Finance class

1/129

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

130 Terms

Three financial statements analysis

horizontal (trend), vertical (aka common size), ratio

horizontal analysis

looks at the percentage change in a line item from one year to the next

issues with horizontal analysis

small percentage changes can hide major dollar effects, large percentage changes from year to year may be relatively inconsequential in terms of dollar amounts

how to calculate horizontal analysis

subsequent year = previous year/ previous year

horizontal analysis things to consider

beware of looking only at the percent changes, can be used to look at multiple years of data, calculate the percentage change from the previous year over a 5 year period

trend analysis

another method of horizontal analysis, compares changes over a longer period of time

compares each year with a base year

any subsequent year - base year / base year

vertical analysis answers what question

what percentage of one line item is another line item?

vertical analysis is useful for analyzing the balance sheet

what's called common size

vertical analysis, converts every line item to a percentage, allows comparisons between the financial accounts of the organizations of different sizes

vertical analysis equation

line item of interest / base line item

preferred approach for gaining an in depth understanding of financial statements

ratio analysis

ratio analysis is an expression

of the relationship between two numbers as a single number

ratio analysis provides an indication of the organization's

ability to cover current obligations with current assets (ability to pay short term debt)

is one raito better than another

no

a ratio can be interpreteed relative to

a benchmark

ratio's should not be

too high or too low

you should also consider what with the ratio

the trend

small differences in a ratio may indicate

large percentage deviations from benchmark

liquidity

how well is the organization positioned to meet its short term obligations?

profitability

how profitable is the organization ?

activity

how efficiently is the organization using its assets to produce reveues?

capital structure

how are the organization's assets financed and ability to take on new debt ?

6 liquidity ratios

current ratio, quick ration, acid test ration, days in accounts receivable, days cash on hand, average payment period

current ratio

proportion of all current assets to all current liabilities

quick ratito

used in industries in whiich net accounts receivable is relativley liquid

acid test ratio

most stringest test of liqudiity

how much cash is avaiable to pay off all current liabilities

days in accounts receivable

how quickly a hospital is converting its receivables into cash

days cash on hand

number of days worth of expenses an organization can cover with its most liquid assets

average payment period

how long on average it takes an organization to pay its bills

operating margin ratio

measures profits earned from the organizations main line of business,

operating income/total operating revenues

longterm debt to net assets

measures the proportion of debt to net assets

long term debt/ net assets

age of plant ratio

accumulated depreciation / depreciation expense

what does age of plant ration tell us

average age of a hospiital's plant and equpment

capital structure ratios answer what questions

how are an organinzations assets financed? how able is this organization to take on new debt?

why take money today

certainty, inflation, opportunity cost

future value

present value grows to its future value

present value

an amount to be received in the future is discounted to present value

what future value depends on

length of the investment period, method to calcuate intresst, interest rate

two ways to calculate interest (2 ways)

simple vs compound

simple interest

interest paid on the principal alone

compound interest

interest earned on both the principal amount and any interest already earned

future value equation

FV=PV(1+r)^n

present value

the value today of a payment to be recieved in the future

preset value takes into account

the cost of capital or discount rate, taking future values back to the present is called discounint

present value =

FV x1/(1+i)^n

annuity

a series of equal payments made or received at regular time intervals

3 types of capital investments

strategic decisions (design to increase long term position)

expansion decisions (increase operational capability)

replacement decisions - designed to replace older assets with newer, cost - saving assets

each decision has 2 components

if its wothwhile and how to finance it

3 ways to analyze capital investments

looking at just cash flow

payback method

net present value method

internal rate of return

payback method is

calculate the time needed to recoup each investment

net pressent value method

difference between the initial amount paid for an investment and future cash flows while adjusting for the cost of capital

how to calculate NPV

takes into account time value of money and cost of capital, looking at money

Formulas for and how to calculate fixed labor cost

FC (fixed cost) all operating expenses = rent&lease + supplies&materials + equipment maintenance + utilities + depreciation + other operating expenses

Finding semi variable amount for fixed labor cost= (salaries&wages + employee benefits) x .6

Formulas for and how to calculate variable labor cost

Variable cost are food, beverages and a portion of labor so everything else is fixed

Finding semi variable amount for variable labor cost = (salaries&wages + employee benefits) x .4

Formulas for and how to calculate variable rate

VR= variable cost (food cost+ beverage cost + variable labor cost)/sales (also called total revenue)

Formulas for and how to calculate contribution rate

CR = 1-VR

VR (varible rate) = Variable Cost (food cost + beverage cost + variable labor cost)/sales (also called total revenue)

Know the break even formula and how to use it to calculate break even as well as desired level of profit.

