

Measure spending on new goods and services by private individuals and households. Rent and college tuition is also included.

Investment C(I)GNX

Spending on new productive inputs such as factories, machinery, inventories (capital goods). Newly built houses are included in this.

Government Purchases CI(G)NX

Technically government consumption expenditures and gross investment.

Goods and services bought by all levels of government.

DOES NOT COUNT TRANSFER RESOURCES TO INDIVIDUALS (ex; Social Security)

Net Exports CIG(NX)

value of goods and services produced domestically and consumed abroad - services produced abroad and consumed domestically.

Real GDP

GDP calculation in which goods and services are valued at constant prices (given for a specific year). Real GDP isolates changes in an economy’s ouput.

Nominal GDP

Reported GDP without controlling for price changes. Calculated based on goods and services valued at current prices. Nominal GDP encompasses changes in both output and prices.

GDP Deflator

Measure of the overall change in prices in an economy.

(Nominal GDP / Real GDP) x 100 = GDP Deflator

Base year is always equal to 100.

If prices have risen answer will be x > 100

if prices have fallen, a year before the base year (~when prices are lower) x < 100

GDP Inflation Rate Equation

[ Deflator(year 2) - Deflator(year 1) / Deflator (year 1) ] x 100 = Inflation rate

GDP growth rate

[ GDP(year 2) - GDP(year 1) / GDP(year 1) ] x 100 = Growth Rate

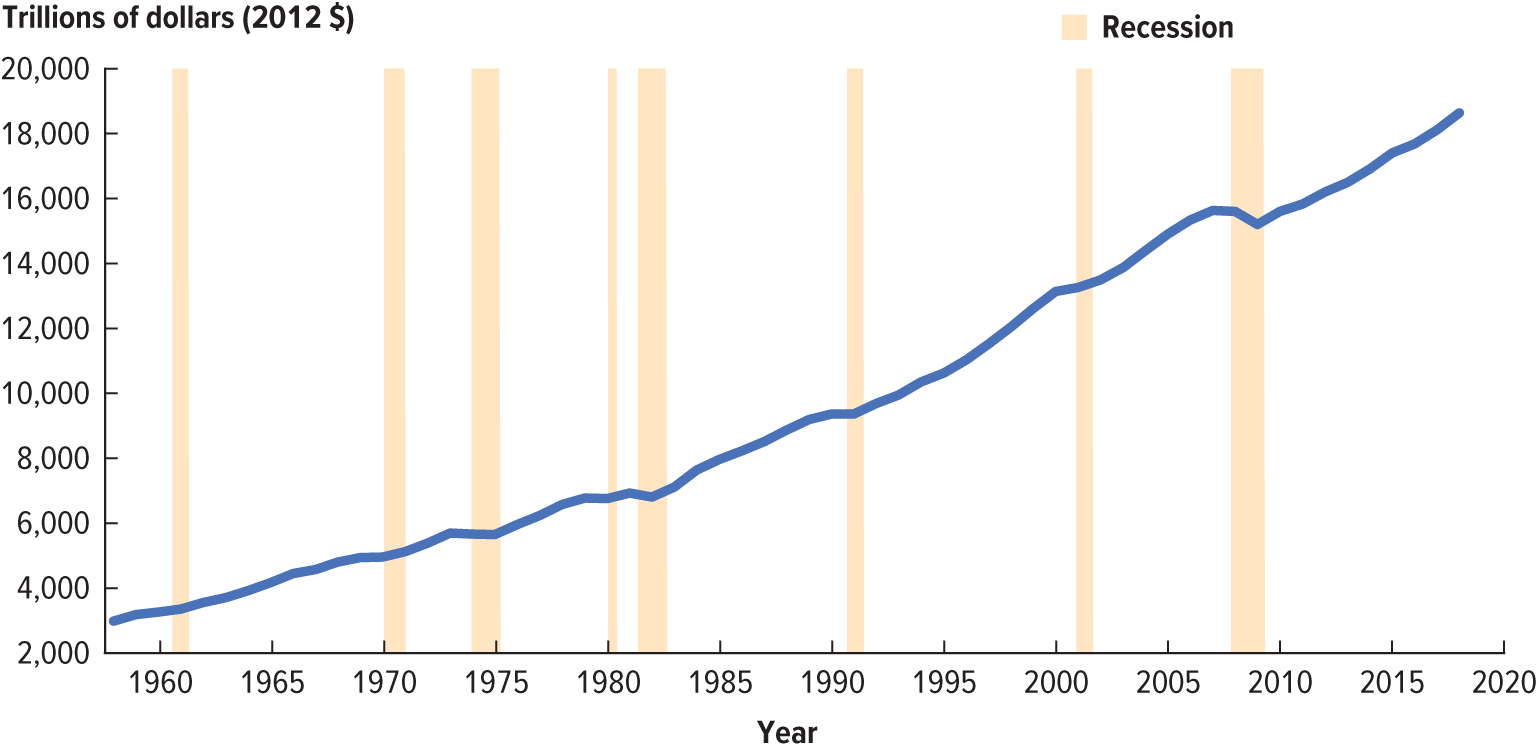

Recession

A period of significant decline in economic activity. A recession is typically marked by falling GDP, rising unemployment, and an increase in bankruptcies.

Years highlighted show recessions.

Depression

An extended or severe recession. Depressions and Recessions are officially determined by the National Bureau of Economic Research (NBER)

GDP per capita

Country’s GDP divided by population.

Home production

Goods and services produced and consumed within one household. Not part of GDP

Underground Economy

Goods and services sold below radar; outside of official records

Subdivisions of the underground economy are Black Market (sale of illegal goods and services)

Gray Market - legal economic transactions not reported to the government

Green GDP

Alternative measure of GDP that subtracts environmental costs of production from positive outputs normally counted in GDP.

Market Value

When expressing goods and services in a common unit they measure by this

Negative Externality

Products that harm people but don’t get counted in production or expenditure measures.

Life Satisfaction Index

Employed expansion of GDP per capita as a measure of well-being and happiness

The Market Basket

