finance formulas sem 1

1/53

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

54 Terms

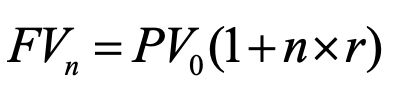

simple interest fv

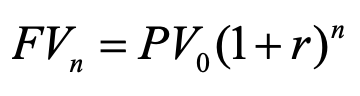

compounding interest

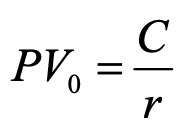

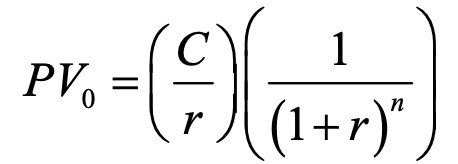

perpetuity

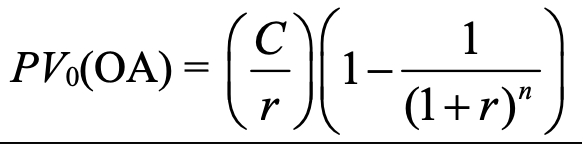

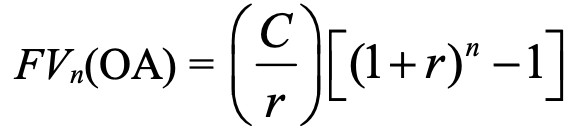

ordinary annuity

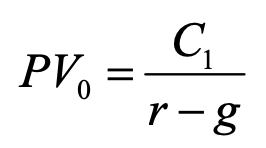

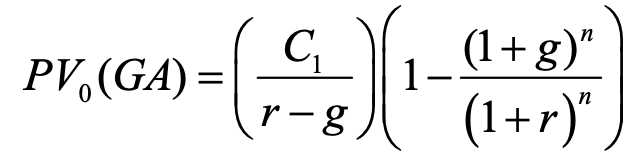

growing perpetuity

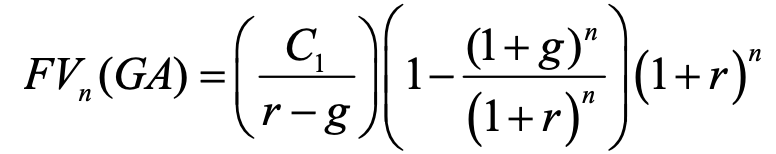

growing annuity fv

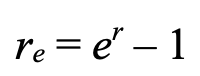

effective interest rate with continuous compounding

r = nominal interest rate

e = eulers number

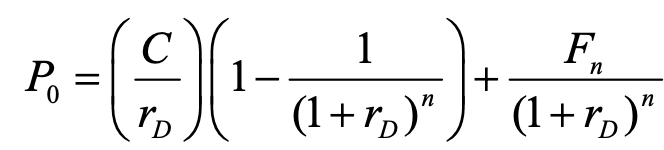

bond pricing / pv of bond

rd = discount rate, n = no. of periods until maturity

fn = face value

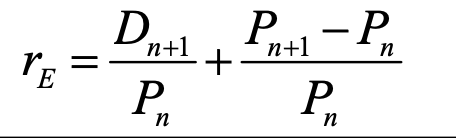

expected return/required rate of return

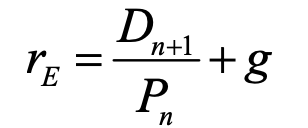

dn+1 = expected dividend at end of period

pn = price of inv at beginning of period/current price per share

pn+1 = price of inv at end of period

expected return / required rate of return

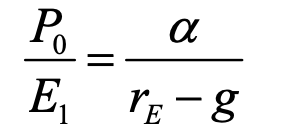

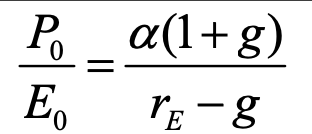

price to earnings ratio (forward)