Sales = (fixed cost + profit) / contribution rate

S=(FC + P) / CR

You need to put the profit at 0 to find the break even point. After you find the break even point put in the profit to the desired amount

Differences between an income statement and a balance sheet

An income statement shows a company's financial performance over a specific period, detailing revenues, expenses, and profits or losses.

A balance sheet provides a snapshot of a company’s financial position at a given moment, listing assets, liabilities, and equity.

Differences between assets and liabilities. How are they categorized on financial statements, and examples of each

An asset is a resource that the company owns.

(cash, inventory)

A liability can be understood as a debt or obligation of the company.

(debt)

Different methods of accounting (accrual vs. cash etc...)

Cash Basis Accounting:

- Revenue and expenses are recorded only when cash is received or paid out.

- Simpler method, often used by small businesses.

Accrual Accounting:

- Revenue and expenses are recorded when they are earned or incurred, regardless of when cash is exchanged.

- Provides a more accurate picture of financial performance over time.

Cost Principle

Recording transactions and valuing assets in terms of dollars at time of transaction

Amount of dollars expended for goods

Cash vs. Accural

Cash: recognize a transaction time of cash flow

Accrual: recognize when earned

Matching revenues and expenses

Match revenues and expenses in the accounting period in which they occur

Depreciation

Costs allocated over the useful life of an asset

How to use the S=VC+CM formula to solve for variable cost per visit

How to solve for variable cost per visit

Total sales = price per visit x number of visits (this gives us our sales)

Sales - CM = variable cost

Variable cost/visit = VC/visit

How to use the S=VC+CM formula to solve for contribution margin

How to get contribution margin:

FC + net income = CM

(Price per visit - variable cost per visit) x number of visits

How to use the S=VC+CM formula to solve for price per visit

How to calculate the price per visit:

(variable cost x numbers of visits) + CM = number of visits

How to use the S=VC+CM formula to solve for number of visits

How to solve for number of visits:

price per visit/profit

How to solve for number of visits:

CM = price per visit - variable cost per visit

How to use the S=VC+CM formula to solve for fixed costs

How to solve for fixed cost

FC= CM -net income (also known as profit)

How to use the S=VC+CM formula to solve for net income.

How to solve for net income:

CM - FC = net income

What should you base your decisions on when it comes to changes in cost

You should choose the option with a higher contribution margin. As this will mean you are making more money

break even formula

the break-even formula is S= (FC + P) / CR

Semi variable fixed labor cost

Finding semi variable amount for fixed labor cost= (salaries&wages + employee benefits) x .6

semi variable for variable labor cost

Finding semi variable amount for variable labor cost = (salaries&wages + employee benefits) x .4

variable rate

VR (varible rate) = Variable Cost (food cost + beverage cost + variable labor cost)/sales (also called total revenue)