List including specific goods and services that roughly correspond to a typical consumer’s spending

Formula for calculating percentage change

[x2-x1/x1]100

Basket Approach

Changes in the cost of your shopping basket assuming you by the same items in the same quantities.

Price Index

Measure the cost of a market basket has risen/fallen relative to the cost in a base time period/location

Consumer Price Index (CPI[U])

Tracks changes in the cost of living in the United States by the cost of a basket of goods and services purchased by a typical U.S. household calculated by the Bureau of Labor Statistics (BLS).

CPI = [ cost of desired-year basket in base year prices/cost of base year basket in base year prices ] x 100

Based on urban consumers (93% of US population)

Changes in CPI over time

Substitution

Idea that people switch similar goods and services when relative prices shift.

Innovation

New goods and services become available people change what they consume.

Undermines constant basket of goods and services. Aim overall is to achieve a certain standard of living.

Hedonic quality adjustment

Break a product into a list of features then determine how much utility consumers get from each feature to determine how these features influence well-being. This allows us to estimate what the price of the good would be without improved quality.

Inflation Rate (CPI)

Inflation rate = percent change in CPI from year to year

Inflation rate = [CPIyear2-CPIyear1/CPIyear1] x 100

Headline Inflation

Measures price changes for the entire market basket of the average urban consumer. Another term for inflation measured using CPI

Core inflation

Measures price changes minus food and energy costs due to the high fluctuations in price.

Producer Price Index (PPI)

Measures the prices of goods and services purchased by firms. PPI is a good predictor of future consumer prices.

GDP Deflator

Measures price changes for everything in the country doesn’t include goods produced abroad and uses actual quantities produced in the economy each year rather than a fixed basket of goods.

Equation to Convert From the Past to Current Value

Real value(year Y) = nominal value(year x) x (CPI year Y/ CPI Year X)

Indexing /Index to inflation/cost-of living adjustments COLAs

Practice of automatically increasing payments in porportions to the cost of living

Purchasing Power Parity (PPP)

Idea that purchasing power should be the same everywhere when stated in a common currency. In reality PPP never holds exactly. Due to

Transaction Costs

Non-tradeables

Trade Restrictions

International Comparison Program (ICP) Index

ICP Main measure that economists use for international price comparisons by the World Bank that represents the cost of living across countries.

