Unit 3 Business Management SL

1/99

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

100 Terms

Finance

Refers to the various available funds that an organization has to fund its business activities.

Role of Finance

All businesses need money

Initial set-up costs

Day-to-day running

Expansion

Capital Expenditure

Fixed Assets. Refers to business spending on non-current assets or capital equipment. It is the expenditure on the long-term investment of an organization on assets, offering gains in efficiency and productivity.

Capital Expenditure Examples

Buildings

Tools and equipment

Computers

Printers

Revenue Expenditure

Daily running of the business. Refers to business spending on its everyday and regular operations. These expenses have to be paid in order to keep the business operational.

Revenue Expenditures Examples

Stocks of raw materials, components, and finished goods ready for sale, paid to suppliers

Delivery costs

Utility bills

Wages and salaries to employees

Cost

The total expenditure incurred by a business in order to run its operations.

Revenue

A measure of the money generated from the sale of goods and services.

Profit

Calculated by finding out the difference between revenues and costs. A high positive difference is a good indicator of business success and also means high profit.

Type of Costs

Fixed

Variable

Semi-variable

Direct Cost

Indirect Cost

Fixed Costs

Costs that do not change with the amount of goods or services produced. You pay regardless of how much you sell. It can still change, but it's independent of the number of outputs.

Variable Cost

Costs that change with the number of goods or services produced. It is proportional to the output produced. If output doubles, variable costs also double.

Semi-variable

Costs comprising fixed and variable costs. Tend to change only when production or sales exceed a certain level.

Direct Costs

Costs that can be identified with the production of specific goods or services. This can be specifically related to an individual project or the output of a particular product

Indirect Cost

Costs that are not clearly identified with the production of specific goods or services. Rent and lighting can be linked to all areas of the business, not just specific parts. Advertising, legal, and insurance.

Total Cost

Total Variable Cost + Total Fixed Cost

Sales Revenue

Price x Quantity

Revenue Streams

It doesn’t only come from sales of goods. It also includes, for instance, transaction fees, franchise and royalties, dividends and so on.

Factors that affect Sources of Finance

Size and type of business

The time scale (what is it need for)

Purpose of finance

Capital expenditure

Revenue expenditure

Internal Source of Finance

Money generated and used from within a business, rather than from external lenders or investors. This includes retained profits, personal funds, and sales of assets.

Personal Funds

The main source of finance for sole traders and partnerships. Using your own savings to fund business growth.

Benefits of Personal Funds

No interest, no cost associated with that money

Full control is retained—no need to answer to investors or lenders.

Drawbacks of Personal Funds

High personal financial risk—losses come directly out of your own wealth.

Limited in value or capital to its personal funds.

Retained Profits

The portion of a company's net income that is kept within the business rather than being paid out as dividends. It’s using previous profit to reinvest in helping the business grow

Benefits of Retained Profits

No borrowing costs—reinvesting profits avoids interest payments

Shows financial health, which can build credibility with future investors or banks.

Drawbacks of Retained Profits

Super slow → takes a long time to gain profit in order to use in the business.

Need to be profitable in order to have the funds

Reduces available funds for other uses, like paying dividends to owners.

Sales of Assets

Unused assets, such as old machinery, can be sold to raise money. Things that exist in the business that have no use, but there is value—liquidating the physical assets, turning them into cash.

Benefits of Sales of Assets

Great if there are redundant materials (Merger and Acquisition)

Provides quick cash without taking on debt.

Free up storage/maintenance costs for unused equipment or property

Drawbacks of Sales of Assets

Not applicable for new business

Remove backups in cases of emergency, limit future operations if it’s needed later.

Depreciating the value of the product, you are unable to sell it for the same price you got it for.

External Sources of Finance

Funds acquired by a business from sources outside the organization itself. These sources are used when a business needs more capital than its internal reserves can provide.