e1 = earnings per share for next year

a = constant

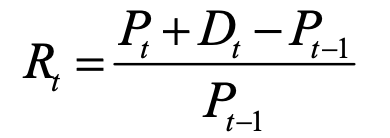

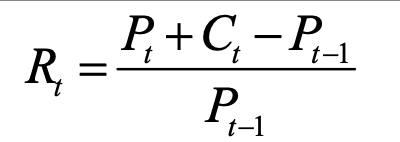

rate of return

rt = rate of return at time t

pt = price of asset at time t

dt = dividends or cash flows received at the previous time period

arithmetic average

r1, r2 etc = individual values in the set

t = total no. of values in the set

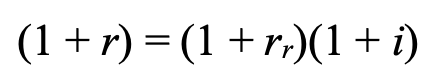

fisher equation

r = nominal interest rate

rr = real interest rate

i = inflation rate

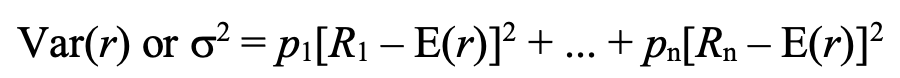

variance

pi = probability of the i-th outcome

ri = i00th outcome of the random variable

E(r ) = expected value of r

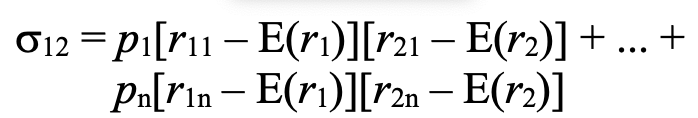

covariance between two random variables

o12 = covariance between r1 and r2

r1i = probability of r1 in i-th scenario

E(r1) = expected value of r1

covariance between two random variables given probability

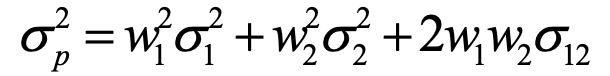

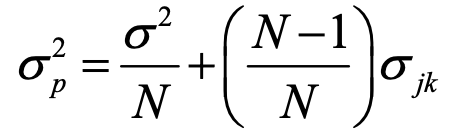

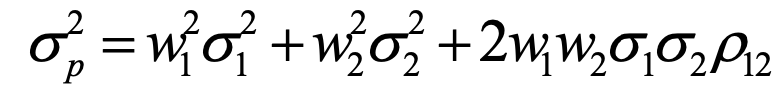

variance of a portfolio of two assets

variance of a portfolio of two assets

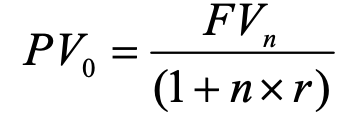

simple interest pv

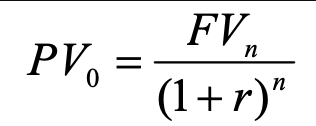

compounded interest pv

deferred perpetuity pv

ordinary annuity fv

growing annuity pv

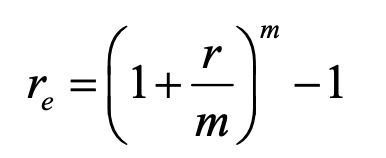

effective annual interest rate

m = no. of compounding periods per year

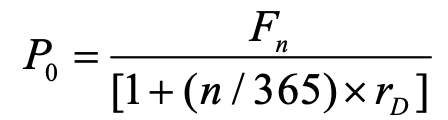

present value / current price of a future payment discounted over time

Fn = future value

n = no. of days

rD = discount rate

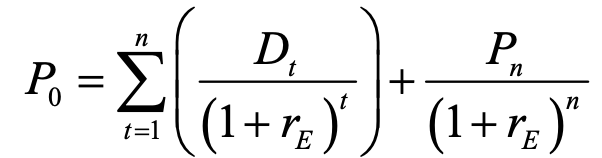

dividend discount model / gordon growth model to find pv / price of stock

n = no. of periods (usually years) over which dividends are considered

t = variable representing each period from 1 to n

Dt = dividend expected in period t

rE = required rate of return

Pn = expected price at end of period n

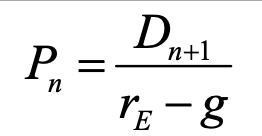

constant dividend growth model to find pv / current price

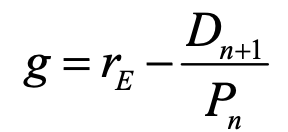

constant dividend growth model to find growth rate

price to earnings ratio (current)