PPP-adjusted GDP Equation

PPP-adjusted GDP = nominal dollars(country A) x (1/1-price level adjustment(countryA))

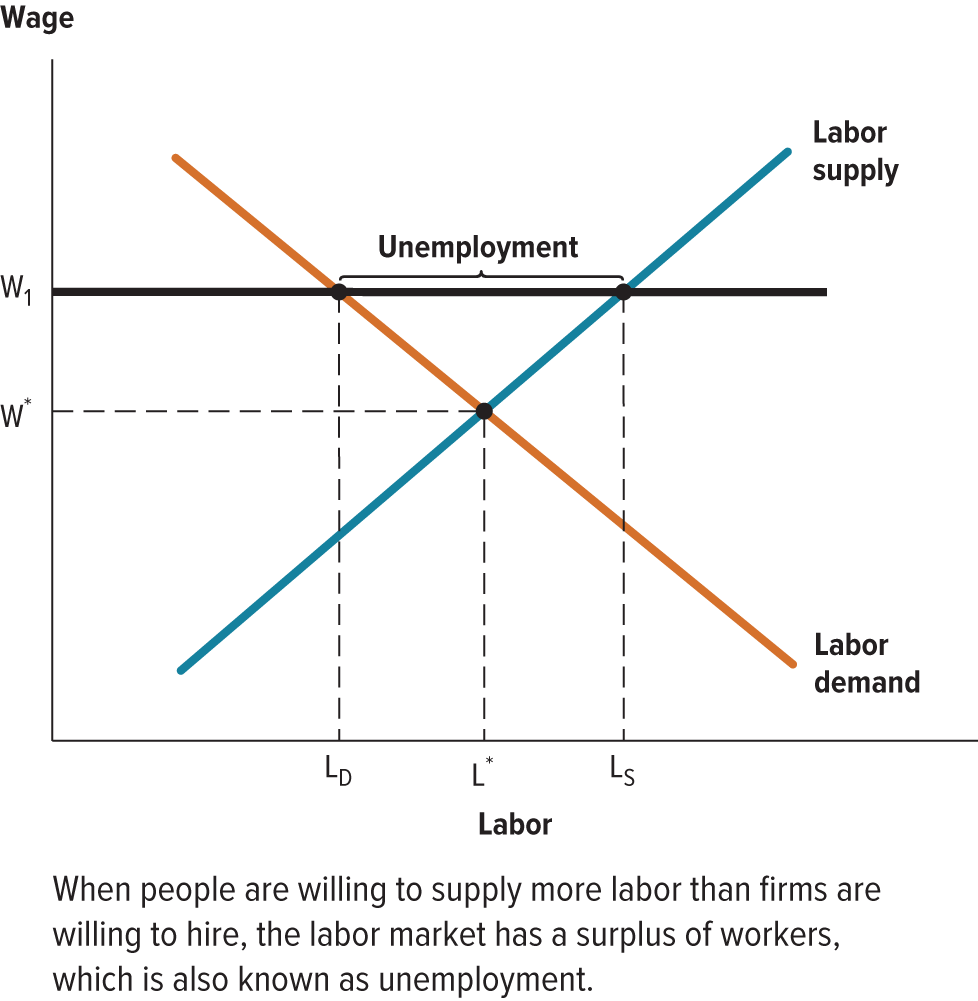

Unemployment

Situation in which someone wants work but is unable too in the current market. When the quantity of labor supplied at the prevailing wage is greater than the quantity of labor demanded (There is a surplus of labor) and meet these three criteria:

They didn’t work at all in the prior week.

They were available to work if they had been offered a job.

They were making efforts to look for a job.

This excludes full-time students, stay at home parents, people disabled to the point of unable to work, people who inherit wealth and choose not too, retirees

Unemployment is a sign of inefficiency and has serious social and psychological consequences.

Regardless of age anyone who works over 15+ hours a week is employed

An increase of unemployment is typically followed by an increase in enrollment of higher education to increase job prospects.

Labor Force

Anyone in the working age 16+ regardless of employment status and who isn’t:

Retired (~64 retirement age)

Institutionalized

Military

EMPLOYED + UNEMPLOYED = LABOR FORCE

Unemployment Rate Equation

[ # of unemployed / labor force ] x 100

Labor-force participation rate

[labor force / working-age population] x 100 = LFPR

typically falls during recessions

Discouraged Workers

People who have looked for work in the past year but have given up looking because of the condition of the labor market

Underemployed

Workers who are either working less than they would like or are working in jobs below their skill level.

Phantom unemployment

People who claim to be looking for work but aren’t in reality

BLS’s 6 measures of unemployment

The Bureau of Labor Statistics collects these stats from ~60,000 households monthly

U1. Counting only people who have been unemployed for a long time (15+ weeks)

U2. U1 in addition with those who have recently lost their jobs or done temporary work

U3. The official unemployment rate.