Share Capital

The main source of finance for limited companies. Selling shares in the company. This gives up a share of the company.

Benefits of Share Capital

Raise capital quickly.

No repayment obligation – Unlike loans, equity doesn’t need to be paid back. The money stays in the business permanently.

Drawbacks of Share Capital

Dilution of ownership. You can lose control over the company if you don’t have a massive chunk of the shares.

Only for a limited liability company.

Loan Capital

Bank Loan/ capital expenditure - Loan from a bank, which you pay interest on.

Benefits of Loan Capital

It allows you to pay off debt in small, predictable chunks. This is great for cash flow.

No dilution of control; lenders don’t interfere in decisions.

Fixed interest payments allow for financial planning (predictable costs)

Drawback of Loan Capital

You pay interest. High risks mean that there is high interest. The longer it takes to pay off, the more interest you will pay.

They can charge you a penalty fee if you pay the loan too late or too early.

Mortgage

A loan specifically for a property.

Benefits of Mortgage

It allows you to get money and pay off in small, predictable chunks. This is great for cash flow.

Collateral makes interest rates generally lower than unsecured loans.

Drawbacks of Mortgages

(2)

You pay interest. High risks mean that there is high interest. The longer it takes to pay off, the more interest you will pay.

They can charge you a penalty fee if you pay the loan too late or too early

Debentures

Long-term loans to a business, usually repaid within 15 years, with fixed interest paid throughout. They are often secured against assets, don’t grant voting rights, and can be irredeemable (never repaid).

Benefits of Debenture

It allows you to get money and pay off in small, predictable chunks. This is great for cash flow.

No ownership dilution - debenture holders do not have any control within the business.

Drawbacks of Debenture

(3)

You pay interest. High risks mean that there is high interest. The longer it takes to pay off, the more interest you will pay.

They can charge you a penalty fee if you pay the loan too late or too early.

Overdrafts

An arrangement between the business and its bank to spend more money than it has in its account. You pay interest on the amount overdrawn, and this is a common method used for businesses to help with cash flow issues

Benefits of Overdraft

Flexible—only borrow what you need, when you need it.

Can be arranged quickly for short-term cash flow issues

Drawbacks of Overdrafts

The bank can demand repayment at short notice.

It can encourage poor cash-flow discipline (poor money management) if used regularly instead of as an emergency measure. Basically, you pay more interest if you keep relying on it.

Trade Credit

Allows businesses to gain supplies but pay for them within an agreed time frame, usually 30–60–90 days window. It’s a marketing technique. Buy now pay later.

Benefits of Trade Credit

Really good for cash flow (making the profit and then paying later for suppliers)

No interest if payments are made within the agreed period.

Drawbacks of Trade Credit

Can negatively impact cash flows for suppliers

Late payment can damage supplier relationships and credit rating.

Usually available only to established, trustworthy businesses.

Crowdfunding

Raising small amounts of money from a large number of people to fund a particular business project or venture. This is typically done via online platforms.

Benefits of Crowdfunding

No interest

Access to funds without traditional bank loans.

Can generate public interest and free marketing for your product/service.

Drawbacks of Crowdfunding

But you need an incentive for people to actually put the money in (not a share ownership, but some kind of benefits at the end).

You might not have enough funds (it’s not guaranteed)

Sale and Lease Back

A business sells an asset, then leases it back and pays rental on it. Basically, it's selling it to get an amount of money, but then now you rent it to use it.

Benefits of Sales and Lease Back

Immediate cash injection without losing operational use of the asset.

Can improve liquidity quickly.

Drawbacks of Sales and Lease Back

You pay interest (and technically pay more in the end rather than paying all in one go)

Lose ownership.

Still responsible for ongoing lease payments.

Hire purchase

Pay in installments for an item like a machine, and after 12/24/36 months of payments, the machine is yours. The asset is the legal ownership of the creditor until all payments are made.

Benefits of Hire purchase

Spreads the cost of expensive equipment.