rate of return for a given period

rt = rate of return at time t

ct = cash flow at time t

pt -1 = price at previous time period

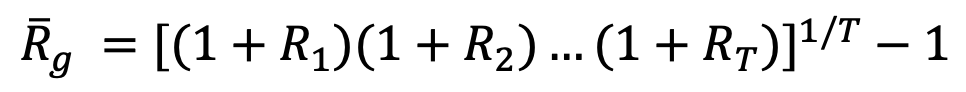

geometric average

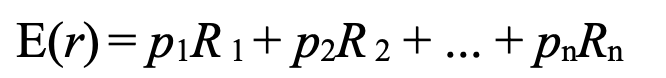

expected return / required rate of return

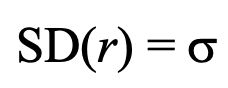

standard deviation

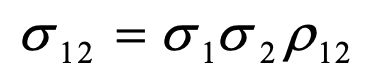

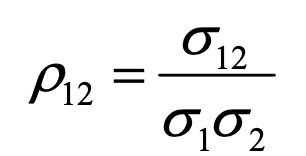

correlation coefficient

o12 = covariance between variables 1 and 2

o1 = sd of variable 1

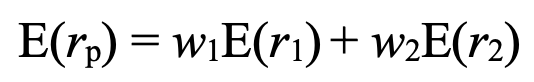

expected return of a portfolio

variance of a portfolio of two assets

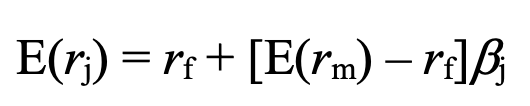

CAPM formula - expected return of an asset based on its risk relative to the market

rf = risk-free rate of return

E(rm) = expected return of the market

Bj = beta of assets (measures volatility relative to market)

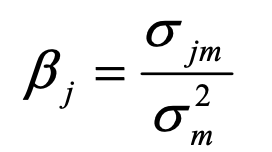

beta

ojm = covariance of returns of asset j and the market

o2m = variance of market returns

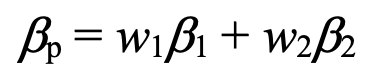

beta of a portfolio

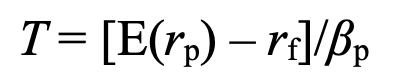

treynor ratio / reward-to-volatility ratio - risk-adjusted performance of an inv portfolio

E(rp) = expected return of portfolio

rf = risk-free rate of return

Bp = portfolio beta

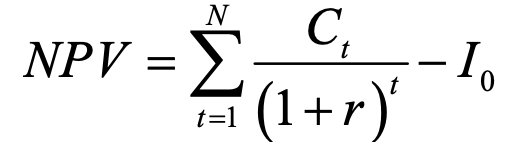

net present value - profitability of an investment

Ct = cash flow at time t

r = discount rate / rate of return

N = total no. of periods

t = time period

I0 = initial investment cost

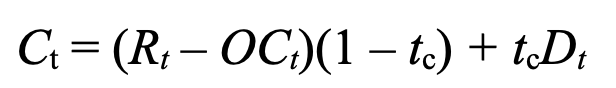

after-tax cash flow

Rt = revenue in period t

OCt = operating costs in period t

tc = corporate tax rate

Dt = depreciation in period t

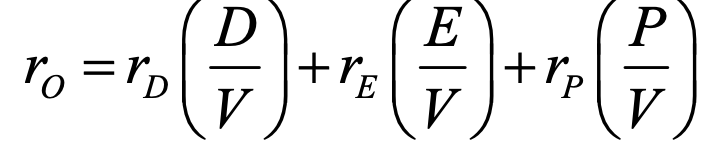

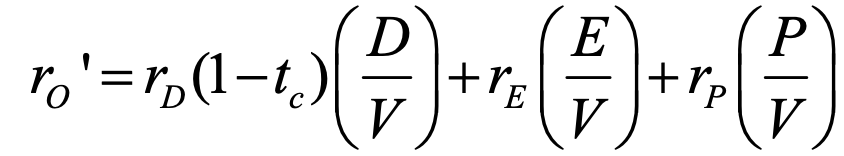

WACC before tax

ro = overall cost of capital (WACC)

rD = cost of debt

rE = cost of equity

rP = cost of preferred stock

V = total market valye of company’s capital (D+E+P)