how to get contribution margin for an item

CM= selling price - variable cost of that item

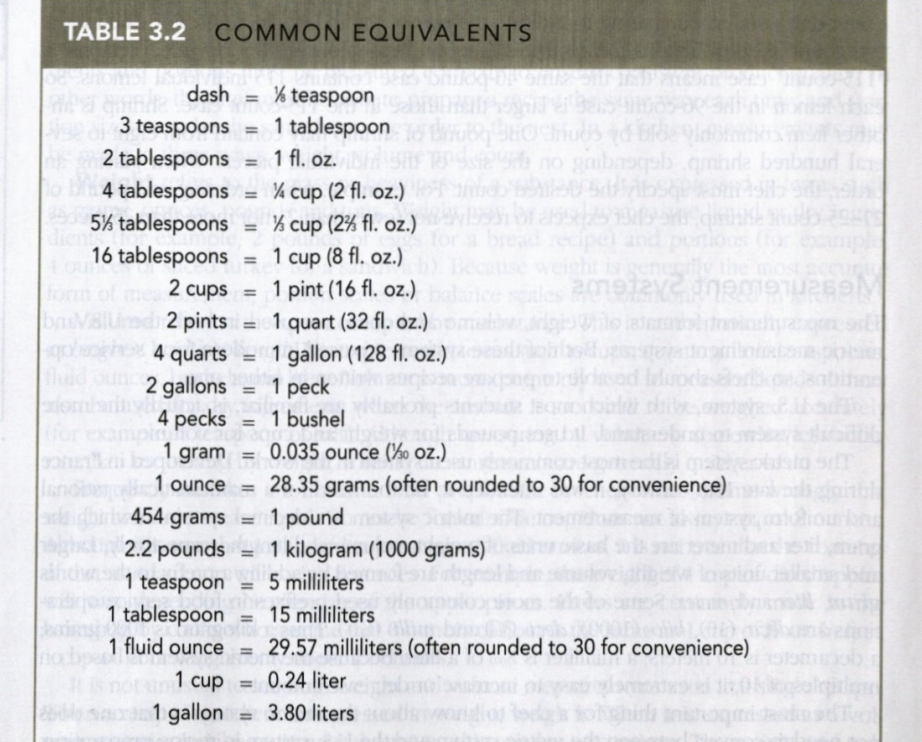

Standardized recipies

a recipe producing a known quality and quantity of food for a specific operation

It specifies (1) the type and amount of each ingredient, (2) the preparation + cooking procedures and (3) the yield + portion size

Have specific operation attached: cooking time, temperatures and utensils

Recipie costing basics

Cost per unit equation = A.P. cost/number of units = cost per unit

Unit cost: the price paid to acquire one of the specific units

Cost per portion

total recipe cost/number of portions = cost per portion

Total recipe cost

The total cost of ingredients for a particular recipe; it does not reflect overhead, labor, fixed expenses or profit

Overhead costs

expenses related to operating a business, including but not limited to costs for advertising, equipment, leasing, insurance, property rent, supplies and utilities

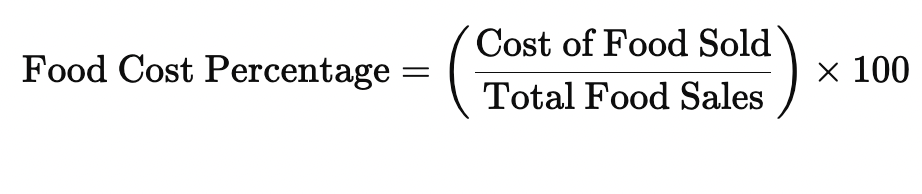

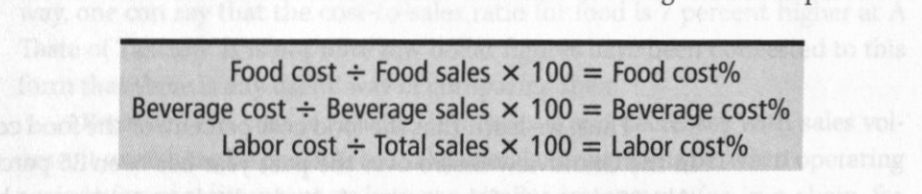

Food cost percentage

The ratio of the cost of foods used to the total food sales during a set period, calculated by dividing the cost of food used by the total sales in a restaurant

Selling price

Plate cost/desired cost % = selling price

A.P. cost

the condition or cost of an item as it is purchased or received from the supplier

E.P. cost

The amount of a food item available for consumption or use after trimming or fabrication; a smaller, more convenient portion of a larger or bulk unit

Yield percentage

Formula: E.P. weight/A.P. weight = yield percentage

Definition: the ratio of the unusable weight of an ingredient after cleaning and trimming for the quantity purchased, calculated by dividing the trimmed weight by the as-purchased weight of an ingredient