U4. Unemployed and discouraged workers

U5. Unemployed, discouraged workers, marginally attached workers

U6. Unemployed, discouraged workers, marginally attached workers, underemployed

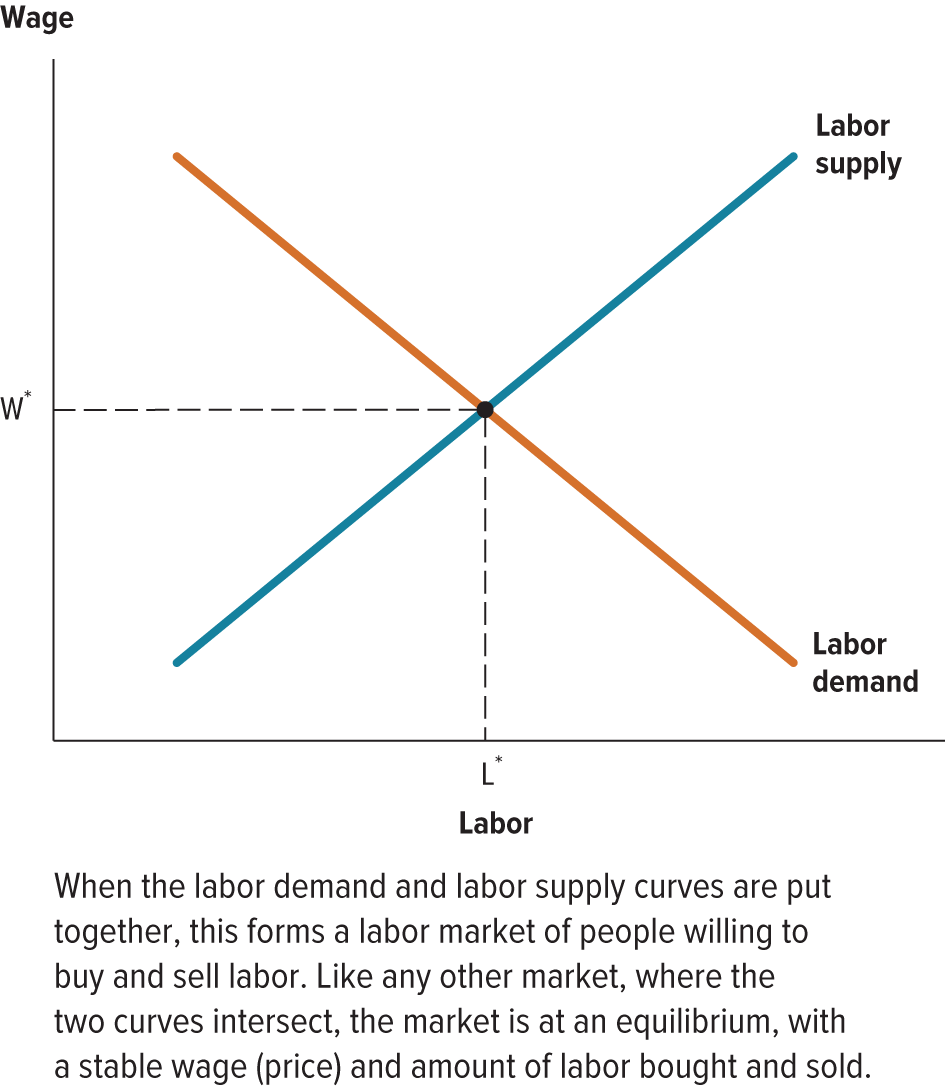

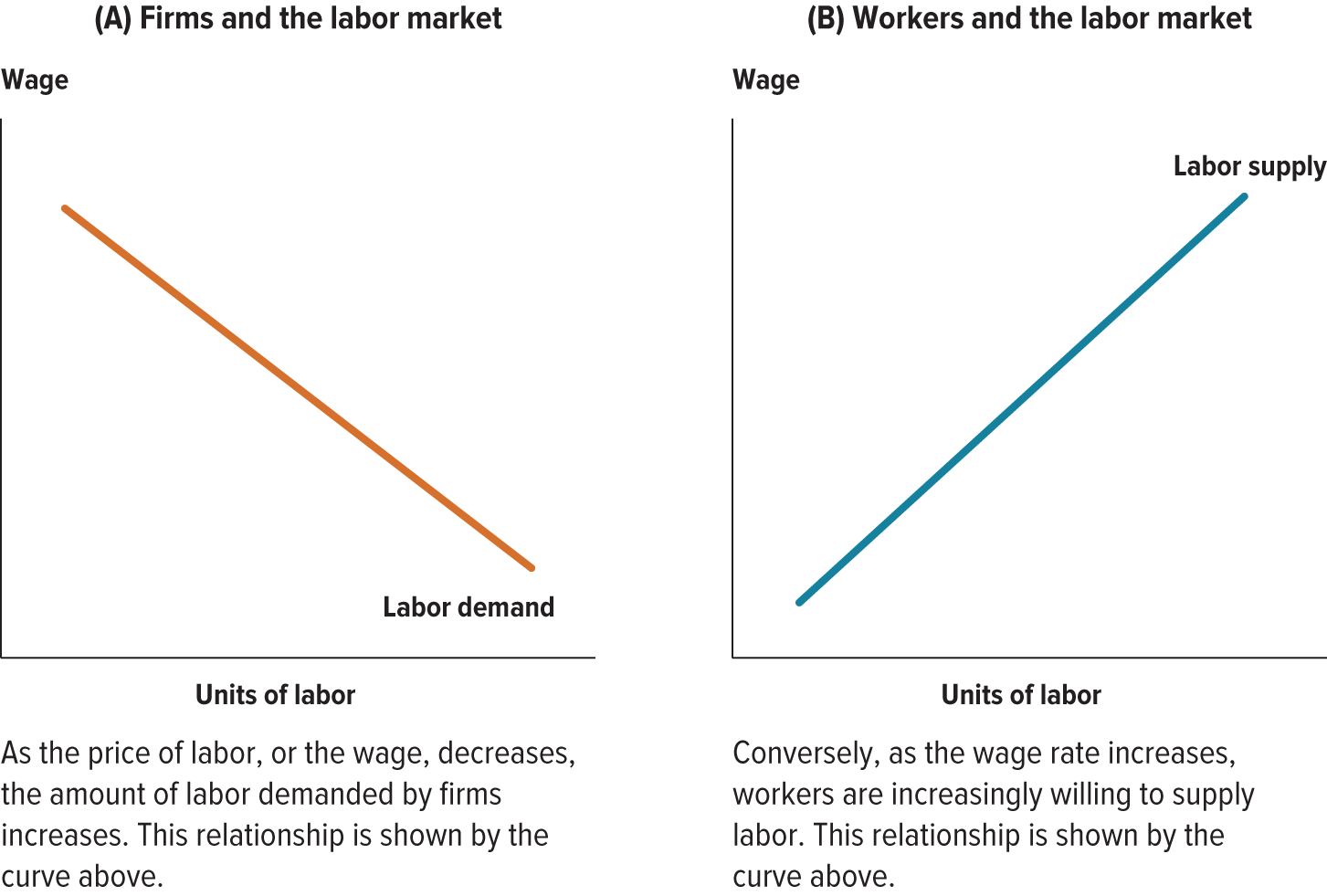

Equilibrium in the Labor Market

Labor is bought/sold like any service/good.

Wage = Price

Supply = unemployed

Demand = hiring

You’d expect the price to adjust until the market reaches equilibrium. Unemployment cannot be fully explained by a model.

Labor Demand Curve

A graph showing the relationship between the total quantity of labor demanded by all the firms in the economy and the wage rate. Together these describe the national labor market

Natural rate of unemployment / equilibrium rate of unemployment

Normal level of unemployment that persists in an economy in the long run

Frictional Unemployment

Unemployment caused by workers who are changing location, job, or career. Some amount of this is unavoidable it’s natural and healthy, jobs open and close, ambitious people go seek better positions. Continue the job search.

Structural

Unemployment that results from a mismatch between the skills workers can offer and the skills that are in demand.

Vocational retraining is an appropriate response to this.

Real-wage (classical) unemployment

Unemployment that results from wages being higher than the market-clearing level. Explanations being:

Minimum wage laws

Bargaining from labor unions

Efficiency wages

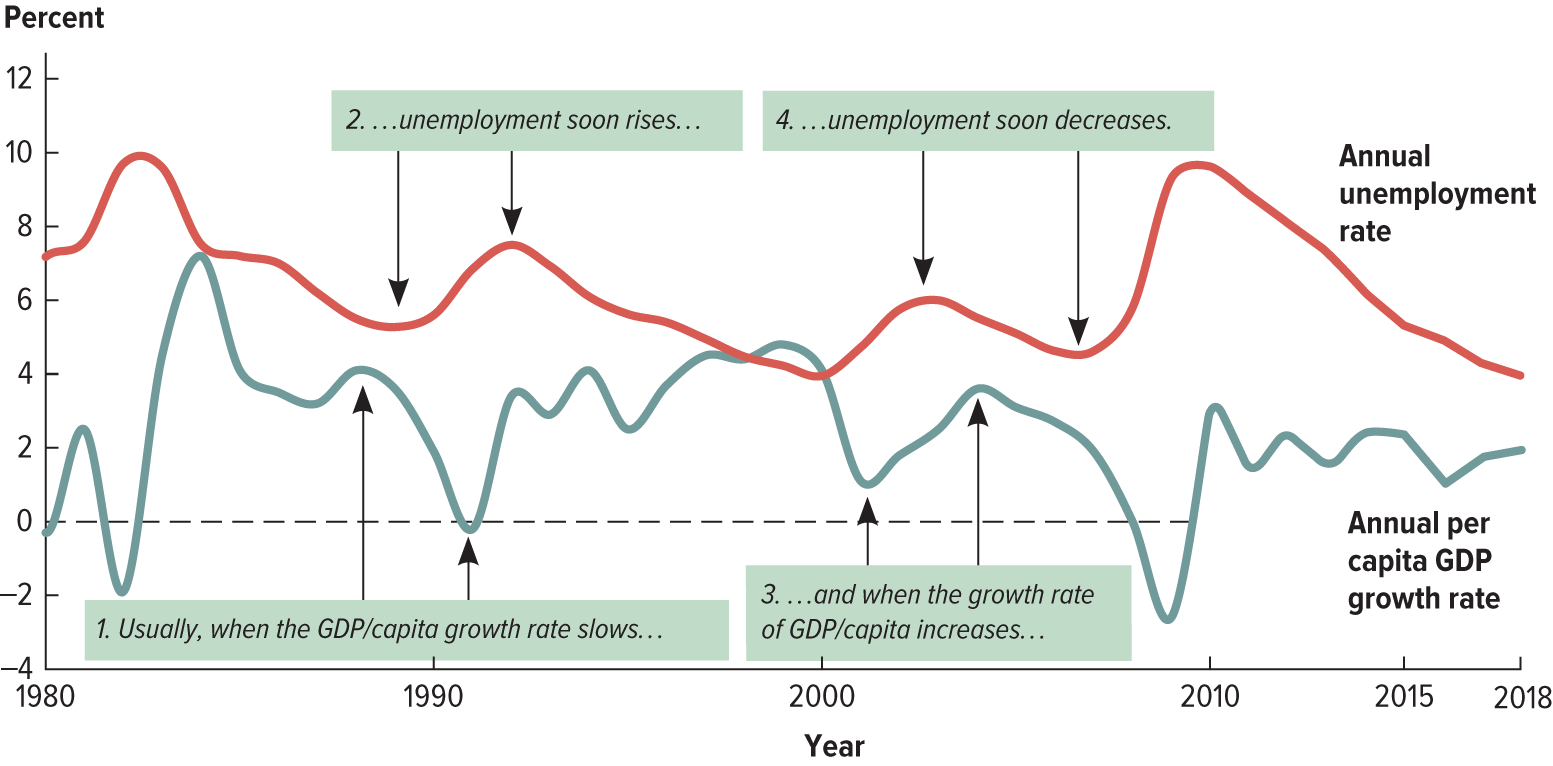

Cyclical Unemployment

Unemployment caused by short-term economic fluctuations. GDP tends to go in cycles so does employment.

Concept of sticky wages

Wages don’t simply fall, wages are slow to respond to shifts in the economy. Degree of stickiness is controversial. This time lag is called lagging/trailing indicator.

Wages tend to remain sticky due rigid employment contracts.

Lagging/trailing indicator

The slight delay in employers waiting to see how bad a recession looks by increasing/decreasing hours before laying off workers/hiring makes unemployment a lagging/trailing indicator. This is part of cyclical unemployment.

Minimum Wage

The lowest wage that a firm is legally allowed to pay its workers. The federal minimum wage is currently $7.25.

Supporters of it cannot agree where it should be set but argue that workers deserve a basic standard of living.

Opponents of the policy suggest that if the wage is higher than the equilibrium wage unemployment will rise. Research shows both. It does/change who is hired substituting workers for unskilled younger workers. AKA driving jobs “under the table”.

Nonbinding Minimum wage

When the minimum wage is set below the equilibrium level having no effect on employment.

Labor Unions

Groups of employees who join to bargain over salaries and working conditions. Their bargaining typically raises wages for the entire industry their employers wanting them to not join a union.

Current union participation is smaller than it was in the 1950s.