Ownership at the end of the payment term.

Drawbacks of Hire purchase

You pay interest (and technically pay more in the end rather than paying all in one go)

The asset can be repossessed if payments are missed.

Microfinance Provider

They are for-profit social enterprises that offer a financial service to those without a job or on very low incomes. They loan really small amounts of money to help those who might need to kickstart a business.

Benefits of Microfinance Provider

Really good for cash flow (paying slowly)

Accessible for small/start-up businesses that lack collateral or credit history.

Can support community and social development.

Drawbacks of Microfinance Provider

You pay higher interest rates than traditional bank loans.

Limited loan amounts may not meet larger business needs.

Business Angels

Extremely wealthy individuals who choose to invest their own money into businesses that offer high growth potential.

Benefits of Business Angels

Networking and connections that are valuable for small businesses.

Provides both capital and valuable business expertise/mentorship.

More flexible terms than banks or venture capital firms.

Drawbacks of Business Angels

You give them a share of your company → dilution of ownership.

May have to align with the angel’s vision, even if it conflicts with yours.

Strategic factors in deciding on a source of finance

Stage PC

Size and status of a firm

Timeframe

Amount required

Gearing – ratio of a company's level of long-term debt compared to its equity capital (value)

External factors

Purpose of Finance

Cost of Finance

Cash

Needed to pay daily costs – the lifeblood of an organization. Without cash, you go bankrupt.

Profit

The simplest form is when revenue is bigger than costs.

Working capital

Cash or liquid assets available for the daily running of the business.

Cash Flow Forecasts

A financial document that shows the expected movement of cash into and out of a business over a time period. It includes:

Cash inflows

Cash outflows

Net cash flow (difference in the time period)

Reasons for a Cash Flow Forecast

Banks and lenders to see the state of the business and its performance to agree lending money

Managers anticipate and identify liquidity problems

Aids planning – good financial control

Causes of Cash Flow Problems

Overtrading

Over-borrowing

Overstocking

Poor credit control

Unforeseen change

Strategies to deal with cash flow problems

Reduce cash outflows (better stock control)

Improve cash inflows (cash payments only)

Alternative source of finance (sell fixed assets)

Limitations of Cash Flow Forecasting

Predictions that sales can change

Do marketing strategies allow optimal performance

Doesn’t anticipate changing customer trends

Ratio Analysis

A quantitative management tool for analysing and judging the financial performance of a business. This is done by making calculations from the final accounts.

Ratio

A number expressed in terms of another number.

Purpose of Ratio Analysis

Examine financial position

Assess financial performance

Compare actual with projected or budgeted

Aid decision-making

Two ways ratio are compared

Historical comparison (your past performance)

Intra-firm comparisons – same industry, similar size (benchmarking)

Gross profit margin

The value of gross profit as a percentage of sales revenue.

Profit Margin

The percentage of sales revenue that is turned into net profit.

Return on capital employed (ROCE)

Measures the financial performance of a firm compared with the amount of capital invested. The higher the percentage, the better it is for the business. A 20% ROCE figure shows that for every $100 invested in the business, $20 profit is generated.

Capital Employed

Capital used/invested in the company

Profitability

Examining profit in relation to other figures, like sales revenue

Liquidity Ratios

Look at the ability of a firm to pay its short-term liabilities (debt)

Creditors and financial lenders are interested in liquidity ratios as they help to assess the likelihood of getting back the money owed.