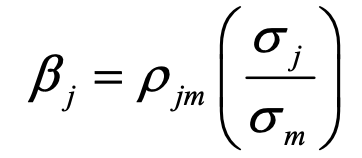

beta of an asset - systematic risk of an investment

pjm = correlation between asset j and market m

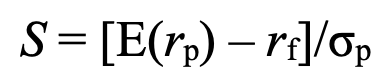

sharpe ratio - how much extra return you are getting for extra risk

E(rp) = expected return of portfolio

rf = risk free rate of return

op = sd of portfolio’s excess return

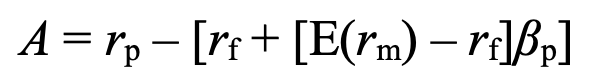

alpha - portfolio’s extra return for extra risk

+ve alpha means portfolio has outperformed expected return

-ve alpha means portfolio has underperformed

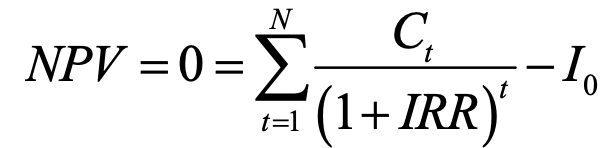

NPV when it equals zero to find internal rate of return (IRR)

E = sum series of values

ct = cash flow in period t

I0 = initial investment cost

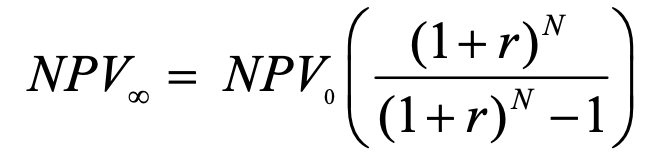

net present value of a perpetuity

N = no. of periods

after-tax WACC

rD = cost of debt

tc = corporate tax rate

V = company’s capital = D+E+P = debt + equity + preferred stock

rE = cost of equity

rP = cost of preferred stock

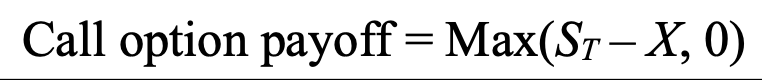

call option payoff

ST = stock price at expiration

X = strike price

if ST > X, call option holder receives difference

if ST < X, option will expire worthless and payoff = 0

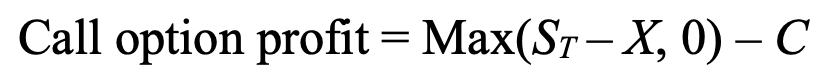

call option profit - provides buyer with the right, but not obligation, to purchase asset at a predetermined price (strike price) on or before a specific date

ST = price of underlying asset at expiration

X = strike price

C = premium paid for call option

if ST > X, profit is difference

if ST < X, profit is zero as this option would not be exercised

C is subtracted from potential profit or zero to determine overall profit

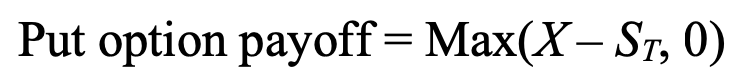

put option payoff

give buyer the right, but not obligation, to sell an asset at a specified price (strike price) on or before a certain date

ST = asset’s price at expiration

if X > ST, payoff is difference

if X < ST, payoff is zero as option expires worthless

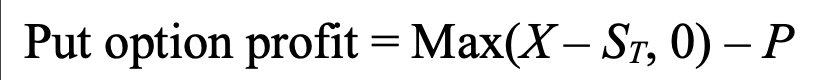

put option payoff

ST = price of asset at expiration

if X > ST, profit is difference

if X < ST, profit is zero