How to factor a recipe and cost individual ingredients (including the use of yield % and weights and equivalent measures)

How to calculate and interpret cost percentages (Cost/sales=cost%)

Take the overall total sales if specific sales are not available

You can find really every kind of percentage you need by taking the cost you are looking at dividing it by total sales and multiplying it by 100

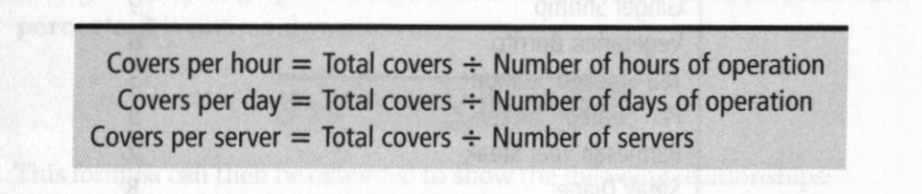

Covers

One diner (person) = a cover

Seat turnover

Seat turnover = number of customers served/number of seats

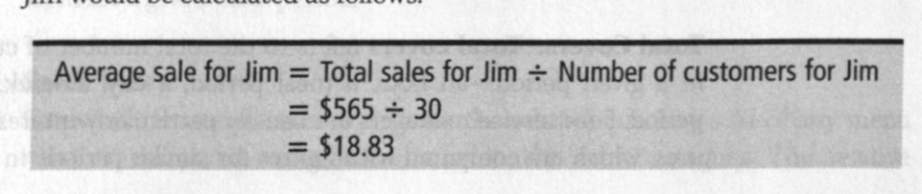

Calculated sales per server

average sale for server = total sales for server/number of customers for server

Variable costs vs. fixed costs and their differences and characteristics

Fixed costs:

normally unaffected by changes in sales volume. little direct relationship to the business volume

examples: insurance premiums, real estate taxes, depreciation on equipment

these should never be taken to mean static or unchanging but merely to indicate that any changes that may occur in such costs are related only indirectly or distinctly to changes in volume

Variable costs:

clearly related to business volume

As business volume increases, variable costs will increase, as volume decreases, variable costs should decrease as well

Directly variable costs: directly linked to vomule of business, so that every increase and decrease in volume brings a corresponding increase or decrease in cost

Examples: payroll costs, food, beverages

Semivariable cost:

A portion of it should change with short-term changes in business volume and another portion should not

salaries + wages

Controllable costs

can be changed in the short term

food + beverages (controlled through changing portion sizes)

Variable costs

Normally controllable

Uncontrollable costs

cannot normally be changed in the short term

rent, interest on mortgage, real estate taxes, license fees + depreciation

Average check

average check = total dollar sales/total number of covers

Prime cost

refers to the costs of materials + labor: food, beverages and payroll

Sales mix

the relative quantity sold of any menu item as compared with other items in the same category

Formula: take the number sold of that item and divide it by the total amount sold of all the items. Then multiply that answer by 100

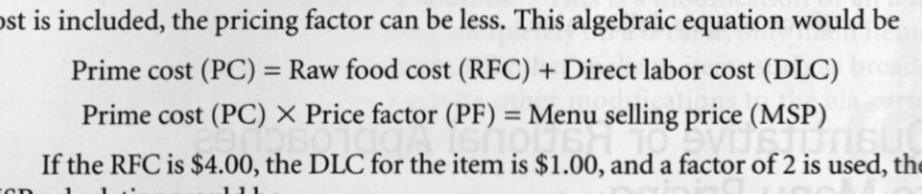

Menu pricing factors and concepts. How to calculate menu sales price (prime cost method)

Raw food cost (also labeled as entree cost or food cost)

Direct labor cost (labor all together)

Prime factor (also called prime-cost factor)

Prime cost: the cost of food, beverages, and direct labor (all labor together) added together

Basic terminology and definitions from each chapter and lecture

Menu engineering- the difference between star, plowhorse, puzzle, and dog; be able to conduct menu engineering analysis including menu mix %, CM, categorization, and classification.

Menu engineering takes a look at every item and sees if it is profitable