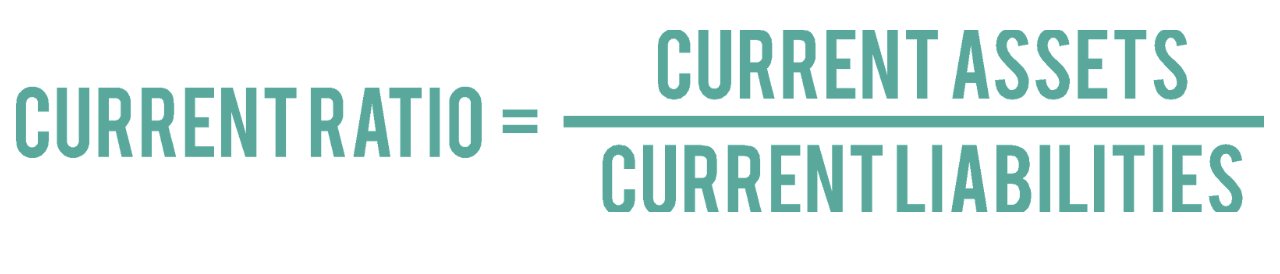

Current Ratio

Reveals whether a firm can use its liquid assets to cover its short-term debts. Generally accepted that a current ratio of 1.5:1 to 2:1 is desirable. This allows for a margin of safety.

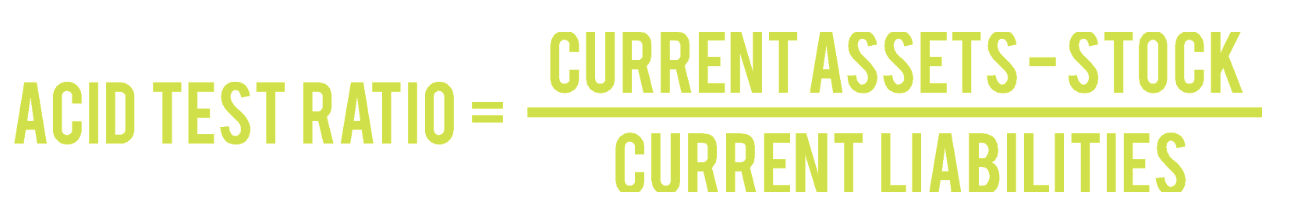

Acid Test Ratio (quick ratio)

Similar to the current ratio, except it ignores stock when measuring the short-term liquidity of a business. It can be more meaningful as stock is not always easy to convert to cash.

Purpose of Final Accounts

Include transactions, revenues, and expenses to help inform internal and external stakeholders of the position and performance of the business.

Final Accounts

Financial statements compiled by businesses at the end of a particular accounting period.

Limitations of Final Accounts

A single year only, no trends shown.

Ignore human resources

No information on non-financial matters (brand perception, ethics)

Only show past performances

Statement of Profit and Loss

This represents all the income and expenditure flows of a business over a specific period of time. It establishes whether a company has made a profit or a loss.

Assets

Items of monetary value that are owned by a business, like cash, stock, and buildings.

Non-current assets

Any assets used for business operations and are likely to last more than 12 months.

Current assets

Cash or any other liquid asset that can be turned into cash within 12 months of the balance sheet date. – cash, debtors, and stock.

Liabilities

A legal obligation of a business to repay its lenders or suppliers at a later date.

Non-current liabilities

Long-term borrowing which will take longer than 12 months to repay.

Current Liabilities

Debt to be settled within one year from the date of the balance sheet e.g., taxes or bank overdrafts.

Equity (capital and reserves)

Shows the value of the business belonging to the owners on the statement of financial position. It can appear as ‘shareholders’ equity’ or ‘owners’ equity’.

Share Capital (Balance Sheet)

Money raised through the sale of shares (price when sold not current market value).

Retained Profits (Balance Sheet)

Amount of net profit after interest, tax, and dividends are paid, that was reinvested. Profit belongs to the owners to do what they choose; that’s why it's in owners’ equity.

Limitations of the Statement of Financial Position

Only shows one point in time

Figures are estimates of the values of assets and liabilities

No universal format → difficult to compare

No intangible asset and human capital

Intangible Assets

Non-physical fixed assets that can earn revenue for a business, e.g., brand names, patents. They are legally protected by intellectual property rights.